UNM trade ideas

UNUM PRICE FORECAST

Unum Group is engaged in providing financial protection benefits. It operates through the following segments: Unum US, Unum International, Colonial Life, Closed Block and Corporate. The Unum US segment consists of group long-term and short-term disability insurance , group life and accidental death and dismemberment products, and supplemental and voluntary lines of business. The Unum International segment engages in the operations of the UK business, which includes insurance for group long-term disability, group life, and supplemental lines of business that include dental, individual disability, and critical illness products and the Poland business, which includes insurance for individual and group life with accident and health riders. The Colonial Life segment includes insurance for accident, sickness, disability products, life products, and cancer and critical illness products. The Closed Block segment consists of individual disability, group and individual long-term care, and other insurance products no longer actively marketed. The Corporate segment refers to investment income on corporate assets and other corporate income and expenses not allocated to a line of business and interest expense on corporate debt other than non-recourse debt. The company was founded in 1848 and is headquartered in Chattanooga, TN .

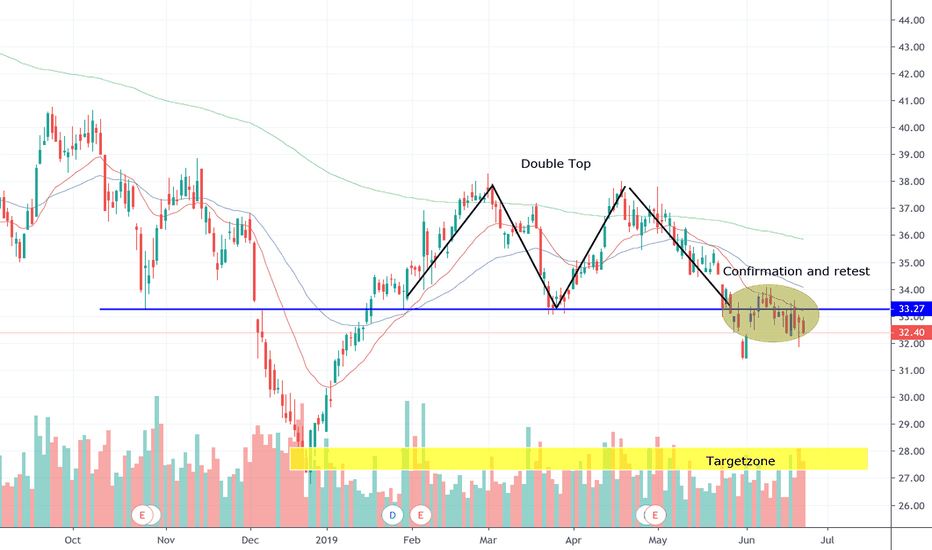

from a technical perspectiveif it doesnt launch now

id go for the second level so yes id short it till there

im expecting the market to continue crashing so i think

it myt just break this level n go to the 2nd level

yet to see financials

SENNA SEASON

$UNM - survived earningsTheir earnings were better than the last quarter.

Based on screener I started collecting commons on this stock and I am adding when it dips under the 20 MA.

So far the trade is working in my favor. I watch closely to remains green. I am 12% green currently and will continue to add on the dips.

$UNM - follows my speculationAccording to my screener, and historical profiling, and tracking past 8 Friday's performance, and listening to people smarter than me....

I have been watching this for a while now. It may dip lower early next week but I really like this ticker and company and may find today presents the entry.

It may dip under $27 - I have open-with-stop set for $27.50 to catch it on the ascent.

