Parabolic

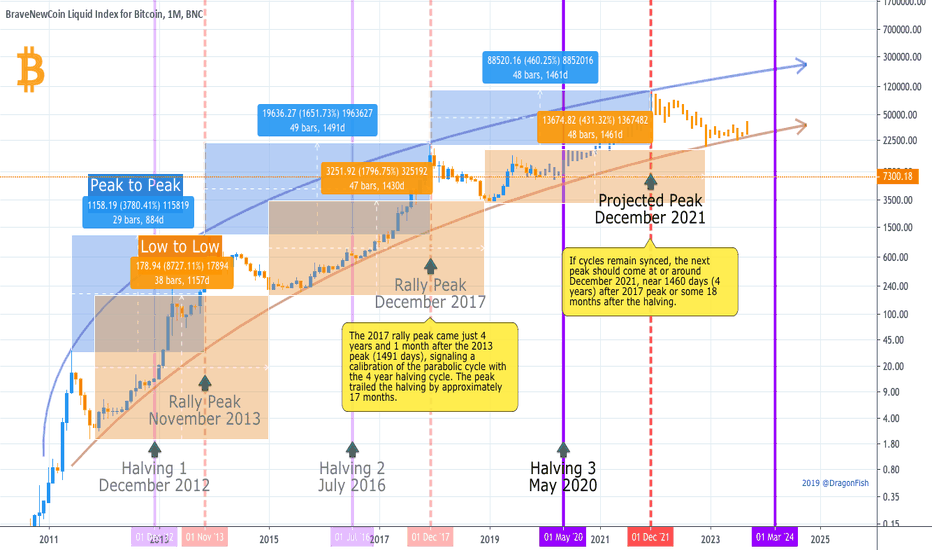

When will BTC peak in the next parabolic rally?This is another iteration of a previously published chart, but simplified to drive the point home.

Motivation

Predicting the peak of BTC's next parabolic rally is critical for the profit-taking strategies of speculators and hodlers alike. For speculators, it's about knowing when to get out. For hodlers it's about how to grow your bags. Really, knowing the timing of the peak is more important than knowing the potential price levels. BTC is a deflationary asset. As market cap continually builds, flow is being squeezed on a pre-set schedule and real value continues to grow. So, we know price will rise. Whatever levels we may reach ($50K? $150K? $250K? 1 million?), taking profits requires knowing WHEN those peaks may be attained.

Two Perspectives

There seems to be two primary camps in the timing debate. In the first camp, there are analysts who note that the time between each previous peak has grown. For these analysts, the first all-time high of around $30 in 2011 is key. The subsequent ATH in 2013 of nearly $1,200 came only 2 years 5 months later (884 days). In contrast, the next ATH took 4 years and 1 month to arrive (1491 days). This 40% expansion in time between peaks logically leads some to believe we will see a similarly expanded time frame as we wait for the next peak, with many predicting peaks delayed until 2023 or even 2024.

Such predictions, however, seem to discount or devalue the underlying architecture of BTC growth, the built-in halving cycle in which the flow of new BTC into the system drops every 4 years when the reward to miners is cut by 50%. The 2017 peak arrived 4 years and 1 month after the 2013 peak (1491 days). Was this a signal that the parabolic price cycle had become calibrated with the 4 year halving cycle? If so, the cycles seem to be offset by approximately 18 months, which would make the target for the next peak in or around December 2021, or some 18 months (1460 days) after the 3rd halving in May of 2020.

The Upshot

Obviously there are so many attenuating factors that can influence the market, and when and where we'll find peak price discovery is anyone's guess, but smart profit seekers would do well to monitor the market closely as we approach December 2021. Even if the peak is delayed, this should be a key profit-taking window for speculators. For hodlers, it will be an opportunity to strategically pull capital from overvalued BTC before the inevitable 75-85% retracement in which we can grow our bags with an eye to 2025 and beyond.

WHY BTC WILL HIT 10k AREASo let's start with the similarities of these two charts.. After the end of the bear market of 2015 we see on the BLX chart that BTC also had a parabolic run similar to the one we are currently having . We notice on the BLX chart that between AUG 19 2015- NOV 4 2015 that the EMAs crossed up and over the 200 EMA and we started going parabolic shortly after, just like currently on my Binance chart. The MACD and RSI were also extended on the BLX chart before the blow off bear wick candle that ended the rally, just like our indicators currently look. Though our RSI has currently cooled off we could resume towards 90 again similar to how the RSI reacted on the BLX chart before the break down on NOV 4 2015.

