The japan titans & worldwide investors have made up their mindAnother idea on the yen which is waking up from its slumber of uncertainty, its 3 years slumber 😴. Which allows me to activate my crystal ball & predict the future.

Hey I even threw an indicator in here, some nobs like them, it pops out but maybe not everyone sees it, the yen is breaking with conviction for the first time since December 2016.

If you don't get what this means just keep reading.

Back in 2016 the stock market was stagnating, George Soros kept shorting it, many funds were shorting it, the JPY had a major decline after a choppy uptrend then some sideways, and after the big very visually noticeable Yen decline, the US stock market had this big big rally for all of 2017 that Trump kept throwing at everyone.

This should clarify things, if it doesn't well contact me to get roasted for free 😀:

If you zoom in in 2016 you even get the same shadow from all the useless parasites stat-arbing this

BoJ next meeting 18 or 19 March, rate going to stay the same for sure, continuing to boost the economy, really boosting the Wall Street hedge fund industry economy.

As a conclusion, perma-bears are going to get laughed at again on CNBC Squawk Alley and other intelligent programs.

Poor Peter Schiff. Nouriel Roubini the great nobel prize is recommending to short since 700 points LOL it's going to 5k soon.

The boy that cried wolf is coming soon, no one is going to listen to any warnings, they must be sick of uncertainty & fear and more convinced than ever.

Stockmarkets

Why Most Traders Lose Money — Here Are The Top 3 ReasonsI’m Markus Heitkoetter and I’ve been an active trader for over 20 years.

I often see people who start trading and expect their accounts to explode, based on promises and hype they see in ads and e-mails.

They start trading and realize it doesn’t work this way.

The purpose of these articles is to show you the trading strategies and tools that I personally use to trade my own account so that you can grow your own account systematically.

Real money…real trades.

Anyone that has been around the markets and trading for any period of time has probably heard that most traders lose money.

In fact, there’s actually an old trading adage that says:

90% of new traders will lose 90% of their account within 90 days.

So after reading that, before you reach for your broker’s phone number to wire out all of your money… how about I let you in on a little secret:

If you follow some simple rules and avoid these 3 mistakes, you can be in that minority of traders that actually make money consistently in the markets.

And if you are currently making one or all of the mistakes, I’ll also show you exactly how to fix it.

So let’s dive in!

1) Most Traders Enter A Trade Too Late

The first thing on my top 3 reasons why traders lose money is: Most traders get into trades WAY too late!

There are a lot of reasons this happens, but most commonly it’s because new traders are basically gambling.

They’re buying stocks or options based on news, or a hot stock tip, which really isn’t what I would consider a strategy.

So let me give you a great example with a company I’m sure you’ve heard of: Uber Technologies (Yes, enemy #1 for taxi drivers worldwide.)

Last year UBER , known for its popular ride-sharing and food delivery services, IPO’d in May (2019).

With the disruption this company caused, their IPO had a lot of hype surrounding it, bringing a lot of investors to the table.

On the day of their IPO, UBER opened at $42/share and people poured into the stock.

For a few weeks, the stock had a turbulent, roller coaster of a ride all the way to as high as $47.08/share, a little over a 13% increase since its IPO.

And around this new high, more and more inexperienced retail traders piled in thinking that it would continue its bullish run with dollar signs in their eyes.

The mainstream media was continuing to hype it and more and more and investors and traders gobbled up more of the stock.

Looking at the image below, you’ll see after that high of $47 things got UGLY fast, with UBER falling day-after-day, week-after-week.

It wasn’t until November of 2019, about 7 months after their IPO that UBER found a temporary bottom at $25.58, down more than 45% from its high of $47.08… and I would bet there were a LOT of people who bought near or at the highs and were still holding at that point.

So what did retailer traders do when UBER made a bottom?

Yes, once again most (losing) retail traders didn’t get in at, or even around the bottom… once again, they piled as UBER neared its previous highs.

And as you’ll see yet again, UBER rolled over on its way to making another new all-time low this past March 2020 going all the way down to $13.71/share.

That’s more than a 70% decrease from its ATH and yes, I’m sure some investors rode it all the way to the bottom.

Now I want to share a second example with you, so let’s take a look at Amazon AMZN .

