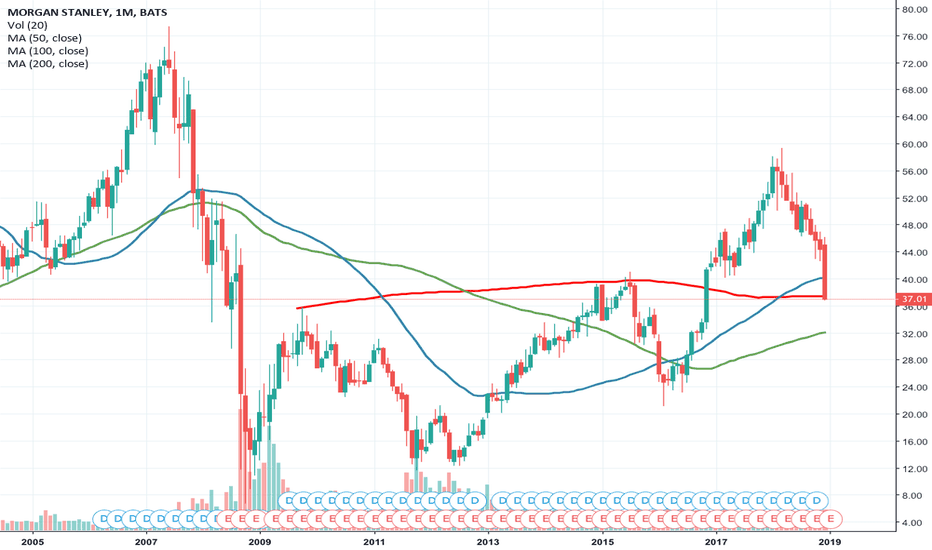

Morgan Stanley's chart is under strain. Break imminent. Morgan Stanley investors are not expecting anything overwhelming from earnings , the warning signs seemed evident as early as May, when JPMorgan's CEO Jamie Dimon projected that his company would see M&A and capital market revenues drop 10% in the second quarter, likely the result of clients postponing deals amid lingering trade policy concerns and a turbulent Brexit process. This is for sure going to be the case for all the banks this quarter.

On the positive side the management have claimed that its investment backlog is very solid, while the stock remains undervalued.

It seems that it is just too risky to get involved prior to earnings as the chart is technically looking weak, there is hope that the stock could break higher as it is in a very tight trading range wedged between Ma's.

LONG ABOVE $45

SHORT ON BREAK BELOW $43 WITH HEAVY VOLUME

0QYU trade ideas

LONG Options Trading: Morgan Stanley(MS) Buy Call $49 Exp: 7/19Understanding The trade:

As an options trader my goal is to identify trend change and utilize a breakout strategy to leverage profit off of major trend changes with minimal risk. Even though this contract does not expire till 7/19 I will be looking to take profit by early july(see green box) as the rate of decay factor starts to come into play as the contract approaches expiry. This should correlate nicely with the Fib Retracement lvl of .786. If you have any questions please feel free to comment below and follow. Thank you and trade safe.

Reasons For Trade:

• Bounced off the Feb & Mar 19' low of 40~41 lvl

• Broken downward channel (1D chart May 1st -June 3rd)

• Broken RSI Channel

• RSI Overbought > 30

Trade Parameters:

• Broker: Robinhood

• Cost For Entry: Free

• Contracts: 20

• Entry Price: .10

• Risk: $200

• Reward: $600

• ROI: 300%

• Risk/Reward Ratio: 1:3

Morgan Stanley (MS) uptrend in formationMorgan Stanley stock is going up with the banks in a strong upward rally. For longterm investors, you can buy into this recent strength and hold it for highly probable and profitable investment. I think this investment should be about the next 6 months -1 year. The technical analysis looks really good too because the relative strength index has broken the downward channel and now is going up positively. If this stock here today is at 47.89, I would expect a retest near the all last highs of 56$-58$. By buying low relatively now and selling higher at 56$, you will receive approximately 16% !!!!!. Now that doesn't seem like ALOT, but it is when your investing consistently.

Anyways, goodluck out there and enjoy buying the banks. (They've finally made bottom from last year !!!)

MS earnings name with gap during after-hours session! MS has earnings today and is gapping up in after hours (not a huge move but still could follow in pre-market). Volume profile is nice and clear with more then 800K shares and price action consolidated above 200sma with a smooth drifting pattern. Nice potential move up here touching hopefully 51

Morgan Stanley Establishes New Uptrend - Bullish Hi All,

MS should easily beat earnings since it's a busy IPO season and they are one of the major banks to underwrite the coming public offerings. I know that they are underwriting Uber's coming IPO.

Feel free to provide constructive critique. I have loaded up on May $45-$46 call options. I am also holding GS call options.

Morgan Stanley | Bearish sentiment ahead of earnings. Looking at Morgan Stanleys chart.

The SQZ indicator continues to turn hard green. Indicating further down side.

The stock has been ascending on descending volume. Bearish sentiment.

The MacD is about to have a bearish crossover.

The chart follows the bearish sentiment that is seen across the market.