WIN

Education: Why your trading strategy win rate doesn't matter!What makes a profitable automated strategy?

Probably the biggest misconception for trading perpetuated in the mainstream is that you need to have a greater than 50% win rate to be profitable.

This is followed by a close second, of constantly assuming you need to have a risk-reward ratio of greater than 1:1 (e.g. 1:2, 1:3 etc). This one is perpetuated mostly by forex and stock market gurus.

By the end of this article, I hope to dispel these myths and aim to shed some truths on how to assess a profitable strategy.

Why your win rate doesn't matter:

Let's simplify this down using an example. Consider the following two strategies. Which one would you rather trade?

Strategy A: 50% win rate - When you win you make 2 dollars, but when you lose, you lose 1 dollar

Strategy B: 50% win rate - When you win you make 5 dollars, but when you lose, you lose 1 dollar

This one was a very obvious case of choosing Strategy B. In this case, both strategies have the same win rate, but Strategy B nets you 5 dollars per win, whereas Strategy A only makes you 2.

Let's take another example. A little less obvious this time. Which one would you rather trade here?

Strategy A: 90% win rate - When you win you make 1 dollar, but when you lose you lose 50 dollars

Strategy B: 10% win rate - When you win you make 200 dollars, but when you lose, you lose 1 dollar

Now the 90% win rate strategy may look attractive on the surface, but when you dig into it, you realise that you could get a massive 50 dollar loss in the 10% of times you do lose! For those of you who chose strategy B, this is the correct answer.

One way we can assess the above strategies is using Expectancy . The formula for Expectancy is as follows:

(Win % x Average Win Size) – (Loss % x Average Loss Size)

We can calculate the expectancies of the strategy below:

Strategy A:

(0.9 * 1) - (0.1 * 50) = -4.1

Meaning you are expected to lose an average of $4.10 per trade using strategy A. Not a good sign.

Strategy B:

(0.1 * 200) - (0.9*1) = 19.1

Meaning you are expected to win an average of $19.10 per trade using strategy B. This is a major winner here!

As you've probably realised. It is possible to have a profitable strategy using a low win rate. Many trend trading/breakout strategies tend to have lower win rates, but with larger rewards to risk, whilst mean-reversion strategies tend to have higher win rates with less frequent but larger drawdowns.

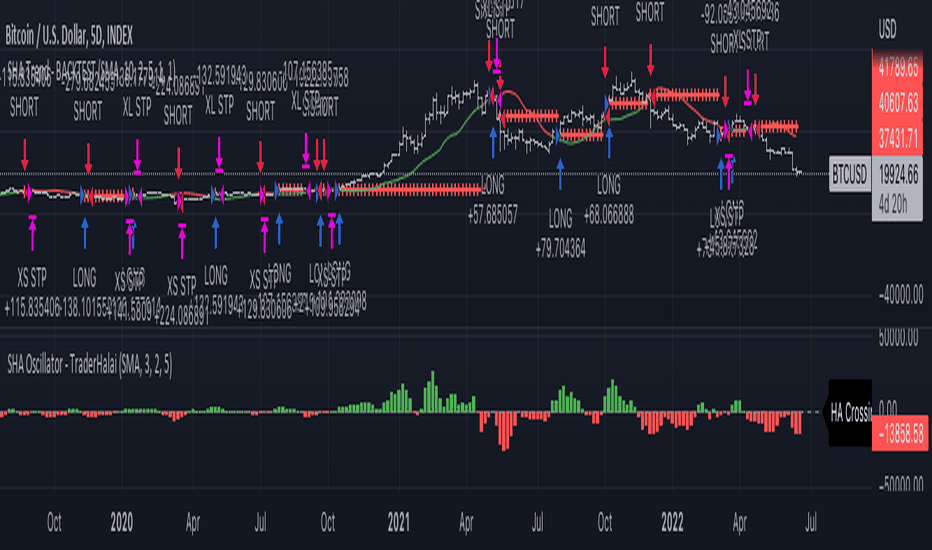

The backtest shown in this post shows an example of a low win rate, and high win amount strategy using the Smoothed Heikin Ashi Trend on Chart indicator which I have developed, with an overall positive expectancy, backtest (note, no strategy is perfect, should not just blindly trust backtest data).

Why you may still choose to define a risk/reward

Better consistency of your strategy

Psychological factor of knowing that you can be expected to lose only x amount (assuming no slippage etc)

As an aside, note that defining a fixed risk-reward may hurt your win rate (which could impact your expectancy) so it's important to backtest to see if you get better results with defined risk-reward parameters. This is beyond the scope of the current article, but an important consideration.

Why do traders gravitate toward a higher win rate?

The simple answer here is that everyone wants to be a winner! It's human nature to want to be right, whether this be about a market direction or when to open or close a trade. It's often easier to brag about how much you win whether that be on social media or just feeling good about yourself.

For algorithmic traders, having a higher win rate may also provide psychological benefits, as losing 20 times in a row can sometimes be very daunting for traders and can throw doubt into the efficacy of your system.

I hope that through this article, I have managed to convey that it may be prudent consider strategies with low win rates also, as these can be very profitable in their own right.

