Harmonic Patterns in Trading: A simple introductionIntroduction

In the world of trading, we often hear about harmonic patterns. These are very special tools in the trader's toolkit. They are complex but very important. In this article, we look into these patterns, how traders use them, and why they are crucial.

Understanding Harmonic Patterns

Harmonic patterns are part of technical analysis in trading. They come from Fibonacci numbers and show potential future price movements. These patterns are not random; they are specific geometric shapes in the markets. Some well-known patterns are Gartley, Bat, Butterfly, Crab, and Shark. Each pattern is unique and uses Fibonacci in a different way.

Top Harmonic Patterns

Gartley Pattern: This is a very famous pattern. It looks like an 'M' or 'W' shape. It helps traders to find good points for buying or selling.

Bat Pattern: This pattern is similar to Gartley but with different Fibonacci measurements. It's known for its high accuracy in predicting market reversals.

Butterfly Pattern: This pattern indicates a strong reversal. It's like Gartley and Bat but has a longer 'wing'.

Crab Pattern: Known for its extreme accuracy, the Crab pattern offers precise entry and exit points.

Shark Pattern: This is a newer pattern. It helps to identify very sharp and sudden changes in the market.

Fibonacci and Markets: A Symbiotic Relationship

Fibonacci sequence is a series of numbers important in many areas, including markets. Traders use these numbers to predict where the market might go.

Importance of Harmonic Patterns in Trading

Predicting Markets: These patterns help traders to guess future market movements, unlike other tools that only analyze past data.

Strategic Trading: They offer clear points for entering and exiting trades, which helps in planning.

Versatility: Useful in various markets like forex, stocks, and cryptocurrencies.

Risk Management: They provide structured ways to manage trading risks.

Complementing Strategies: Harmonic patterns can be combined with other market analysis methods for stronger trading strategies.

Learning Curve

Understanding harmonic patterns requires time and market knowledge. But they offer a clear insight into market behavior, which is very valuable for traders.

Challenges

Using harmonic patterns can be tricky. They need correct identification, and market volatility can sometimes affect their accuracy. So, traders need to be adaptable.

Conclusion

Harmonic patterns are a mix of mathematics and market understanding. They use Fibonacci to interpret market movements. For traders willing to learn, they offer deeper market insights. In trading, understanding these patterns can be a great advantage.

W-pattern

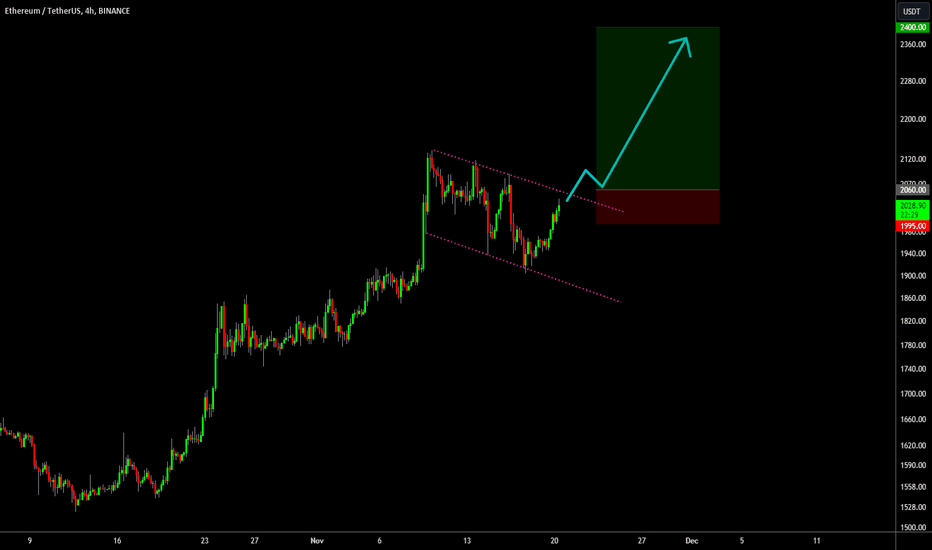

🔥 Ethereum PERFECT Bull-Flag Break OutIn my most recent ETH analysis I wrote that ETH was likely forming a bull-flag pattern and was going to break out in the near future.

