Tesla: Second expansion phase. Upside potential $1,200 - $1,270.We are looking more deeply into Tesla's technical potential after its very aggressive (and continuous) rise since October. We were among the first to enter this rise early at 205.50 posting that trade back in May 2019:

Needless to say we didn't expect it to rise that strongly on such a short period of time. This is a parabolic move on the 1W chart which turned even this very long term time frame overbought (RSI = 89.001, ADX = 75.689, MACD = 75.910).

In our attempt to find pointers and a comparision framework to move into projections of the future price movement we went back to 2013 during TSLA's first expansion phase. See how similar the two parabolic sequences are. Both were preceded by 850 - 900 days of accumulation with a clear Resistance level (illustrated by the orange zone) and when this level broke, the parabolic rise started.

Based on the above comparison, if the principles stay the same on the current parabola (so far the same parameters are followed), we see no reason why Tesla can't repeat and complete a full +630% rise. Our Target Zone is 1,200 - 1,270.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

Techstocks

Netflix: Update on our long term Buy.This is an update on our NFLX buy position since we posted the following trade in September 2019 when the price was trading on the $250-260 bottom:

We have called for a long term Target of $650 but in the mean-time told more medium term investors to start booking profits near the 385 - 415 Resistance. If you took that trade with us you should be almost +50% in profit. With 1D on a steady Channel Up (RSI = 62.074, MACD = 6.790, Highs/Lows = 8.4729), we think it is a good time to update this position and look at the more short term price action. That resembles the previous time Netflix reached 385. A Golden Cross comes as confirmation. If you are a short term investors book profits within 378.00 - 385.00.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

Facebook: Higher High on 1W. Potential pull back.Facebook has been trading within a 1W Channel Up (RSI = 69.832, MACD = 8.020, ADX = 41.061, Highs/Lows = 15.2786) since early February 2019. Right now the price is only a fraction below the pattern's Higher High trend line which is typically an early bearish signal.

On top of that both the MACD and RSI indicators on the 1D chart have reached their respective multi month Resistance Zones. This is an additional sell signal. As FB has been trading within a narrower 1D Channel Up since the October Low, our short term Sell Target can't be below the Higher Low trend line (dashed line). Since the former July ATH at 208.50 matches perfectly on the trend line, we will take that as TP (target/ take profit). Notice how well the 1D MA50 comes for support near that level.

