Ethereum Name Service ($ENS) Partners with Ubisoft Coin Surge 10The Ethereum Name Service ( NYSE:ENS ) has captured attention once again, surging 10% following a groundbreaking partnership with Ubisoft. This collaboration aims to integrate ENS subdomains into Ubisoft’s identity card system for the Captain Laserhawk universe, merging Web3 innovation with immersive gaming experiences.

About Ethereum Name Service (ENS)

ENS is a decentralized naming system on the Ethereum blockchain, translating complex wallet addresses into simple, human-readable names like *john.eth*. It revolutionizes the way users interact with blockchain technology, making it as seamless as accessing websites via traditional domain names. Beyond usability, ENS enables ownership of digital identities and supports Soulbound Tokens (SBT) and Real-World Asset (RWA) tokenization, solidifying its role in the decentralized identity space.

Since its launch, ENS has built a robust reputation, supported by its November 2021 retroactive airdrop, and now ranks among the top Ethereum-based projects.

The Ubisoft Partnership

Ubisoft, a global leader in gaming, recently unveiled a project inspired by its popular **Captain Laserhawk animated series**, collaborating with Magic Eden to expand blockchain gaming horizons. Through this partnership, ENS subdomains will power the identity system in the Captain Laserhawk universe, merging the blockchain ecosystem with the gaming world.

This move highlights the growing convergence of blockchain and gaming, as well as ENS's critical role in facilitating seamless integration.

Market Reaction

The announcement fueled NYSE:ENS ’s rally, pushing its price to $44.29 with an 8.11% daily gain. Over the past four days, NYSE:ENS has surged by 45%, recovering from its recent low of $30.33. With trading volumes exceeding $813M in the last 24 hours, the momentum shows no signs of slowing down.

Technical Outlook

On the charts, NYSE:ENS is exhibiting signs of bullish continuation:

- Support Level: In case of a pullback, the 38.2% Fibonacci retracement level near $40 could act as a strong support zone.

- Resistance Level: Persistent bullish pressure could push NYSE:ENS to test the $50 resistance level, marking a significant psychological and technical milestone.

- Relative Strength Index (RSI): The RSI indicates room for further growth, reinforcing the possibility of a sustained uptrend.

Why This Matters

This partnership underscores ENS’s growing relevance in bridging Web3 with mainstream industries like gaming. The ability to seamlessly integrate ENS subdomains into complex ecosystems like Ubisoft’s highlights its adaptability and potential for widespread adoption.

As the gaming industry embraces blockchain solutions, NYSE:ENS is positioned as a vital component of this evolution, offering decentralized identity management that is both scalable and user-friendly.

Looking Ahead

With a $1.55B market cap and an ever-expanding ecosystem, ENS continues to lead in decentralized naming services. Its partnership with Ubisoft not only boosts its fundamental value but also opens doors to new applications in gaming and beyond.

Should bullish momentum persist, NYSE:ENS could break past $50, further solidifying its position as a key player in the blockchain and gaming spaces. Investors and enthusiasts alike will be watching closely as ENS continues to push the boundaries of decentralized identity and integration.

Ubisoft

Can Tencent salvage Ubisoft's sinking ship?Ubisoft’s stock pumped 35% couple of days ago following a Bloomberg report suggesting that Tencent may either acquire the company or take it private

Although the French gaming company didn’t confirm or deny the speculation, it did state that it’s considering "all strategic options" for the benefit of its stakeholders and will notify the market when necessary

If Tencent proceeds, it would mark another significant acquisition in a wave of major gaming deals over recent years:

- Activision Blizzard acquired by Microsoft for $69 billion in 2023.

- Zynga acquired by Take-Two for $12.7 billion in 2022.

- ZeniMax Media acquired by Microsoft for $7.5 billion in 2021.

- Savvy Games acquired by Scopely for $4.9 billion in 2023.

- Bungie acquired by Sony for $3.7 billion in 2022.

- Glu Mobile acquired by EA for $2.4 billion in 2021.

- Keywords Studios acquired by EQT for $2.4 billion in 2024.

Ubisoft’s valuation sits at just $2 billion, nearly 90% below its peak in 2021! The stock fell by more than 40% in September alone, so this recent surge is only a brief reprieve. Given its diminished value, a potential buyer offering a premium wouldn’t necessarily be a massive win.

So, how should we interpret this news, and what can we anticipate for future gaming M&A activity? Let’s break it down.

