DCO trade ideas

oh Deere oh Deere getting some conflicting signals maybe it wants to squeeze to $420 but it's encouraging a diamond with a potential to really take a nose dive... GL trade safe not saying i don't believe in them in the long term, but the short term could really bring some pain. I believe in their robotics and AI development as well as the need for farming to make huge upgrades in machinery over the coming years, but best to stay on the sidelines here and wait to plant some seeds another day imho.

Earnings 11-23 BMOEarnings on the 23rd BMO.

Price hit C in an ABC Bullish pattern and it was off to the races.

A rising wedge has formed that is not valid as the bottom trendline has not been broken.

Rising wedges can stay bullish for quite a while. Neutral until broken.

The wedges are also on hourly.

Possible targets in green valid if price does not break the support or bottom line of the rising wedge it has been in since C is not broken.

Target 1 in larger green type. It is very possible to break up and out of a Rising Wedge. Personally I steer clear of them unless I am already in a security when a wedge forms.

If I am already in I tighten my stop so I am not caught in the fall.

I do not have the .236 marked on this chart, but price is above it.

No recommendation.

Safety is free so use plenty of it (o:

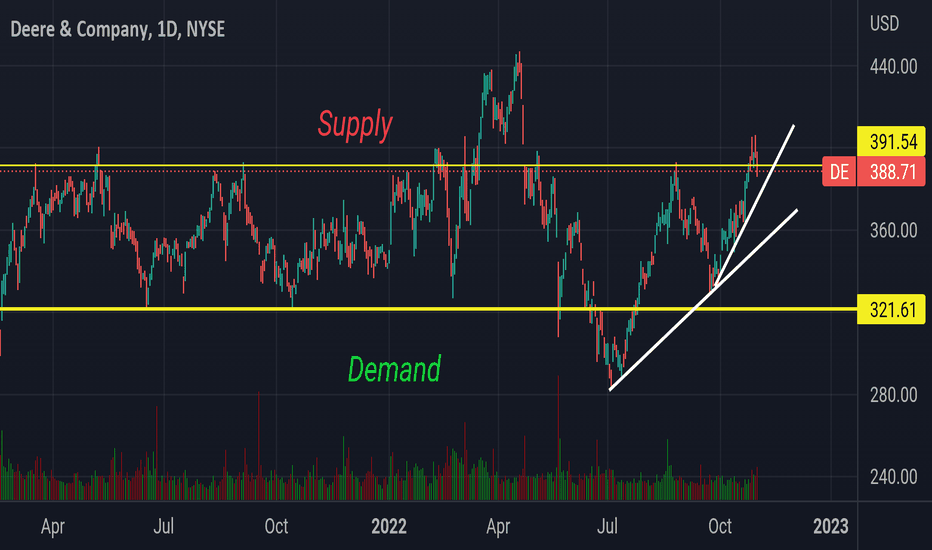

John Deere Short Trading at the top of a 2 yr range.. showed some heavy selling yesterday and I expect a follow up today..

My short term target would be 373 or daily 21ema..

If it drops below 373, 351 then 321...

The 373 could be a swing trade but this is overall a long term short (60days) .

It all depends on how fast the Dow Jones sells

Deere in the Headlights?Deere has been one of the better-performing members of the S&P 500 since the summer, but now it could be hitting resistance.

The main pattern on today’s chart is the falling parallel channel along the highs of April, August and October. The farm supplier probed that resistance on Friday before reversing along with the rest of the market. Could it now push lower into the channel?

Second, notice how the rejection occurred at the 50-day simple moving average (SMA) and 200-day SMA. Failure to remain above those SMAs could reflect a bearish trend.

Third, stochastics are dipping from an overbought condition.

Finally, other agricultural stocks like Mosaic and CF Industries fizzled last week after trying to rally. A continuation of that trend could potentially weigh on DE.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options, futures and cryptocurrencies. See our Overview for more.

Important Information

TradeStation Securities, Inc., TradeStation Crypto, Inc., and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., all operating, and providing products and services, under the TradeStation brand and trademark. You Can Trade, Inc. is also a wholly owned subsidiary of TradeStation Group, Inc., operating under its own brand and trademarks. TradeStation Crypto, Inc. offers to self-directed investors and traders cryptocurrency brokerage services. It is neither licensed with the SEC or the CFTC nor is it a Member of NFA. When applying for, or purchasing, accounts, subscriptions, products, and services, it is important that you know which company you will be dealing with. Please click here for further important information explaining what this means.