It can be argued that the 1W Channel Up has a gap to fill much lower for a Higher Low, but it is too early to discuss that. If the MA50 breaks, then the MA200 may come for support and accumulate buyers without reaching the Higher Low trend line. And since Facebook is on a long term uptrend it is best to buy such pull backs (when/ if they come) and not sell.

~~~ Our previous long term call on Facebook issued last September with the 220 target hit:

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

Tesla: Attention, entering a Sell Zone.We've been bullish on TSLA since May 21st and the 180 bottom right when most were calling on a death spiral. As you see on the chart below both 360 and 380 Targets have been hit, making us over +100% return on the stock in a few months:

Right now however we are getting some medium term sell signals on the 1W chart that makes us call for caution. First of all the 1W RSI has been on Lower Highs since 2013, thus on a bearish divergence to the actual price action.

On a second note, the actual price is near the Higher High trend line of the wide Channel Up that started in late 2013 with 1W near overbought territory (RSI = 73.073, MACD = 29.460, ADX = 55.095, Highs/Lows = 76.5621). If the price is rejected within the red Triangle then we may get a pull back towards the 1W MA200 at 300.00, where we will be waiting with strong buys again. If on the other hand the Higher High trend-line breaks to the upside we expect a peak at 480.00 (before a new trend emerges), which will complete a roughly +175% rise as Tesla did on its last Higher Low - Higher High sequence.

Trade these levels wisely, it is not necessary to hold.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

QQQ bulls running the showTICKER: $QQQ

Just like SPY, QQQ also confirmed its daily cup and handle pattern. Bulls in full control at the ALL TIME HIGH.

Weekly RSI is at 70, the highest since the top of the V shape bounce of April 2019.

"The trend is your friend" they say and its true, don't doubt the bulls.

Anything above $203.44 on the daily time frame is a high lower.

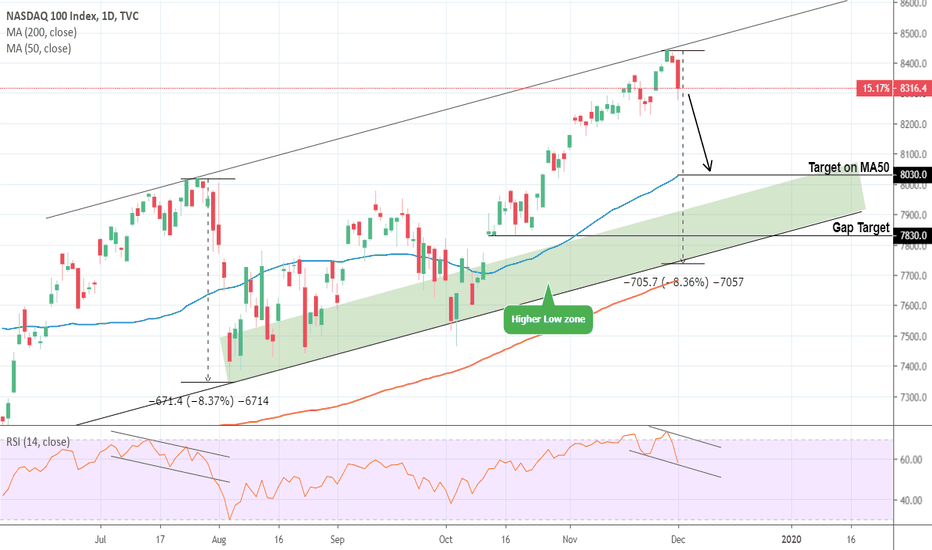

Nasdaq: Sell opportunity towards the 1D MA50.NDX has been trading within a Channel Up since July (1W RSi = 64.749, MACD = 236.300, Highs/Lows = 208.4773). Last week that pattern touched the Higher High trend line giving the first Sell Signal. The 1D RSI is on a bearish divergence similar to the late July Higher High.

Technically the index must touch at least the 1D MA50 before it resumes the bullish trend, so 8,030 is a moderate Target. Traders who can tolerate more risk may extend all the way to the Higher Low zone (green) and the 7,830 Gap Target.

See our recent successful trades on Nasdaq using this Channel:

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

Apple stock continues to rally, $295 is the target! 100% in 2019Over the last 14-weeks, Apple stock has had 2 red weeks, and they've been almost negligible. The stock is up nearly 80% this year alone!! We can see the stock gain 100% by the end of the year if this continues, especially around the holiday season. Since Apple is on all-time highs, the only instrument to help us with the potential upside target is the Fib extension, we've used two different levels to identify levels at which Apple may get attracted to and/or stall.

The first target level is $275 based on the Fib extension from the impulse that brought price up to this high.

The second target is $295 based on the Fib extension from the move that managed to drop price heavily in December 2018.

Where could a trader get in? The logical level is where the last slight pullback happened and the broken high at $240-$250 however that is pretty far from the current price, if the equity market does see a pullback then Apple may be more prone to retrace.

Disclaimer: This trade idea is for educational purposes exclusively, this does not constitute investment or trading advice. TRADEPRO Academy is not responsible for any market activity.

Amazon stock back up to $1950-$2000.Amazon stock has been on the rise for the past few days on strong volume through some key resistance points, one being the year to date POC. The upside structure is starting to build up as well, as the low that caused the move higher was higher than the previous drop. The volume on the recent pop shows promise to the upside. There is a resistance point that is coming up which may spell trouble for the stock.

The resistance between $1845 and $1865 is based on a previous peak high and the 100% Fib extension on the current move. This level could push price down again into the $1770 support however if it breaks the upside is going to open.

Tech has gone up nearly 50% this year alone and Amazon is a lagger, the retail spike during the holiday season will have some effect on the upside of the stock as well.

Disclaimer: The following idea is for educational purposes. TRADEPRO Academy is not held liable for any actions taken in the market as a result of this idea. This idea does not constitute investment or trading advice.

NQ1! Nasdaq Clear Path Up 100+ Pts to 8400 ???After today's move down, it might be said this is the beginning of a larger, SHORT, run down...typical to think and may be true! However, based on the price (not wave) cycles I've seen over the years, there is still room to move up to 8400 (and higher) and that is my bias for this trade. Today's action just made it easier to make that move upwards after clearing out some LONG players.