So as you know, AMZN is a HOT STOCK and last year it has a crazy move where it crossed $2000/share…. and yes, just like our example with UBER , inexperienced retail traders piled in at the very top.

Once again, in the weeks that followed, AMZN’s stock tanked leaving those who’d piled in dazed and confused, now holding onto sizable losses.

So as you can see, the first of my top 3 reasons most traders are losing money is simply because they’re piling in way too late in a stock’s move, generally near a high.

Now on to reason number 2:

2) Most Traders EXIT Too Late

Yes, as you can imagine if people are getting in too late, well, they’re also typically getting out too late as well.

So let’s talk about why this happens.

Why do retail traders tend to hold onto trades way too long, either turning a small loss into a BIG loss or sometimes even more painful, turning a winner into a loser?

Let’s take a look at another example with an UBER competitor, LYFT .

Like UBER, LYFT also had its IPO in 2019, opening up at $87.24/share… but that didn’t last long.

In less than two months, LYFT went as low as $47.17… and what do you think those who bought during the IPO are saying right about now:

“Oh, I’m holding it because IT WILL TURN AROUND!”

This is generally where I see traders get religious

Instead of ‘taking their medicine’ and getting out when the trade moved against them, they held on and are now pleading and praying the stock will turn around.

I hate to be the one to break it to you, but ‘hope’ is not a strategy… at least not one with a winning trading record.

Now on to number three in our list of top reasons why most traders lose money:

3) They Don’t Have A Trading Strategy

As you’ll see, I’ve saved the best for last as this one alone can help fix or eliminate the other two we just discussed.

So first, let’s answer this question: What Is A Trading Strategy?

Well, a trading strategy gives you three key pieces of information you need before ever entering a trade:

1) It tells you WHAT you are trading. Is it stocks, options, futures, cryptocurrencies? This is answered in your trading strategy.

2) It answers when you ENTER a trade.

3) It answers when you EXIT a trade and that’s exiting with a profit or loss.

Now, let’s take a look at an example here using TSLA on how I make trading decisions.

I like to look at three different indicators, that when in alignment, give me a clear signal to go long or short a stock or ETF.

As you can see on the charts, back in December of last year (2019) my indicators gave us a long signal on TSLA at around $370/share.

And the indicators told me we were good to go until around $850/share.

All I had to do is let the indicators tell me when to get in and when to get out… no guessing, hoping or praying.

Summary

So as you can see, there’s actually no big secret to why most traders are losing money.

It’s actually pretty simple to see and correct, but it takes a plan and a little bit of discipline.

If you’re brand new and not sure where to get started, I’ve written The PowerX Strategy, a book that outlines my EXACT trading strategy for trading stocks and options.

$50 MILLION REGISTERED DIRECT OFFERING case study$VISL ANNOUNCES $50 MILLION REGISTERED DIRECT OFFERING PRICED AT-THE-MARKET UNDER NASDAQ RULES

$VISL today announced that it has entered into a definitive agreement with institutional investors for the purchase and sale of 18,181,820 shares of its common stock and common stock warrants to purchase up to 9,090,910 shares of common stock at a combined purchase price of $2.75 per share in a registered direct offering.

The common stock warrants will be immediately exercisable, have an exercise price of $3.25 per share and will expire five years from the date of issuance.

The closing of the offering is expected to occur on or about February 8, 2021, subject to the satisfaction of customary closing conditions.

finance.yahoo.com

ANNOUNCES CLOSING OF $50 MILLION REGISTERED DIRECT OFFERING PRICED AT-THE-MARKET UNDER NASDAQ RULES

finance.yahoo.com

What we can learn from the registered direct offerings?

Roku review for February. Lets see what March will bring. Hello traders

A lot of my ideas of late have been Forex based so time to show how one stock I followed performed for me in February.

The stock in question is Roku and I'm working the one hour time frame here.

Only two trades last month a long and short. Both trades were a 1:4 risk to reward ratio.

Once the trade has played out I simply wait for the next signal alert and go again if any present this month.

The purpose of this idea is to show the adaptability of our strategy on different instruments.

As with all my ideas back tested data can be found at the foot of this header.

Back test data is based on 10 contracts per trade with a £1000 starting capital. The back test data is from Jan 2019 to now.

Quick overview of the strategy in use.

The strategy is a trend based strategy.

The inner workings of the strategy are 5 individual strategies rolled into one . Trades are only valid when all 5 confluences line up.

At this point the trade presents on the chart. Alerts can be set and the the strategy can also be automated.

No excess time spent at the charts

Adaptable strategy to suit your trading style.

Works on any instrument and time frame.

Want too know more?

Sure drop me a message and feel free to ask any questions.

How I’ve Improved Productivity in My Trading DayI’ve been trading for a long time, and over the years, I’ve learned different ways to make the most of my time.

Today, I want to talk about three ways I boost productivity in my trading day:

- Using my PowerX Optimizer to quickly scan for long and short trading ideas.

- Using my Wheel Income Calculator to find attractive premium collecting ideas.

- Having a trading plan and following that plan.

In this article, I’m going to break down each one of these and explain what they are.

I’ll also explain how they help me streamline my trading. This gives me more time to focus on other things I’m interested in, like my business and real estate.

3 Pillars To Trading

I always say there are three pillars to trading:

- You need to have a trading strategy.

- You need to have the right tools.

- You need to have the right mindset.

For me, I trade two strategies: PowerX and the Options Wheel.

And I developed my own software tools to help me trade these strategies quickly and efficiently.

The PowerX Optimizer software shows me what I should trade, when I should enter, when I should exit based on my preferred criteria, and my Wheel Income Calculator tells me which option strike has the best risk/reward.

If trading software doesn’t show me this, it’s not allowing me to make the best use of my time.

Let’s take a closer look at these software programs, starting with the PowerX Optimizer.

PowerX Optimizer

With my PowerX strategy, I’m looking to buy calls on stocks trending higher or buy puts on stocks trending lower.

The PowerX Optimizer is a software I programmed for myself, my head coach Mark, and my son.

A few years ago, we made it available to everyone.

This software answers the three questions I’m looking to have answered when I’m looking for stocks

- What to trade.

- When to enter.

- When to exit.

The PowerX Optimizer will answer all three of these questions for you.

Now, I had the software programmed for myself because I wanted all my criteria in one place.

With the PowerX Optimizer, I can scan for my basic criteria that I set within the software.

For instance, I want to see a 60% return on investment over the past year, I also want to see stocks that are between $5 and $200, and I want a profit factor higher than 3 and a risk/reward higher than 2.

This is the criteria I use for trading this strategy. Your criteria may be different.

The scanner finds the best stocks and options for me based on my criteria.

I certainly don’t want to just stumble across a stock or trade everyone on TV is talking about.

Worst case scenario, if nothing meets my criteria, I simply move on.

Every day this scanner produces a list of stocks that I potentially want to trade — in less time than it takes to make a cup of coffee! Talk about a time saver!

In the beginning, I would just use charting software like TradingView, and I would go through a bunch of stocks every day to see if they met my criteria.

It got to the point where I figured there had to be an easier way, which is why I had the PowerX Optimizer developed

Instead of spending hours and hours sifting through charts and doing the math, I’m able to find a handful of stocks to look through every day in just minutes.

This frees up my time to focus on other things.

The Options Wheel Calculator

With my Options Wheel strategy, the idea is to “get paid to wait until you buy the stock.”

So I’m looking to sell a put and collect premium, and I want to pick a strike that coincides with the level I would feel comfortable buying the stock.

Ultimately, I want to get assigned, and then I’ll look to potentially sell covered calls on the stock.

The tool I use to identify stocks and options I want to trade with this strategy is the Wheel Income Calculator.

The Wheel Calculator pulls up stocks and tells me the minimum option premium I need to collect to make this trade work for me, and the risk/reward setup for each strike.

I have set aside $500,000 in buying power for this strategy.

That’s what works for me. It does work with smaller accounts if that’s what you have to work with.

That’s why I love these tools. They have made my life so much easier.

I’m not just picking a trade based on a gut feeling.

Instead, I’m trading with a systematic approach that’s based on data.

Remember, I like to trade for SCR Profits.

SRC stands for Systematic, Repeatable, and Consistent.

