22UA trade ideas

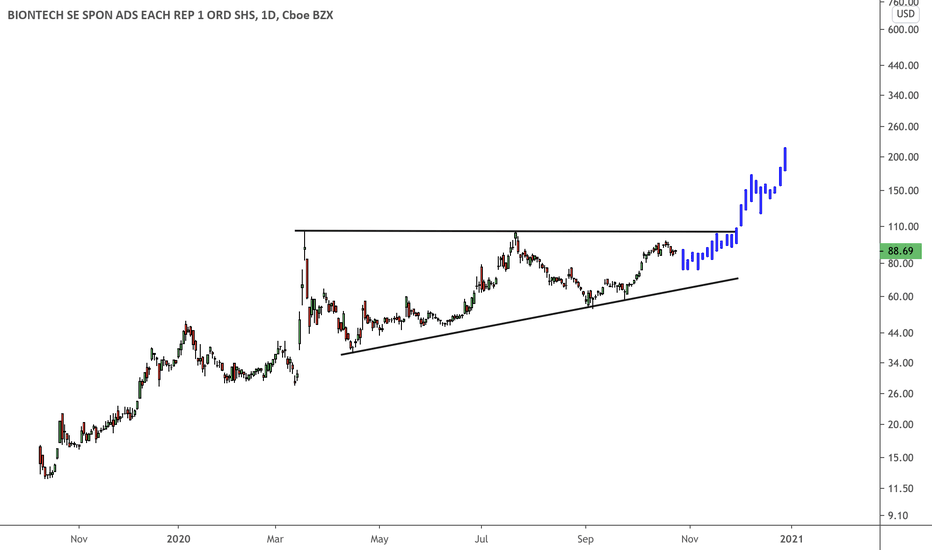

BIONTECH | BULLISH EXPECTATIONSWith the announcement of COVID-19 vaccine developments, Biontech shares saw a surge in price. In terms of technical analysis, it gave a bullish sign by breaking the resistance with high volume and a gap in the daily chart. Expecting a further increase in price in the upcoming dates and week.

BNTX - Pfizer and BioNTech could make $13bn from coronavirusThe US drugmaker Pfizer and the German biotech firm BioNTech stand to bring in nearly $13bn (£9.8bn) in global sales from their coronavirus vaccine next year, which will be evenly split between the two companies, according to analysts at the US investment bank Morgan Stanley.

Pfizer’s half would be more than the US pharmaceutical group’s bestselling product, a pneumonia vaccine that generated $5.8bn last year.

BNTX Biontech - A Star is Born - LONG CRV 2.5:1CRV-Wert 2.5:1

Covid-19 vaccine from Pfizer and BioNTech is strongly effective, early data from large trial indicate

Pfizer and partner BioNTech said Monday that their vaccine against Covid-19 was strongly effective, exceeding expectations with results that are likely to be met with cautious excitement — and relief — in the face of the global pandemic.

The vaccine is the first to be tested in the United States to generate late-stage data. The companies said an early analysis of the results showed that individuals who received two injections of the vaccine three weeks apart experienced more than 90% fewer cases of symptomatic Covid-19 than those who received a placebo. For months, researchers have cautioned that a vaccine that might only be 60% or 70% effective.

The Phase 3 study is ongoing and additional data could affect results.

In keeping with guidance from the Food and Drug Administration, the companies will not file for an emergency use authorization to distribute the vaccine until they reach another milestone: when half of the patients in their study have been observed for any safety issues for at least two months following their second dose. Pfizer expects to cross that threshold in the third week of November.

“I’ve been in vaccine development for 35 years,” William Gruber, Pfizer’s senior vice president of vaccine clinical research and development, told STAT. “I’ve seen some really good things. This is extraordinary.” He later added: “This really bodes well for us being able to get a handle on the epidemic and get us out of this situation.”

BioNTech delivers like promised | NEW COVID VACCINE DATA | Hey fellow Traders!

Today From MAINZ, Germany to NEW YORK .

In the last Analysis we talked about upside potential of the freshly developed Covid-19 Vacccine from NASDAQ:BNTX and NYSE:PFE

Also calling out those huge gains even before all those news were released.

