Community ideas

LTC: My Reasoning Behind Accumulating Litecoin NOWHi Everyone! I show in this video how Litecoin Saw a Sign of Weakness in Phase E well before any other MARJOR Top Market Cap coins. It looks like we have been in ACCUMULATION for quite a while with Litecoin. ALSO, The indicators in the Mid Term Group of time frames look more bullish compared to Bitcoin, Cardano and Ethereum; which are in just now going into Phase E Distribution with a Sign of Weakness - OR - about to go into Phase E Sign of Weakness (ETH).

LTCUSD has a LOT OF SUPPORT at $40 to $45 price range. If we do see a drop down in LTCUSD, it has a high probability of being a Wyckoff Spring (finding support between $40 and $45) RATHER THAN ANOTHER Sign of Weakness in Phase falling substantially below $40.

This is my reasoning behind Litecoin being one of my top coins for ACCUMULATING at this present time. Please consider beginning to take as many coins off exchange NOW... I have my reasons behind doing this NOW... Please consider not having more than 5 percent of your equity on an exchange; with a broker or even in your bank for a while. The world is about to get rather bad soon politically, geopolitically, financially, economically and socially.

Hope this was helpful...

If you don't mind, take a moment to SMASH the like (boost) icon.

Happy Trading and Stay Awesome!

David

GBP/USD levels just ahead of the Chancellors Autumn statement

Disclaimer

The information posted on Trading View is for informative purposes and is not intended to constitute advice in any form, including but not limited to investment, accounting, tax, legal or regulatory advice. The information therefore has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Opinions expressed are our current Disclaimer:

opinions as of the date appearing on Trading View only. All illustrations, forecasts or hypothetical data are for illustrative purposes only. The Society of Technical Analysts Ltd does not make representation that the information provided is appropriate for use in all jurisdictions or by all Investors or other potential Investors. Parties are therefore responsible for compliance with applicable local laws and regulations. The Society of Technical Analysts will not be held liable for any loss or damage resulting directly or indirectly from the use of any information on this site.

Live stream - TA Session #147 - Wednesday Session on the Road in👉Scheduled Streams:

Monday - Friday 9:15 am EST (15 minutes before NYSE Open)

and we go for about 45 min to a 1hr+ depending on the

markets.

👉Stream Content:

Price Action based TA, Key Level gain/loss, Swing Failure,

and Liquidity Grab Patterns. Market

Live stream - TA Session #146 - Tuesday Market Open👉Scheduled Streams:

Monday - Friday 9:15 am EST (15 minutes before NYSE Open)

and we go for about 45 min to a 1hr+ depending on the

markets.

👉Stream Content:

Price Action based TA, Key Level gain/loss, Swing Failure,

and Liquidity Grab Patterns. Market

Metals to Break its All Time High AgainMetals to Break its All Time High. I have discussed about Gold before and in this tutorial we will study into Copper.

From last week Fed chairman statement, he said “it is premature to be talking about pausing our rate hike. We have a ways to go."

The continuous inflation is almost a certainty into next year, and what asset or instrument works well with inflation?

Content:

Why interest in copper again

• Fundamental

• Technical

5 Major Copper Uses:

• Building Construction

• Electronic Products

• Transportation

• Industrial Machinery & Equipment

• Medical

Copper Consumption Worldwide:

1. China 54%

2. Europe 15%

3. Other Asia 14%

4. America 11%

5. Other 6%

Source: Statista 2021

Minimum fluctuation

0.0005 per pound = $12.50

0.001 = $25

0.01 = $250

0.1 = $2,500

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

SPY: Thoughts & AnalysisHey everyone,

I apologize, I tried to post a live stream and it just did not work :(.

I think my internet is the problem. Many times my internet has caused massive losses because of being so terrible, so I am pretty sure that is the problem.

Anyway, I just wanted to pick up where I left off and finish up my thoughts on SPY. In the live stream I went over all the indices, but here I am just sort of focusing on SPY (and a bit on DIA).

Also, I have a cold so excuse the congestion and sniffling! haha

Overall, my bias in neutral. Targets for Monday are:

Bull

1. 378

2. 379

3. 381

and Bear:

1. 374

2. 372

3. 370

Targets for next week (prospective) are:

Bull

1. 382

2. 385

3. 387

Bear

1. 370

2. 366

3. 363

Thanks everyone for watching, leave your comments/questions and critiques below and have a great weekend!