Trading Plan

And that leads me to the last thing I want to talk about today: having a trading plan.

You see, having a trading plan is key to having the right mindset to trade.

There are three key parts of a trading plan that I’ve already mentioned, but again, they are:

- What you’re going to trade?

- When you’re going to enter?

- When you’re going to exit — both for a profit and a loss.

This is also where those limit and stop-loss orders I mentioned earlier come in handy.

Limit orders allow you to tell your broker the price you want to get filled, and if you get that price, you move on.

Same with stop-loss orders. You tell your broker what point you want to get out of the trade, and if the stock hits that level, you’re out.

This allows you to not be tied to your computer, watching every tick the stock makes and opens up your day to allow you to focus on other things.

I cannot stress enough how important it is to be prepared when you’re trading — and to have a plan before you enter a position.

So, as you can see, by defining my strategies, I developed tools like the PowerX Optimizer and Wheel Income Calculator to help me find trades quickly and efficiently that work with my rules and my plan.

I hoped this helped and I’ll see you at the next one.

$DYNT Announces Extension of Key Distribution AgreementDynatronics Corporation Announces Extension of Key Distribution Agreement

Bird & Cronin Renews Group Purchasing Agreement with Intalere for Orthopedic Soft Goods and Bracing

Dynatronics announced today that its wholly-owned subsidiary, Bird & Cronin, LLC, renewed its purchasing agreement with Intalere, one of the leading national group purchasing organizations in the healthcare industry. The new agreement which extends the partnership through January 2024.

Intalere members will receive negotiated pricing on our full line of orthopedic bracing solutions for spine, upper and lower extremities including key products such as the Sprint® air walker boot and U2TM wrist brace. With more than 100,000 members from healthcare organizations all over the country, Intalere members make nearly $9 billion in purchases annually.

finance.yahoo.com

Apple shortThe breaking of the purple channel pushes the price down. The formation of a red channel is another sign of the strength of the sellers. The third sign is the increase in volume within the red resistance range.

in return

The center line of the green channel, which is orange, has usually been strong, and the Trend Magic line has sometimes been a good support line

The lower shadow of the one-hour candlestick was large when hitting the resistance of the red descending channel

These are also signs of the power of buyers.

But the power of buyers seems to be less than that of sellers because the signs of the body are weaker.

We can wait a little longer until everything is clear, but in this case we may lose a lot of profits!

Apple stock prices will probably go yellow. The range of $ 100 to $ 103 is good to buy, but people who want to take the risk to buy the stock cheaper and of course they may not be able to buy! They can wait until Apple shares hit the bottom of the green channel!

Also, if during the first 2 or 3 days of next week and the price manages to break the red downward channel upwards or the price manages to return completely to the purple channel, it is a good time to buy!

Personally, I find the yellow route more probable. But for more investments, I am waiting for the market to determine its path better and more!

Berkshire Grey Announces Business Combination with $RAAC spacBerkshire Grey, a Leader in AI-Enabled Robotics and Automation Solutions, Announces Business Combination with Revolution Acceleration Acquisition Corp

Combined company to have an estimated post-transaction equity value of up to $2.7 billion

Transaction expected to provide up to $413 million in cash proceeds, including a fully committed PIPE of $165 million anchored by Chamath Palihapitiya, Founder and CEO of Social Capital, Hedosophia and funds and accounts managed by BlackRock

Current Berkshire Grey shareholders Khosla Ventures, New Enterprise Associates, Canaan Partners and SoftBank Group Corp. rolling 100% of their equity in the combined company

Berkshire Grey expects to have $507 million cash, which will be used to fund operations and support new and existing growth initiatives, and no debt on its balance sheet following the combination.

The intellectual property supporting BG’s market-leading solutions is protected by more than 300 patent filings.

The intellectual property supporting BG’s market-leading solutions is protected by more than 300 patent filings.