Now for some positive contrast... on NOV 4 2015, we saw a candle that showed us that a major pull back was eminent because of the bear wick. You could tell at that time that the sentiment was changing, people saw that we had made a higher high and that people obviously were taking profits, not buying up the pull back as if they were no longer bullish in general. It makes me think that currently we still have room to grow because you can see that in the last couple days the market is buying up the dips creating bull wicks like the 17th of May 2019.

Currently candles have been finding support upon the 21 EMA , we have our lower EMAs crossed up and over the 200EMA. The dips are being bought up creating bull wicks, we are creating what seems to look like a ascending triangle pattern ( bullish ). The RSI has cooled off a little giving us a chance for another solid run upward, and the MACD does not look as if it wants to cross under the signal on the 1D Binance chart. Basically we look very bullish even though we have started to run up parabolic.

Based off my analysis I see that we could hit the 10k area because it is the next major resistance, which we can find by looking left on the chart. I also caution everyone that in my opinion we would see a candle similar to the one on NOV 4 2015 soon, because we generally get some type of warning before a major pull back especially when we are moving up parabolic style.

This is not financial advice just my opinion and observations on the market. -AZTEC-

Timing the Peak of the Next BTC Bull RunWhen will Bitcoin reach the peak of its next parabolic advance? Probably at roughly the same time it did in the last rally. This seems straight forward enough, but other trend analysis on this platform has variously projected the next bitcoin price peak from sometime just after the third halving in May 2020 all the way to sometime in 2023. While the earlier prediction is highly unlikely, the extended prediction is supported by the fact that, peak to peak, the third bull run of 2017 was much more extended (1491 days) than the previous bull run (884 days). Therefore, we may assume that subsequent parabolic moves will also play out over longer and longer time frames.

However, the simplest answer is probably the best in this case. If we consider that the halvings are roughly 4 years apart, it is notable that the third peak came just over 4 years after the second peak. This suggests that in fact the peaks have become calibrated to the halvings and that the next all time high will come near the 4 year mark (or day 1460) as well. Bitcoin is unique in that the stock to flow ratio can be very precisely projected, unlike any other traditional market, making this rough prediction of the timing possible.

This probably doesn’t help us predict price discovery, however. Government regulation, current events, technological disruption, etc., etc., all affect market sentiment and make it nearly impossible to guess where the price will go. That said, we do know that the halvings will become more and more priced into market valuations in the future as the market gains a greater awareness of the halving algorithm, and this process has probably already started. Futures markets (CME & Bakkt) will also act as tempering forces on BTC volatility (apparently the intention when futures trading was launched on CME in 2017). And as the value of BTC has become more tagged to store-of-value than currency utility, volatility and price discovery have naturally been tamed (relatively), a process that will also continue. This is to say that conservative predictions may fall closer to the mark. On the other hand, the mere fact that flow is dramatically cut after each halving as demand continues to grow gives BTC bulls a lot of hope.

Whatever the peak of the next parabolic rally, it is likely to be tied closely to the halving cycle and stock-to-flow models, and trend lines will probably remain inside the general channel indicated by history. In other words, we're probably not going to the moon, but we are still holding the best performing asset ever seen.

Hopefully these observations aren’t too obvious. They are just meant to help us all keep our eyes on the big picture as we hodl into the future.

DF

Sell: Parabolic move that usually fades.

After Gap moves like this, there is usually a pull back to half way, followed by a bounce into resistance, then a fade to fill the gap.

Strong sell after bounce.

Do not fall for the trap and buy.

BTC bottomed at 7300?What is Parabolic Move?

In purely mathematical terms, a parabolic move is an exponential rise. Parabolic Curve chart patterns are generated when steep rise in prices are caused by irrational buying and intense speculation. Parabolic curve patterns are rare but they are reliable and are generated in mega bull trends. These patterns trend gradually making higher highs and lower lows in the beginning stages but can be volatile in the exhaustion and reversal stages.

Irrational buying in the public generates a strong rally to push prices vertically, followed by a steep sell off. Examples of this market types are the NASDAQ bullish markets during 1990–2000 (retraced 80%) and Gold prices from 2000–2011 (retraced 62%).

Parabolic curve is a reversal pattern and has a very predictable outcome. Although they are predictable, they are relatively difficult to trade since the market sentiment is bullish and may be relatively tough to point reversals to trade. Most Parabolic curve patterns have a significant correction of 62–79% of its price rise (from the top).

The basic ideas behind Parabolic curve patterns:

— Pattern is easy to spot but difficult to trade with excessive volatility.

— Most Patterns retrace to 62–78% of its rise. 50% retracement is first target.

BTC moved from 3.337 to 13.868 = $10.530 with %315.49 increase

From $13.868 to $7296 = $6.572 with %48 (correction) retracement.

Are we done here or there is another %30 drop coming?