Apple stock historically bottoms out at higher earnings yields In last 20 years, apple stock has 'bottomed' out at earning yields in the 6-10% range. However, in the past it was a smaller company with a high growth rate potential. Current earnings yields on apple are in the 4% range and now its a near 3 trillion dollar company. I dont know if thats an apples to apples comparison ;) NASDAQ:AAPL QQQ MSFT

HOW-TO: Using Data Gathered in Divergence BacktesterHello Everyone,

Here is a small video describing the idea on studying divergence data based on divergence backtester script.

To understand further, you can study some of my older scripts on divergence. You can find them under my profile: www.tradingview.com

Filter only open source scripts so that you will see only free to use scripts with code available. This is not a fully fledged strategy. But, just means for studying the impact of divergence data on price action. Please let me know if you have any questions.

Tug of War Among Central BanksThere is a tug of war situation among the central banks to hike interest rates. What is the bad and the good that will come out from this?

i. Last week of October, European Central Bank officials announced another massive 75 basis point hike, increasing interest rates at the fastest pace in the history of the euro currency.

ii. This week, the Federal Reserve is expected to increase rates by 75 basis points for the fourth time in a row.

iii. The Bank of England could join the club on Thursday.

Content:

. The Interest Rate race has just started, why?

. The impact on different currencies

. It may not be all bad news, why?

With higher interest rates, it attracts investors to buy its currency, in this case the USD.

Currency is always a pair, when USD strengthens, the other side weakens.

When a currency gets weaker, it is very bad news for inflation because they will have to pay more on their imports.

Therefore in order to counter inflation, one of the best measures is to hike rate

Expect more volatility in the currencies market, meaning currencies will take its turn to move.

And if you are a trader, you should welcome volatility. Because with volatility, there are opportunities.

GBP Futures

0.0001 = $6.25

0.001 = $62.50

0.01 = $625

0.1 = $6,250

1.1000 to 1.2000 = $6,250

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Key Support Levels For E-mini S&P This Week ES1!As we enter a huge week of data for markets it's important to know the key levels of support and resistance for the E-mini S&P 500 Futures ES1! In this video I explain how to use an RSI, Auto Anchored VWAP's, 10 Day Moving Average, Bollinger Bands and my Beacon Indicator to determine key areas in the market. I use this strategy for day trading and swing trading the E-mini S&P.

Past Performance is not indicative of Future Results. Derivatives Trading is not suitable for all investors.

USDJPY: What goes up.. Must come down. Massive Trading LessonLooking at the USDJPY will provide perhaps the most important lesson in trading you can find. Ascertaining what is Market value; what is a high price (and what your decision needs to be) VS what is a low price and what you should do.

The USDJPY is a classic example. Price has rallied for 22 months or so and the price has risen enormously. This is OVERSOLD and you can see how Traders (Who know what they are doing) have moved into the market and pushed it down. We called it and said this would happen because we looked at the market from a factual non biased perspective.

We also looked back to key price action levels to determine what further adds to the concoction (evidence) for a short.

Tie it all together and you get a fall you can take gains on. We can now look for further falls after price pops until we reach Price levels to get final exits, again using our knowledge of market value.

All in all, when trading any market, just do it factually. No stories. High price V Low. That's what works!

I hope that helps as always!

Trading RSI Divergences LIKE A BOSS (I may have failed you)Get your copy of the Free Heiken Ashi Algo Oscillator

I'm not going to lie. There is WAYYY too much technical stuff to type up in this for you guys. its best if you watch the video. Always Always Always ask questions below. I am always more than happy to show you what's what.

This is some UPPER LEVEL STUFF in this video and i know a lot of you won't fully understand it but i want you to understand what it is that you DON'T KNOW about.

Unless you know these things, you won't know what questions to ask about. So here we go. Let's get into it.

Trading the RSI Divergence like a BOSS

After the RSI Divergence is found:

On the chart: (KEYS)

1 = last HH

2 = current HH

3 = 1st HH Closing Price

4 = Confirmation of candle closing BELOW 1HH close price

5 = Find your targets

6 = Pinpoint any target with multiple confirmations

Steps to take:

1. See last Highest High

2. Draw a line across the last Highest High close price.

3. Confirm second HH is higher price but lower RSI value.

Now wait....

4. Wait for candle to close below price of step (2)

5. Enter SHORT if (Heiken Ashi Candle is closing RED)

6. Your 50ema is Take Profile #1 (Set it up)

7. Your swing high is your stop loss

8. What does the RSI Formula tell you? Is it in the positive? So what! Use the same numbers but trade SHORT. Yep, that what i said, TRADE IT IN REVERSE! This is Take Profit #2

9. Do the Fibonacci trick to confirm which is closer (tp 1 or tp2)

10. Look left for the most recent area of Liquidity. It's a candle with a long wick up or down where price reverses sharply.