"Today those companies announced their mRNA-based vaccine candidate, BNT162b2, against SARS-CoV-2 has demonstrated evidence of efficacy against COVID-19 in participants without prior evidence of SARS-CoV-2 infection, based on the first interim efficacy analysis conducted on November 8, 2020 by an external, independent Data Monitoring Committee (DMC) from the Phase 3 clinical study. After discussion with the FDA, the companies recently elected to drop the 32-case interim analysis and conduct the first interim analysis at a minimum of 62 cases. Upon the conclusion of those discussions, the evaluable case count reached 94 and the DMC performed its first analysis on all cases."

This means we are right on track for the FDA Fast Track Drug Approval, on which the whole world put their hopes on. With increasing daily cases this news are like a rescue ring in the middle of the ocean.

But lets get back to the chart.

We had a huge upper resistance level at the psychological mark at $100 but if this move today turns out to not just be a bull trap and we can see a solid consolidation phase, im optimistic to see a new support level building up at the prior resistance.

As we can see the uptrend is still intact and we could form a nice resistance/support level over time. With the incoming cataclyst it should be pretty obvious that we are likely to see a evven stronger upmove soon. But this stock is still a playball from big hegdefonds and investors. So be careful when trading this.

Personally i´ll use the next the next rebound to stock up, wait for the news and then sell nearly all those shares on good news.

Why i am sure about this?

- Well the stock had the same moves for the past months, and if you understoof this, it was like a money making machine.

- First come first served

- Millions of pre sold Vaccine doses to dozen of countries.

- Momentum

- No insider sold yet

- MRNA TECHNOLOGY

- CANCER MEDICICNE IN THE PIPELINE

- Incredible Management Team

- And of course Everyone wants to finally get their old life back.

- $1.4 B Potential Revenue

- Bill Gates

Thank you for taking your time to read this.

I hope this was interesting and useful to you.

Best greetings and happy trading! :)

Disclaimer: All writers opinions are their own and dod not constitute financial advise in any way whatsovver. Nothing published by me constitutes an investment recoomenddation, nor should any data or Content be relied upon for any investment activites. I strongly recommend that you perfom your own independdet research and/or speak with a qualified investment professional before making any financial decisions.

COVID-19 Biotech Play: Bullish chart pattern developingBIONTECH could be forming an ascending triangle from here. If it does, this is how I could see price develop in the coming months.

Click here for the company's landing page

"We are aiming to address the global pandemic- Our goal is clear: making a potential vaccine available worldwide as quickly as possible"

Click: COVID-19 strategy

BIONTECH is largely focused on cancer therapy, but also actively developing a vaccine for COVID-19.

I currently have no position - I'll start buying in small layers in the coming days/weeks

The ideal price action I want to see is continued consolidation, followed by a breakout above $105. ~$65 needs to hold.

BNTX 8H: BEST Level to BUY/HOLD 100% gains(SL/TP)(STOCKS)Why get subbed to me on Tradingview?

-TOP author on TradingView

-15+ years experience in markets

-Professional chart break downs

-Supply/Demand Zones

-TD9 counts / combo review

-Key S/R levels

-No junk on my charts

-Frequent updates

-Covering FX/crypto/US stocks

-24/7 uptime so constant updates

BNTX 8H: BEST Level to BUY/HOLD 100% gains(SL/TP)(STOCKS)

IMPORTANT NOTE: speculative setup. do your own

due dill. use STOP LOSS. don't overleverage.

🔸 Summary and potential trade setup

::: BNTX 8hour chart review and outlook

::: Biotech sector outperforming market

::: BNTX one of the best biotech stocks

::: so far in 2020 YTD gains

::: BUY dips / buy the pullback

::: noteworthy compression now

::: BUY close to 75 USD

::: is the best strategy BULLS

::: wait for pullback/dips and BUY IT

::: recommended strategy: BUY LOW 75 USD

::: SL 10% TP is 170/175 USD +125% gains

::: BUY/HOLD setup

::: DO NOT expect overnight gains

::: This is stock market

:::Not casino in Macau

🔸 Supply/Demand Zones

. N/A

🔸 Why should I follow your setups?

