Sp500index

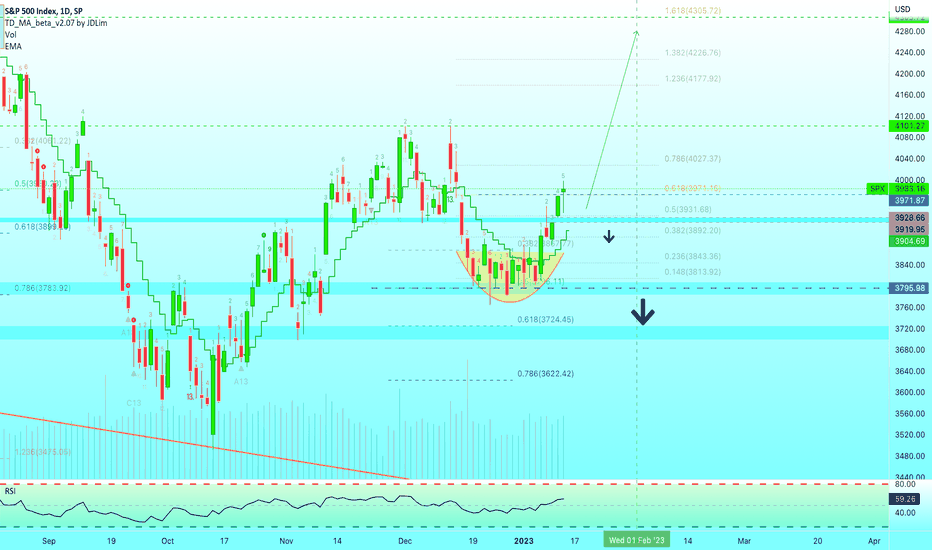

SPX Daily TA Cautiously BullishSPXUSD daily guidance is cautiously bullish. Recommended ratio: 80% SPX, 20% Cash.

* GOLDEN CROSS WATCH . US December CPI came in 0.1% lower than in November (which saw a rise of 0.1% from October), whereas Core CPI came in 0.3% higher than in November (which saw a rise of 0.2% from October). The UofM Consumer Sentiment Index (Preliminary) for January is currently 64.6 , up from 59.7 in December. The current GDPNow US Q4 GDP estimate is 4.1% , up from 3.8% on 01/05/23.

It seems as though markets are pricing in a "turnaround in inflation", but with Russia/Ukraine and ongoing supply chain disruptions from China it is likely premature to make such an assessment. Additionally, CPI is conflated and this is largely because the cost of gas has been falling in recent months; this is due to to a combination of: weakening demand from China amidst record COVID cases and resulting lockdowns; a price cap on Russian oil; a dramatic slowing of travel in the winter season (US); and lingering effects of the US government tapping into the SPR. Russia deciding to ban oil exports to any organization or country supporting the $60 price cap begins on February 1st and the next OPEC meeting could result in a cut to production in effort to boost prices.

Cryptos are mixed. US Treasuries are up.

Key Upcoming Dates: US December PPI at 830AM EST 01/18; US December Retail Sales at 830AM EST 01/18; Next GDPNow US Q4 GDP Estimate 01/18; US Federal Reserve Beige Book at 2PM EST 01/18; US December Building Permits and Housing Starts at 830AM EST 01/19; US Federal Reserve Governor Lael Brainard (FOMC member) Speech at 1:15PM EST 01/19; US Federal Reserve Governor Christopher Waller (FOMC member) Speech at 1PM EST 01/20. *

Price is currently testing the 200MA at $4k as resistance. Volume remains Moderate (moderate) and has favored buyers for the last four sessions as Price trades in the Point of Control. Parabolic SAR flips bearish at $3810, this margin is mildly bearish. RSI is currently forming a soft peak at 61 as it approaches 68.42 resistance. Stochastic remains bullish and is currently trending sideways at max top (it can remain in this 'bullish autobahn' for a few sessions). MACD remains bullish and is currently trending up at 14.5 as it breaks above the uptrend line from March 2020, if it can sustain this momentum then it will likely test next resistance is at 33.08. ADX is currently trending up at 15 as Price continues to trend up, this is mildly bullish at the moment.