I'm personally looking for an entry within the RED BUY zone.

1st Target, 50% of way through the range, 8330

2nd Target, Double Top at 8380

3rd Target, 8400.

A break below today's LO would have my rethinking this scenario.

Alibaba: Potential rise to the 2019 High.Alibaba is trading inside a very standard 1W Channel Up since June (RSI = 52.639, MACD = 1.760, Highs/Lows = 0.0000) with the Low to High legs symmetrical at +21%. If the current leg is completed on equal strength then the peak (+21%) will reach 195.50 which is the 2019 High. So if the Higher High trend line of the Channel Up breaks, be ready to extend your long positions to 195.50.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

Ebay: Long term Buy Signal.Ebay is coming off a strong rebound last week on the 1D MA200. 1D is again gradually turning bullish (RSI = 50.474, ADX = 33.642, Highs/Lows = 0.3699, CCI = 102.4213) as it approaches the 1D MA50.

What is more interesting is that last time Ebay touched the 1D MA200 after a Golden Cross formation (took place last March) was in 2016/ 2017. The rebound was extended then to a new Higher High. Based on that we have turned bullish again on Ebay targeting 43.00.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

Amazon: Signs of a Dot Com Bubble burst.This study is intended to point out some very obvious similarities of Amazon's current trading action with that of the stock's Dot Com crisis period.

Our sole purpose is not to spread panic to a stock market that is currently strong and trading on All Time High territory but to keep investors on their toes and make potential buyers check and double check by looking on all possible angles before investing on AMZN.

Even though the price action now and then share many common features, it is of course common sense that it takes more than just similar candle action to justify such a bubble burst like the Dot Com collapse and that comes on a certain fundamental framework of a very negative series of events that shake a part of the economy as a whole (even a recession). Some can argue that the U.S. - China trade war is such an event and they do have a valid point. But it is too early to tell.

Can this be an end of an era for Amazon? Hard (and as said early) to tell, but it certainly provides a certain structure that investors may follow in order to limit the risk of such a potential price blast. In our opinion it is safer to either buy AMZN once the All Time High breaks or if by any extremely negative turn of events approach 1,300 again.

Use this information at your own discretion but certainly be very skeptical of this tech giant.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

Apple: Testing All Time Highs. Next Target $300-$350.AAPL is a step closer this week to its $233.47 All Time High. The market is skeptical, investors proceed with caution on this Resistance especially since the 1W RSI is just above the 70.000 barrier, but should they?

History shows that every time the 1W (weekly) RSI of Apple Inc breaks 70.000 after after a specific sequence and following a Higher Low on the long term Channel Up that started in 2012, it moves on to new highs, specifically chasing to price a new Higher High within the Channel.

It is astonishing how the date range (time interval) of each of those times (when the RSI hit 70.000 after a Higher Low) is exactly 987 days. Assuming the lowest % increase out of the past 2 occurrences takes place (i.e. +145%), we have a Target Zone for Apple at $300 - $350.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

$RESN Chance To Break Previous Highs?Volume is up over the last 45 days compared to 45 day period prior. The penny stock's news didn't hurt but what will help it go that extra distance

"Resonant Inc ( RESN ) enjoyed impressive gains on Wednesday. This came after it announced the agreement of an important deal. Resonant is involved in changing the ways in which radiofrequency front ends are designed. Yesterday, it announced that it had reached an agreement with radiofrequency and module provider Murata Manufacturing Co." *

About RESN

Resonant Inc is a late stage development company. It is developing software, intellectual property and a services platform to increase designer efficiency, reduce time to market and lower unit cost in the design of filters for radio frequency front ends for mobile device industry.

SOURCE: Are Penny Stocks Worth It? 3 Up Big In October

Netflix: Ideal long term Buy opportunity. Potential Target $650.Netflix has been under heavy selling pressure since July on the 1W chart (RSI = 31.642, MACD = -16.980, Highs/Lows = -48.8636) and is approaching the 231.23 December 2018 low. This is an ideal buy opportunity as the Demand Zone is set within 236.11 (Feb 2018 low) and 220 (expected contact with the 1W MA200 (orange line)).

Furthermore, what makes the current levels even more appealing is the fact that since 2015 a Double Bottom formation on the Demand Zone always initiated the next strong rally with the 1W MA200 supporting. Even in 2012 when then Double Bottom marginally broke, the Demand Zone held and delivered a rally of nearly +800%.

We are therefore long on NFLX and assuming the modest scenario of the 2015 rally is replicated, a +179% rise can push the price to $650.00. You are of course free to choose your own target zone with 385 - 415 Resistance Zone also an appealing option for short term investors.

*Note: the log chart was used on this study in order to best display the long term patterns.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