Unum $UNM Insurance: Long-Term Value High Probability OptionUnum is an insurance company that is listed on the S&P 500 Index . In October 1992, their TTM income was about $250,000,000, and their most recent quarter TTM income is just shy of $1,000,000,000. However, their value derives from their P/E ratio , for that is about 5, the same value of the S&P 500 index's all-time-low P/E ratio (which occurred around 1929). Their other fundamental characteristics are very safe: Price to Book 0.4849, Debt to Equity Ratio 0.3102, Book Value Per Share as of date of charting $53. Technically, UNM is trading in a logarithmic channel and its current price is under its linear regression , which leaves room for a multi-year long (decade) increase in price. Expect an Elliott Wave (1) $36 (2) $18 (3) $60 (4) $36 (5) $135. The strategy is to invest in Long-Term Equity Anticipation Securities (call options with expiration dates about 100 days away) and roll them over at 45 days until expiration. Deep OTM calls provide more leverage with the March 19, 2021 $30 call currently boasting a multiplier of 8.15 (Delta 0.14, Ask $0. 40 , UNM Market Close $23.27). Since the current Federal Open Market Committee's target rate is 0.00-0.25 and Fed Chair Jerome Powell saying interest rates will stay low, stock prices are likely to rally, and value investors and are likely to purchase this stock soon, as UNM's dividend yield of 4.90%; the beginning of this can be seen in the increasing RSI!

UNUM GROUP ChartHello traders, UNUM GROUP is a bullish movement with a turn and an attempted return of buying will traded In TIMEFRAME M1 a hammer candle is observed with a return of sell volume executed it will make a trend reversal on its last low. It is possible to breakout the price and go on the top to test end up breaking out the stabilization zone to get to a new one. To reach the last point higher in order to fill the bearish breaking gap before significant resistance has passed. Then test the top of the zone for possible breakout attempt which corresponds to the top of the bullish channel.

Please LIKE & FOLLOW, thank you!

UNM Unum Group - one of the safest betsUnum Group is engaged in providing financial protection benefits. It operates through the following segments: Unum U.S., Unum UK, Colonial Life, Closed Block and Corporate.

The company offers group long-term and short-term disability, group life, and accidental death and dismemberment products; supplemental and voluntary products, such as individual disability, voluntary benefits, and dental and vision products; and accident, sickness, disability, life, and cancer and critical illness products.

3.619B MARKET CAP

Net Income 1.1B

Amazing 3.62 P/E ratio

6.67% DIV YIELD

If you are interested to test some amazing buy and sell indicators, which give the signal at the beginning of the candle, not at the end of it, just leave me a message.

UNM Too Good To Be True?First off, Nobody can predict the future so you should always take everything I (and others) say with a grain of salt. My opinion on great stocks could be risky or unwise to others.

Currently UNM is trading at a P/E ratio of 3.62 and are expected to grow at a 1.5% rate annually. Their book value per share is $49.10 and their annual cash flow is higher than their stock’s share price. Their average on safety and have a rising dividend with a 6.8% yield with only a 22% payout ratio! The rest of their earnings are split between buybacks and reinvesting in equity.

UNM appears average to their industry/competitors on return on assets, price to sales ratio and debt to equity ratio.

WARNINGS: Their first quarter earnings are (.79) compared to their prior quarter (1.44) but their earnings are expected to recover to at least ($1.20) next quarter. Before net income their spending 1/8 of their profits on debt interest which isn’t too much of a problem imo. I couldn’t find any info about their ‘stock based compensation’ but that’s already included in the net income so thinking not too big a deal.

UNM does disability insurance for major accidents and illness like car crashes and serious sickness.

Was a long one

UNM Approaching Resistance, Potential Drop! UNM is approaching our first resistance at 34.40 (horizontal pulllback resistance, 23.6%, 50% fibonacci retracement) where a strong drop might occur below this level pushing price down to our major support at 30.62 (50% fiboancci retracement).

Stochastic (55,5,3) is also approaching resistance where we might see a corresponding drop in price.

Let UNM fall a bit further...Shares of insurer UNM are falling after reporting mixed results. I'll be the first to admit that the insurance space is not something I follow closely, but I do see a technical play forming.

The $36-37 area was a breakout level on the weekly chart, so the level should act supportive.

Income investors may also find that level attractive, as the shares would yield about 2.5% at the $37 level.