BND trade ideas

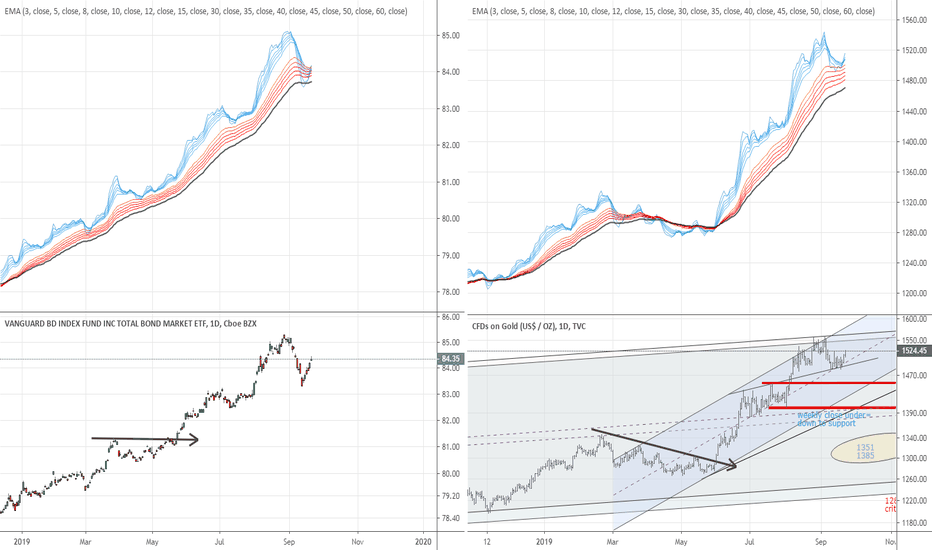

revisiting the BOND/SPY ratioIt's possible today was the day bonds finally reverse and start becoming attractive to investors again. This is a monthly chart with steep bullish divergence, so we're talking about a multi year (and possibly decades) of an uptrend from here. If you don't know how to read a ratio chart, it simply shows the amount of SPY etf it takes to make one BND etf. If it's in an uptrend, then it takes more SPY to make one BND. That could mean 3 possibilities -

1. SPY and BND rally together but BND outperforms to the upside

2. SPY keep going down and BND goes down much less in percentage

3. SPY keeps dropping or stays stagnant for years while BND rallies

My guess is 3. Especially if SPY drops and then meanders for years with meager returns, BONDS may become the play for the coming decade.

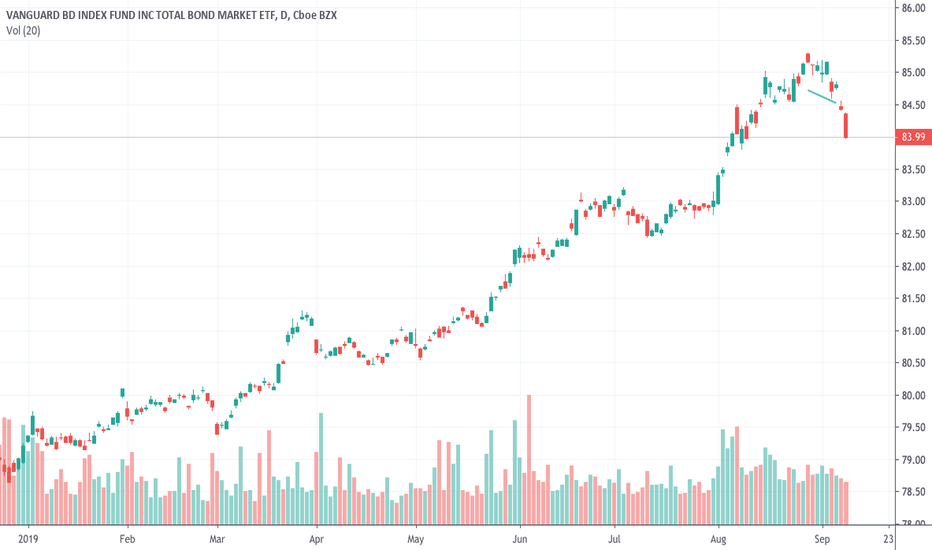

The Bid for BondsBND looks to have finished it's C wave and now getting ready to rally past most expectations. On the BND ETF, it should make new highs.

Strong weekly bullish divergence and A=C 1.272 which is a very common extension for C. For those looking for a fundamental reason for bonds to rally, I recommend David Rosenberg's excellent interview a few days ago on Wealthtrack - youtu.be/44_kSXbuJYc

James Bonds vs I SpySpy vs Bond ratio chart. An uptrend means that bonds are outperforming spy.

Monthly bull divergences, monthly PPO about to cross bullish, Slow Stochastic over 21 for the first time in 2 years. This is a generational opportunity for bonds. Chances are good that the economy tanks mid-year and Powell and the other geniuses at the FED rethink the rate hike strategy, so bonds will continue to rally vs SPY. 60/40 portfolio may become 10/90 by next year.

Are bonds not attractive? $BND $JNK $AGG $HYG $LQDWith cpi inflation up at 6.2 % why should I be willing to hold a bond fun which as way above average prices and yielding between 2% and 4.4% for junk bonds? Shouldnt I be avoiding this reach for yield and get either more constative and look for future discount opportunities, or should buy a traditional portfolio and pray a sell off doesnt happen over next 5-10 years? #worried

BND large scale paterns my work is applicable to all time scales. I prefer to stat with the entire data set and work down to the details. My intuition works best when I don't have skin in the trade.

The major fluctuations on the market have anachronistic traits seen in past and future.

BND total bond market.

Total bond market index( $BOND 1M ) Classic Wyckoff accumulationThe chart speaks for itself. I expect higher prices in the future meaning negatives yields...

Learn more about the Wyckoff Method : school.stockcharts.com

As time goes by, I will keep you updated on the evolution of the chart, so make sure to follow me on Tradingview

Disclaimer : This is not financial advice as I’m not a financial adviser.

This is just my knowledge on what can be said and done from the chart.

Due to the volatile nature of the cryptocurrencies market, it can change on a day to day basis.

Everyone is wise to manage their risk properly when considering any trading decision or activities.

Bond bubble about to blow.With a yield-to-maturity of only 2%, how much lower can it go (or prices of bonds rise) given that the 'real' rate of return is now negative? Deteriorating global economic growth will soon cause spreads to widen (a good portion of these ETF bond funds are in higher yielding corporate bonds) which will hurt bond prices.

BND: Defensive Against Trade WarI have three bond funds that I use for a regular market hedge as well as a possible target for short-term down market conditions. Unless some last minute Hail Mary comes out on this US/China trade dispute, I expect the rest of May and maybe June and July to be difficult months to weather in stocks. There's some money to be made, but it'll require strict vigilance to adhere to your trading signals and risk management rules.

If BND Ever Does This Again, Beware29th of November, 2007 - bond market experiences a flash crash which is quickly bought up by the FED in an effort to prevent widespread debt defaults. Worked for a few months only for companies to begin defaulting anyway, probably through a series of realized margin or interest spike risks. This is what caused the financial markets to implode in 2008.

Watch and study the bond market, it can tell you more about medium to long-term market direction than any other indicator.