WEED STOCKSSS: CRONHey everyone, in my portfolio I have added a good bunch of stocks and I will be sharing my positions, very small positions via options all expiring on the 15th of March. Currently the market is a little shaky, right at the point of buyer exhaustion but also mixed with fomo of this trade deal coming out very well with China. So what am I even talking about? Well a group or sector of stocks typically do well when the market begins to act shaky and those are weed stocks and utilities. I am focusing on weed stocks as I have profited greatly before and I have also been a week early from the bottom before the huge multi day rips. The chart is pretty self explanatory, we are in a triangle of consolidation that is currently breaking out after a wild run already in January and February. CRON and ACB are of my top watch in weed plays CGC and NBEV are lagging a bit but also good to keep watch or have light positions. Goodluck and have fun!!! No targets on this just play accordingly.

Weed

WEED Symmetrical Triangle BreakoutAfter a few weeks of watching canopy and trying to short it. I've become convinced its going to produce a similar breakout from the previous rally.

Jan 9th > The first breakout started. Support began then the crowd started to rally and it produced substantial gains for longs leading into the next congestion phase.

Jan 14 - Jan 24 > The Bull flag congestion print which held selling volume and built up buying pressure to move it to a higher point.

Jan 28 - March 7th > Symmetrical Triangle Breakout - Jan 28 hit a top then 67.99 Feb 4th. Earnings were on Feb 13 which showed poor EPS however revenue was stronger than last year which is what captivated the crowd. The continued support is due to the sentiment of the overall market. Participants believe its going to the moon. April 1st stores open. There is a good reason to be optimistic about WEED/CGC and the market in general. (Fluff) Feb 15 was light due to ER mixed feelings of poor EPS and high revenue from prior earnings.

Hit a support level of $56.49 on Feb 25th. My target is within a few weeks for this to breakout like it did in October. Similar formation has formed. There seems to be strength behind canopy still. I plan to make this a mechanical trade and stick to what I've listed below.

This is my analysis I think there will be a breakout happening shortly which will push it into the 70 levels in the next few weeks. This isn't trading advice just my idea.

Call Contract expiring March 22nd Cost $3.45 Per contract. Target is $74 3 contracts

Stop price is $2.2 Delta is 0.53

Full sell of all contracts at $56.50 as this is support if it breaks then my trade is wrong.

Aurora upward trend to ATH?Not Trading Advises. only for learning. Appreciate feedback and criticism

I think Aurora is in a upward trend to its ATH price range based on the following:

• HH & LL

• RSI showing positive signals and positive momentum

• Volume increased

• Structure/Support at $9 Cad, not sure how strong the support is, and if the support is hold at $9, i interpret it as bulls have control over the stock and expect to see higher SP.

• Respecting 200 Ma, and trading over 50 Ma.

• By and large $ 175 millions Cad in revenue Q4/Q1 2019/2020, by and large $700 millions – $ 1.2 Billions Cad Revenue 2020. ( PE 10 on today's price ) and expected to grow in to a Billion dollar quarterly revenue company,

• Aurora is getting traction in the media. Buy rating.

• Cannabis market is getting more love every week, being talked about more and more, many times a week on Yahoo Finance, and Aurora is often mentioned.

• Higher marginal products coming online

Target: $12-$13.

If the price drop under $9 Cad, trade is not viable. ( my rule )

Disclosure: Aurora is my biggest holding, resp 30%. Planing to hold for life if the company continues to grow.

Not Trading Advises.

CRON Short TSX Re-test of $25 is coming. Lets see if it penetrates.

Double top formed after CGC ER catalyst move.

Great short entry at $24.80 if confirmation wanted and a more aggressive strategy at this level toward $25 if fade strategy is in play.

I am shorting 200 shares at 27.32 holding till $25 to fade if it breaks through I'll add. Stop is at $27.60.

I think Canopy Growth will retest its support in the coming week

I think Canopy Growth will retest its support in the coming weeks. Much based around the accounting error and no short term catalyst to move the SP higher from a already high SP, price near ATH. I think Canopy Growth will find support around $48-55 Cad or as low as $40 Cad, depending on more factors then only Canopy.

