Trends

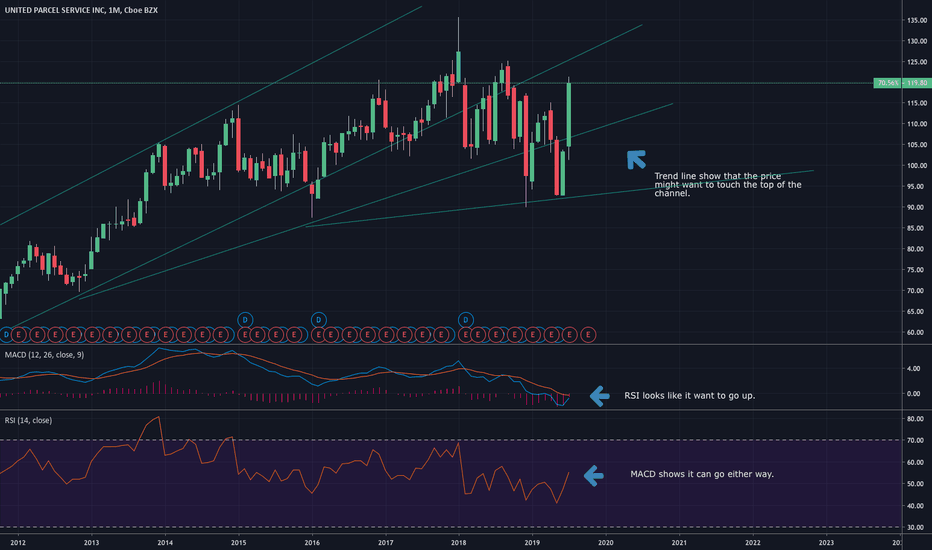

Target earnings release comingFrom the technical perspective, RSI currently indicates a magnitude of 61,52, slightly starting to lean towards the overbought side and a possible breakout again at 70, whereas MACD in the following days shows a golden cross triggering a buy signal at 112-124 $. In regards to past performance of a stock price, from 2018, January until 2019, August the stock traded between 64,89 $ and 90,17 $ levels, but then on 20 of August 2019 surged an increase about 19% in price due to strong Q2 release results. Right now, there is a lack of data to draw meaningful entry positions since the stock has been trading mainly sideways starting from 20. August. However, our recommendation would be to enter a long position within a range of 110.39 (expected bottom) and 112.00 (expected up-verse trend).

Bitcoin is falling, as was naturally expected...The current fall of bitcoin is natural motion at this time. strange would be if we watched a high and the price back to 15k.

We are still in a long term downtrend. In my perception, we live the second big fall of bitcoin, which is still just a baby. however, the macro movement is bullish and remains an excellent long-term investment, something for life.

Maybe bitcoin will still reach 5500; if it does, it's worth selling some patrimonied to buy it.

Thanks ! (((*)))

Shaman

Shanghai A composite, potential drop!Hello, Dear friends

Long time no see!

China shanghai composite potential drop, 2500 will be the first support if 2870 break, and the weekly RSI is toward to 30.

But I still think it a good time to buy when oversell happens.

Thanks!

SPY short term fallToo much uncertainty with the US economy, combined with negative pointing indications. Definitely going down short term. 2 possible rally points for Monday, either the 297 support line, or the next 296 support line. If both of these fall, then it will be a very very very hard climb back up. I wouldn't go long on SPY for a while, just to be safe.

SPY Chart Trends & AnalysisRough days for SPY ahead.

This chart & its indicators are complicated and slightly convoluted; it's not for everyone. I recommend you expand the chart indicators and read the names. Read the chart lines and understand the different indicators & what they're showing.

Anyway, time for my trend guess: with the China economy slowdown, the upcoming US inquiries into the Trump administration, and all other signs of a shaky economy, why risk it? Looking at my relative volume indicator, you can see there has been massive sell spikes continuously. That trend will only continue as the economy gets weaker and people are more unsure.

GA BuyI drew trend lines on the daily (trending up). Noticed price was fairly low and had a buy limit set, right at the bottom of where the wicks are before bouncing up and taking off. Because it sky rocketed fairly quickly, I would probably look for a buy entry close to the bottom of the candle. Possibly this week/Friday. But may have to wait until next week. I have a small position and most likely will be holding toward the upper trend line to the top Fib zone of -16 - -27% . Staying disciplined during this time will be the challenge. But will focus my efforts on other set ups while this runs.

CTHR - MA200 Retest. This could be key.Charles & Colvard Ltd. engages in the manufacture and distribution of moissanite jewels and finished jewelry featuring moissanite for sale in the worldwide jewelry market. It operates through the following business segments: Online Channels, and Traditional. The Online Channels segment refers to the e-commerce outlets including charlesandcolvard.com, third-party online marketplaces, drop-ship, other pure-play, and, e-commerce outlets. The Traditional segment consists of wholesale and retail customers. The company was founded in 1995 and is headquartered in Morrisville, NC.

P/E Current

14.87

P/E Ratio (with extraordinary items)

15.92

P/E Ratio (without extraordinary items)

15.35

SHORT INTEREST

194.59K 09/13/19

Average Recommendation: BUY

Average Target Price: 2.50

Knock It LooseBitcoin is pretty slow right now. We're all aware. Why is this happening?

Because you're all waiting for the same thing. Everyone is speculating on where it's going to go, and there's no consensus for either. The volume of money going in either direction has shunted quite a bit to represent the divide here.

You've got people already in it that won't spend a penny more until they see signs of life and people that aren't yet in it until they're sure it wont break down any lower.

That's usually the story when we see consolidation go on for so long and volume ramping down. A lot of this is to do with people being far more fearful of risk of catastrophic loss than they are hopeful for incredible takeoff.

Anyhow, I drew out some resistance lines that graze the tops of successive peaks from their starting point (light blue). My advice would be to use these as milestones to cross and watch what happens to the price if it comes above it. Usually, if it crosses above the nearest resistance but does not bounce on it as it corrects down some, that resistance hasn't evolved into a support area. It is to say that a lower bottom will be sought out.

If it does, however, cross over the top and does so in an exceeding fashion, you can gauge the trend of that line to be the next minimum support in the future. It will almost always have some interaction there until violated again before falling down.

The exact opposite is true for the support lines tracing to successive 'bottoms' from the line's point of origin. In this case, if the price falls beneath the supports, it will be adopted as the resistance trend line for any future price movement moving upward after falling beneath that line (dark red).

If in the future, say Late November/Early December, you find that the price is crawling back up while beneath the last support line, then the moment in which it finally crosses upward and over that support line is the very moment you can expect incredible volume to steepen that upward climb.

This is because people usually seek a percentage as their prospective gains, and as the price moves higher, you need an exponential climb upward to continue getting that require percentage of return for the next guy coming in to invest.

I've noticed that with just about all charts where it depicts a that threshold being crossed with massive volume.

People have a tendency to herd and with herds come independent return requirements and you get that momentum following spikes in volume.

All things considered, I don't think this next event of major activity is going to take us higher. I could easily see volume opening up again but propagating the price about some average-just with more volatility around that flat point; and subsequently knocking the confinement "loose" to slide down beneath $9,000.

GBPJPY UPWARDS TREND !! GO LONGGOLD HAS HAD A GOOD RISE TODAY

THE RESISTANCE LEVEL WAS BROKEN AND HAS CONTINUED THE RISE

AS SHOWN FROM LEVEL 130.934 TO 135.098 THERE HAS BEEN A PULL BACK THEN RISE PULL BACK THE N RISE BOTH TOUCHING THE SUPPORT LINE SHOWN ON UPTREND THE THIRD PULLBACK DIDNT TOUCH WHICH I THINK MEANS THIS WILL BREAK OUT AND CONTINUE A NEW RISE WAITING TO CATCH ON A PULL BACK TO THE ARROW SHOWN ON CHART

Please follow and show some support

Visa. Examining potential downside risks. VAssessment:

Neutral Hold- Going Long.

Market Climate:

Bull controlled, increasing volatility.

Industry:

Financial Services

Indicators:

None

Patterns Identified:

Harmonic ABCD

Macro Broadening Wedge

Visa has seen steadily rising bullish accumulation since first breaking out in December 2012. Since then, the security has experienced a change in price of roughly 612%. The security has been methodically traded between two ranges demonstrated through the broadening wedge depiction. More importantly, the stock has broken beyond the major resistance line of the broadening wedge, pulled back, and continued a break out extension symmetric to the pole of the wedge structure.

However, with mid-2018 to late 2019 thus far facing significant increases in overall volatility by a variety of factors, the security is for the short-term from a technical standpoint demonstrating an increase of inherent risk to visa bulls. With echoing discussions of an impending recession, international trade tension, the effect of the Fed on the US economy, and the slowing of corporate earnings visa may be in a tight position that could affect the value of the underlying asset. Take note of the harmonic ABCD.

The ABCD demonstrates a breakout structure from the stock’s primary macro trend. An ABCD harmonic cresting either at or breaking beyond major resistance typically indicates the potential for change in trend or direction. Although the overall security remains controlled by bullish accumulation, visa bulls may begin to sit sidelined waiting for a more defined consolidation structure.

There is also room for down trending to occur back to the previous macro support within the wedge. Similarly, a pullback to the broken beyond resistance line now became support, displays significant area for the stock to decline before a more attractive entry becomes available. Long-term investors who have taken a long approach should consider reducing on other lagging securities while similarly waiting for an activity of greater confirmation. Keep in mind, that a short-term devaluation in the overall underlying asset does not necessarily signify a reversal of control from bulls to bears.

Wedge Pattern On EURJPY FormedA wedge pattern has formed on the 1hr chart for the EURJPY. Price is likely to break to the upside, but look for a break in either direction. Upside targets are around 119.80 for first targets and 120.40 for second target. Wait for a pullback if breaking to the upside but if breaking to the downside there most likely won't be a pullback considering theres no support after the break so entry would be as soon as it breaks. Strong red candle would be an ideal break to the downside and best entry as soon as it closes.

#LTC will soon try to test 0.0122Currently just breaking the wedge and within what I think is an accumulation phase it seems that the next move that #LTC will do is test the monthly level of 0.0122 satoshis. This will be a nice trade if you are able to get aboard just now and hopefully the move will get there, it could also be even greater as it could try to get to the 0.01614 satoshis level which is a great sign looking to recover the previously trend that was created before April 15th. In the opposite direction the failure to test it and gain the 0.0122 level or a rejection to it will probably make it downwards and loose the 0.0097 satoshis level and head very abruptly towards the 0.0075 satoshis level which will be a very big loss for the bulls.

Final push up for the EUR against the POUND?Since I am currently in a long trade for a final push up I will not be getting involved but we have a nice double bottom on the 4H and 1H, now at a Risk reward of 3.56

Good luck, if correct im expecting price to test the previous 4h highs and then start to see a reversal in the trend and become bearish.

Daily shows bearish divergence and an asceding channel, quite a strong combination on the daily TF.

Good luck guys.

My final target for this is

0.90382

Potential trade setup: GBP/AUD analysisOn a technical perspective, price is clearly indicating that GBP could potentially reverse versus the Australian currency, price is respecting the weekly region of 1.7700 with previous daily closing above it, today's daily close could add further confirmation if the candle closes as a spinning top/Doji. technicals are pointing out to price possibly extending to the 4HR resistance region as a lower high if the price breaks the counter trendline we could expect for price to revisit the psychological area of 1.81000. Fundamentals ahead could be the catalyst needed for the price to move in our favoured direction, with Australian job reports expected to fall, and an improved consensus on retail sales for GBP could strengthen the sterling. As part of risk management, SL will be moved to breakeven just in case we do conceive adverse economic data.

Great risk-reward trade.