If Price is able to break above the 200MA with conviction, the next likely target is a retest of $4058 minor resistance . However, if Price is rejected here, it will likely test the 50AM at $3913 minor support . Mental Stop Loss: (two consecutive closes below) $3913 .

SPY S&P 500 ETF Price Target for 2023After an extended Santa Rally, which reached all the Elliot Waves Price Targets:

I think we will see an earnings recession in the first two quarters and SPY S&P 500 ETF will test the October 2022 low on a Double Bottom Chart Pattern.

Then it will rally to $431 by the end of the year!

Looking forward to read your opinion about it.

$SPY Monthly 9/21 Death Cross - WARNINGThe only other time the 9EMA crossed under the 21EMA on the monthly was the 2000 Dot Com & 2008 Great Financial Crisis. (Noted with the blue + symbols & down arrows). Each time, the RSI was near 50. Each time, the ADX indicator has been lower than the preceding level (in the 20s, WEAK - NO TREND. The massive drop in monthly volume should be noted. When the next BIG DIRECTIONAL MOVE comes, it'll be accompanied by VOLUME & a rise in the ADX (to STRONG TREND). If this 3rd time ever 9/21 DEATH CROSS is like the other two, a MASSIVE WATERFALL SELLOFF could occur. If such an event occurs, FEAR WILL SPREAD causing a MASSIVE VOLATILITY SURGE. I'm HEDGED for crisis with $UVIX $UVXY. My suspicions point toward a DEBT BUBBLE IMPLOSION. Protect your #kingdollar. GL.

S&P500 A-B-C Corrections Complete After A Break Above "B" LevelAfter successfully forming inverted head and shoulders, S&P500 picks up bullish momentum and now on the verge of breaking downward trendline used to trace swing highs from early 2022. A break above "b" level of the A-B-C corrections will indicate possible potential of the index to re-test January 2022 swing high. IF perhaps the index then struggles breaking "b" level, bears might likely take over...

N.B

- Let emotions and sentiments work for you

-ALWAYS Use Proper Risk Management In Your Trades

#s&p500

#spx500

$SPY AKA Humpty DumptyI'm struggling to understand any of the long ideas out there for $SPY. Not saying I'm right, but there doesn't seem to be much upside left here. Market breadth is very overbought and there's a lot of resistance up top.

I expect the debt ceiling shit show to give us a shorting catalyst. AMEX:SPY

SP500 | SPY - Bottom for the bearmarketIf we look at the rising trendline from 2008 you can see that we have a strong support there around 320 SPY . The fibonachis line up pretty well with that too. We also have strong support around that level from the coronadays.

If you measure in M2 supply you can clearly see that we should atleast go down to 2000 levels, low as 2008 may be a overreaction. With the current market condition, high rates + high inflation + energy crisis + credit card debt at ATH I believe we should go lower down.

RSI does also point that we should go lower if we are going into a similiar bearmarket as 00 and 08. The drop from top to bottom will be lower than 00 and 08 but there is many more people invested in the market today than it was at that time, which will make a difference. We also dropped 2 years ago during covid, and that was a massive drop, due to that drop we may not need to drop as much as 50% this time.

During the coming earnings this Q1, We will see many companies with lower earnings . Due to lower spending from customers, expensive goods and a smaller workforce.

320 SPY may be the bottom and that is where I will start buy. The road to that bottom could vary, The potential for more upside is still likely but if so we need to break the decending trendline which will be very hard to break.

NFA

DYOR

Good Luck

/aFinancialMind

💾 SPX Conquers Another Resistance, Bulls Strong, EW TheoryThis level here marked orange, 3971, is important for the SPX based on multiple indicators and we see a close above it; this is good for the bulls.

A rising window/gap, was left from 10 to 11 January which is a bullish development but at the same time these gaps tend to filled we just don't know when.

So the bias is up, upwards, strong but there can be a sudden shakeout or retrace at some point.

The more probable scenario though is that the SPX continues with its bullish move and this gap is filled when the main correction comes by the 1st of February.

The correction will happen when the FED announces their next rate hike.

We have all the way until January 31/February 1st to gradually rising prices.

One final note. Between today and the 22nd of January there can be some uncertainty at some point... If this uncertainty makes itself clear, stay in the knowing that the end goal will remain up.

I am wishing you a lovely weekend ahead.

If you are one of the dying bears, do not worry, the market works in cycles and this meant to happen... At one point people will become complacent on the way up, they will become over-confident and then the market turns.