And with positive news around the Cannabis market not having a significant impact on the share price, i believe it impact the sentiment to become more positive towards Cannabis market, see it with a little bit less risk.

And with risk in mind, i think most well known companies have there share price reflecting the risk in the market rather then the potential of the market.

When the shift comes from investing for the potential rather then the risk. I think the good companies will have lower volatility and a steady SP and healthy technical moves. Rather then this risk investing climate, with high volatility, fast up and down moves and SP destroyed in a couple of days/weeks.

Based on the belief stated above, i think the SP will move down from 60 range to 40-50 range depending on sentiment/ things unknown to me.

And from there trade in an range until a leg up or down, or a shift in the sentiment.

ACB ready for the next step up >8.50We know how fast weed stocks move when they hit proven support lines.

One more trading day to prove 6.90-7.00 support will likely bring ACB >8.50 by 3/1. It's possible we'll see a little lag, but expected move should happen by 3/8.

Peak-to-peak, ACB has averaged 10%-20% leaps. 10% leap from previous peak of 8.34 brings us >9.00

ACB trading at 6.93 while posting this.

CGC triangle formationThere is no stopping the weed train, at least in the Canada's 9 billion weed market. CGC went from $20's in dec to $50 this month. And I can see a triangle formation on chart. Maybe a breakout in upper 50's next week?

ACB in descending channelIf it cannot break out of the descending channel we will retest lows in the next 24-48 hours.

Short play with $6.22-$6.12 target price

Bitcoin temporary bull run coming!Hello traders,

Looking at the daily chart for marijuana stock, WEED, we see that bulls are started to do profit taking. As a matter of fact, we see majority of marijuana stocks (CRON, N, ACB, APHA) just reached temporary top and looking to consolidate in next few days/weeks.

What I want you to notice is that marijuana stock and bitcoin has inverse relation, aka when weed stock goes up, bitcoin goes down, and vise versa (see highlight region). If people start to taking profit from marijiana stock, most likely we will start to see money inflow into the crypto market. My chart looks a little bit messy, but my temporary target is $3600.

Happy trading!

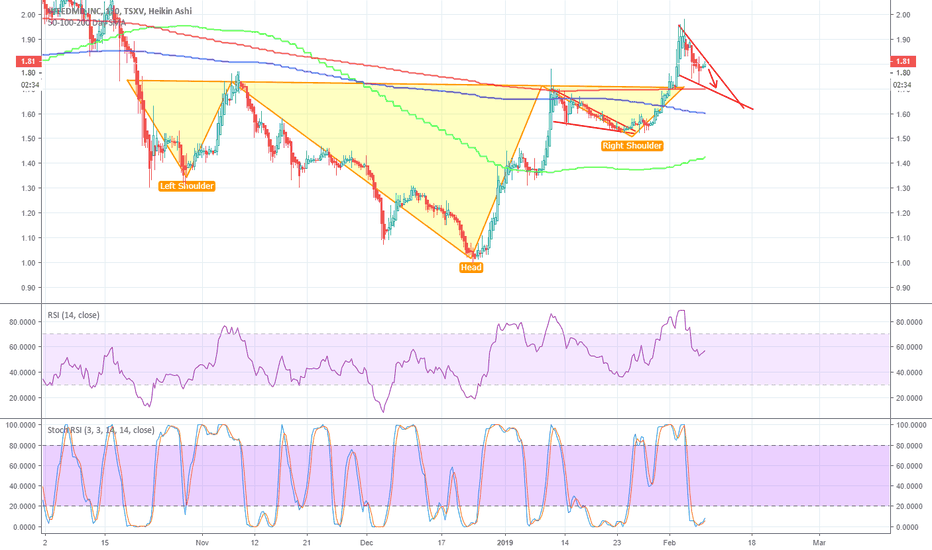

WeedMD Slight Pullback Then LongBurst through H&S and previous resistance, forming bull flag. WEED closed +1.5% today, with WMD closing -0.5%. Divergence between these two never last. Likely pullback to 200D SMA (last support), before breaking through bull flag.