And here we are. A break out, followed by a retest of the top resistance, which is exactly what bulls want to see.

Our entry has been hit and stop moved just below the retested resistance. This constructs a very decent trade with a risk-reward well over 12.

#XRP : Targeting 1$ in the Near Future. Expecting at least 35%.XRP have been in a good position and a healthy market phase compared to the overall crypto market. For now we can witness that a beautiful cup & handle pattern already formed and is finishing its current phase preparing for a breakout. If things keep the same as it is, there will be a high probability to see Ripple making some good North side moves.

Besides the formation of the pattern: -- We can witness a bullish divergence with the RSI and MACD.

- Stochastic showing an oversold behavior and seems sellers are being knocked out as we speak.

- MACD and RSI are still showing an uptrend momentum and that there is a space for growth in the near future.

- The handle on the 1D chart is already forming a bullish falling wedge on lower time frames and a break out will confluence the 1D chart.

- Ichimoku Cloud is providing a good support at current price level.

- Next strong resistance area will be in between $0.71 - $0.73 and these areas will be much more interesting to follow.

- If the neckline can be broken at any point of time we sure can wait for a successful retest and that will be our entry for a confirmed move towards the $1 price tag.

- Will be updating about the fundamentals soon too and a closer watch to this formation for sure will repay the patience.

- Stop loss will be considered to be at the price level where a failure of the retest occur. By this depeding on ones trading strategy putting the stop anywhere below the neckline will be a wise move.

Keep spreading the knowledge and +ve energy. Let you be peace in every single steps of your life. Stay tuned for more.

@ cryptotalket

🔥 Bitcoin Bullish Triangle: Preparing For Next Leg Up!BTC has been consolidating for nearly a month now. Not a lot of of trading in one direction, but short-term trends being reversed quickly.

Note that the price has consistently making higher-lows, whicb is a sign of strength.

On the other hand, the 38.000$ area is getting notorious. Every time that the price reaches the top resistance area, a quick sell-off follows.

Since this bullish triangle is classically a bullish break out pattern, odds are that we're going to break out sooner or later. My assumption is that the longer-term indicators, like the weeky RSI, needed some cooling down and that the bullish trend will continue once indicators have cooled.

The next leg up will likely bring us to 40.000$, if not higher. Keep a close eye for a higher time-frame candle to close above the top resistance of the triangle.

🔥 FTM Easy Bounce Trade: Support Holds!FTM has been falling like the rest of crypto, but the price failed to fall through the main bullish support of the last few weeks.

In my view, this gives us a nice opportunity to play the bounce with a clearly defined stop and profit target.

BTC appears to be reversing as we speak, so it's a matter of time before alts start regaining their losses.

GBPUSD SELL TO BUYThe price approaches the key zone where manipulation will be observed.

With the seller's work and the formation of bearish formations, this range for further movement is 1.2318-1.2186, where it will be interesting to consider the reaction of the buyer to continue the upward movement to the local accumulation of liquidity in the range of 1.2750-1.2930

Maintain your risks and act in accordance with your trading system.

🔥 Ethereum Bull-Flag: Patience For Break OutETH has been consolidating for nearly 10 days now, after a huge move from the 1500's to 2100$.

With the market rallying over the last couple of days, I see a decent probability for ETH to break out of this bull-flag and continue the rise up. Bull-flags are bullish continuation patterns, to bullish price action is the most likely result from this pattern.

Target at 2400$ for the coming weeks.

🔥 HBAR Triangle Break Out: Huge Risk Reward!HBAR has been going up with the rest of the market, but on a lower intensity than a lot of top performers. Still, there's more than enough opportunity to grow in the long-term.

I'm waiting for the price to confirm the break out by closing above the diagonal trend line. Target at 0.20$.

Xau/Usd (Gold)Hello traders!