:::Check track record it's all been posted

::: MRNA 200%+ gains, NVAX 300% gains, REG 60%

::: AMD 40% gains and a lot more in 2020

Cup and HandleNo rising wedges

NV is high on this one

Cup and handle patterns are only valid over long entry level

Not a recommendation

Earnings 11-10 bmo

BioNTech SE, a biotechnology company, develops and commercializes immunotherapies for cancer and other infectious diseases. The company is involved in developing FixVac product candidates, including BNT111, which is in Phase I clinical trial for advance melanoma; BNT112 that is in Phase I/II trial for prostate cancer; BNT113, which is in Phase I trial to treat HPV+ head and neck cancers; BNT114 that is in Phase I clinical trial for triple negative breast cancer; BNT115 in a Phase I trial in ovarian cancer; and BNT116, which is in preclinical trail for non-small cell lung cancer. It also develops individualized neo-antigen specific immunotherapies, such as RO7198457, which is in Phase II clinical trial for first-line melanoma, as well as in Phase I clinical trial to treat multiple solid tumors; mRNA intratumoral immunotherapy comprising SAR441000 that is in Phase I clinical trial for solid tumors; and BNT141 and BNT142 to treat multiple solid tumors. In addition, the company develops RiboCytokines, which include BNT151, BNT152, and BNT152 for multiple solid tumors; chimeric antigen receptor T cell immunotherapies, such as BNT211 to treat multiple solid tumors, and BNT212 for pancreatic and other cancers; and next-generation checkpoint immunomodulators consisting of GEN1046 and GEN1042, which are in Phase I/II a clinical trial to treat multiple solid tumors. Further, it develops MVT-5873, an IgG1 monoclonal antibody, which is in Phase I/II clinical trial for pancreatic cancer; BNT411, small molecule immunomodulator product candidate for solid tumors; and infectious disease immunotherapies and rare disease protein replacement therapies. The company has collaborations with Genentech, Inc., Sanofi S.A., Genmab A/S, Genevant Sciences GmbH, Eli Lilly and Company, Bayer AG, Pfizer Inc., Shanghai Fosun Pharmaceutical (Group) Co., Ltd.; and Regeneron Pharmaceuticals, Inc. The company was founded in 2008 and is headquartered in Mainz, Germany.

Hide

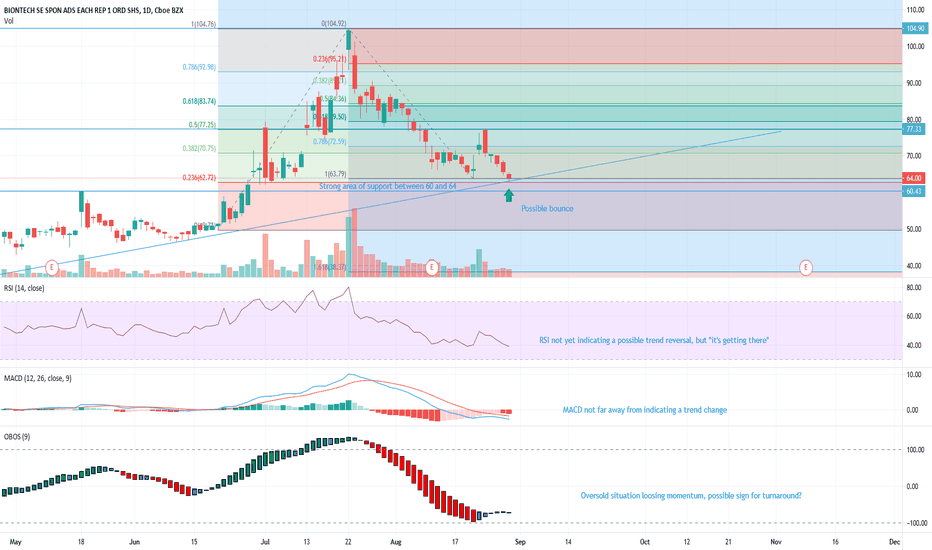

BioNTech: Support level found?The current chart of the German biotech company BionTech might suggest that the price hits a stronger support zone, leading to a possible end of the ongoing downtrend.

When viewing the trendline and Fibo retracement levels in the chart, a possible support zone between 60 and 64 USD emerges, giving a bit of confidence that we might see a switch into a sideways trend soon.

RSI and MACD support this opinion, although they have not provided a clear signal (yet).