CGC breaks trend on hourly and 4HCGC lost the hourly uptrend and subsequently the 4H. After a move of almost 50% this will now retrace and needs to find a new base of support.

Canopy GrowthI believe the majority of cannabis investors are retail investors with low knowledge about the market and there company(s) of choice, with a hope of becoming rich fast and without pain. I see reports about cannabis investors that says investors are young people, and talks on yahoo about young investors in the cannabis space. I have followed the charts closely since mars 2018, when most retail hype started to come around, and people in my surrounding start to talk about cannabis. And for most part it, it looks the same, Big gains under some time and then selloff for some time after, and the sellers i believe are the buyers wanting to get rich fast, which is probably 90% of young investors mindset. The selling is under much lower volume then the buy up.

And with no new news on sale or progress in the US that indicates a higher valuation for the companies already high valuation compared to revenue and earnings, i can easy see "smart money" just waiting for price to slowly come down and then start to buy. I believe if the industry were to get a higher valuation the price will continue to climb higher and stabilize with smaller movements. Not continue to sway 10-15 % or more per week, for me that indicates a market without serious players, and more a environment where the big players sees a opportunity to make big money without risking not getting a good price for the stock, there is room and time to play the markets. But the time is counting down as the companies gets better sales figures, and really show its a viable business model. Given the fact the companies is losing millions on there operational side of business. And only time will tell what company will survive until breakeven. And the really big money will start pouring in..

If the volatility in the stocks get lower and trade in a tighter range, in a slow and steady climb, that indicates for me that the markets players is starting to buy up the stocks and is anticipating a higher valuation of the cannabis industry/company. And with growth slowing down on many sectors like tech and more, cannabis industry will become a good place for growth investors, looking for growth during a slower economy.

With all the negative news coming out on the cannabis sector, specially on the big player on over valuation or right out scams, when the real trouble in this young industry is to pick a company that will survive and flourish, its not that the cannabis industry not will create big winners. So, the impotence of getting in early is not that important and there is no early getting in now, the valuations is high for all companies until they produce much better numbers, most companies in the industry have valuations when they are running at 2019 full year capacity, and some with a premium, etc Canopy and Cronos, as people view them having a competitive edge with the investment of Constellations brands and Altair, where the cash injection they revived and partnership it gain it enables them for bigger and better business opportunities where they can make massive profits and it protects investors from the risk of the company running out of money, a premium investors are willing to pay in this new and high risk market. Where companies without partnerships have a higher risk to them of needing to issue new shares for capital or face bankruptcy. As so price is lower and the reward is higher.

When companies start to show strong signs of breakeven with strong revenue growth the price of the stock will skyrocket, as it shows investors with lower risk profile, where the most money is, will start to pour into the market and specific companies. Until then the market will continue to move money from the impatience investor to the patience investor.

So with that said:

Canopy growth are now trading in there ATH range, after a strong January, and nothing really new information beside a 60 Cad $ rek and the stock become cheap at a point, with heavy buy volume to follow, and the price increased almost 100 % from lows of late 2018. So if the price on Canopy is going to be higher i want to see a slow and steady climb from here to 70 ish. With a possible pullback to 60 range before continuation of the uptrend.

With many days of good gains and the market is still being played price will drop below 60, and buying will comeback at lower 50 range, where it can do two things, continue to trade in a range of start to trade higher.

Only for educational purposes.

NBEV about to break out?Been looking at this ascending triangle formation for a while. Not a pro at charting but looks about right?

Mid-Term Prospects for POT EFT MJWeed is the future, or so they say. 2018 saw a ton of overweight equities, but they have proven to be some of the most resistant names in today's market. Therefore, it stands to reason that if names like CGC, TLRY, and CRON will continue their rise, this ETF will reflect that success. It needs to retract, but will offer a great buying opportunity in the next 1-2 weeks.

NWGFF is our new cannabis breakout pick. See why a +60pct move..=====================

NWGFF New Age Brands Inc.

Alert Price: $0.0478

Chart Analysis

========================

Members,

Are you ready to kickoff the month of February with a bang?

For our next trade idea, we are focusing on a red-hot sector that has proven highly profitable for our members time and time again.

