TRADE IDEA: USO OCTOBER 16TH 2 X 2/MAY 15TH 5 CALL RATIO SPREADPictured here is a bullish assumption diagonalized call ratio spread with two times the number of long calls at the 90 delta strike in October as the number of calls in the front month with a 4.45 break even versus 4.47 spot. As of Friday close, it's priced at a 4.89 debit and had delta/theta metrics of 134.84/.45.

I generally visualize this setup in two, separate pieces -- one consisting of a long call diagonal and the other, a standalone long.

Assuming price breaks the short call running into expiry (and stays there), the long call diagonal consisting of one long call and the front month short will converge on max profit. This will be the difference between the width of the spread (3.00) and what it cost to put on one long call leg and the short call (2.17) or .83 ($83), at or near which that aspect should be stripped off.

The remaining call is then left to ride alone as synthetic stock to be taken off in profit, potentially targeting the $8-10/share, making a 5.25-7.25 profit on the standalone long conceivable.

In the event price doesn't clear the short call toward expiry, the short call aspect is rolled out to reduce cost basis further.

USO trade ideas

Which way should I go now ? Yes, it can be frustrating to see your profits evaporated after it has broken out from the bearish trend line and then pull back to where it was at your entry price.

That would be considered a break even trade since your SL is not triggered.

It is back to its psychological support level at around 10.38 and this level is crucial as if it breaks down, we can see it revisit the bottom at 9.23 to 9.37 level.

Watching closely on 4H time frame before buying. Be patient and let the trend tells you what to do.

USO - Support areaUSO 4 hour chart 2/22/20

This is a short term 4 hour chart. USO is correcting from its first resistance. If the support box is broken, then USO is likely to go further down to the Trend line below near 10 area. If the support box is held, I will be on the look out for (i - ii) micro level structure to be bullish.

All Roads Lead to... Freaky Friday? - Mid-Term USO Overview

United States Oil ( USO ) falls on spread of Wuhan virus, U.S. oil-stocks build.

Currently $10.50 per stock or $50/bbl seems like local support while bearish downtrend still is in action.

Looking forward for major bearish continuation, until nearest (Mar '20) Triple Witch.

$USO May Now be a Contrarian Long TradeUSO has hit the skids amid demand concerns as China turtles under the weight of Coronavirus quarantining. OPEC+ has failed to deliver a cut.

But support is holding and a squeeze is possible because better days lie ahead, powered by new stimulus and a coming jump in post-quarantine demand.

USO - ETF will riseUSO: United States Oil Fund

- Most active strike prices are the weekly 1/10 $13.50-strike calls

- People are betting on USO will break out above $13.50 next two weeks

People are buying on this ETF because of what happened in Iran, crude oil futures, prices, and all else related are due to rising tensions. The assassination of Qassem Soleimani impacted the market yes, (SPX -0.71%, COMP, -0.79%, and DJIA -0.81%), but his death's biggest impact would be on the price of oil & gold.

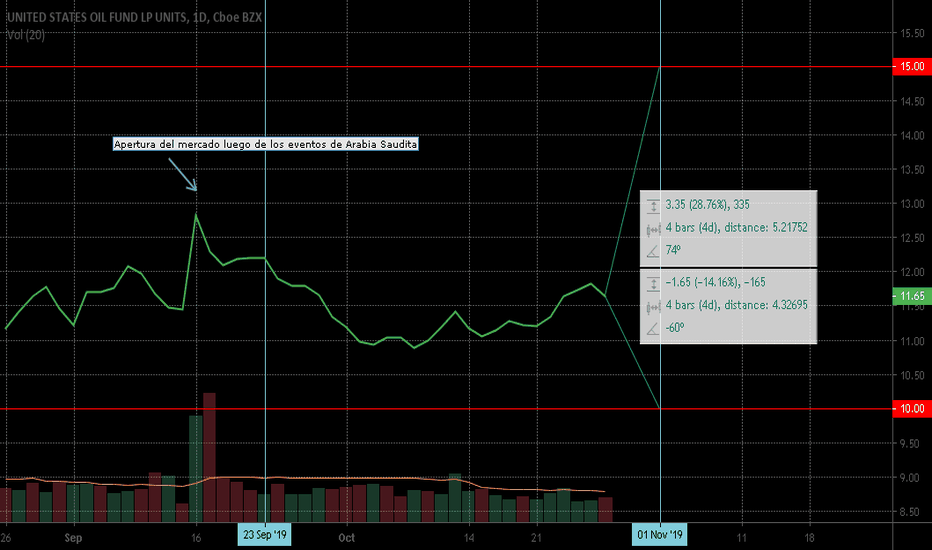

Looking at USO, we can see that it has been in a bull trend since October of 2019 (2-3 months), and has gapped above it's previous resistance level of $13.00-13.15. A double top should still be something to be cautious about, but the recent news only makes this ETF much more appealing to trade.

technicals: Used fib extension to draw levels, worked wonderfully. Tested $13.35 level once and got rejected, if this level breaks on Monday, can see the next price target at $15.00.

- MACD: volume doesn't showcase anything as of yet, looking for a strong bull signal, be wary of fakeouts

- RSI: started to finally touch oversold area, good bull signal

USO looking great for this uptrendAs you can see from the daily chart, the Oil is being in an uptrend since mid Oct, and I expect this trend will continue until at least we have a double top. I’m staying long until I hit my target, which will the next resistant line at $13.25.

If you agree with my analysis, please share your thought. I would love to hear from you.

$USO Stumbles Into Major Catalysts to Close Out the WeekUSO

The United States Oil Fund LP (NYSEARCA:USO) is an exchange-traded fund that attempts to track the price of West Texas Intermediate Light Sweet Crude Oil.

One other major macro factor in the current scene guiding the macro picture for markets is the performance of the oil market.

Right now, both energy stocks and the oil commodities market are largely defined by the process of Saudi Arabia gearing up to go through the IPO of the largest energy company in the world, Aramco. Don’t think for a moment that this is not a primary concern for those involved in the largest positions dominating the oil market. Aramco, and its success as an IPO, I one of the defining points across all asset classes at present. The Aramco IPO will unquestionably be the largest IPO in stock market history.

And the relative performance of oil as a commodity market will be the number one input defining exactly how much that IPO is worth.

In addition, tomorrow will bring us the results of the latest OPEC meeting, in which the countries in control of OPEC’s destiny will decide whether or not to do further production cuts to support the price of oil.

Traders will want to pay special attention to this catalyst as it unfolds today.

Read More at: dailytrendingstocks.com