UAL trade ideas

A downtrend on United Airlines.A downtrend is developing in United Airlines since the last 27 days. Until the price breaks this bearish trend line, it will drop. When the price breaks up the line and the volume confirms it, we can establish a long position, with the stop loss near to the trend line. Chart temporality: 1 day

OPENING (IRA): UAL APRIL 17TH 70 MONIED COVERED CALL... for a 66.40 debit.

Metrics:

Max Loss: 66.40 (assuming the stock goes to zero)

Max Profit: 3.60

Return on Capital at Max: 5.42%

Break Even/Cost Basis In Shares: 66.40

Notes: Selling nondirectional premium in the margin account, (See Post Below), but looking for a quickee dirtee in the IRA. The natural alternative is to sell the 70 put, paying 3.50, with a resulting cost basis of 66.50.

UAL headed to $40Seems like a wild call. But around May-June timeframe I firmly believe United will be around $40, if not sooner.

This covid-19 disease has pretty much stopped air travel. You might think you saw your airport with people in there and other anecdotal stories. But I know many

But I can tell you that business travel has been cut to almost zero. I know this is a once in a generation event for travel, and for the airlines, it may be worse than the financial crisis. Maybe not worse but different. And the numbers have not even shown up in the books as of yet.

I am hoping United bounces closer to $70 this week on false hope... and then I will place a very large short.

Best of luck trading.

UAL (United Airlines Holdings), Time cycled trading!If you look at this time cycles you can see how we can predict the future using the past!

And we don't need to be an oracle to chose the Buy Zone place.

Push like if you think this is a useful idea!

Before to trade my ideas make your own analysis.

Write your comments and questions here!

Thanks for your support!

UALEarnings to be released later today. Expecting some volatility in price today moving into towards the last hour of the day. After Hours market will aid in determining what the outlook for united will be. With weakening indicators there is potential for continuing of the consolidation in the sideways trend,.

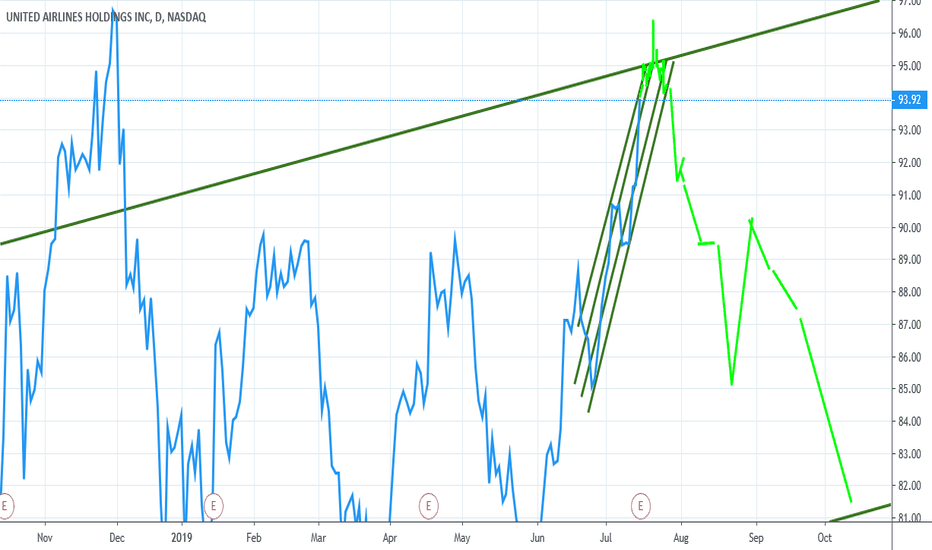

$UAL Trading a breakout in United Airlines. Entry level $88.50 = Target price $97.00 = Stop loss $87

Trading for the breakout on earnings tomorrow.

Stock is in a very tight range and the move should be quite frantic.

Indicators are bullish.

Fundamentals are strong, Fuel costs remain low and passenger demand increase.

Downside is limited.

BUY $UAL under $95 SELL $UAL over $95.25The chart speaks for itself. It's an inversion of United States broader market index movements (defensive sector rotation). As broader markets trend lower over the next week, UAL will continue a slow path upward and most likely over 95.50 for a moment. But just as the going seems to be good for $UAL, and as everything seems to be nosediving in broader SPY index, suddenly UAL will descend upon the lower ranks of well, lower. Probably 5 points lower, at least.