Key Points

1.Ubisoft’s Challenges

2.Potential Buyers

3.IP Gold Rush

4.Future of Gaming M&A

1. Ubisoft’s Challenges

Ubisoft has faced setbacks including canceled games, delays, and a dip in quality in the post-pandemic era. Let’s take a look at the fiscal year 2024, which ends in March.

Consider this metric reflects the total amount spent by users within a period, covering game sales, in-game purchases, subscriptions, and downloadable content (DLC). It’s an important measure of business performance, with net bookings recognized as revenue over time, depending on content delivery and user engagement

Key takeaways:

Digital-first: 86% of Ubisoft's net bookings come from digital sales (premium, free-to-play, and subscriptions). It was 12% in 2013, illustrating the transformative past decade.

Far behind on mobile: Ubisoft has trailed its peers, with only 7% of revenue coming from mobile. In contrast, nearly half of the industry’s revenue comes from smartphones.

Margins improved after cost-cutting: Digital games are a high gross margin business, particularly with the back catalog (title released in previous years) making up nearly two-thirds of net bookings. Targeted restructurings impacted FY23, making the short-term margin trend misleading. Ubisoft laid off 1,700 employees between September 2022 and March 2024, roughly 6% of its workforce.

Short-lived turnaround: FY23 was a challenging year, with Net bookings collapsing by 18% with the underperformance of Mario + Rabbids: Sparks of Hope and Just Dance 2023. In FY24, Net bookings rebounded sharply, growing 34% with the successful release of Assassin’s Creed Mirage and The Crew Motorfest.

FY25 Collapses in a Week: After the underperformance of Star Wars Outlaws (released at the end of August and originally expected to be a blockbuster) and the delayed launch of Assassin’s Creed Shadows from November to February, Ubisoft revised its FY25 net bookings forecast down to €1.95 billion, a 16% decline year-over-year (compared to the "solid growth" expected earlier). The company now anticipates barely breaking even on an adjusted basis.

The decision to delay Assassin’s Creed Shadows just weeks before its scheduled release was influenced by the poor reception of *Star Wars Outlaws*. However, the three-month delay might not be enough to resolve concerns over game quality or criticisms from the Japanese community regarding historical and cultural inaccuracies.

But that’s not all!

In addition to these financial and operational difficulties, Ubisoft has faced allegations of a toxic workplace. Several former executives from the *Assassin’s Creed* studio were arrested as part of an investigation into sexual assault and harassment.

This situation mirrors the downfall of Activision Blizzard in the months leading up to its acquisition by Microsoft, which leads us to potential buyers for Ubisoft.

2. Potential Buyers

Ubisoft remains a family-run company, largely overseen by its founders.

The latest annual report reveals the following voting rights:

- The Guillemot family controls 20.5%

- Tencent owns 9.2%

In September, minority shareholder AJ Investments claimed it had gained backing from 10% of shareholders and called for Ubisoft to be sold or taken private, estimating a fair value of €40 to €45 per share. With shares currently trading at €13, this seems highly optimistic.

So, who are the likely candidates for a Ubisoft buyout?

Key Players:

-Tencent: Already a significant shareholder, Tencent could increase its stake or seek majority control. As the largest gaming company globally by revenue, Tencent has a history of acquisitions, such as its purchase of Finnish publisher Supercell (*Clash of Clans*) for $8.6 billion in 2016. However, Tencent's aggressive expansion has drawn regulatory scrutiny, especially in the US and Europe, which could complicate any attempt to acquire majority control of Ubisoft.

Guillemot Family: The founding family might be interested in reclaiming greater control of Ubisoft and steering it in a new direction. To finance the buyout, they could collaborate with a private equity firm or a strategic investor. However, given Ubisoft's current size and the significant cost associated with a buyout, it could be difficult for the Guillemot family to pursue this path on their own.

Other Potential Investors: Private equity firms or strategic investors within the gaming sector might also join a buyout consortium. These investors could be drawn to Ubisoft’s valuable intellectual property (IP) and see potential for a turnaround under new leadership.

Gaming Companies: Besides Tencent, the largest gaming revenue players in 2023 are highlighted in the visual.

-Apple and Google: Although both tech giants have been expanding into gaming, acquiring Ubisoft seems unlikely given their current antitrust scrutiny.

-NetEase, EA, and TakeTwo: These companies would find an Ubisoft acquisition to be a straightforward studio consolidation. NetEase, in particular, might find it appealing to broaden its console and PC presence in the West, but Tencent’s involvement could complicate this.

