Apple_analysisThe yellow line shows the original trend line before the first downward movement

The blue lines represent the current trend and its forming symmetrical triangle (www.investopedia.com)

In any normal market, the assumption is that the trend will continue, but considering apple gonna have Earnings and they got heavily impacted by Trade war, I feel the movement is solely will be controlled by earnings numbers.

So if you believe apple earnings gonna be good, then go long or else exit.

This is not a great formation for entry, the traders will wait for the breakout which I feel at this point will happen through earnings numbers only.

Quarterly

Is RVNBTC ready to take the lead (again) ? Hi,

RVNBTC is now in a consolidation and will break out probably after finishing the fifth wave inside the consolidation.

after completing the Bearish Bat Pattern , as shown in my recent post, we are now in the stage of profit-taking.

This comes at a perfect point, the last half of the month of june, the numbers will be given out in two weeks from now on and

new announcements can bring a significant change, especially in this volatile, young market.

However:

I expect RVNBTC to stop around the Green Support Linie , which represents the 0.78 of the recent move to the upside.

A bounce up will be likely since the Leader of the Sector BTCUSD refuses to show weakness in the past days.

Entry : Wait for a test of the yellow trendline and allow the price to turn around. Wait for a retest of a valit support zone

before entering the trade. Also watch for bullish chart patterns of the lower time-frames around the key-levels.

Use multiple timeframes method and a Top down strategy to enter the trade.

If you do not know what that is please check out George beaulieu on youtube.

With patience

Heish

Seems like the greenback will be heading down!They always say nothing good seems to ever last forever. This is also apparently true in the currency world as well. The green back USDJPY pair has been held strong due to the strength of the DXY(USD) but due to inflation the fall of the DXY(USD) is inevitable, and unavoidable.

Here my long term technical analysis illustrates that over the course of the next 16 weeks we are in for a decline in the value of the USDJPY trading pair. I am expecting that today 4/16/2019 will be the beginning of that declination.

Take a look at my illustration and give me your feedback

BTCUSD 1D - New quarterly cycle, long till ~29 November 2018.New quarterly cycle just kicked in from ~20 September 2018 till ~21 September 2019 .

We're going up till ~ 29 November 2018 after that will start going down with the yearly Christmas/new years chaos coming. I expect it to go up around ~ 21 February 2019 again.

Important levels we need to break: ~ 7550 and ~ 9940 after that the bulls are in control.

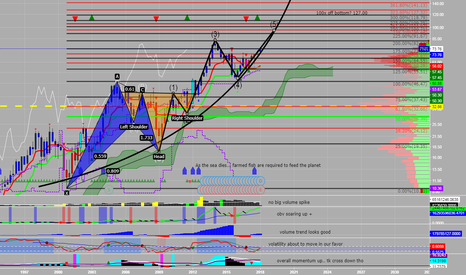

PNR Quarterly ChartPentair makes all kinds of equiment for fish farms which will be required in the not too distant future to maintain population growth as the seas continue to decline.

I see 30% pretty easily in the next few quarters. 100x off the bottom is 127 dollars another key level to watch if we dont correct very much after my (potential) wave 5 completes

Be sure to manage your risk

gl hf

xoxo

sn00p

Tesla Short Term Daily TurnaroundTesla's share price has just double bottomed on both the 200 day EMA and MA, two very strong trend support/resistance zones. Coupled with the pending quarterly earnings report tomorrow (November 1st, 2017), I expect a bullish week ahead. This is a very low risk trade with a stop loss ~$3 below the entry, which is right below the 200 EMA/MA, and an initial target of $338 just below the 0.236 fib, which is entirely dependent on the details of the earnings report. On the last earnings report on August 2nd when earnings were beat by 0.61 points (yet still at a loss below -$1/share) price immediately jumped from that daily open of $318 to the next daily open of $345 to continue upwards into the next week, topping at $370, an increase of 16%. I anticipate similar results for tomorrow if analysts earnings estimates are beat again.

Artificial Intelligence pioneers with NVDA, arrow or landNVDA is continues with crazy growth. We almost touched 170 briefly, which was extremely unexpected. Here is a view on the channel we are back to. Was it a quick previous of future to come?

After successfully reaching 155, as previously discussed and even 160-165, here is my new setup for the summer and next September. 190 is the new target, which with the current channel would be beginning of August. Not sure if there will be another big correction, but there is space for one. Based on previous trend of NVDA, we can expect between 25-35% drop. NVDA however is behaving very good so far after the massive sell of, which makes me think that the pump was in order to have buffer for last Friday sell off. The company recovered relatively quickly and together with Tesla, they were the only two closing positive on my stock watchlist. The 'deadzone' is marked in red, and currently is around 120. Waiting to reach 155 to unload last trade from previous setup and keeping one long to 190. Possible discounts coming months, looking for 141 down to 120.

Cheers and happy trading!

OKCoin quartliers buy zone If we're still respecting that trend 1255 could be a good buy zone on quarterlies

TRYRUB @ -17.30% one of (1482) best performer (4th Quarter) !Take care

& analyzed it again

- it`s always your decision ...

(for a bigger picture zoom the chart)

This is only a trading capability - no recommendation !!!

Buying/Selling or even only watching is always your own responsibility ...

1482 Cross-Rates (4th Quarter Statistics) @ drive.google.com

Best regards

Aaron

EURGBN @ 0,00 % lowest performer (4th Quarter) of 1842 !Take care

& analyzed it again

- it`s always your decision ...

(for a bigger picture zoom the chart)

This is only a trading capability - no recommendation !!!

Buying/Selling or even only watching is always your own responsibility ...

1482 Cross-Rates (4th Quarter Statistics) @ drive.google.com

Best regards

Aaron

TRYRUB @ -17.30% one of (1482) best performer (4th Quarter) !Take care

& analyzed it again

- it`s always your decision ...

(for a bigger picture zoom the chart)

This is only a trading capability - no recommendation !!!

Next week i`ll confirm or change my opinion about this SetUp :)

Buying/Selling or even only watching is always your own responsibility ...

1482 Cross-Rates (4th Quarter Statistics) @ drive.google.com

39 Currencies (4th Quarter Statistics) @ drive.google.com

Best regards

Aaron

EURGBN @ 0,00 % lowest performer (4th Quarter) of 1842 !Take care

& analyzed it again

- it`s always your decision ...

(for a bigger picture zoom the chart)

This is only a trading capability - no recommendation !!!

Next week i`ll confirm or change my opinion about this SetUp :)

Buying/Selling or even only watching is always your own responsibility ...

1482 Cross-Rates (4th Quarter Statistics) @ drive.google.com

39 Currencies (4th Quarter Statistics) @ drive.google.com

Best regards

Aaron