Digging further:

This article is only just scratching the surface of how to create and validate if a strategy is something that you should consider trading. There are many aspects of backtesting including Monte Carlo simulation, understanding standard deviation of returns and risk, Sharpe ratio, Sortino ratio, walk-forward analysis, and out-of-sample analysis to name a few that you should conduct before you evaluate a strategy as suitable for live trading.

If you've made it this far, thanks for reading. If you like the content, feel free to like and share, as well as check out some of the free scripts, strategies and indicators that I have published under the scripts tab.

Thank you!

Disclaimer: Not to be taken as financial advice, anything published by me is purely for education and entertainment purposes

Don't worry there will be many more opportunities!sometimes you dont get what you give or what you are expecting! ive been looking this chart for few weeks now and i was expecting a nice trade from this, i did what i had to i read the chart understood it, and made a decision to look over the price and the structure that i drew. and after these days of analysis and studying the idea i had for this market didn't do what i expected. that also happens during our course of life, you want to see the things as you wish but they dont go that way. THATS NORMAL! JUST KEEP ON LEARNING FROM EVERY SITUATION, EVERY UPs & DOWNs, DON'T BE FOOLED BY THE CONCEPT OF RESULTs AND WININGs JUST GO WITH THE FLOW. LOVE THE PROCESS. and you'll sure find satisfaction.

XAU/USD June 1st Trade SetupHello all here is the Gold setup for the day:

Short: Look for a break and close below 1832.02 to fill the range down to 1815.

Long: Look for a break above 1838.255 to fill the range up to 1846.

Risk Management:

Stop loss: Previous candle high (1-2% Risk)

Strategy:

When the Trade is in 10 Pip's profit close 50% and add a stop loss breakeven allowing runners to final take profit. Advance traders look for larger plays when available.

Blue Vertical Lines: Major News Events

WIN adam&eve or cup&handl#WIN/USDT

$WIN shaped adam and eve pattern.

🐮 so if price break out from current resistance that now struggle inside, it will head up to 2 fib level to complete adam & eve pattern.

🐻 if price reject from this resistance it will drop to support zone between 0.5 and 0.618 fib levels and maybe shape cup and handle to continue its rally to 2 fib level.

WINkLink (WIN) formed big bullish Shark for upto 209% pumpHi dear friends, hope you are well and welcome to the new trade setup of WINkLink (WIN)

On a weekly time frame chart, WIN has formed a bullish Shark pattern.

Note: Above idea is for educational purpose only. It is advised to diversify and strictly follow the stop loss, and don't get stuck with trade

WIN (WINK) Token Analysis 19/03/2021Fundamentals:

WINk is a gaming platform for users to play socialize and stake across multiple blockchain ecosystems that leverages the WIN token as the native digital asset within the platform. Through behavioral mining innovative token economy design and other incentive mechanisms WINk aims to build an ecosystem that provides a high-quality decentralized gaming experience to enable developers to build dApps that drive genuine adoption and engages users to participate and contribute as active stakeholders in the platform.

What is WIN Token?

WIN token is a TRC-20 utility token built on the TRON blockchain. Within the WINk platform, WIN is the token used to incentivize active participation from key stakeholders i.e., developers and users.

The following is a non-exhaustive list of the token's core use-cases:

Earning Win Power: token-holders receive Win Power for staking WIN tokens.

Airdrops: token-holders are eligible for WIN airdrops.

WinDrop staking: all DApps connected to the gaming platform can share a portion of the winnings with WIN token-holders through its "WinDrop" program.

Governance rights: token-holders can influence both the development and direction of the platform through its built-in governance mechanism.

Resource burns: token-holders can alleviate transaction costs by staking WIN.

Exclusive opportunities and experiences: token-holders are able to participate in exclusive events, such as celebrity poker tournaments or car giveaways.

Gameplay bonuses: high-volume players and dApps that serve large user bases receive benefits for each transaction. For instance, benefits may include direct discounts, increased payouts, or accelerated mining rates.

Key Features:

Developer tools and APIs that allow teams to integrate their projects or create gaming dApps from scratch

Development team comprised of veterans from the gaming industry

Social features live operations and events

Investment and strategic partnership with TRON

WinDrop reward mechanism

Fiat onramps stablecoins and more DeFi integrations

Governance model content discovery engine and ecosystem fund coming soon

Curaçao and Costa Rica gaming licenses

Technical Analysis:

this Token has almost done its initial Accumulation and seems to be on the Move UP phase.

The Move UP phase has done many Distribution and Retracement on the way which is the sign of a health Growth

we can define Targets with Fibonacci projection

we have defined total of 4 Targets which are very much viable

Wink - WIN/USDTWIN/USDT has hit its cycle top on 5TH April 2021 and has since then lost to date around 86% of its value. It has been trading sideways since 20th May 2021 until now. This is what happens to move crypto coins over the cycles they have. Now represents an amazing time to buy this coin at an 85% discount. you could possibly sell at the 0.236 level (the price would be 0.000914) for profit or hold longer term back to higher fib levels.

(I have marked some wicks that could pottentially be filled in the future cycles & could also provide some tragets for profit & added some lines to display pottential brake out price action once the next cycle begins).

BINANCE:WINUSDT