VGT trade ideas

VGT Post-Election Year ReturnsVanguard Information Tech ETF ( AMEX:VGT ) tends to consistently perform best in the year following a US Presidential Election. I believe given its track record, VGT could replicate the previous three post-election years. This would put the price at approximately $800 at the end of 2025.

Strategy:

My strategy has been to build a position throughout the pre-election and election year, and rotate out of the position into better yielding opportunities exactly one year after the November 2024 election.

Weekly Chart Looks Breakout StrongAI, interest rate cuts, and the 2024 presidential election in the United States will likely support another steady climb in large cap tech. One year target right around $610 is the measured move from the bottom of this weekly cup and handle to the upside. Any action to that price earlier than a year from now could suggest an over-market in need of another sell off like the end of last year. Easy to hold VGT long term with setups like this one. Easy to sell if the funds are needed and the price grinds much higher over the next year. Happy hunting investors!

Broad Market Technology ETF TrendsVGT compared to 5 alternatives (QQQ / IGV / XLK / FTEC / IYW)

AMEX:VGT | NASDAQ:QQQ | AMEX:IGV | AMEX:XLK | AMEX:FTEC | AMEX:IYW

Expense Ratios

VGT 0.10%

QQQ 0.20%

IGV 0.46%

XLK 0.12%

FTEC 0.084%

IYW 0.43%

Holdings

After looking at the graphs, I am only considering VGT / QQQ / IGV

VGT:

Apple Inc 21.81%

Microsoft Corp 15.37%

Visa Inc Class A 3.31%

NVIDIA Corp 3.10%

Mastercard Inc A 3.06%

PayPal Holdings Inc 2.51%

Adobe Inc 2.30%

Intel Corp 2.04%

Salesforce.com Inc 1.95%

Cisco Systems Inc 1.82%

QQQ:

Apple Inc 12.25%

Microsoft Corp 9.13%

Nvidia Corp 2.67%

Adobe Inc 2.27%

Paypal Holdings Inc 1.98%

Intel Corp 1.69%

Cisco Systems Inc 1.56%

Broadcom Inc 1.46%

Qualcomm Inc. 1.42%

Texas Instruments Inc 1.25%

IGV:

Microsoft Corp 8.72%

Salesforce.com Inc 7.99%

Adobe Inc 7.83%

Oracle Corp 5.1%

ServiceNow Inc 4.79%

Intuit Inc 4.34%

Zoom Video Comm Inc 3.7%

Activision Blizzard Inc 3.35%

Autodesk Inc 2.83%

Snap Inc 2.42%

Market coiling into electionAs forecast the market and volatility has been coiling all week and likely into next week too with the election the week after that, I exited 2 pairs trades and put on 1 new pairs trade, long $VGT vs short $FDN. Highly likely I won't enter any new trades next week and flatten the portfolio before next weekend.

Jared

VGT 41% profit on 2nd COVID-19 market dropLong -term investment idea for ETF AMEX:VGT on potential 2nd COVID-19 market drop.

VGT 41% profit / Long trade 194.23 -> 273.52 / TrailStop 39.65 of price amount

Profit: 41%, Risk: 20.5%, Risk ratio = 1/2

Allocation: 15% of the portfolio

All equities from our ideas was fundamentally checked and have good ratios (P/E, Debt/Equity, Sales past 5Y, Profit Margin) together with strong long-term up trends.

Stay tuned with more ideas and market signals with our Telegram-bot.

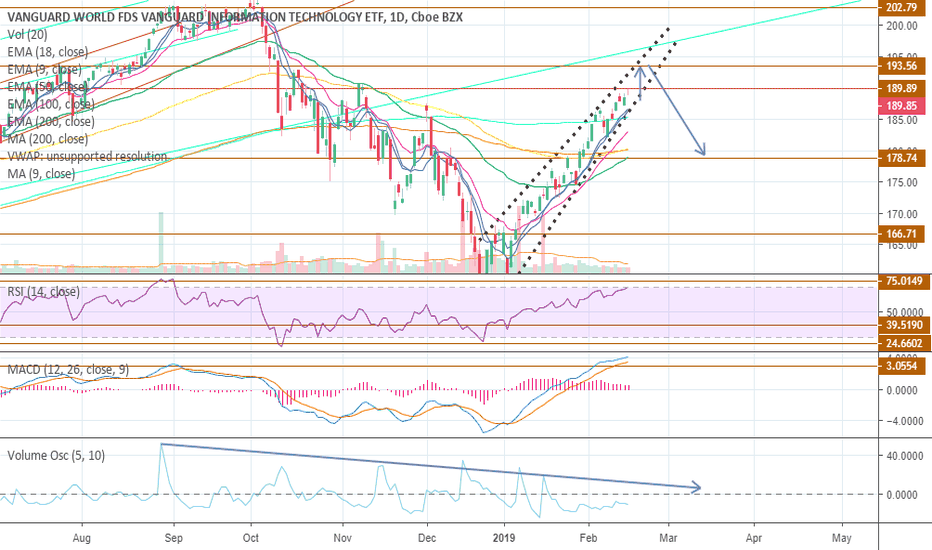

VANGUARD TECH - Bearish engulfing- Yesterday's close ended with a bearish engulfing candle on a major resistance (on volume)

- I would be cautious to add any long positions at this level, expecting a pull back

-- MANAGE YOUR RISK - -

Disclaimer: All ideas are my opinion and should not be taken as financial advice.

AMEX:VGT