Transaction is expected to close during the second quarter of 2021 and is subject to approval by RAAC’s stockholders and other customary closing conditions.

finance.yahoo.com

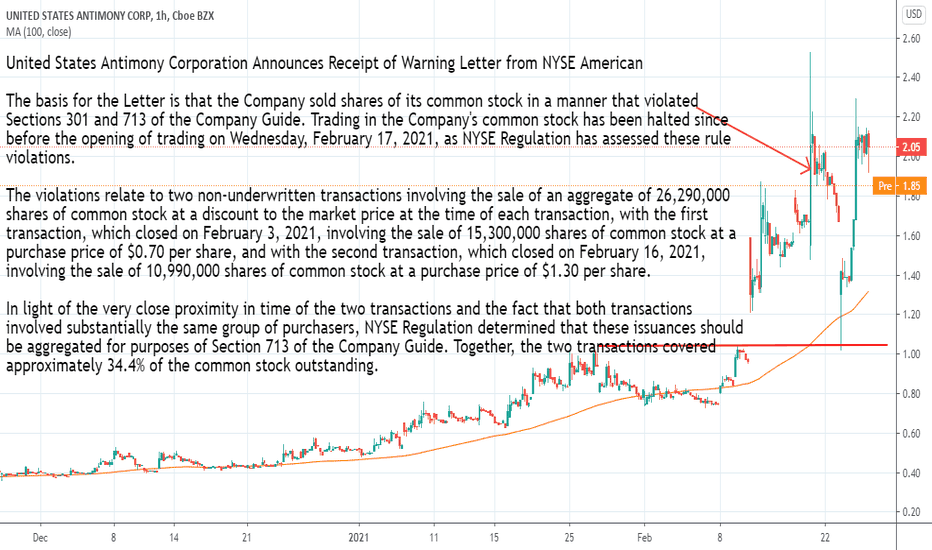

$UAMY Announces Receipt of Warning Letter from NYSE AmericanUnited States Antimony Corporation Announces Receipt of Warning Letter from NYSE American

The basis for the Letter is that the Company sold shares of its common stock in a manner that violated Sections 301 and 713 of the Company Guide. Trading in the Company's common stock has been halted since before the opening of trading on Wednesday, February 17, 2021, as NYSE Regulation has assessed these rule violations.

The violations relate to two non-underwritten transactions involving the sale of an aggregate of 26,290,000 shares of common stock at a discount to the market price at the time of each transaction, with the first transaction, which closed on February 3, 2021, involving the sale of 15,300,000 shares of common stock at a purchase price of $0.70 per share, and with the second transaction, which closed on February 16, 2021, involving the sale of 10,990,000 shares of common stock at a purchase price of $1.30 per share.

In light of the very close proximity in time of the two transactions and the fact that both transactions involved substantially the same group of purchasers, NYSE Regulation determined that these issuances should be aggregated for purposes of Section 713 of the Company Guide. Together, the two transactions covered approximately 34.4% of the common stock outstanding.

Section 301 of the Company Guide states that a listed company is not permitted to issue, or to authorize its transfer agent or registrar to issue or register, additional securities of a listed class until it has filed an application for the listing of such additional securities and received notification from the NYSE American that the securities have been approved for listing.

Section 713 of the Company Guide requires shareholder approval when additional shares to be issued in connection with a transaction involve the sale, issuance, or potential issuance of common stock (or securities convertible into common stock) equal to 20% or more of presently outstanding stock for less than the greater of book or market value of the stock.

As stated in the Letter, the Company failed to submit a completed listing application in advance of the February 16, 2021 transaction to obtain advance approval as required by Section 301 of the Company Guide and also did not obtain shareholder approval for the aggregate issuance of 26,290,000 shares that exceeded 20% of the common stock of the Company outstanding as required by Section 713 of the Company Guide. NYSE Regulation noted in the Letter that, after it became aware that the Company had entered into a purchase agreement in relation to the second transaction, NYSE Regulation informed representatives of the Company that it would be a violation of the applicable NYSE American rules for the Company to close the second transaction without first obtaining shareholder approval . Notwithstanding this clear guidance from NYSE Regulation, the Company went ahead with closing the transaction without notifying the Exchange.

The Company has been advised by NYSE Regulation that the Company's common stock will resume trading on the NYSE American following the issuance of this press release and the filing of a Current Report on Form 8-K disclosing the receipt of the Letter, which the Company anticipates will be prior to the open of trading on Friday, February 19, 2021.

finance.yahoo.com

KeyBanc Capital analyst Philip Gibbs raised rating- $10 target $TMST surged higher on very heavy volume, after KeyBanc Capital analyst Philip Gibbs said it's time to buy the steel maker's stock as the macro recovery is unfolding.