The xau/usd (gold) pair is in a triangle pattern. In my opinion, there are two scenarios. Scenario number 1: The pair should test the level of 1975.00 and then take a buy move at the level of 1992.0 and continue a buy move towards the level of 2009.33. Scenario number 2: The pair should test the level of 1975.00 and then take a buy move at the level 1992.0 without breaking the line to go to the level of 1941.00. Wait to enter the trade! Be careful!

Don`t forget to look at the economic calendar!

MAKE MONEY AND ENJOY LIFE 💰

THANK YOU!

GOOD LUCK!

🙏🏻🙏🏻🙏🏻

🔥 Weekend Technical Analysis Fiesta🎉- Name Your Crypto!Another month has passed and a lot of things have happened. Time for another Crypto Fiesta! 🎉

Short-term view

Bitcoin is still looking like it wants to go up, but we have to acknowledge the inability of BTC to break through the 38.000$ resistance area.

Most likely is that the daily/weekly RSI wants to cool down a little bit before the next leg up. On the other hand, the bullish channel is still intact. As long as we're above the channel's support, no worries for the bulls.

🎉CRYPTO FIESTA🎉

Comment your favorite crypto below and I'll do my best to make an easy to understand technical analysis on it. Will be making these analyses all weekend!

Give this analysis a like if you enjoy the content🙏

ETH/AMC chart to follow MOASS/ SqueezeNotice when ETH/ AMC correlation corrects, AMC runs. Currently, RSI, Macd, and price is double topping on Eth/AMC. Again, this is ETH compared to AMC price. not prices overlapping two charts. A run for AMC is due on the charts, but only until we break patter/ trend line will a massive squeeze start.

🔥 TRB First Oversold Bounce In 2 MonthsTRB has been one of the biggest winners of the last two months, doing a 14x whilst most other crypto's only did a 2x-3x.

It was a matter of time before TRB corrected. Patient bulls like myself have been waiting for this opportunity.

Since TRB hit oversold levels on the 4H chart for the first time since late September, this might be the perfect time for bulls to step in for a swing-trade position.

Stop below the recent swing-low, target at 230$.

🔥 Altcoin's Highest Value Since Summer 2022: Mini Altseason!The total marketcap of altcoins, TOTAL3, has reached the highest value since August of 2022. In my view, this clear breakout marks the end of the bear-market accumulation phase and is the start of the next bull-cycle.

Like mentioned in my other analyses, the fact that the lows are in doesn't mean we will go up in a straight line. Most likely it's going to be a bumpy road towards the summer of next year, with the 'real' bull-market starting and the end of 2024 or start of 2025.

For now, I think that alts will see more growth. The yellow resistance is the most logical area in the short-term. Over the next few months, the blue resistance should be possible. Keep in mind that BTC has to trade relatively stable during this time.

With the Bitcoin dominance (above) in a clearly bullish trend, it's likely that alts will underperform BTC on average. Once BTC.D breaks down through the yellow line we can experience a 'mini altseason' where alts will outperform.

🔥 Bitcoin: The Best Next Cycle's Top Forecast 🎯Foreword

In this analysis I want to make an attempt at forecasting both the date and the price range at which Bitcoin will top at in the coming bull-cycle. The forecast is 100% based on historical data and is based on math and not on feelings, so be prepared to see some numbers and formulas.

This analysis is speculative in nature because we're forecasting the price of an asset around 2 years into the future. So take it with a grain of salt.

Halvings

The yellow dotted lines are past and future halving dates. For the last two halvings, Bitcoin has topped (green) between 74 - 78 weeks after the halving. The next halving is scheduled around 22 April 2024.

Bottoms

The red dotted lines are past bear-market bottoms. For the last two cycles Bitcoin topped 151 and 152 weeks after the bear-market bottom.

Monthly RSI

Based on this analysis BTC will top between 47-49 months after the top. In short: between September and November 2025.

Forecasting the DATE

Applying the logic of the two historical analyses above, we can make the assumption that BTC will top around 152 weeks after the market bottom. Assuming that the bottom is in, this brings us to early November 2025. This would be 79 weeks after the 2024 halving. Looking at the time between the halving to the top, this ranges from 74-78 weeks. All of the above is in line with my Monthly RSI analysis.