There is never straight down nor straight up...

More like Elliot's Wave Theory and Nature's Law...

5 steps forward, 3 steps back.

5 The impulse, can be up or down.

3 The correction, can be up or down.

Sorry... I got carried away.

Namaste.

SP500 - It's still winter and cold!The SP500 started its descent from the end of 2021. In 2022 it had a drop of over 25%. In the last quarter of last year, it started to recover.

The dollar index, mirrored by the SP500, rose over 20% in 2022. Also in the last quarter it started to go down. What will 2023 bring? I think the SP500 will still suffer. The good times are not yet near. It's still winter and cold!

S&P500 - Pt.3 Capricious indexIn our first post we explained how we believe the sp500 index will complete the bearish wolf wave at 3600, either completing a wave B of an ABC to the upside correcting the whole 2022 downtrend or in a wave 3 of (C) to make a lower low. We were stopped out from the first trade losing 1% of equity, so according to our trading rules we can only risk up to 0.5% in the short trade we are going to place around 4000. The invalidation level is the previous high of 4136.8.

SPX Model Trading Plans for THU. 01/12Inflation Numbers Good, but Not Great

The CPI numbers and Initial Jobless Claims this morning have not really provided any directional thrust other than a huge whipsaw. As of nearly one hour into the release, there is really no directional catalyst on the radar for today. Our models indicate choppy trading while the index is between the broader range of 3900-3965 on a daily close basis, with a mildly bullish bias while above 3965 but below 4002. The index has to clear 4002 for the bullish bias to settle in.

In our trading plans published yesterday, Monday, 01/09, we stated: "The index is now approaching the resistance band in the range of 3960-4002, and the price action in this range determines the next leg". This range is still in effect for today's session.

Positional Trading Models: Our positional trading models are currently flat and indicate staying flat until otherwise indicated.

By definition, positional trading models may carry the positions overnight and over multiple days, and hence assume trading an instrument that trades beyond the regular session, with the trailing stops - if any - being active in the overnight session.

Intraday/Aggressive Models: Our aggressive, intraday models indicate the trading plans below for today.

Trading Plans for THU. 01/12:

Aggressive Intraday Models: For today, our aggressive intraday models indicate going long on a break above 4002, 3987, 3965, 3953, or 3936 with a 9-point trailing stop, and going short on a break below 3997, 3961, or 3930 with a 9-point trailing stop.

Models indicate no explicit long exits, and short exits on a cross above 3903 for today. Models also indicate a break-even hard stop once a trade gets into a 4-point profit level. Models indicate taking these signals from 09:41 am ET or later.

By definition the intraday models do not hold any positions overnight - the models exit any open position at the close of the last bar (3:59pm bar or 4:00pm bar, depending on your platform's bar timing convention).

To avoid getting whipsawed, use at least a 5-minute closing or a higher time frame (a 1-minute if you know what you are doing) - depending on your risk tolerance and trading style - to determine the signals.

(WHAT IS THE CREDIBILITY and the PERFORMANCE OF OUR MODEL TRADING PLANS over the LAST WEEK, LAST MONTH, LAST YEAR? Please check for yourself how our pre-published model trades have performed so far! Seeing is believing!)

NOTES - HOW TO INTERPRET/USE THESE TRADING PLANS:

(i) The trading levels identified are derived from our A.I. Powered Quant Models. Depending on the market conditions, these may or may not correspond to any specific indicator(s).

(ii) These trading plans may be used to trade in any instrument that tracks the S&P 500 Index (e.g., ETFs such as SPY, derivatives such as futures and options on futures, and SPX options), triggered by the price levels in the Index. The results of these indicated trades would vary widely depending on the timeframe you use (tick chart, 1 minute, or 5 minute, or 15 minute or 60 minute etc.), the quality of your broker's execution, any slippages, your trading commissions and many other factors.

(iii) These are NOT trading recommendations for any individual(s) and may or may not be suitable to your own financial objectives and risk tolerance - USE these ONLY as educational tools to inform and educate your own trading decisions, at your own risk.