This content is for informational and educational purposes only. This is not a recommendation regarding any investment or investment strategy. Any opinions expressed herein are those of the author and do not represent the views or opinions of TradeStation or any of its affiliates.

Investing involves risks. Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options, futures, or digital assets); therefore, you should not invest or risk money that you cannot afford to lose. Before trading any asset class, first read the relevant risk disclosure statements on the Important Documents page, found here: www.tradestation.com .

DE -- Long--Bullish candle on CPI report

--hold on tight for a couple days on 21, 50, 200 ema(s)

--Re-claim 200 ema

--Breakout from W pattern 3 days ago, awaiting for CPI report

--Cut loss at 7%, gain 2:1 ratio

--Avoid if choppy price action

--Entry above 1.25-2% (play safe)

--MACD show entry for couple of days, RSI above 50

--MACD shows strong momentum

--Small gap above at lower target need to be fill

Deere and Co Continues to Meet with Gravity. DEWe are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in purple with invalidation in red. Confirmation level, where relevant, is a pink dotted, finite line. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statistically likely levels that the market will go to. Having said that, the market will always do what it wants and always has a mind of its own. Therefore, none of this is financial advice, so do your own research and rely only on your own analysis. Trading is a true one man sport. Good luck out there and stay safe.

RectanglePrice is close to the support line of the Rectangle.

Old rectangle and price has managed to break above and below it without continuing the trend.

This is a very, very steep trend up and I will post the weekly chart below. It is easier to visualize a long steep trend and/or Parabolic Arcs on the weekly timeframe.

Price is above the .382 and even at this level, it seems to be a deep pull back a lot at first glance on the daily timeframe. But in the scheme of things it has not.

If this is an arc, on average they will pull back between the .5 and .786 Fib levels, although from what I have noted as of late it is more like between the .618 and the .786. Some fall further, some less.

No recommendation/Short interest is low at around 1.17%.

Possible M pattern forming but too soon to tell for sure.

Good idea to take a look in the rear view mirror before you make a move.

Is $DE ready to move higher from here?Notes:

* Very strong up trend

* Great earnings track record

* Was basing for about a year before volatility kicked it around to both the up and down side of the base

* It's currently back within that base (between 394.4 and 323.5)

* Last weeks close had strong volume coming in (above average)

* Recently came back above the $357.1 mark on the weekly, which seems to be a battle ground for bull and bears (with higher than average volume)

* Was consolidating tightly all of last week with increasing volume and broke out of that consolidation on Friday with abnormally high volume

* Currently offering an early entry and a pocket pivot

Technicals:

Sector: Industrials - Farm & Heavy Construction Machinery

Relative Strength vs. Sector: 1.02

Relative Strength vs. SP500: 1.18

U/D Ratio: 1.2

Base Depth: 53.52%

Distance from breakout buy point: -16.72%

Volume 208.01% above its 15 day avg.

Trade Idea:

* You can enter now as the price is just breaking out of consolidation with higher than average volume

* If you want a better entry you may be able to get one around the 361.9 area if it comes back within the consolidation range

* This stock usually has local tops when the price closes around 13.34% above its 50 EMA

* Consider selling into strength if the price closes 13.14% to 13.54% (or higher) above its 50 EMA