Results of the ongoing clinical trials (phase III) are planned to be released in October, which could lead for buyers and sellers to take a neutral position before the results are getting published.

This is not an invitation to trade this stock, just posting my opinion.

BioNTech Stock Will Soar With Its First-Mover Vaccine AdvantageNASDAQ:BNTX a German company and its american partner NYSE:PFE

will likely have a first-mover advantage in the coronavirus vaccine race in the U.S. This will affect both stocks, once the final vaccine results are in.

Assuming the bottom is in and we are about to continue the Trend as previously, im expecting a big move after the approval, so dont forget to take risk of the table!

The reason for this is that the two companies are expecting to be the first to produce large-scale results from their Phase 2/3 clinical trials in October, according to Barron’s.

Depending on how effective their vaccine is, the U.S. Food and Drug Administration may even grant it emergency-use authorization

The advantage of their trial is that it is large, involving more than 30,000 participants.

The FDA wants to see at least 50% efficacy in trials before granting any Covid-19 authorization.

Why BioNTechs Vaccine Looks Like a Winner

With Pfizer in the back FDA and President Donald Trump are likely to move quickly.

According to them even the first small study with 24 Persons that took their messenger RNA vaccine produced antibodies.

With a lower doses usage of the vaccine and developed antibodies after 28 days — at levels about two times higher than in normal, recovering Covid-19 patients.

BioNTech and Fosun Pharma to Potentially Supply 10 Million Doses of BioNTech’s BNT162 to Hong Kong SAR and Macao SAR

Also a Deal to Supply Japan with 120 Million Doses of Their BNT162 mRNA-Based Vaccine Candidat

This combined with the huge buying volume and market shifts will grant momentum for bigger goals.

Just think about what ccould happen when they get kinda a monopol situation going for them.

Thank you for take the time and reading this and as always stay storng in those shaky times!

Sebastian

BNTX Analysis On 24/8/2020 i posted an analysis on this stock being over valued. The min entry price of $57.

AstraZeneca starts U.S final-stage trial of covid-19 vaccine have meant that BNTX is behind the race, but that also means speculators will come in long soon.

Look for short term buying opportunities to price of $70.

DO Not hold this high growth stock, dangerous.

BIONTECH Quantitative Analysis 24/8/2020BNTX

BTNX share is overvalued, things to note as labelled as high growth share and in the industry of breakthrough medical technology, contains high returns if succeed, but overall based on current analysis, I would recommend to ‘hold’ rating, as risk of failure is too high. Optimism may spark share price ahead to grow to a cap of $105, but not a good price to enter.

The rule for BioNTech investing is to enter early when prices are low and absorb full risk of failure from low ground. Instead of chasing optimism and opportunity.

For value investors a fair price to enter is 3.08 PEG in industry and expected earnings growth average in 5 year 6.81. Thereby price range $39-86 is within rationale price bound.

$57 and below would ideally be a fair entry. Based price of $19.5.

Fund management companies added 10% for july of total share holdings , while institution are reducing 17% of their holding View of top 20 companies buying and selling

Institutions : +514,841 shares vs -2,506,063 shares

Funds : +3,244,521 shares vs -1,318,947 share

Company top management team contractual term is due in 2022 . which is something to take note as currently their share options have made them wealthy, if there company successfully approved covid vaccine , they will be able to retire comfortably, if they fail, all they have to do is issue more debt securities to sustain their position and clock out 10x on their share options, Remuneration of Supervisory Board Members have 3.45x more from year 2018 to 2019. Which is absurd. The Management Board received aggregate remuneration, for the CEO alone is 10.8x more. Major private shareholders of company have bought in and hold at 15-19$/share

Biontech revenue is unstable, cost of sales has been seen rising even though revenue dipped. This shows the inefficiency of handling cost. Operating losses have been building up for the past few years, in this pace, funds might run out earlier than their expected 2 years.

Earning per share has been negative for the past 4 years , and have no signs of improvements, only signs of degradation. Biontech funds their research on issuance of additional shares as we can see the past activity of more diluted shares. Cash outflows have more than tripled due to competing for the coronavirus vaccine.Significant amount of deferred tax assets has been amounted due to operating losses that have not been realized. Valuation allowance has been adjusted to offset these assets.