-Sony and Microsoft: As first-party publishers, both would benefit from boosting their subscription services with exclusive content. They’ve aggressively acquired studios in recent years. Given that the Activision Blizzard deal was approved, there’s no reason a Ubisoft acquisition couldn’t pass as well. In their latest fiscal year, gaming accounted for 32% of Sony’s revenue and less than 9% of Microsoft’s.

3. IP Gold Rush

In the gaming industry, intellectual property (IP) is crucial. Iconic franchises like *Call of Duty*, *Mario*, and *Grand Theft Auto* are multi-billion-dollar assets that significantly impact a company’s future. As a result, many companies are eager to acquire established IPs or gain access to the teams behind them.

Why is IP so valuable?

-Lower risk: Developing a new AAA game can cost hundreds of millions and take years, with no guarantee of success. Acquiring a popular IP allows companies to tap into an existing fanbase and reduces the risk of failure.

-Brand power: Consumers are more inclined to purchase games with familiar characters, worlds, or studios behind them. Well-known creators like Hideo Kojima (*Metal Gear*) and Hidetaka Miyazaki (*Elden Ring*) are just as significant.

-Content scalability: Famous IPs can generate revenue through sequels, spin-offs, and licensing deals. Large publishers have the infrastructure to maximize returns across multiple channels.

This strategy isn’t unique to gaming. Media giants follow similar patterns:

-Amazon’s acquisition of MGM: In 2021, Amazon acquired MGM for $8.5 billion, gaining access to franchises like *James Bond* to enhance its Prime Video content.

-Disney’s acquisition of Lucasfilm and Marvel: These acquisitions have delivered massive returns through movies, TV series, and licensing opportunities.

Why now?

-Consolidation pressure: Subscription services and cross-platform gaming are driving consolidation. Big companies want to secure valuable IPs to differentiate their services and attract loyal customers. Meanwhile, smaller studios are more open to selling early to avoid competing in an increasingly crowded and capital-intensive market.

-Value in ownership: Owning IPs in gaming allows companies to create expansive worlds and engage players long-term through updates, expansions, and live services. This keeps players coming back and generates recurring revenue, which is harder to achieve in video content.

-Cross media expansion: Popular games can expand into movies, TV series, or theme parks. For instance, *The Last of Us* became a hit HBO show, and Sony is developing TV adaptations for Horizon Zero Dawn and God of War. This leads to more revenue, a broader audience, and long-lasting IP appeal.

The Ubisoft Angle

Ubisoft’s IPs, like *Assassin’s Creed*, *Far Cry*, and *Tom Clancy’s Rainbow Six*, have significant potential for future growth, despite recent struggles. However, realizing that potential might require new leadership or a fresh strategy, which a new owner could provide.

Even though Ubisoft faces challenges, its strong portfolio might attract various buyers. For the right acquirer, Ubisoft's problems could represent a chance to buy low and rework its creative direction.

As more studios seek to hedge their risks in this changing industry, we can expect more mergers and acquisitions (M&A) in the future.

4. The Future of Gaming M&A

The gaming industry is constantly evolving, and several trends are fueling a surge in mergers and acquisitions:

-Mobile-first: Mobile gaming is the largest and fastest-growing segment, making companies with a strong mobile presence attractive. Examples include Playrix (Gardenscapes,Homescapes) and Scopely (MONOPOLY GO!,Stumble Guys)

-Cross-platform: Cross-platform play is becoming the standard, and companies with expertise in this area are in high demand. Unity and Epic Games play vital roles with their popular game engines, while major studios are also building in-house solutions.

- Cloud gaming: Still in its early stages, cloud gaming has the potential to revolutionize how games are played. Companies with cloud infrastructure are becoming more valuable, with leaders like Microsoft (Game Pass Ultimate), Sony (PlayStation Plus Premium), and NVIDIA (GeForce Now) pushing the trend.

-Metaverse: Beyond AR/VR, virtual worlds like *Roblox* and *Fortnite* have created immersive, social spaces that keep players engaged beyond traditional gameplay. Companies developing these experiences are attractive targets for firms looking to capitalize on this trend.

-Web3 & Blockchain: Web3 games enable decentralized ownership and in-game economies powered by blockchain. This trend lets players own and trade digital assets, opening new revenue streams and drawing interest from companies exploring the intersection of gaming and crypto.

-AI driven studios: AI is already influencing game development, and its role will only grow. Companies with AI expertise, particularly in game design and player behavior analysis, are becoming highly sought after. As AI reduces development costs, budgets could shift towards live services and marketing.

