AvH (ACKB.br) bullish scenario:The technical figure Triangle can be found in the Belgium company Ackermans & van Haaren (ACKB.br) at daily chart. Ackermans & van Haaren (often abbreviated as AvH) is a diversified group operating in four core sectors: Marine Engineering & Contracting (DEME, one of the largest dredging companies in the world - CFE, a construction group with headquarters in Belgium), Private Banking (Delen Private Bank, one of the largest independent private asset managers in Belgium, and asset manager JM Finn in the UK - Bank J. Van Breda & C°, niche bank for entrepreneurs and the liberal professions in Belgium), real estate and senior care (Leasinvest Real Estate, a listed real estate company - Extensa, a major land and real estate developer with a focus on Belgium and Luxembourg) and energy and resources (SIPEF, an agroindustrial group in tropical agriculture). The Triangle has broken through the resistance line on 30/04/2022, if the price holds above this level you can have a possible bullish price movement with a forecast for the next 23 days towards 174.70 EUR. Your stop loss order according to experts should be placed at 163.40 EUR if you decide to enter this position.

Ackermans & van Haaren realised a record result of 407 million euros over the full year 2021.

Excellent results of the companies across the whole AvH group support this impressive result, which also surpasses that of pre-COVID year 2019 (despite the substantial capital gains realised in that year).

A substantial increase (+17%) of the dividend to 2.75 euros per share is proposed to the general meeting of shareholders.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

Philips shares can Show It's Power Soon.Hello Dear Traders, i Think we have 2 possibility In the near future:

something will happen Like Financial recession of 2008 and the all worlds' stocks and shares will fall or they should Rise and go Up A.S.A.P because it's not normal to stay for a long time in Lower Line of Up Trend Cuz it can Break it so Strongly and there will be a Mega Bearish Trend.

Result: J.K(Just Kidding) :-D

Buy Philips Stock and You will see Profit and benefit of your patience.

Income Statement Analysis: Gross MarginThe Gross margin is one of the first margins we can find on the Income Statement. The Gross margin is shown in percentage and it will give us a good indication of the performance of the core activity of a company. The formula to calculate the Gross margin goes as follows:

Gross margin (%) = Gross profit / Total revenue

Before we take a look at the interpretation of the Gross margin we first have to understand the concept of Gross profit. We can find the Gross profit after deducting the cost of goods sold from total revenue.

Gross profit = Total revenue - Cost of goods sold

with Revenue = Price x Quantity

In analyzing revenue we have to analyse both components:

Price: pricing power

Quantity: market share, macro economic environment

The Cost of goods sold (COGS) are the direct costs we have to make to generate revenue. In a retail environment like for EURONEXT:AD the purchase of the products are an important component of the cost of goods sold. In most cases the cost of goods sold are variable costs. Which means that those costs will fluctuate with a change in output.

Now that we have a better understanding of the Gross profit, we will continue with the interpretation of the Gross margin. To calculate a margin in the Income Statement we often divide a profit result by Total revenue. I will repeat the formula for the Gross margin (%): Gross margin = Gross profit / Total revenue

The Gross margin can increase in the following ways:

An increase in Gross profit: this can be the result of an increase in revenue or cost optimization (decrease in cost of goods sold)

Decrease in Total revenue: pay attention because a decrease in Total revenue also means a decrease in Gross profit

Gross profit increase > Total revenue increase

Total revenue decrease > Gross profit decrease

It is very important to take a deeper look into the source of the increase in the Gross margin. The growth rate of the revenue versus the growth rate of the cost of goods sold plays an important role here. If revenue grows faster than the cost of goods sold the portion of the COGS in % to total revenue will lower. As a result the Gross profit as percentage of Total revenue will increase (increase in Gross margin).

Example: Inflation has less consequences on the Gross margin of a company with pricing power, because the company can increase its price which will result in higher revenue to compensate for the increase in cost of goods sold.

Value stock. Bic.Bic has a p/e ratio of 6.5. 4.7% dividend yield.

Has been down trending since 2015 and is now range bound with a high of 64.9 and a low of 38.5.

Printing a falling wedge which is a bullish reversal pattern.

RSI struggling with breaking into bullish territory at the 50 level.

AO showing bullish divergence and no real momentum.

Key levels indicated by horizontals show support and resistance.

Will tag on monthly analysis.

Alfen about to fall? Alfen

Short Term - We look to Sell a break of 80.66 (stop at 85.50)

Further downside is expected, however, due to the strong support below we prefer to sell a break of 82.00, which will confirm the bearish sentiment. We look for losses to be extended today. The bias is still for lower levels and we look for any gains to be limited. Selling continued from the 78.6% pullback level of 94.34.

Our profit targets will be 64.78 and 60.10

Resistance: 90.00 / 95.00 / 100.00

Support: 82.00 / 70.00 / 60.00

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis, like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis, as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

Deconstructing Alstom!Alstom

Short Term - We look to Sell at 21.65 (stop at 22.65)

A shooting star has been posted as prices reject the higher levels. Posted a Bearish Outside candle on the Daily chart. Further downside is expected although we prefer to set shorts at our bespoke resistance levels at 21.65, resulting in improved risk/reward. We have a 61.8% Fibonacci pullback level of 18.76 from 16.36 to 22.65.

Our profit targets will be 19.00 and 17.65

Resistance: 21.65 / 22.65 / 25.00

Support: 20.00 / 19.00 / 16.36

Disclaimer: (for each signal)

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis, like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis, as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

SOF.BR - 40% upwards potential over the next monthsThis content is not an investment advice and does not constitute any offer or solicitation to offer or recommendation of any investment product. It is for general purposes only and does not take into account your individual needs, investment objectives and specific financial circumstances. Investment involves risk.