Gibbs raised his rating to overweight, after being at sector weight since July 2018, and set a $10 target for the stock, which is 19.8% above current levels. Gibbs said his new bullish view "post due diligence" reflects the macroeconomic recovery, better contract and spot pricing and widening raw material spreads, as well as "self-help," which includes cost cuts. The latest available data showed that short interest was 9.72% of the public float.

$RETO Stock surged on Two RumorsWhile the stock is running for the top, there has been nothing by way of press releases or SEC filings. So, what’s the deal?

- ReTo Eco-Solutions May Be an Olympic Provider. According to various social media posts, investors are awaiting an announcement surrounding involvement in the Olympic Games in Beijing. The rumor suggests that the company’s work with the 2022 Olympics in Beijing will be expanded, exciting investors.

- Merger With Apple Rumor. There’s another rumor hitting the tape too, and this one’s the big one. According to various social media posts, investors are awaiting the announcement of a merger. According to these rumors Apple is interested in merging with RETO.

- The Short Squeeze. the heavy short interest on the stock, combined with the ultra-tiny public float of under 15 million shares could lead to supply and demand related jumps in value. Ultimately, as the shorts race to cover their positions, demand for shares rockets, but with only under 15 million shares available to the public, the demand increase for RETO shares could lead to tremendous gains.

cnafinance.com

$CTXR Announces Closing of $76.5M Registered Direct OfferingCitius Pharmaceuticals Announces $76.5 Million Registered Direct Offering Priced At-the-Market under Nasdaq Rules.

today announced that it has entered into definitive agreements with certain healthcare-focused and institutional investors for the purchase of an aggregate of 50,830,566 shares of its common stock and accompanying warrants to purchase up to an aggregate of 25,415,283 shares of its common stock, at a purchase price of $1.505 per share and accompanying warrant in a registered direct offering priced at-the-market under Nasdaq rules.

The warrants have an exercise price of $1.70 per share, will be immediately exercisable, and will expire five years from the issue date.

finance.yahoo.com

Citius Pharmaceuticals Announces Closing of $76.5 Million Registered Direct Offering Priced At-the-Market under Nasdaq Rules

finance.yahoo.com

Shares of $VIOT surges due to hype in social mediaShares of $VIOT SURGES higher due to the uptick in discussions about this stock has been surging on social media platforms like Reddit, Twitter, StockTwits, Facebook, and Discord. In a StockTwits post, Insider-Analysis.com pointed out that 7 institutions increased their positions in the stock while 3 decreased as of this past quarter.

There is also a bullish report published about the company at Xueqiu.com. After translating the article to English, I read that Xueqiu believes that VIOT is expected to grow 10x this year due to its leadership position in appliances and Internet of Things devices.

VIOT was also listed on a number of day trading watch lists on Reddit. And VIOT was listed in the “Daily Movers” on the Robinhood trading platform — which also added to the momentum of this shares.

pulse2.com

$WATT Shares Skyrocket on Apple Battery RumorsEnergous Shares Skyrocket on Apple Battery Rumors

Energous jumps on news that Apple is working on a wireless charging attachment for the newest iPhones.

The battery pack would attach to the back of an iPhone 12 using the MagSafe system, which all the new iPhones use for charging and pairing other accessories such as cases and wallets.

Energous develops WattUp wireless power technology that consists of semiconductor chipsets, software controls, hardware designs, and antennas that enables radio frequency based wire-free charging for electronic devices.

Energous had said in a regulatory filing that its WattUp product will undergo compliance testing with Apple, according to CNA Finance, but there was no reference to a partnership.

www.thestreet.com

Boeing-Backed Aerion Is in Talks for $ALTU SPAC ListingBoeing-Backed Aerion Is in Talks for Altitude SPAC Listing

The companies are discussing a deal that would value the combined firm at up to $3 billion, said the people, who asked to not be identified because the matter isn’t public. A deal could be announced as soon as this month, the people said.

The talks could still fall apart and end without an agreement, they said.