* The last closing price is 8.67% away from its 50 EMA

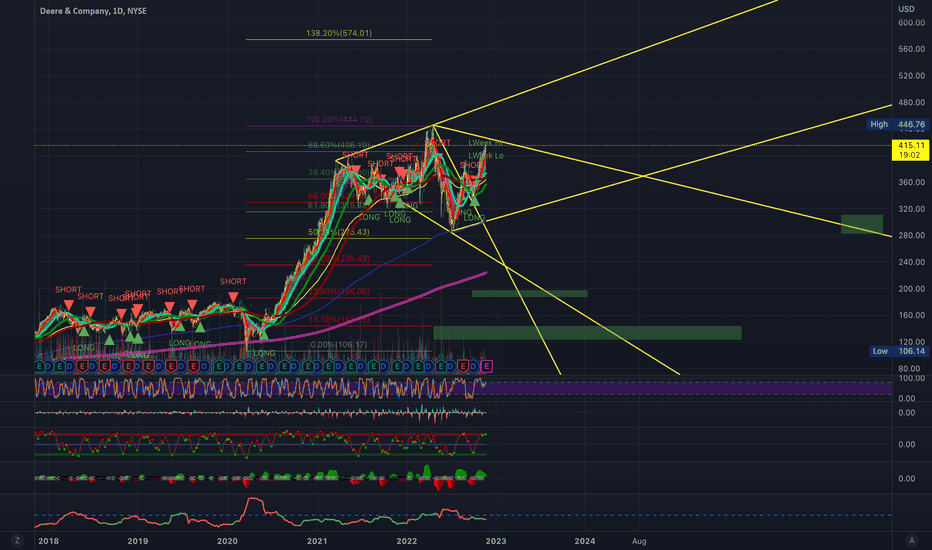

Bears are going to eat this deereHey all, I wanted to share with you my macro outlook on DE. This stock trades surprisingly clean for a low-volume stock-perhaps manipulation? Regardless, this thing looks like a child from 2000 & 2008- it looks more similar to 2000 with the false breakout it recently made- all it needs now is follow-through down, which I expect. This is one of my largest positions short right now, and currently, is my biggest loser being down just over 2%. I am not worried about this thing in the least bit- the risk:reward to the downside is incredible, in my eyes. I think Deere gets slaughtered by bears by year-end, and sees pre-pandemic levels- I'm predicting this stock is going to halve well before this thing sees all-time highs again(probably will take many years), and I think that's a safe bet to make considering context clues from the market right now.

DE short ideaHey all, I was short DE ahead of earnings and was surprised to see my green position switch to red in virtually an instant. I don't think this'll last. If you look back by the end of the year, new lows should be made, not new highs. I don't think this thing sees new 52W highs for a very long time. I'm currently down about 2% on my DE short position, and I'm comfortable holding through a possible momentum follow through upwards on this name. In my eyes, it's making virtually identical patterns to what it made in 2000/2008.

Trouble Ahead For DeereTechnicals: This is not at all a perfect short setup solely off of the technicals. With that in mind, some clear signs of weakness can be seen in DE's weekly chart. One such sign was the new lower low formed at around 285 in July, which broke DE from its previous trading range of around 310-400 a share. Deere's recent bull rally since July's new low I find to be relatively weak due to lower volume. MACD (momentum) on the weekly has sustained a bullish cross. Monthly MACD is still positive yet a bearish cross has occurred. While the MACD on the daily timeframe is signaling a relatively strong uptick in momentum on the shorter timeframe. Despite the bullish momentum on the daily, the longer-term momentum indicators are signaling that there will be a sustained period of underperformance ahead for DE.

Fundamentals: Earnings for DE are on the 18th. P/B ratio of roughly 6. P/S of around 2.5. Debt to assets of 2.6. These all appear to me a bit weak. That being said, Deere's profit margins have expanded quite nicely over the last couple of years. I am not very excited about their margin growth, as I see global inflationary pressures providing headwinds for Deere's intermediate-term profitability. Overall, DE is an overvalued stock with little potential for further upside gains in my opinion (especially with the global macro picture steadily deteriorating).

Prediction: I do believe the short-term momentum will carry DE up to the 378.32 resistance, likely before earnings are announced on the 18th. Earnings will be a major risk event for DE traders. Should earnings come in higher than expected DE could easily rally above 378.32 and into 398.36 territory, possibly even higher (just look at WMT and HD's price action after their beats earlier today). If Deere comes out with disappointing earnings and/or worrisome guidance we should see a sharp sell-off, ultimately causing a move that allows for a retest of support zones in the 316.71 to 277.09. Earnings risk is something I generally avoid when trading, but the risk to reward for adding a DE short position at the moment almost looks too attractive to pass up. With earnings coming in so soon, it is hard to give a decisive prediction. That said, I will fall back on my underlying thesis, that Deere is overvalued and is facing technical and economic headwinds. I expect to see serious volatility in DE trading over the coming weeks, which eventually will lead DE back down to the 285 low, possibly even grinding into new lows testing support of 236.59.

As always this is not financial advice. Good luck!

Deer in headlights...Hey all, I've been calling for a rally these last few weeks, and the rally has occurred. I am now looking to enter short with heavy size tomorrow, 7/29. DE is one of my favorite shorts- it has made a setup very similar to the ones it made in 2000 and 2008(Wyckoff distribution at the top), respectively, and has virtually no support until the high 170's. This thing could violently dump, and I'm going to bet on that occurring.

DE short farm machinery manufacturers like CAT and DE been really weak last few days with big volume on gap downs. DE has been closely tracking XME since last year or so which doesn't look too good either.

Also, if we overlap IWM chart with DE, it looks pretty close to IWM chart before the break down.

if it breaks 295 again or if it can get to 305-306.

DE 9/16 280P

PT's : 280.70

SL : 301 and 311 respectively