#8 by Marketcap in France (Buy)$AI.PA ranked #8 in France with a 82.29B Market cap, engages in gas supply for large industry and health businesses has been ranging since late march.

1D chart is showing a bounce from the 20EMA and 0.236 Fibonacci level a possible sign of Bollinger band squeeze. The price might be taking a break at this point before continuing its upward trend.

4H chart is showing similar data, with a bounce from the 0.236 level and dipped briefly below the 20 and 50 EMA. It has now moving back to the top end of the range. RSI is increasing and broke through the 50% mark and MACD has also started to turn positive.

Buying today @ 165

Target price @195 (top of the current parallel channel)

Adyen EuropeSun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions

KBC Ancora Europe Sun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions

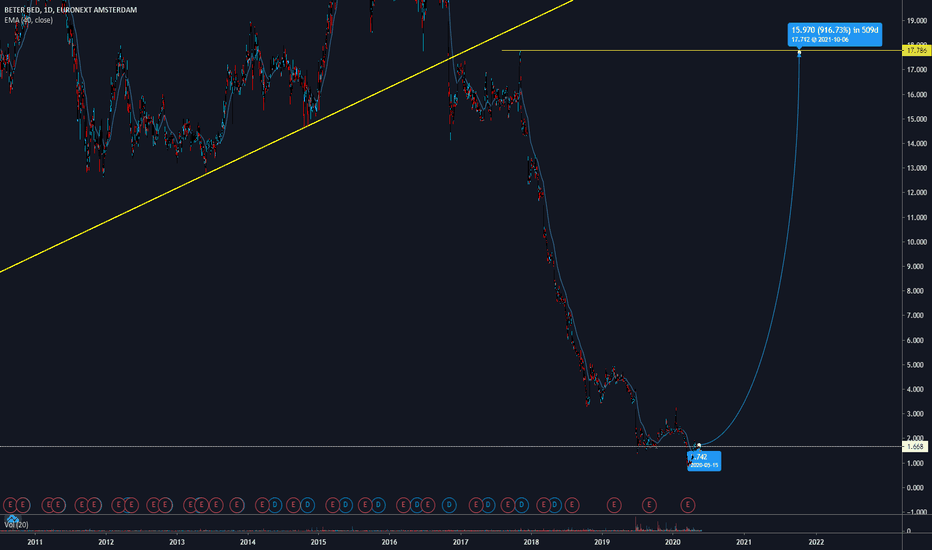

Retteketet naar Beter BedQ1 2020 sales increased by 8.0%,

Even in corana time many orders keep coming

BAM BAM BAM The construction sector has tremendous growth potential due to the large home shortage. BAM Group went through difficult times, but with a major reorganization and a new CEO Ruud Joosten who only seems to be making good choices at the moment. I see a bright future for BAM GROUP.

I have drawn two levels where I get into position.

ALERS Cup & Handle BOALERS EUROBIO SCIENTIFIC is a company on the French stock market in the vitro medical diagnostics and also producing CAVID19 tests. It made a nice CUP & Handle BO with volume

EURONEXT:ALERS EURONEXT:ALERS ://www.tradingview.com/x/Uw1WlyDV/]https://www.tradingview.com/x/Uw1WlyDV/

Is this the Solution to Your Problem? Solutions 30

Short Term - We look to Buy at 6.05 (stop at 5.71)

We look to buy dips. Previous support located at 6.00. A higher correction is expected. Although the anticipated move higher is corrective, it does offer ample risk/reward today.

Our profit targets will be 7.05 and 7.45

Resistance: 7.00 / 8.00 / 9.00

Support: 6.00 / 5.00 / 4.00

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis, like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis, as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

Koninklijke BAM Groep NV. BAMNB. Cup & Handle. BAM has been in an uptrend since Feb 2021. However, in mid-February 2022 a nice dip from € 3.45 to € 2.07, but the uptrend has started again reasonably well.

If the price continues to rise in the coming weeks, we will see a cup & handle pattern and a test on the fibonacci golden pocket.

When this fibonacci is broken, the price can return to € 3.50. And that could be another selling point.

16-04-2022. My 2e TA.

MT: WATCH FOR BREAK OUTArcelorMittal, one of the major steel producers.

This is the weekly chart. After a big double bottom , MT is back at historical resistance around 30-31.

I would watch that level and enter a long swing trade if it breaks 31.

First target would be 40.

Most analysts rate this as a buy with a target at 50.

Trade safe.

ING Groep About to Drop? ING Groep

Short Term - We look to Sell at 9.90 (stop at 10.24)

Further downside is expected although we prefer to set shorts at our bespoke resistance levels at 10.00, resulting in improved risk/reward. Trading close to the psychological 10.00 level. Price action is forming a bearish flag which has a bias to break to the downside. There is scope for mild buying at the open but gains should be limited.

Our profit targets will be 8.24 and 7.45

Resistance: 10.00 / 11.00 / 13.50

Support: 9.00 / 8.00 / 7.25

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis, like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis, as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

Euronav NV (EURN)Euronav is an international shipping enterprise which focuses on oil transport by sea. On 7 April 2022 there was announced a merger between Euronav and Frontline Ltd. pending regulatory approval and ironing out of the last details. The combination would be based on an exchange ratio of 1.45 shares in Frontline for every Euronav share. Euronav shareholders would own 59% of the merged entity and Frontline shareholders 41%. The merged company would have a market cap of $4.2bn based on 6 April market values and a fleet of 69 VLCC and 57 Suezmax vessels, and 20 LR2/Aframax vessels.