The Big Picture

The gaming industry is consolidating, with major players acquiring valuable studios and IPs. While there will always be space for indie games—especially as AI lowers the barrier to entry—industry consolidation will likely strengthen the top companies and leave less room for those in the middle.

If a company like Ubisoft, valued at over $12 billion in 2021, is struggling to survive on its own, the future looks bleak for many smaller studios

DOGA Dogami crypto backed by Ubisoft and Animoca BrandsAs a Web3 mobile game backed by major players like Ubisoft and Animoca Brands, Dogami allows players to adopt, train, and compete with virtual dogs to earn $DOGA tokens.

With a market cap of just $1.8 million USD, this could be viewed as a risky yet potentially rewarding investment opportunity.

DOGA Dogami is currently down 99% from its all-time high, which highlights the volatility often seen in the crypto space.

Despite its current low valuation, the game's unique premise and strong partnerships suggest there could be substantial upside potential if it successfully attracts a user base upon launch.

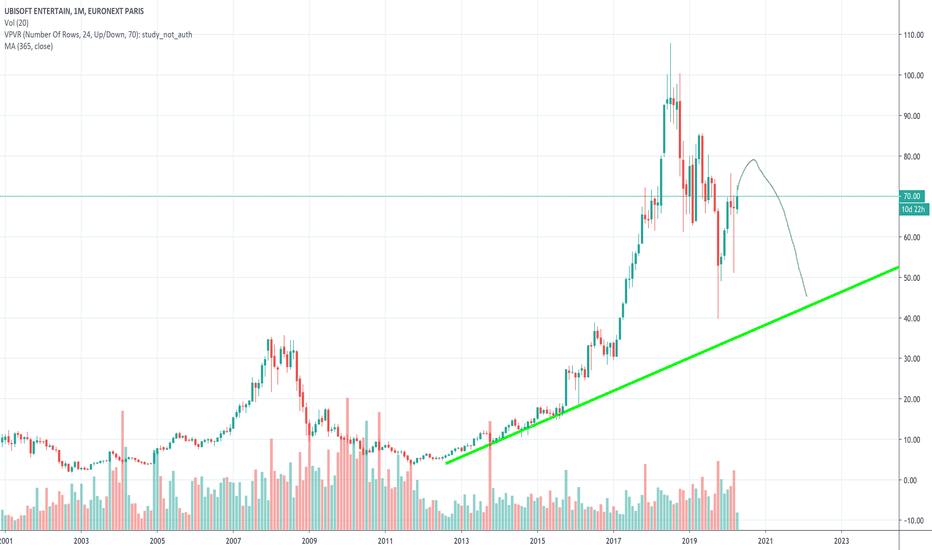

Possible 200% UBISOFTHello everyone,

I share with you today about a french company that i have watched since few weeks.

I see a high probability to double my money in a long term position.

This company is underrated , normally the price is around 40$ without the bad buzz since the DEI.

If the company continu in the way of the DEI. We can consider a possible -69% on the position until the more historic low position.

Tencent and Guillemot Brothers evaluate the purchase of UbisoftUbisoft, the famous video game developer responsible for sagas such as Assassin's Creed and Far Cry, is in the midst of a financial crisis that has caused a 50% drop in its shares over the last year. Faced with this situation, Tencent and the Guillemot Brothers, the company's founding family, are considering acquiring full control of the company, according to Bloomberg.

This potential deal would turn Ubisoft into a private equity firm, with Tencent holding a stake of less than 10%, with no veto rights or ability to sell its shares for the next five years. Meanwhile, the Guillemot Brothers would retain operational control of the company, in an attempt to stabilize it and keep other potential buyers away.

Key points:

• Financial crisis: Ubisoft has lost 50% of its stock market value in the last year.

• Possible acquisition: Tencent and the Guillemot Brothers are negotiating a deal to take control of the company.

• Market impact: Ubisoft shares jumped more than 30% following rumors of the takeover.

• Terms of the deal: Tencent would have no veto rights and could not sell its stake for five years.

• Future of Ubisoft: The goal is to revitalize the company and protect it from further acquisitions.

•

This move could mark a new stage in Ubisoft's history as it struggles to regain its position in the video game industry.

Ion Jauregui - ActivTrades Analyst

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acing on the information provided does so at their own risk.

UBISOFT REKT- What happens when you're one of the biggest video game companies in the world and you rest on your laurels? You sink.

- That said, as traders, we can always attempt to capitalize on a dead cat bounce.