That's right, it's time for another cannabis play...

Please turn your full attention to NWGFF (New Age Brands Inc.).

After witnessing a downtrend the past few months, NWGFF appears to have finally bottom'd out.

NWGFF has been quietly building up momentum, and is now showing signs of a highly profitable bullish reversal in the making

Shares of NWGFF closed up over +17% today, while trading on higher than average volume, and we are feeling confident that another double-digit move is in store for NWGFF tomorrow.

There's a strong change that today's double-digit move caught the Street's attention, so don't be surprised if we see a move past $0.05 early tomorrow!

If you look at NWGFF's 1-year chart, you will see that the last time we saw this particular setup, shares rallied +200% from $0.04 all the way to $0.12!

NWGFF appears to be grossly oversold and undervalued at these levels, especially when you take into account the growth initiatives their management has made over the past few months.

The Company has made several market friendly announcements as of late, all of which could be considered bullish catalysts as we head into Q1 2019.

MassRoots, Inc. a leading technology and rewards platform, signed an agreement with NWGFF subsidiary, We are Kured, LLC, to serve as a leading online retailer of the Company's #1 best-selling CBD Pen.*

Wholly owned subsidiary, We Are Kured, LLC (“Kured”), plans to launch a new vape option for their broad spectrum 48% CBD oil. Although their main product offering will be the current 500mg disposable vaporizing pen, this new vaporizing cartridge will help round out KURED’s product line.

We Are Kured, LLC’s Pineapple Express vape pen is the top selling vape pen at the iconic Native Roots Wellness CBD store in Denver, Colorado. The success of the vape product in the leading CBD market in Denver, one of the most advanced in the country, is helping to increase awareness of both the Company and the benefits of the new and burgeoning CBD market for consumers and investors.

Entered into a “Drop Ship” agreement with The Grown Depot with respect to their two fully owned subsidiaries, We Are Kured, LLC and Drink Fresh Water LLC. Under the terms of the agreement, The Grown Depot will sell the Company’s products through their website (www.TheGrownDepot.com) while the Company will facilitate the shipment of orders through their Denver, Colorado warehouse.

Secured an order of its wholly owned subsidiary’s Fresh Water CBD product with Colorado’s largest liquor store, Argonaut Liquors, located on Colfax in downtown Denver. Argonaut Liquors, a historical Denver staple liquor store, is seeing the momentum of CBD water and wants to be ahead of the competition by offering Fresh Water CBD to their 21+ clientele.

As you can see, the management at NWGFF is taking a highly aggressive approach in increasing brand awareness.

The Company's CBD Pen is a hit already, and its only a matter of time until we see its effect on NWGFF's bottom line.

In addition to having a top selling product, NWGFF is also very attractive from a technical standpoint.

Based on our very own chart analysis, we see the potential for a move of +60%!

We know it has already been a highly profitable week/month for our members, but we believe NWGFF could add a significant amount to that already impressive gains total.

That being said, we ask that all members read our full profile, start their research now, and consider grabbing up a position in NWGFF tomorrow morning at 9:30AM EST!

About New Age Brands Inc.

New Age Brands is an innovative Cannabidiol ("CBD") lifestyle Company. Through the Company's wholly owned subsidiaries We are Kured and Drink Fresh Water, the Company's main business activities encompass the development, marketing and distribution of CBD products (including vaporizer pens and beverages) throughout the United States and internationally. In addition, New Age Brands has extensive retail and cultivation land investments in Oregon.

About We Are Kured, LLC

KURED is a wholly owned subsidiary of New Age Brands, acquired in December 2017. KURED is building an innovative online CBD and lifestyle company. KURED has partnered with best in class hemp cultivators, edible manufacturers, cutting edge product formulators to develop, market and distribute multiple lines of CBD products including, but not limited to, CBD vaporizer pens, topicals, gel capsules and more. All of We Are Kured's products are 100% THC free and will be available for purchase internationally. THC, or tetrahydrocannabinol, is the primary active ingredient in cannabis.

