VOW trade ideas

Do you know what to keep in your wallet ! VOW3 STOCKThere is a high probability that VOW3 STOCKS continue to up and gets to a level of 155,28 , then to 162 ,52 EUR ,

Push like if you think this is a useful idea! Before to trade my ideas make your own analysis. Write your comments and questions here! Thanks for your support!

#VOW - New (un)Normal #Volkswagen #VW #VWGroup10.1 million short-time workers of 30 million employees (without public service) in Germany alone, collapsing demand for cars and interrupted Just In Time production chains but the stock exchange is going crazy, as if there were no skid marks nor profit declines nor climate goals with drastic CO2 reduction, ....

It should be fine with me and give the stock exchange a few more weeks to move into the 145-155 Euro range.

At 140 Euros, however, my first alarm clock rings for a closer look at the structure, to see if a bad awakening could come from June/July.

But maybe the sales crisis is only taking place in Europe, North- and South America and the Chinese, who are responsible for half of the VW sales, are more than compensating the drop of sales. Will all mentioned concerns above simply wiped out?

www.kfz-betrieb.vogel.de

Short term long,

medium term short but wait for new Q2-numbers.

Greetings from Hannover

Stefan Bode

VWAGY (Volkswagen) - WeeklyShort term forecast for long term positioning

Looking for a reversal within the coming month & eventual downwards trend towards the DCA zone

Recent news: Volkswagen recently restarted operations amid concerns of actual demand within the global market.

FA: From 2018 to 2019, Volkswagen saw a 20+% increase in yearly net operating earnings generating up to just over $16.9 billion.

As a major player, the company is well positioned to adapt to future automotive trends, given they continue to embrace smart

car innovations. Due to the current global environment and reasonably forecasting decreasing demand for vehicles for at least

the short term, it wouldn't be a surprise to see price action return to the range between 10.65 - 14.51, this area may serve is a

good opportunity for securing some longer term positions via DCA.

Always DYOR & keep risk managed :)

*Disclaimer: The above analysis is an expressed opinion only and should not

be confused as professional financial, investment, trading or legal advice.

Volkswagen - Company to Watch in 2020All comments and likes are very appreciated.

_________________________________________________________________________________________________________________

Volkswagen is one of the world's largest automotive manufacturers. Automotive brands include Volkswagen passenger cars, Audi, Bentley, Bugatti, Lamborghini, Porsche, SEAT, and Skoda. Commercial vehicle brands include MAN, Scania, and Volkswagen. The company's financial services group provides dealer financing to support floor plans, consumer financing for vehicle purchases, and other financial services.

Volkswagen AG has a chance to leave the diesel emissions scandal behind and become the dominant electric car company. Key to the effort is the ID.3, which VW will start selling in mid-2020 priced starting at about $30,000, to compete with the Tesla Model 3. VW has at least 70 electric cars in its pipeline, including cargo vans and the Taycan, a battery-powered Porsche.

The automaker is keen to acknowledge its green credentials following diesel-gate. An accelerated push on battery electric vehicles (BEVs) is one way management is trying to distance itself from the 2015 crisis—Volkswagen is looking to overtake Tesla as the leading manufacturer of electric cars through its Audi and Porsche brands. Global scale will come from the company’s 18% market share in China—the biggest BEV market, key to electric vehicle dominance. VW plans to unveil five new models in 2019 and numerous plug-in hybrid electric vehicles, including the Audi e-tron and battery-powered versions of the VW Lavida, Bora and Golf. Two new China plants with the capacity to produce 600,000 units annually are set to open next year. The switch to BEVs will remove an estimated 1% of global CO2 emissions yearly, according to company forecasts. By 2025, VW expects to achieve a 30% cut in CO2 fleet emissions, a 50% cut in plant emissions, and the use of renewable energy in every one of its plants. —Michael Dean, adapted from a BI: Focus report on Volkswagen.

I and/or others I advise hold a material investment in the issuer's securities.

_________________________________________________________________________________________________________________

All comments and likes are very appreciated.

Best Regards,

I0_USD_of_Warren_Buffet

TSLA (Tesla Inc) How to recognize the Bubble?..If you compare these two charts you will see they have similar patterns.

There is a volume pump on the Volkswagen chart in 2008 and a big spike to 116.15.

After that, the price will never back to such high levels. Now we can watch at Tesla chart and see the same patterns, high volume, and big spike.

That's mean we shouldn't look for Buy in such situations!

Dear followers, the best "Thank you" will be your likes and comments!

Before to trade my ideas make your own analysis.

Thanks for your support!

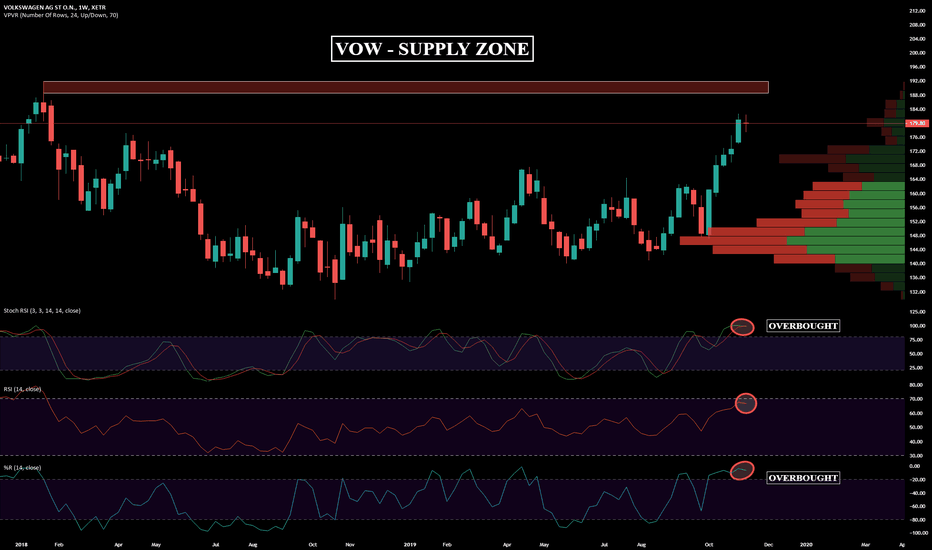

VOW - WEEK CHARTVOW - Volkswagen AG

Hi, today we are going to talk about Volkswagen AG and its current landscape.

Volkswagen AG it's poised to gain traction on the market since Tesla today has shaken the European auto markets by announcing that it has chosen the region of Berlin in Germany over the U.K to be the new engineering and design center site. A big step for the company that until now had to rely on a single plant in Fremont, California, to sustain the whole Tesla produce chain. The new Tesla factory should become fully operational only in 2021, according to Musk estimates.

The establishing of Elon Musk company on European soil sets a significant threat to the European automakers, which can be seen in a type of allegory represented by the Golden Steering Wheel award that Musk received in Germany yesterday. The prize was due the Model 3 been elected the midsize car of the year, beating the BMW and Audi models. We must remember that several countries on the European Union like Norway, Germany, France, U.K, Scotland, Netherlands and Ireland, have been making efforts to drastically reduce its using of fossil fuels cars, as an effort to diminish pollution. With the expansion of Tesla manufacturing network, with possibilities of more accessible prices, Tesla that it's already ahead on the electric car race will have the upper hand on the sector, and it might weaken its European competitors.

Thank you for reading and leave your comments if you like.

To have access to our exclusive contents, join the Traders Heaven today! Link Below.

Disclaimer: All content of Golden Dragon has only educational and informational purposes, and never should be used or take it as financial advice.