S&P: Possible parabolic move left yetHad some concerns at the end of 2018, but it tweezed and stayed above the curve in black. Following, it executed a perfect bull flag right to 100% of the pole length. I'm suspecting we may have another one of these, and it could be parabolic this time all the way to 340. Expecting some correction in the flag until at least February or so of next year until we hit our confluence of support (FIBs, support curve, flag median, etc.)

I know I have an ugly inverse head and shoulders pattern on RSI. I suspect with the current RSI bullishness and pattern that we could see it go massively over bout in the 90+ range if the movement plays out.

Hopefully none of our politicans will screw it up, or at least wait until we all make a little $$$ :). Approach with caution!

BTC Parabolic Rise|Correction?Volume Climax and Key Resistance Hello Traders !

Quick Update on Bitcoin!

What a move for BTC from its critical support zone (noted on previous chart)! Price is now trading around major resistance; will a correction be more probable from here or a continuation of the parabolic trend?

Points to consider

- Trend still parabolic

- Testing major structural resistance

- Local resistance at .236 Fibonacci level

- Stochastics topping out

- RSI in overbought territory

- EMA’s yet to meet price

- Volume climax

BTC has had an insane parabolic rise with extreme bull volume taking out key resistance levels, negating the overall market structure…

Price is now testing structural resistance, now potential support if bulls are able to hold this level successfully; this will more likely then confirm a continuation. Local resistance is in confluence with the .236 Fibonacci level, sellers are looking very strong above that area due to the long wicks.

The Stochastics is currently topping out, no real clear direction as it can stay in upper region for an extended period of time. RSI is quite overbought; a correction will help cool it off.

EMA’s are yet to meet price, it must hold price as support to confirm a continuation of the trend, however it does have a long distance to meet price. We also have an extreme volume climax bar, which signals that, a temporary top maybe in for bitcoin…

Overall, IMO, a correction may be more probable, but it’s too early to tell, we need price to mature a little more. Consolidation in the orange box will allow the indicators to cool off and confirm support of a key level. However if this level breaks, then we are more to test the .6181 Fibonacci level.

What are your thoughts?

Please leave a like a comment,

And remember,

It does not matter how slowly you go as long as you do not stop.”Confucius

20191015 XRPEUR 4 Stage of Parabolic Move at 4 hours completedHi there,

Price just reached 4 stage of a parabolic movement at 4hs Chart. Besides, it was stopped of a Chuvashov Fork Line comming from past and from 1D Chart.

Every Colored line is an indicator for parabolic movement. When one of the lines are broken, the one before serves as support line.

Probably would try to go back to supply zone before breakout and retest to continue uptrend.

Cheers.

Charter X

Bitcoin Short to 50, 100, and 200 EMAJust as the title says I am looking to enter short on Bitcoin until the Daily 50, 100, and 200 EMA's: that gives us 6550, 7659, and 9014 as our targets respectively.

Generally on retracements of this size Bitcoin has reached or breached the 100 EMA but often fails to reach the 200.

The Daily Ichimoku Cloud Tenkan and Kijou give us support around the $7,000 mark.

I will be looking to enter on spot and margin longs between the 200 ($6,550) and 100 ($7,659). I have been shorting since the 11-12k area.

At the time of publication Bitcoin has just breached the 20 EMA of $10,375, which has generally held up the price on every touch since we started the bull run at 4k.

On June 26th, 2019 Bitcoin reached a high of $13,868.44 on CoinBase and Daily RSI reached a level of 91.56 signalling that we were approaching far overbought levels. I began shorting above $11,000 and selling spot above $10,000.

ADX has also failed to reach old highs, falling from a peak above 60 on our run up to $8,500 to between 40-45 on this spike up to $14,000. We can conclude from this that the trend may be weakening as DMI and ADX fail to reach old peaks on each continued new local high.

We have also got a convincingly large Daily Bear Divergence formed by the 3 arrows on RSI on the chart; as RSI failed to make higher highs on the run from $8,500 to $14,000 yet price continued to make new highs.

Bear Divergence:

Price: Higher High

Oscillator: Lower High

BCHUSD 300% Parabolic Move Some thoughts and highlighted trendlines regarding Bitcoin Cash's quiet sideways movement, perhaps we'll see some movement from alts into 2020 now that attention is on Bitcoin. We have a head and shoulders possibility here to send us down, but I think that is already invalidated. H&S usually don't hold much weight in crypto.

Keep an eye on it!

FMX, Fomento Economico Mexicano SAB - Parabola SupportNYSE:FMX

Very particular this pattern in which the price has been bouncing perfectly for 6 and a half years on the parabolic support and is in the theoretical final phase before any breakout of the resistance that lasts a long time.

We set the alerts and wait.

Stay Tuned!

finance.yahoo.com