Russell2000

E-Mini Russell 2000 One Hour Long $790.00The E-Mini Russell 2000

One hour time frame has shifted from side ways

movement to a down channel. The market is at

the bottom of the channel and is showing signs

the market could push bullish towards price point

1566 about +158 Ticks away. Which is around

$790.00 of profit opportunity with one E-Mini

Contract. Stops can go below the bottom of the

channel.

IWM Has No More Upside - Longterm Target Is 112 USDCurrently we are in a ABCDE formation down. Next target is 141 USD, where it will make a corection up to 151 USD for the (e).

In my last post i noted that transportations are also expecting a correction down, which should take IWM with it. Therefore the larger target of IWM is 112 USD. Best case Scenario we are looking at a target of 99 USD.

SImple The Stochastic Pop was developed by Jake Bernstein and modified by David Steckler, who wrote a corresponding article for Stocks & Commodities Magazine in August 2000. Bernstein's original Stochastic Pop is a trading strategy that identifies price pops when the Stochastic Oscillator surges above 80. Steckler modified this strategy by adding conditional filters using the Average Directional Index (ADX) and the weekly Stochastic Oscillator. This article draws on both methodologies to present another modified version of the Stochastic Pop suited for SharpCharts.

Once the trading bias is established, Steckler used the Average Directional Index (ADX) to define a slowdown in the trend. ADX measures the strength of the trend and a move below 20 signals a weak trend. Steckler preferred ADX below 15, but would use 20 as well. A high and rising ADX signals a strengthening trend, while a low and falling ADX indicates that the trend is weakening. On the chart below, 14-period ADX on the daily chart shows a weak trend when it moves below 20. Notice how Gap (GPS) moved into a trading range as ADX dipped below 20 twice (yellow areas).

the obv volume is very important for to determinated the market trend...

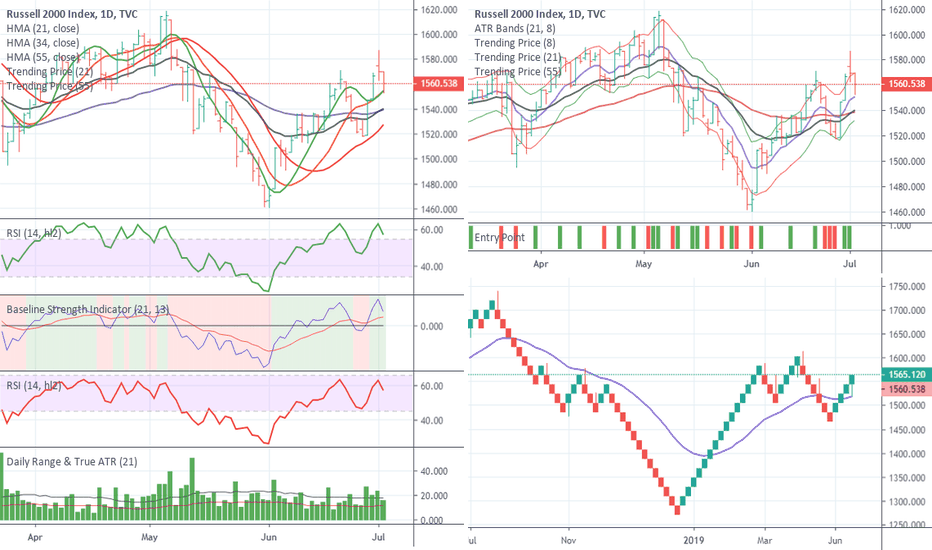

Bearish Update 18 July 19The one index that has been showing true signs of the economy.

Price to HMA position is indicating short.

Price projection from the Bull RSI returning into neutral territory indicating weakening strength is targeting 1526.66

The consolidation range which has lasted a couple of week is broken to the low side.

Short $US2000 $IWM For JUL 15 - AUG 20 Seasonal TradeWe ended the late June to July 15 Seasonal trade with a huge bang... except Russell 2000 lagged terribly. Notice the potential rejection of the June close here along with the top rail of the big wedge.

Seasonality starts July 15/16 and Russell along with DAX are the worst performers.

charts.equityclock.com

EYPT | Range bound Long-Term pattern suggests that after previous dilution, Eyepoint's stock price went range bound for quite awhile before breaking out.

This marks potential accumulation range for anyone looking to build a position in EYPT.

Ranges make for good swing trade positions (especially 20%+ both ways) and a way to average down.

Range low/ highs, range from $1.42 - $1.87 is approximately $0.45 of profit both ways up (~20%+) until EYPT confirms they are adhering to terms of loan with CRG.

Weekly MACD and Stochastics have divergence with stock price. This could infer spring board type action on good news (break below range could cause problems).

Previous quarter showed that $EYPT was on track w/ meeting terms of CRG loan agreement.

positive earning/ ER beat should help satisfy some hedge funds/ big $ investors. I remain cautiously optimistic.

$EYPT could potentially come and test lows of the range within next week. I am looking to use this as a way to add to current position/ swing trade it to highs and lower cost basis on my long-position.

**On the other hand, falling below this range could cause knee jerk reaction/ selloff. I am going to be watching this carefully.

Tip # 7: When trading, It is very important to have a game plan. It is good practice to establish rules to your system (i.e. do you buy in increments?, at what point do you not like the investment anymore? how long are you willing to hold?).

- Please Like and Follow for trade ideas & so I can continue to chart and build my reputation. Thank you in advance =)

Have a Twitter? check out my page for more: @volatilitywatch

Disclosure: I am long EYPT. This is not a note to buy or sell. Please do your homework before investing.

//-----------------------------------------------------------------------------------

Check out current trade in TGTX =) #BULLISH

RTY One Hour time frame. $850.00The E-Mini Russell 2000 one hour time frame

is in sideways movement. The market is at

the bottom of support price point 1560 and

is showing signs of a potential up push.

A potential entry would be to wait for the

market to close above the counter trend line

bullish. The future resistance price point

1580 about +170 ticks away may be a great

exit for potential profits. About +$850.00

trading one contract.

Monitor with cautionConsolidation has been established with a range of 1548.12 - 1586.77

For the technicians out there who like patterns. A Pivot High was just completed. So, look at the bottom of the consolidation range for your breakout signals.

Anchor bar on the consolidation is a positive bar which suggests a 70% chance of breakout to the top.

Coupled with the pivot high - I would decrease that down to 30%.

This is a mixed bag of directional signals, suggesting the market hasn't decided yet.

Strong Week AheadPersonally endured an internet brown out this weekend. This is getting released late.

Noticed immediate change in strength of the Russell after reorganization.

No new projections this last week.

Bullish going into the weekend.

G20 announcements are exciting for the market.

Expecting a range this week of between 1542.80 - 1629.23

ES1! AB=CD WEEKLYCURRENT LEG SUPPORT A STRONG MOVE DOWN 2700-2500 RANGE

CURRENT DOUBLE TOP

CURRENT OSCILLATION TURNING POINT

WITH A LOT OF HANDS HEAVY LONG SUPPORTED BY CHINA TRADE MEDIA PUMP ES COULD VERY WELL SMACK DOWN INVESTORS 3RD QTR

3000 IS STILL A C>D TARGET

CURRENT MOVEMENT IS B>C

A>B HAS BEEN SATISFIED TWICE WHICH MEANS A DOUBLE TOP

E-Mini Russell 2000 One hour time frame +319 ticks BullishThe E-Mini Russell 2000 One hour time frame

entered into an up channel. The market is

now at the bottom of the channel to where the

market could extend to the top. The future

high price could be 1566.80 about +319 Ticks

away which is $1,595.00 for every one contract

traded. I am going to use the tunnel trader for

entry as the market extends to the top.

A cautionary tale (commentary)There is an old traders tale that says something to the nature of, if a price tries three times to break a support or resistance level, yet fails, it will retreat the opposite direction.

January 2018, the DJI tried to break above 27,000. It got to 26,616 before it retreated. Not enough strength.

October 2018, it tried again and got to 26,951 before it retreated. It pulled back to 21712 to get a running start in an attempt to break it.

April 2019, it tried for the third time and reached 26,695 before pulling back to 24,248.

Did it finally punch 27,000 hard enough that it just needs a love tap? Or is this last attempt going to be a half-hearted thud before a drop 20,000 or 18,000?

It is difficult to tell.

All the strength indicators reflect that it can get through this level.

DJI is trying to reach 27,058

SP500 is trying to reach 2999

NASDAQ is trying to reach 8178

Russell 2000 is trying to reach 1552

But they are also weak signals. Signals generated while being caught in consolidation so near to the top.

Consolidation so near the summit, it is like being trapped in a room that has filled with water, you have nearly broken through the ceiling but you are running out of breath as you take your last breath from the last few inches left of an air pocket before....... we break through or we drown.

Once we reach this level again, will we become impacted by a tweet? A trade war? An oil embargo? Such as we were in May?

The wind was in the sails that day. The markets all closed the Friday before strong. Yet Sunday evening prior to the Far East opening the markets for us to start a new week. A little tweety bird went out and took all of the markets enthusiasm away.

Yet here we are again. The 26,000 range.

Extreme caution needs to be exercised here - Trade with caution. Double check everything. Monitor your stops, monitor the VIX.

This can be a record year - either as an amazing new start to the bull market. Or the year we stripped 23% - 32% of the market away.