Aviation giant Boeing Co. announced a partnership with Aerion in 2019, along with a significant investment in the company, according to a statement at the time. Aerion had planned to finalize the design of its first supersonic business jet model last year, according to its website. Manufacture of the AS2 will start in 2023 with plans for it to be in service in 2027.

www.bloomberg.com

Why $DNK stock price surged heavily in november?Why DNK stock price surged heavily in november?

What triggered the stock price surge is a report by Chinese media outlet Thepaper.cn saying that 5I5J Holding Group (owner of Danke’s rival Xiangyu) is in takeover to buy Danke.

There have been reports that Danke was pursuing bankruptcy, but the company denied those reports on its Weibo account earlier then, according to South China Morning Post. One of the reasons why there is speculation about Danke filing for bankruptcy is due to upfront payments being collected from Danke tenants, but there was a failure to pay the landlords. This is why tenants and landlords protested at Danke offices later.

pulse2.com

Why $BRN skyrocketed in January?Barnwell Industries Reaches Agreement With MRMP Stockholders to End Potential Proxy Contest

$BRN is pleased to announce today that it has entered into a cooperation and support agreement with MRMP Stockholders, with respect to the potential proxy contest pertaining to the election of directors to our Board of Directors (the “Board”).

the Company will nominate its current slate of directors, which includes three of the MRMP nominees and two new independent directors elected in 2020, to stand for reelection to the Board at the upcoming 2021 annual meeting of stockholders.

The MRMP Stockholders have agreed to vote their shares of common stock of the Company in favor of the election of the designated slate, and the MRMP Stockholders have agreed to withdraw their proposed slate of directors.

I’m gratified that the Board of Directors will be unchanged from last year and be able to continue its efforts to move the Company forward.

The agreement that we have forged with the Company should avoid distraction and unnecessary expense allowing our Board to continue to position Barnwell for long term positive cash generation and further share price appreciation.”

finance.yahoo.com

$PHCF low float chinese stockSince the company has not announced any news directly and there are no SEC reports to trigger a stock price increase, it appears there was a coordinated move on social media to drive the price up.

I am seeing references to $PHCF in Twitter hashtags, Many of these posts mentioned the advantages of the high volume and relatively low float chinese stock.

Buy $TWM - NRPicks Ene 31The TWM is an X2 Bear ETF of the Russell 2000 Index, which is at a key level due to its third consecutive rebound in the MA 50.

We consider that in the current context where volatility is high and large trading volumes can be evident in Small Caps and according to our views, this scenario could stay that way. That's why we think this inverse could benefit from a drop in the IWM index close to -5%.

Technical:

MA 50 bounce

Breakout at 17.65 accompanied by an interesting volume of purchase

Average RSI levels

Buy $BA - NRPicks Ene 31Boeing is a leading aerospace and defense company. Headquartered in Chicago, the firm operates in four segments, Commercial Airplanes, Defense, Space and Security, Global Services and Boeing Capital. Boeing's commercial aircraft segment generally produces about 60% of sales and two-thirds of operating profit.

Due to the restrictions, the company has experienced order cancellations, resulting in reduced sales. The company could be considered very important, as it is one of the two companies supplying the airline sector. On the financial side, it has consistent debt with respect to its competitors.

Fundamentals:

- Value

- 54.2% estimated net earnings growth for the next 3 years.

- ROE 10.5% VS 12.4% industry.

- Price to Book 1.1x VS 1.2x industry.

Technicals:

- Price level below SMA 250-200-150.

- Williams R% at -89% levels

- RSI (40) Neutral

- -6% average downside during the month

A 20% correction was presented from Dec. 7 to Jan. 27, which stopped at $193.5 support. The stock has no key fundamental reasons for a pullback, in addition, some analysts have raised its target price which should resume the uptrend. Finally, the technical indicators show a positive buy signal.

Buy $GBTC - NRPicks Ene 31Grayscale Bitcoin Trust is solely and passively invested in Bitcoin, enabling investors to gain exposure to BTC in the form of a security while avoiding the challenges of buying, storing, and safekeeping BTC directly.

Technical:

SMA Support 50

Continue trending

Volume Pattern

Flows could return to BTC (Target ATH)