11. Scan the Algo for a price level WITH volume. You have found your target. Adjust your take profit and walk away.

Gold is still an inflationary hedge asset, why?My answer is definitely a Yes! But why many say no. It is because they are looking at Gold from a very microscopic view; into its day-to-day to week-to-week movement. But if we analyse Gold from a macro perspective, we will able to appreciate Gold better, that it is still an inflationary hedge asset.

And from today’s case study, we will also learn why it is time to get into Gold again at around this price.

Content:

• Gold is still an inflationary hedge asset, why?

• When to enter into the Gold market again?

For investor, you can invest into the physical Gold, Gold ETFs, funds and even those mining stocks that pay dividend.

For traders, I would like to trade into Futures.

COMEX E-Mini Gold Qo1!

0.25 per troy ounce = $12.50

1.00 = $50

1650 to 1750

= 100 x $50

= US$5,000

COMEX Micro Gold MGC1!

COMEX Regular Gold GC1!

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

Stay tuned for our next episode in this series, we will discuss more on the insight of inflation and rising interest rates. More importantly, how to use this knowledge, turning it to our advantage in these challenging times for all of us.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

The easiest way to spot divergences and how to trade them

Welcome to the coffee shop everybody. This is your host and baristo Eric, and in today's video I am giving you a video Lesson based off of my preferences on how you should look for and use RSI Divergences.

THe Oscillator used in this video is The Heiken Ashi Algo Oscillator

Get it free here and always BOOOOOOOOOOST IT!!

There are three problems that people have whether they are experts or when they are novices in spotting Divergence between the RSI and price.

First problem is they don't know where to look because the RS I can have hundreds of high values and hundreds of low values but you need to know which ones are the relevant ones to look at.

The second problem is a common question where people ask "which way will the price go?"

The answer to that is basically the slope of the RSI is the new slope of your price so, if the RSI is angled up your price will angle up. If the RSI is angled down your price will angle down.

Now hold on a minute don't run off and start acting like you know how to trade divergences yet because there's still question number 3.

When will it go in that direction?

Just because you see a Divergence doesn't mean it's going to immediately happen so you need to know what to look for to let you know that it is actually going to go in that direction and when will that Trend begin. So in today's video I do a nice lengthy coverage on how to spot those answers and you can use the oscillator in the video by going to this link.

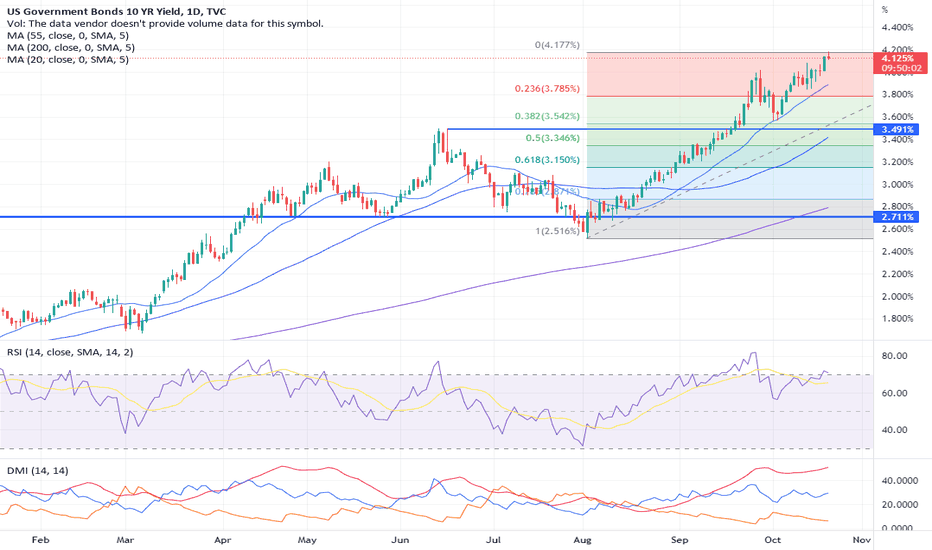

US 10Y yield convergence of resistance levels around 4.19/20We have a convergence of levels around the 4.19/4.20 zone of the chart, it is a long term double Fibonacci retracement and represents significant lows seen in 1998 and 2001.

Will be quite interested to see if the market pauses here in order to consolidate sharp gains that have been pretty relentless since August.

Disclaimer:

The information posted on Trading View is for informative purposes and is not intended to constitute advice in any form, including but not limited to investment, accounting, tax, legal or regulatory advice. The information therefore has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Opinions expressed are our current opinions as of the date appearing on Trading View only. All illustrations, forecasts or hypothetical data are for illustrative purposes only. The Society of Technical Analysts Ltd does not make representation that the information provided is appropriate for use in all jurisdictions or by all Investors or other potential Investors. Parties are therefore responsible for compliance with applicable local laws and regulations. The Society of Technical Analysts will not be held liable for any loss or damage resulting directly or indirectly from the use of any information on this site.