#spx #spx500 #spy #sp500 #esmini #indextrading #daytrading #models #tradingplans #outlook #economy #bear #yields #fomc #fed #newhigh #stocks #futures #inflation #powell #interestrates #cpi

S&P500 - Pt.2 Another leg downIn our first post about this index we explained our general view. Here is the wolfe wave and the micro count. We will observe and update about the price action to assess probabilities of the scenarios outlined in the first post. We are either in a wave 3 and we will go for a lower low, or in a wave c of B of an ABC to the upside. In both case we believe that we will visit 3600 area, which is the target of our short position.

SPX Not Giving UpA small follow up for the bullish case of the SPX:

We're still in the resistance zone, located below the resistance line of the bigger falling channel we're in.

Now we've seen the first rejection of the upper part of the resistance zone, however, we just shot right back in. That is still bullish. Right now, the bullish case for the SPX is still in play, and im excited to see wether we can break the resistance.

I guess we'll get our answers within a couple fo weeks.

SPY S&P 500 ETF Santa RallyU.S. stocks tend to rise during the Santa Claus rally period.

The Santa Rally is considered the last five trading sessions of the year and first two of the new year.

Since 1950, the S&P 500 has traded higher 78% of the time during the Santa rally period for an average gain of 1.3%.

My price target for SPY is $384.

Looking forward to read your opinion about it.

BTC BREAKDOWNIf everything goes as I expect down on the chart where the arrow is pointing in that candle we will see on the 30 minute chart a big increase in volume, on the price chart we also want to see a big black candle ending somewhere around $16975 which will look right into the SHORT for retail and we can go straight up, if there volume will not be downward but instead shoot up I would expect there to be somewhere close to the high of the trend which may change with the results of inflation on Thursday

SP500 Pt.1- Still more downside

Good Morning!

In this first post on the SP500 we will do a breakdown of the situation and our current views on this index.

We are in a downtrend from Jan 4 's top of 4821. During this downtrend, we can see price created an head and shoulders pattern to the downside, and then get rejected twice into the big volume cluster.

According to our main scenario, this cycle corrective move is still about to complete and we need to finish primary wave (C)

In our alternative count, the first corrective leg concluded at 3491 and we are correcting all the downside move with an ABC to the upside.

In both cases, the count will agree with the price action: either it is a B of an ABC to the upside or a wave 3 of (C), the price got rejected at the volume cluster after creating a bearish wolfe wave pattern, and then gave us an impulse to the downside with a corrective move up to the 50% retracement: we therefore believe that the price will complete this pattern with another impulsive move to the downside.

We are therefore short on the index, targeting the wolfe wave target around 3600, that will be consistent with both the counts cited.

Our stop loss is our entry price 3940.3. We want to play it safe, since Powell is about to speak and big volatility is expected.

We will update on this trade and our next analysis! W

GMR

SP500 on false breakout 🦐SP500 on the 4h chart started the week with an uptrend move.

The market after a distribution phase tested the previous support now turned resistance and took the liquidity with a false breakout of the area.

The price after the rejection move to the top level of the distribution box and a possible bearish continuation can be seen.

How can u approach this scenario?

I will wait for the European market open and IF the price will break below we can set a nice short order according to the Plancton's strategy rules.

––––

Follow the Shrimp 🦐

Keep in mind.

• 🟣 Purple structure -> Monthly structure.

• 🔴 Red structure -> Weekly structure.

• 🔵 Blue structure -> Daily structure.

• 🟡 Yellow structure -> 4h structure.

• ⚫️ Black structure -> >4h structure.

Here is the Plancton0618 technical analysis , please comment below if you have any question.

The ENTRY in the market will be taken only if the condition of the Plancton0618 strategy will trigger.

$enph will cool down?$ENPH is on uptrend on big picture and It is non stop going down for almost one month so It is time to cool down and make some correction or continue it uptrend. We just need to benefit from bounce back.

Entry; $220.30

S/L; $205.91

TP1; $249.09

Please always do your own search and analysis before you take any trade. Do not rely on anyone :)

I am spending some time on analysis so please like my posts to motivate me to post more :)

$SPX (SP500) - Live Update.. BEAR? Hold this level!$SPX (SP500) - Live Update.. BEAR?

Unfortunately, we erased all the gains for today. Currently trading at +0.08%.

We broke out of the 'bear-flag / pennant', which was surprising.

The Gray Box was resistance.

A close below the red line: $3870 would make me a bear.

As in this case both of the previous bullish developments would be invalidated.

#SP500