NWGFF is growing quickly in the Cannabis industry, and it's doing so by focusing on the fundamentals. The Denver-based company is meticulously carving out its share of the emerging hemp and CBD markets in the U.S., Canada and South America. And, in the process, it's providing the cannabis space with more choices while offering investors an opportunity to get in on the ground floor of an ever-expanding company.

First and foremost, to understand more about New Age Brands , we have to understand the markets within the cannabis industry that they've chosen to call home—the Hemp and CBD markets. Hemp is the fiber and seed part, and the most valuable part of the Cannabis plant, which is why hemp is often called a "cash crop."

Meanwhile, CBD or cannabidiol is a naturally occurring cannabinoid in hemp that has significant medicinal benefits without the psychoactivity of THC. CBD is an appealing option for patients looking for relief from inflammation, pain, anxiety, psychosis, seizures, spasms, and a host of other conditions.

So how has New Age Brand's management chosen to create what it feels will be a successful footprint in the cannabis industry?

Well, while many smaller companies use lots of press releases and promises of great things to come to attract investors, executives at New Age Brands are actually building the company fundamentally with:

Acquisitions that make up a growing portfolio of revenue-producing companies already operating in the CBD/hemp space

A number of property assets in Washington State and Oregon

The expansion of its footprint into markets that provide a sustainable operating environment and allow New Age Brands to maintain its goal of becoming a worldwide "brand."

With continued success in these three areas of growth, this small company's future in a burgeoning industry looks very attractive.

When asked about New Age Brand's focus moving forward, management said that it has decided to move its attention and resources into acquiring already proven business entities and businesses that it feels have strong growth potential and strong core management in the hemp and CBD space.

Additionally, the company says it's currently working with a number of science teams to develop innovative products that New Age Brands is confident can accompany its growing portfolio while also standing out on their own in the industry.

Currently, New Age Brands has two subsidiaries that it recently acquired:

We Are Kured or "Kured" (www.wearekured.com) and Drink Fresh Water (www.drinkfreshcbd.com). Both companies are generating revenue with the sale of products in the hemp and CBD industries.

Through its subsidiary, Kured, New Age Brands is building an innovative online CBD and lifestyle company. Kured has partnered with best-in-class hemp cultivators, edible manufacturers, and cutting edge product formulators to develop, market and distribute a number of CBD products. In addition to filling orders in the U.S. and Canada, Kured recently expanded into South America where it plans to distribute products throughout the region with "Kured Latin America LLC."

Its other subsidiary, Drink Fresh Water, is a California-based company created by a group of industry leaders that offers New Age Brands immediate entry into the CBD-infused beverage industry with its flagship product, "Fresh Water." The CBD-infused, nano-amplified alkaline water can be found in retail stores in 35 different states across the U.S., and with the drink's success, management has already expressed that it expects to expand the company's lineup of products by adding additional SKUs in the near future.

New Age Brands is also growing a portfolio of properties that are proving to be revenue-producing assets for the company as well. Management at New Age Brands says they look to acquire properties that have strong, proven and permitted operating tenants, and if the company chooses to acquire a property, they will implement their industry-leading expertise to optimize the potential revenue and overall net profit with that asset.

The company says the properties it recently acquired in Oregon have already proven to be a great acquisition that they were able to take advantage of, while they're still evaluating the properties the company owns in Washington State to decide the best course of action for these properties.

New Age Brands acts as the "landlord" of the two properties it acquired in Oregon—the Cave Junction, Oregon, property and the Portland, Oregon, property where New Age Brands generates almost $250,000 annually in rent payments alone.

A state of the art outdoor and greenhouse cannabis cultivation facility is operated by Trellis Farms on the company's Cave Junction property, and the Portland property has been home to an established dispensary for the last four years.

New Age Brands has laid out a plan that, so far, management has done a great job of sticking to, while being flexible enough to expand upon that plan when necessary. Its expansion into Latin America is one such example of the company not being afraid to grow where they feel there is a sustainable operating environment.

Executives at New Age Brands feel that due to the uniqueness of the company's focus on hemp, regardless of being housed in the United States, they are not hand cuffed to the same onerous and expensive state-by-state marijuana licensing laws. Simply put management sees New Age Brands as a global brand. The company feels strongly that the wave of the future is in the hemp derived CBD market, and they will be building a plethora of brands to gain as much market share as possible in the industry.