Combining everything above, we can forecast that Bitcoin will top between late September and early November 2025.

Log Price Bands

In order to calculate the price we make use of my Logarithmic Price Bands Indicator. I've removed the bottom two bands since we're only interested in the top band, which forecasts the top. The top band is based on a complicated exponential formula that gives a certain Price (Y) for a certain time (X).

See this indicator for more info.

Forecasting the PRICE

By filling in the dates of late September 2025 and early November 2025 into the Log Bands formula, we get a lower and an upper band of the price. This price ranges from 171k - 250k.

This is the best forecast that historical price action can give you, although we had to make the assumption that the coming cycle will follow a similar path as the previous two, which is not far-fetched since the asset has matured more.

Conclusion

Date: late September - early November 2025

Price: 170.000 - 251.000

The macro environment has changed a lot over the last two years, so I'd be happily surprised if this forecast turned out to be true. Personally I'm more conservative than this analysis suggests because of interest / inflation / recession.

Still, this analysis is 100% based on historical facts and the best factually correct forecast I can give at a next cycle's top.

Please share your thoughts on this analysis. Also interested to hear your predictions! 🙏

Eur/UsdHello traders!

Yesterday, the couple made a buy move because the US inflation came out less than it was thought to come out. The pivot (1.08860). If the price manages to break the level (1.08860), then we will have a buy movement at the levels (1.09310); (1.10000) ; (1.11040). My opinion is that the pair will keep the bullish movement.

Wait to enter the trade! Be careful!

Don`t forget to look at the economic calendar!

MAKE MONEY AND ENJOY LIFE 💰

THANK YOU!

GOOD LUCK!

🙏🏻🙏🏻🙏🏻

Xau/UsdHello traders!

Yesterday, the couple made a buy move because the US inflation came out less than it was thought to come out. The pivot (1975.00). If the price manages to break the level (1975.00), then we will have a buy movement at the levels (1988.00); (1995.00) ; (2002.00). My opinion is that the pair will keep the bullish movement.

Wait to enter the trade! Be careful!

Don`t forget to look at the economic calendar!

MAKE MONEY AND ENJOY LIFE 💰

THANK YOU!

GOOD LUCK!

🙏🏻🙏🏻🙏🏻

🔥 Bitcoin's Secret Pattern: Guess What Will Happen! Bitcoin's long-term price action is following many patterns, one of them is seen on the Monthly RSI.

As seen on the chart, the monthly RSI is following a very clear channel in which is oscillates. Bitcoin tops at the top of the channel and Bitcoin bottoms at the bottom of the channel. Trading this pattern has resulted in traders buying the general bottom and the general top.

Since the monthly RSI bottomed in December 2021, it has been steadily moving up. What will happen next you might think?

I think that the RSI will likely continue to move up. This doesn't mean that BTC will rise in a straight line like the 2015-2017 bull-market, but the long-term trend has been established.

When solely looking at this chart, we can also make a speculation on the time where BTC will top. Seeing that the previous bull-market top to bull-market top took 49 and 47 months, we can speculate (based on this analysis alone) that Bitcoin will see a market top somewhere between October 1st and December 31st 2025.

Agree with this analysis? Share your thoughts 🙏

Pennant - GJHere I have GBP/JPY on the 1Hr Chart in what looks to be a Pennant Pattern!!

We've had 2 tests of the Falling Resistance and 2 tests of the Rising Support! There is still room for price to play in the "Pinch Point".

As of now I have a Bullish Bias on this idea because price was in a Uptrend prior to entering this pattern! Along with GBP showing strength across the board!

-BUT-

GBP is heavy with news this week so if news is bad, there is potential for a Bearish Break!

Fundamentally:

GBP -> Claimant Count Chance (Tue), CPI (Wed) and Retail Sales (Fri)

JPY -> "Clear News Week"

**Chart Patterns are known to fail 1/3 of the time so BEWARE OF FALSE BREAKS!!