NASDAQ - Selling a re-test of the broken channelTrade Idea

Broken out of the channel formation to the downside.

Bespoke resistance is located at 7872.

We have a 50% Fibonacci pullback level of 7878 from 7776 to 7980.

We look for a re-test of the upward trending resistance.

Expect trading to remain mixed and volatile.

We look to Sell at 7870

Stop: 7910

Target 1: 7760

Target 2: 7636

Nasdaq: MA50 break-out aims at 8,300.Nasdaq has just crossed above the 1D MA50 on a very bullish technical outlook (RSI = 58.618, MACD = 2.240, Highs/Lows = 131.2143). The index is repeating the 2018 bull trend with the Highs and Lows price drops almost identical. As a result we have calculated the next High to be at 8,300 and this is our medium term target.

Note that this comparison has been very reliable and helped us catch both the previous High and Low of the pattern:

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

Facebook: Long term Buy Opportunity. Two levels to watch.Facebook has been trading within a long term 1W Channel Up (RSI = 53.674, MACD = 5.760, Highs/Lows = 0.0000) having only recently made its Higher Low. Technically there can be room for one more minor pull back near the previous Low as the current candle sequence resembles that of February 2019. If however the 1D MA50 breaks (blue line) the pull back bias are invalidated and the 1W Channel Up can continue rising towards a new Higher High. Our Target is 220.00.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

Are We Nearing The End of An Era? (Amazon & Netflix)In the last year or so, any time I've said to certain people that I thought Amazon, Apple, and other tech giants were in a bubble, they thought I was crazy. But now...I've noticed people are starting to worry. The chart looks scary. If the double-top is confirmed, and these guys break down below their December 2018 lows, we could easily see our first widespread stock market panic since 2008. Growth has stagnated, yet the job market is flourishing. Friends of mine are making six-figures right off the bat at tech companies I've never heard of, acting as glorified secretaries. Things don't add up. Where does this money come from?

Back in December, I wrote a few pieces on why I thought big tech was going to slow down. My primary feeling is that things have changed too rapidly in our every day lives for us to both biologically and psychologically cope with all this innovation. I think people are pretty satisfied with the current level of technological innovation, but they're dissatisfied in other areas (income, family, relationships, etc.). Opioid abuse is on the rise. Why do you think that is? People are lost. When everyone starts to give up and look for other routes for fulfillment, there is a point at which people will refuse to pay higher prices for things that give minimal reward. That's not to say that I don't think there will be more innovation. I just don't really see us adapting quickly to this growth. I believe things really need to slow down. When people stop desiring the newest and best thing enough to pay for it, these companies stop making money. Guess what? The growth has been so unsustainable that they cannot afford to stop making money, even for a little while. It's totally ridiculous. The proof of this is the panicky response of the FED to any sort of potential stock market worry. They're like my 11-month old kitten.

Articles keep popping up about how it's not time to panic "yet." The problem with these soothsaying excuses for journalism is that it will be too late. Even the media can't afford to lose money. No one wants a crash, because it would be devastating. But that's life! You can deny the hardships of existence all you want, but eventually things will turn bad. But hopefully, if things turn bad, they won't stay that way. Another pet peeve of mine is seeing two articles from Barron's within the SAME day: "Stocks Surge Because The Trade War May Not Be That Bad" and "Stocks Plunge Because The Trade War Is Far Worse Than We Imagined." Get it together! The trade war is not the primary cause of economic uncertainty. It's our own greed and our pathetic debt-fueled economy.

People are already starting to heavily weigh the risk/reward of staying in certain equities. People are even getting out of more speculative markets like marijuana and smaller crypto projects because they're reducing risk exposure. Yeah, maybe stocks have a liiiiitle bit of upside. But the downside? Anyone with a brain can look at the two above charts and see that there is a lot of room to fall. These are shown in linear scale to emphasize the parabolic nature of the growth we've experienced in the last decade. I picked Amazon and Netflix, because I see their business models as particularly fragile. Too big to fall? Just look at these charts. There is hardly technical support after the December lows are breached until roughly 50% down from that point. What does that tell you about the nature of the growth?

I could make an attempt to go into the real economic factors that would drive a 60-95% decline for many tech companies, but there are much more seasoned economists/analysis out there. I'm simply a guy who likes reading charts, sentiment, and particularly the psychology behind denial and delusion. Everyone's guilty of these things, including myself. That's the only way to understand it.

In my opinion:

Likelihood of sustained upside from here is less than 20%