When asked to offer a report card of sorts on the plan that management has put into place, we were told that Kured is growing at a faster pace than they expected with profit margins increasing by 100 percent with its in-house manufacturing. The newly acquired Oregon properties are a great monthly revenue addition. Fresh Water is already in 35 states and by adding its own team's expertise, they are hopeful to be generating sales of Fresh Water on 2 continents by the end of 2018. The company says they're in talks with other existing CBD brands to potentially acquire, and New Age Brands also has ideas for its own CBD brands, which it says will be first to market.

Market Outlook

The cannabis market has grown at a tremendous pace over the recent years and as such, the industry has established itself a major global market. According to data compiled by Grand View Research, the global legal cannabis market is projected to reach USD 146.4 Billion by the 2025. It is also expected to grow at a CAGR of 34.6%. The market itself is witnessing a widespread legalization movement due to the growing adoption of the plant within the medical sector. Cannabis is being used heavily around the global for medical applications and treatments for maladies such as cancer, mental disorders, chronic pain, and others. However, the recreational market is thriving as well due specifically to the U.S. and Canada. States like California, Colorado, and Nevada are expected to propel the recreational sector forward at an encouraging rate.

The acceleration of research and development has led to new products within the market, enhancing consumer experiences. The research suggests that the industry is expecting strong exchanges of technological knowledge and information. Meanwhile, as countries like Canada, the U.S., Germany, and Australia lead the market in sales, countries like Israel are focusing on research and technology development to further expand within the industry. Additionally, there are various new forms of technology being introduced into the cannabis sector, such as virtual reality, payment solutions, and medical devices. "That's why we firmly believe that technology stands at the center of the industry's advancement and growth," said Ben Curren Chief Executive Officer of Green Bits, "This innovation will continue to generate market growth, improve public perception, protect public health and safety and enhance the implementation of state programs and regulations.

Technical Analysis

Those of you who love "buying the dip" should be licking your chops at NWGFF.

The Company is down nearly +75% from its 52-week high of $0.184.

That being said, NWGFF appears to have been building momentum over the past few days, and we believe a bullish reversal is just starting to take shape.

A reversal all the way back to its 52-week high would net members gains of over +284%!

We did our own chart analysis, and see the potential for a more realistic move of around +60%!

No matter which way you slice it, NWGFF looks like the next potential double-digit winner in our book.

As such, we are urging all members to start their research now, and consider grabbing up a position in NWGFF tomorrow morning at 9:30AM EST!

(*Remember to use a basic Stop-Loss Order or more advanced Stop-limit Order to protect your gains, as well as limit possible losses.)

Best Regards,

The TopMarketGainers Team

Don't Miss Our Next Huge Winner...

Text 'GAINS' to '67076'

to have our Trade Alerts

Delivered Direct

to your Cell Phone.

(There is no charge.

Msg&data rates may apply.)

DISCLAIMER

This newsletter is a paid advertisement, not a recommendation nor an offer to buy or sell securities. This newsletter is owned, operated and edited by both MJ Capital, LLC and PennyStockLocks, LLC. Any wording found in this e-mail or disclaimer referencing to “I” or “we” or “our” refers to MJ Capital, LLC and PennyStockLocks, LLC. Our business model is to be financially compensated to market and promote small public companies. By reading our newsletter and our website you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature, and are therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis of making investment decisions, and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our newsletters or on our website.

We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website and newsletter are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our newsletter and on our website may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. MJ Capital does NOT own any shares of the companies mentioned herewithin, nor intends to buy any in the future.

MJ Capital’s business model is to receive financial compensation to promote public companies. We have been compensated twelve thousand five hundred dollars by third party to conduct investor relations advertising and marketing for NWGFF. Any compensation is a major conflict of interest in our ability to be unbiased. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. The investor relations marketing may be as brief as one day, after which a large decrease in volume and share price is likely to occur. Our emails may contain forward looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our email newsletters and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, MJ Capital often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice.