USDBRX trade ideas

The massive number of coronavirus cases in BrazilThe bullish trend for the US dollar to Brazilian real exchange rate was reignited back in late July and is expected to remain strong even until earlier September. Looking at it, the risk appetite in the market should have already helped the cause of the Brazilian real. However, despite the regenerating risk appetite, it remains vulnerable against most major currencies, not just the US dollar. Perhaps the massive number of coronavirus cases in Brazil has sparked a great concern for the country’s currencies. Not only that, but the Brazilian president himself has been under intense scrutiny for months and is now the center of another controversy. Jair Bolsonaro is facing online criticism after he unsuccessfully tried to snuff out some questions about his family’s financial conditions even going as far as saying that he wants to punch a journalist’s face. The controversy involves the president’s wife, Michelle Bolsonaro, and Fabrício Queiroz over corruption.

USD/BRL (U.S. Dollar / Brazilian Real) -> Analysis of 23 Aug.

-> Hello Friends, here is my Month -Chart idea to USD/BRL. -> (all further information can be found in the chart)

-> Please note: These analyses are not intended as investment recommendations! The analyses presented by me are in no way to be understood as financial advice! Please also note that you are always responsible for your own investments when trading on the stock exchange! The analyses are only based on my opinion and view. Many thanks for your attention

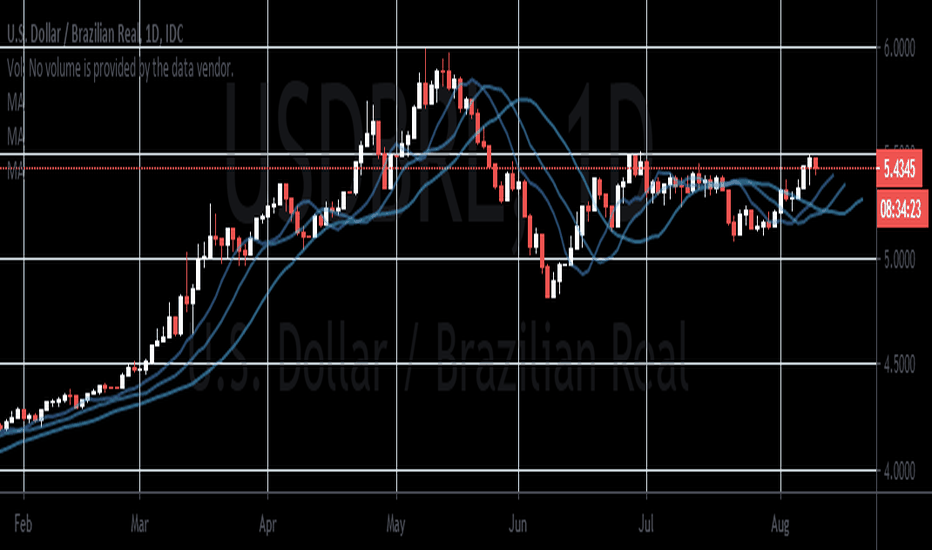

Prices are on track to climb towards their higher resistance levThe US dollar is currently seen working hard to force the Brazilian real past its initial resistance level this Tuesday. The trading pair has been awfully bullish in the past few weeks despite the major stumbles of the US dollar. Prices are on track to climb towards their higher resistance level, reaching ranges last seen in May 2020. The surge should help the bullish investors maintain their dominance, buoying the 50-day moving average further against the 200-day moving average. The US dollar has gained traction as investors tune in closely on the trade tensions between the United States and China and the stalemate in the US Congress over the massive fiscal stimulus. Just yesterday, the White House and US Congressional leaders expressed their interest to resume their discussions on a stimulus program that would save the US economy. Meanwhile, Beijing ordered sanctions on some US Republican lawmakers, intensifying the tension between the two parties.

The USD/BRL trading pair is still on an uptrendDespite the alarming weakness of the US dollar in the global market, the USD/BRL trading pair is still on an uptrend. That means that the Latin American currency is significantly weaker and that prices could soon hit their resistance in the second half of the month. According to one analyst, the broader appreciation of the pair could actually force a profit-taking sell-off once it reaches the resistance level. The greenback is severely struck by multiple fundamentals including political and economical risks. However, most experts believe that it will stand against the test of the coronavirus pandemic, but it will get weak. In the past, the Brazilian real has benefitted from the improvements in the foreign and domestic markets. Now, the currency is seen struggling to buoy itself as Brazil sees an uncontrollable surge in coronavirus cases, the rate might not be as high as America’s, it’s still forcing the economic slump to get even deeper.

USDBRL Why The BRL is probably at fair valueMost people think the Brazilian Real is cheap and will suddenly go back down to 4-1 with USDBRL. What most people don't take into account are the 4 most important factors when it comes to a currency: Inflation, Interest Rates, Economic Health, Political Risk.

Inflation is the first aspect to look at. Typically a currency will stay in a range whilst inflation continues to increase asset prices and eventually teh currency breaks out of the range to establish a new range. At the moment of the breakout, everyone thinks it is temporary and will go back down, when in reality it is just the currency finally catching up to a fairer range inline with inflation over the period. This repeats itself over and over again.

If you add a reducing interest rate, weak economic health and political risks you can expect the currency to depreciate further than the longer-term inflation average as foreign investors do not want to own a risky currency that offers low-interest rates.

So is the BRL cheap? We dont think so! We think it is actually at its fair value and until interest rate increases to make the country risk worth the currency risk! The Finance Minister Guedes has openly admitted that he does not have intentions to intervene heavily in the exchange rate and Brazil will see a higher demand for exports with a weaker Real which they need if they are to keep the economy going. A rate of 5.5 is probably going to be around for a while

The US dollar is seen trading strong against the BRL todayThe US dollar is seen trading strong against the Brazilian real today despite its broader weakness in the global market. In fact, the US dollar is seen dropping to its 2-day lows just today. So, why does the US dollar to Brazilian real exchange rate continues to rise? The answer is simple. Investors are really alarmed by the number of coronavirus cases and deaths in the Latin powerhouse. This is driving the demand for safe-haven currencies such as the US dollar by local traders. The risk sentiment in the market has been fluctuating the past sessions, now it was reported that China’s coronavirus vaccine is showing impressive signs. CanSino Biologics reportedly developed the vaccine and the Chinese military recently received the approval to use it. The clinical trials of the said drugs found that it was safe to use, and it showed efficacy to the patients. China currently has eight candidates for the coronavirus race which still has a long way to go.

USDBRL Breaking out PointUSDBRl is on a mid range with clear chart formation. If it breaks above 5.40 it will try to find 5.90 very soon. On the other side, breaking down it aims 4.80 again on a double top formation.

With the moving averages crossing, the MACD still generating momentum, covid crisis taking off again in the US, risk off momentum can build up, bringing strength to USD and favoring the trade.

US Dollar overcomes first projected resistanceThe US Dollar has reached and overcome the first projected resistence around R$5.30.

It seems like its going to keep rising till the region of R$6.00, where it is going to retract to R$5.30 tops.

On the other hand if this recent overcoming fails, the US Dollar may retreat back to the next support around R$4.80.

What do you think?

Does it make sense for you?

USDBRL - wave b should bring it to range 5.04 - 4.97, before up As predicted in our post of June 3rd, the currency reached the target range and turned up as forecasted, completing the minor wave A. It seems to have finished tracing minute wave a of minor B. If this is the case, the next move should be to the down side up to the range of 5.04 to 4.87 when minute b should complete and minute c should elevate its quote to the range 5.40 to 5.50. FOLLOW SKYLINEPRO TO GET UPDATES.

USDBRL - possible minor correction to 5.2 before last leg downAs predicted in the post of May 26, USDBRL reached a level a few points below the target for the correction. Now USDBRL is tracing minor wave A down and it is currently at the beginning of minute 4 up that could reach levels around 5.20. After this the currency pair should enter in the last leg down to complete wave A (our current target for this is at R$4.87) When wave A finishes, wave B should elevate USDBRL to the range between 5.42 to 5.55 before it continues its trend down again. FOLLOW SKYLINEPRO TO GET UPDATES.

The Brazilian real makes a comeback against the US dollarThanks to the efforts of the Brazilian central bank, the Brazilian real makes a comeback against the US dollar. The broader strength of the greenback in the global market is no match for the determination of bearish investors to recover. Considering the US dollar to Brazilian real trading pair’s sharp decline, the pair should reach its support levels by the second half of the month. The Brazilian real is gaining strong momentum after struggling thanks to the previous interest rate cut of the Latin American country’s central bank earlier this year. The currency is feeling the pressure from both political and economic factors; the looming recession in the heavyweight country and the intense controversies regarding the Brazilian president and anti-lockdown protesters. As for the US dollar, it’s reign is about to end as other currencies thrive and the risk sentiment continues to prosper along with the hopes for a speedy recovery of the global economy.

USDBRL - probable correction up to 5.60 aheadUSDBRL reached the target forecasted on the post of May 7, where it completed intermediate wave 3. It is now tracing minor wave A down and just seems to have finished minute wave 3. It should correct to around 5.60 where minute wave 4 should end before trending down again. FOLLOW SKYLINEPRO TO GET UPDATES.