Little Direction with Trends in the Market; Patience is KeyIf you don't want to watch the video, here is the trends going into 10/19/2022;

Last Macro Trend Signal Spots

30m - 3709 Downtrend (10/18/2022) Higher Low

1Hr - 3681 Uptrend (10/17/2022) Higher High

2Hr - 3700 Uptrend (10/17/2022) Higher High

3Hr - 3682 Uptrend (10/13/2022) Lower High

4Hr - 3680 Uptrend (10/13/2022) Lower High

6Hr - 3759 Uptrend (10/17/2022) Higher High

12Hr - 3606 Downtrend (10/10/2022) Lower Low

Daily - 4041 Downtrend (8/26/2022) Lower Low

Weekly - 4366 Downtrend (2/14/2022) Higher Low

As I said in the video, things are a bit mixed up at this point, with medium timeframe trends accompanied by the 6hr trend in an uptrend, and the 4hr, 12hr, and Daily all in that downtrend.

I expect today to be a negative overall for the day, perhaps bringing us down below 3700 several times. However, before we get there, we have to see if this 1hr Uptrending line can maintain us as a support level, which thus far it has managed to accomplish. The 30m and 2hr were pretty close to each other, and we ended up crashing through both just recently going into this morning, which reversed another near 1.5% gain overnight at the peak.

While I find it frustrating to have to sit out, I'd prefer to let the market show me a design in all of these major upswings and downswings, then to jump in on the wrong side of a major movement and have to take a quick negative loss. Basically I feel we are currently in almost a 50/50 in where we go from here, but any movement up I have little faith in, since the bullish uptrends just haven't formed enough to begin erasing such a bearish market, even for a bear market rally.

Outside of Trends we've got;

Earnings - Tesla is AMC today. That will be a major driving force in the market today. Reports I have is that revenue is at an all time high, but more because of price hikes than sales, and that the company may be having issues meeting the projecting sales growth they wanted.

There are a few other major companies I went over in the video, and I'll report on the big ones in the comments as we go.

Economic Data - Nothing major today that I see really driving the market anywhere. It'll be movements more based around earnings and technicals than any economic data.

My current sentiment;

Shorter Term ; Neutral

Short Term ; Bearish

Medium Term ; Bullish

Long Term ; Bearish

What a bag of mixed feelings that is, right?

Anyways, remember your risk management plan, and safe trading!

Gold - not exciting yet, but needs to go back on to your radarWe are in consolidation mode around the 1615 zone, this is the 55-month ma, a long term Fibo and the mid-point of a long-term up channel.

The market has recently failed at the 55-day ma, so it has not really done enough to suggest that it is ready to head higher either.

So not a market to get excited about yet, but one that really should go back on your radar given the key band of support it is sitting on.

Disclaimer:

The information posted on Trading View is for informative purposes and is not intended to constitute advice in any form, including but not limited to investment, accounting, tax, legal or regulatory advice. The information therefore has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Opinions expressed are our current opinions as of the date appearing on Trading View only. All illustrations, forecasts or hypothetical data are for illustrative purposes only. The Society of Technical Analysts Ltd does not make representation that the information provided is appropriate for use in all jurisdictions or by all Investors or other potential Investors. Parties are therefore responsible for compliance with applicable local laws and regulations. The Society of Technical Analysts will not be held liable for any loss or damage resulting directly or indirectly from the use of any information on this site.

How to Setup Daily Charts using Price Action Trading!Hey Traders here is a quick video that explains what I believe is one of the best ways to setup your charts for trading success. My chart trading style does not use indicators. I use a naked charts with support and resistance levels. I use end of day trading daily charts with trend following, and chart patterns, and of course Fibonacci retracement levels. Learning how to setup your charts to see the long term picture of the market can really benefit us in our trading.

Enjoy!

Trade Well

Clifford

Inflation & Interest Rate Series – Below 5.3% is Crucial for CPIContent:

• Why CPI must be below 5.3%?

• Can we invest or trade or hedge into inflation?

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

Stay tuned for our next episode in this series, we will discuss more on the insight of inflation and rising interest rates. More importantly, how to use this knowledge, turning it to our advantage in these challenging times for all of us.

Micro 5-Year Yield Futures

1/10 of 1bp = US$1 or

0.001% = US$1

3.000% to 3.050% = US$50

3.000% to 4.000% = US$1,000

See below ideas on the previous videos for this series.