- Right now, nothing to buy, if Ubisoft not down more and bounce before, just forget it.

------------------------------------------------------------------------------------------

Trading Parts :

------------------------------------------------------------------------------------------

- Buy around 10€ ( 30% invest )

- DCA Rebuy to 8.5€ ( 70% invest )

------------------------------------------------------------------------------------------

- TP1 : 17.9€

- TP2 : 29.9€

------------------------------------------------------------------------------------------

SL : 5.9€

------------------------------------------------------------------------------------------

Stay S4fe

Happy Tr4Ding !

Ubisoft Entertainment SA / UBIUbisoft Entertainment aka ubi "bug" is a french video game publisher headquartered in Saint-Mandé with development studios across the world. Its video game franchises include Assassin's Creed, Far Cry, For Honor, Just Dance, Prince of Persia, Rabbids, Rayman, Tom Clancy's, and Watch Dogs. Ubisoft was one early investors in web3 technologies and projects too

last year was a terrible year for ubi because not only they didn't succeed with their franchise like farcry 6 but also they entered the bear market while they were working on their bigger projects like AC. “We are clearly disappointed by our recent performance,” said Ubisoft Chief Executive Yves Guillemot. “We are facing contrasted market dynamics as the industry continues to shift towards mega-brands and everlasting live games, in the context of worsening economic conditions affecting consumer spending.”

2023 is a big year for ubi and they are going to publish some of their best games like Assassin's Creed Mirage, Tom Clancy’s The Division Heartland and skull and bones

ubi stock now in Accumulation phase and its next targets are 21, 23 and 25

GOG - Guild Of GuardiansGOG - Guild Of Guardians is a Blockchain mobile RPG with 150k+ players on the waitlist.

Published by Immutable, and developed by Stepico.

www.guildofguardians.com

PARTNERS & BACKERS :

APEX CAPITAL

COINBASE

UBISOFT

IMMUTABLE

SANDBOX

etc.

icohigh.net

www.ubisoft.com

//////////

Guild of Guardians is one of the most anticipated blockchain games of 2022 and is built on ImmutableX, the first layer two solution built on Ethereum that focuses on NFTs. Aiming to provide more access, it will function as a free-to-play mobile role-playing game, modeling P2E mechanics.

Like blockchain-based games like Axie Infinity, Guild of Guardians game assets can be traded. The project appears to be of interest to many players and investors, with its NFT founder sale and token launch generating nearly $10 million in volume. Launched in October 2021, Guild of Guardians (GOG) tokens are ERC-20 tokens called "gems" in the game. These are the gems that power key features of the game, such as hitting NFTs in-game and interacting with the marketplace, and can be earned while playing.

Like blockchain-based games like Axie Infinity, Guild of Guardians game assets can be traded. The project appears to be of interest to many players and investors, with its NFT founder sale and token launch generating nearly $10 million in volume. Launched in October 2021, Guild of Guardians (GOG) tokens are ERC-20 tokens called "gems" in the game. These are the gems that power key features of the game, such as hitting NFTs in-game and interacting with the marketplace, and can be earned while playing.

Over the past month, the Guild of Guardians token has seen a fairly stable performance after hitting its all-time high of $2.81 after its launch. Although the token is down more than 50% from its all-time high, at the time of this writing, some community members are looking forward to the possibility of staking and liquidity pools, which are features that tend to help stabilize token prices.

//////////

DYOR

Is Facebook ready to buy a major gaming stock?Facebook’s transition into Meta Platforms (NASDAQ:FB) and Mark Zuckerberg’s big push into the metaverse — the concept of a shared 3D virtual platform where people can socialize, work, and play — spurred a sector-wide move by tech companies to branch out into other areas like gaming.

The burgeoning gaming industry has transformed into a $198.4 billion sector in 2021, far exceeding the combined market size of the box office and the music industry, according to market research firm Mordor Intelligence.

Meta and VR gaming

Even before Meta announced its push into the metaverse in October 2021, the social media behemoth has built a presence in the gaming market with its acquisition of virtual reality company Oculus in 2014. Meta’s foray into the metaverse would make its Oculus VR headsets more appealing to the market amid strong competition against other VR headsets in the market like HTC’s (TPE:2498) HTC Vive and Sony’s (NYSE:SONY) PlayStation VR.

A sharper focus on gaming would encourage Facebook to double down on its investments in the gaming sector far beyond hardware and building a metaverse. The company, which also owns Instagram and WhatsApp, could soon build an army of tech talents that specialize in gaming.