Likelihood of extended bear market (negative 60-90 percent returns) from here is around 60% . This could even extend into the latter half of the 2020's, marking the next decade with poverty and upheaval, but hopefully resulting in some positive change.

Likelihood of a medium sized drop and then long consolidation I think is around 20%. That's only if regulatory and financial authorities figure out a solution.

If we really start to see breakdowns, I'll probably post some more short setups for some stocks, just for fun.

Netflix Bearish Targets:

230-245

130

82

46 (roughly 90% down from peak)

Amazon Bearish Targets:

1320

693

288-300 (possible bear market bottom) - Roughly 85% decline from peak.

As you can see, the potential deepest retraces for these equities are perfectly in line with previous bubble pops. We may not ever get down there, but there is substantial risk for it to happen. As for where all that money will go? Already some of it is fleeing towards precious metals and a little bit of Bitcoin. Buying property with cash is probably something people are doing as well. It'll be really interesting to see what happens.

It would be silly of me not to mention potential upside, by the way. I said I thought it was unlikely at this point (particularly due to the inability of the Dow Jones to sustain a new high above 27000), but it's perfectly possible if a magical stimulus is introduced that pumps the market with more fake money. Based on the potential double-top in the Amazon and Netflix charts above , it seems that people are no longer falling for these shenanigans, but you never know. Microsoft, for example, has blown past the potential double-top target from earlier this year (chart linked at bottom). MSFT is an outlier though. I posted a fractal analysis on the DJI a while ago. The in-depth analysis below shows that there could be more upside before the fractal potential completes, sending us into a downward spiral of uncertain depths. In this chart, you can see that the "mania" phase might have been short-lived compared with 1929. At least that would mean downside may not be as severe as the Great Depression.

This is basically me ranting my opinion. No one should take this as financial advice. These are purely my thoughts on the current situation. Thanks for your support!

-Victor Cobra

Entered my first marked "Buy Zone"NASDAQ:DOCU DocuSign entered my first area marked as a "Buy Zone", and where I had set a limit order. I now own some shares at 44.01, and have set my next limit buy in my second Buy Zone at 36.31. Depending on price action, I will either wait to buy there or add more in this area. Between 40 and 37 is my "No Man's Land" where I would be in limbo. This is a buy based almost solely on growth prospects, as I see the Fintech sector as being a strong leader in the future. One day your grandkids grandkids will have a dollar bill framed on the wall explaining to their kids how people used to have to carry around these dirty pieces of paper everywhere and hand them to other people. (Which they will be thoroughly repulsed by) DOCU is not a fintech company; however it stands to benefit greatly by the rise of fintech through the quick, convenient e-signature that will soon be a staple of all credit agencies/banks wordlwide. There are others inthe same line, but I am placing my bet on this recent IPO to be in its earliest stages of growth. Though the street hated last quarters earnings, the growth shown was staggering nonetheless. I like the company, I love the sector and all the various opportunities it presents. Happy hunting and GLTA!

NASDAQ - Engulfing on 4H chart, more downsidside expected.Trade Idea

Broken out of the channel formation to the downside.

A mild correction has been posted from yesterday’s low, this is seen as a retest of the breakout level.

The bearish engulfing candle on the 4 hour chart is negative for sentiment.

Negative overnight flows lead to an expectation of a weaker open this morning.

Further downside is expected although we prefer to set shorts at our bespoke resistance levels at 7500, resulting in improved risk/reward.

Stop: 7570

Target 1: 7160

Target 2: 7000

[DMF] Hmm, that last study on PS ended weirdly... Let's dig in!Hey Traders!

In the last video we were analyzing DMF's performance against PluralSight (NASDAQ:PS) from 7/21-7/31/2019. Near the end of the video, I noticed that the study period ended with an open short position and I thought it'd be fun to do a quick peek at how it would have performed.

DMF issued a short signal just before the end of the trading session on 7/31 which led to a substantial return. In fact, that one trade exceeded the profit of the entire study period in the last video! But of course an individual call is not a great representation of the strategy, so I expanded the time range to show how it would have played out with a broader view of price movement patterns on either side of that two-day study.

Happy trading!

Links:

Directional Momentum Flux Strategy

DMF vs PluralSight (NASDAQ:PS) - A Two Week Performance StudyHey Traders!

Today we're looking at how the Directional Momentum Flux (DMF) strategy performed against PluralSight (NASDAQ:PS) during a study period consisting of the last 8 trading days of July, 2019. Overall, PS was rather subdued during the period (7/21 to 7/31/2019), but DMF was able to identify many momentum inflection points and generate a 13.66% return. Check out the video and join the discussion below!

Happy trading!

Links:

Directional Momentum Flux Strategy