Due to high uncertainty of the length of time and activities associated with discovery and development of our product candidates, companies are unable to estimate the actual funds the company will require for development, marketing and commercialization activities. Financing through debt equity /government funding /private equity are what they have just achieved, but there is still a high level of uncertainty whether the funds on hand is enough, competitors have successfully raised more funds then biontech.

Due to company limited resources, they may not be able to effectively manage this simultaneous execution and the expansion of our operations or recruit and train additional qualified personnel. This may result in weaknesses in our infrastructure, give rise to operational mistakes, legal or regulatory compliance failures, loss of business opportunities, loss of employees and reduced productivity among remaining employees.

The pandemic has also affected business operations and slowed down r&d efforts.

manufacturing, could also be disrupted due to the potential of the impact of staff absences as a result of self-isolation procedures or extended illness.

Company have limited experience in filing and supporting the applications necessary to gain marketing approvals and may need to rely on third-party contract research organizations, or CROs, regulatory consultants or collaborators to assist them in this process.

No mRNA immunotherapy has been approved, and none may ever be approved. mRNA drug development has substantial clinical development and regulatory risks due to the novel and unprecedented nature of this new category of therapeutics.

Delay or failure to obtain, or unexpected costs in obtaining, the regulatory approval necessary to bring a potential product to market could decrease company ability to generate sufficient product sales revenue to maintain our business.US election favors of joe biden could stop trump from overriding FDA approvals SOP which is supposed to take 4 years. Thus has a negative impact on vaccine production. Significant competition in an environment of rapid technological and scientific change, and company failure to effectively compete would prevent them from achieving significant market penetration. Most of their competitors have significantly greater resources than they do and they may not be able to compete successfully.

Company currently has no marketing and sales organization and as a company, and has no experience in marketing pharmaceutical products.The patent position of biopharmaceutical companies generally is highly uncertain, and has been the subject of much litigation in recent years thus hindering or removing company ability to limit third parties from making, using or selling products or technologies that are similar or identical Company has time and time again diluted shareholder equity, and therefore has gone in the route of forming mergers to maintain share prices.

Company will have a substantial amount of goodwill and other intangible assets resulting from the Merger. At least annually, or whenever events or changes in circumstances indicate a potential impairment in the carrying value, therefore the balance sheet of the company may due to have significant changes in coming times.

material weakness in company internal control over financial reporting and may identify additional material weaknesses in the future that may cause them to fail to meet their reporting obligations or result in material misstatements in our financial statements. If company fail to remediate our material weakness, they may not be able to report their financial results accurately.

A significant portion of our total outstanding ordinary shares will be restricted from immediate resale but may be sold in the near future. The large number of shares eligible for sale could cause the market price to drop significantly, even if business is performing well. I don't foresee company will pay dividends as german tax laws will tax them twice.

Company expects to commit approximately an additional €250 million through 2023, on PPE.

Revenue on clinical and technology platforms have not improved while expenses in these areas have soared. Company does perform well in the manufacturing area which is their strength and therefore should focus in that area alone and not incurred higher expenses in an area not of their forte.

Total Equity per share = $12.66

The companies are in global race with Moderna, AstraZeneca and others to develop a vaccine for COVID-19, the respiratory illness caused by the new coronavirus, which has claimed over 803+ thousand lives globally. The companies said they expect to start a large trial with up to 30,000 participants as soon as later this month, upon regulatory approval.

They also expect to make up to 100 million doses by the end of this year and potentially more than 1.2 billion doses by 2021-end, if the vaccine is successful.

The science and business of biotechnology is complex and uncertain, and trying to figure out biotech companies' prospects for success is no easy task. Because many ventures are in the development stage, they often confound traditional financial analysis: With little or no cash flow, earnings or even revenues, putting numbers on a firm.

Therefore this analysis relies heavily on qualitative analysis rather than quantitative, financial methods of valuation.

Naturally, a biotech company's product portfolio and research pipeline are the lifeblood of its success.

$BNTX Gives Up the Vax Gap... What's Next?BNTX seems like it should have held onto its opening gains given the power of the company's positive vaccine data premarket.

But vaccines generally aren't profitable, this is probabilistic, and revelations may still arise as to IP rights. $60 support is the key here.