Meta gobbles up gaming studios

In the months before it rebranded into Meta, Facebook went on an acquisition spree buying small gaming studios. Among its most recent acquisitions in the gaming space are studios Ready at Dawn, Unit 2 Games, VR firm BigBox VR, Downpour Interactive and Sanzaru Games.

However, Meta has yet to spend billions of dollars on a gaming company since its acquisition of Oculus in 2014 for $2 billion, raising the prospect of a potential acquisition of a larger gaming studio similar to recent moves by Sony, Microsoft (NASDAQ:MSFT) and Grand Theft Auto publisher Take-Two Interactive (NASDAQ:TTWO).

Multi-billion gaming deals

Three multi-billion dollar gaming deals welcomed the year in January, starting with Take-Two’s plans to buy mobile video game company Zynga for $12.7 billion, which was thought to be the gaming industry’s biggest acquisition on record until Microsoft announced that it is buying Activision Blizzard (NASDAQ:ATVI), the studio behind the Warcraft, Diablo, Overwatch and Call of Duty franchises, for $68.7 billion in cash.

Microsoft said the deal would make it the world’s third-largest gaming company in terms of revenue behind Tencent (HKG:0700) and Sony. Two weeks later, Sony said it is buying Bungie, the video game developer behind the Destiny and Halo franchises, for $3.6 billion.

Which gaming studio is Facebook eyeing?

With Meta’s intentions to promote the metaverse concept, industry watchers are now waiting for the company’s next big move. Meta will likely look to gobble up a gaming studio with a massive presence in the market such as France’s Ubisoft (OTCMKTS:UBSFY), the developer behind Assassin's Creed and Prince of Persia. Ubisoft CEO Yves Guillemot last month hinted that it is open to offers from companies.

Roblox (NYSE:RBLX), Playtika Holding (NASDAQ:PLTK) and Super League Gaming (NASDAQ:SLGG) are also likely targets if Meta chooses to snap up the bargains on these companies after their shares tumbled to near record lows recently.

In June 2021, Meta bought Unit 2 Games, the studio behind Roblox-like gaming platform Crayta.

Ubisoft Analysis - Double TopDouble Top formation and completion

The question is where does price go from here?

Price may recover along the 1/1 Gann line, which has previously been a resistance area for price

Or it may recover at the red line plotted which has been a strong pivot point for price

Its all based on the strength of the double top

Uuii UbisoftBuying points:

-trend line from July,15

-strong support at 51.14€

-MACD: MA lines extremely under average

-RSI: oversold

Selling points:

-all SMAs above the price

-MACD shows negative momentum

Fundamentals

-selling pressure bc of bad earnings of the gaming industry (take-two)

-seasonal summer impact -> people are more outside, fewer sales

-guidance of next earnings: meh

Conclusion

Technically the stock has a great potential to bounce back to a certain level which I think is 59-60€. So, with a tight stop loss, we are looking for a 17% return.

My strategy, in this case, is to sell the stock when it hits SMAs like 50 or 100 (main goal 100).

You could argue that the share has the chance to get to the upper downtrend line but the fundamentals do not support this theory, not in the short-mid term.

Short opportunities could arrive after we go under the trend and support line (full daily closed candle). This would become approximately 20% down to the next support line of 40€.

As all ways, I try my best to calculate the best risk/reward ratio. If you like my analysis you can follow for more quality content.

RLC IEXEC - GOOGLE, INTEL, IBM CLOUD, UBISOFT 5000%++ GAINSRLC is running the bull run first in the crypto market.

RLC will be the main decentralized cloud computing provider for the BIG tech companies.

Why? RLC helps these major TECH companies earn more ROI for unused cloud storage.

GOOGLE CLOUD will be next in the line, alongside all other cloud companies that has not been announced.

IEXEC just announced that they have joined Confidential Computing Program and have been working on the project since the alpha release.

Huge things to come soon.

July - DEFI news

SEPTEMBER- MAJOR news for mainstream adoption!

RLC is following LINK bull run from NOV 2018.

1W CHART wise, SUPER bullish,

Fundamentals wise, ULTRA bullish.

i'm holding RLC for that 5000%+ gains!

*Not financial advise, this is all my opinion.

Ubisoft downtrend confirmation or island reversal?Ubisoft has been stuck in a downtrend for awhile now, an initial island can be observed and linked to the current downfall of this stock. Currently the price is trading within a downtrend, where a second island bottom is present, which may lead to a reversal at the immediate support zone. Overall the bearish momentum, outweighs the possible bullish factors.