Oversold

Wanting to Short Stocks? [CAUTION]A time like this is when it is most interesting to look at charts that serve as indicators to the broader market.. such as the good ol VIX as we see here on the chart.

The VIX, which quantifies the volatility level of the S&P500 on a chart, has been a beautiful gauge on the overall markets temperature on being short heavily one way vs being long heavily the other.

When I first introduced this chart almost a year ago now on August 1st, I pointed out how traders on average just believe that buying and holding good stocks are a good idea ALL the time.. this chart shows there are periods where this is simply not the case.

There are downturns which can last way longer than an average trader's ability to remain solvent and this will always be the case.

So, with that being said, in my previous introduction of this the VIX was showing that we were in a trader's market. This was the time last year when people were still fairly optimistic about stocks due to the tremendous and seemingly invincible growth of tech companies over the last decade. The VIX, however, was showing that this was not an ideal time to be a holder in this market but more so a trader. Meaning trade quick swings and get out.

Fast forward, and notice from August of that time last year to now, there has been an overall trend going upward into our area of highest volatility. The overall trend for weeks and months were illustrating an upward and impending trend into a period of high volatility.

And today, according to this current weekly candle that closes tomorrow, we are seeing that the volatility is in an area where volume-based selling usually declines.

The signal to confirm this would be multiple weekly candles closing back below our take profit area for shorts and ultimately back into our trade zone that we were in last year.

And that last paragraph may just be the most important paragraph in this entire post.

At MINIMUM, 2 things must occur:

1. The trend on the chart must be broken on the weekly.

2. The VIX must break back into the Trade zone.

Only then can we begin to get "optimistic" about stocks becoming bullish again.

In the meantime, the volatility chart is now showing that we are in all time high territory. In order for the price to continue going down in a way that makes it actually profitable for a short seller, the bears will have to move mountains.

This does not mean that prices cannot go further down in the immediate short term. It does mean however that we are close to a peak in market volatility according to this charts overall history.

Keep in mind that this is also not a signal to start longing either. The volatility is still in very high areas and you roll the dice as a gambler would when jumping in choppy waters such as these.

This is a time for smart short sellers to take profit after seeing this setup months ago. New shorts would only be providing exit liquidity so be careful.

In all, keep an eye on this and lets see if in the coming months the volatility dies off and things become somewhat boring until the 4th quarter rolls around. If this happens, a move back into our golden buy and hold zone could be on the horizon!

Bitcoin bottom is near IMOEvery time the 20 week SMA (Yellow Line) crossed down over the 100 week SMA (Red Line) it marketed the Bitcoin bottom within a few days. These two averages just crossed so the bottom is either in, or will be in be in soon. Also, Bitcoin has never closed a weekly candle below the 207 week SMA (Orange Line). Lastly everybody is screaming for much lower prices and as we know Bitcoin rarely does what everybody wants.

I'm still adding to may Bitcoin bags below $21K as this seems to be a historical area to do so.

Good luck!

BBS Out.

Agilent looking for technology rallyMy models say the Fed cannot raise rates beyond 0.5 points tomorrow or they cannot be trusted in the future. We should see a quick rally to end this week and perhaps begin next week, before the reality of $6+ fuel prices set in again and we continue the bear market.

Based on historical movement, the trough could occur anywhere in the larger red box. The final targets are in the green boxes. The pending top should occur within the larger green box as has been the historical case. Half of all movement has ended in the smaller green box. In this instance, the signal indicated BUY on June 10, 2022 with a closing price of 121.62.

If this instance is successful, that means the stock should rise to at least 122.53 which is the bottom of the larger green box. Three-quarters of all successful signals have the stock rise 2.205% from the signal closing price. This percentage is the bottom of the smaller green box. Half of all successful signals have the stock rise 3.812% which is the end point of the black dotted arrow. One-quarter of all successful signals have the stock rise 6.56% from the signal closing price which is the top of the smaller green box. The maximum rise on record would see a move to the top of the larger green box. These are the same concepts for the levels in the red boxes as well.

The ends/vertical sides of the boxes are determined in a similar fashion. The peak of the rise can occur as soon as the next trading bar after signal close, while the max rise occurs within the limit of study at 50 trading bars after the signal. A 0.4% rise must occur over the next 50 trading bars in order to be considered a success. Three-quarters of successful movement occur after at least 18 trading bars; half occur within 28 trading bars, and one-quarter require at least 38 trading bars.

The black dotted arrow represents median historical movement. Medians are a good metric, but they are just one of many I use when forecasting future movement.

As always, the stock could decline the very next bar after the signal without looking back (therefore the red boxes would not come into play) or the stock may never decline (and the green boxes may never come into play).

TXN to join quick tech rally?My models say the Fed cannot raise rates beyond 0.5 points tomorrow or they cannot be trusted in the future. We should see a quick rally to end this week and perhaps begin next week, before the reality of $6+ fuel prices set in again and we continue the bear market.

Based on historical movement, the trough could occur anywhere in the larger red box. The final targets are in the green boxes. The pending top should occur within the larger green box as has been the historical case. Half of all movement has ended in the smaller green box. In this instance, the signal indicated BUY on June 10, 2022 with a closing price of 159.445.

If this instance is successful, that means the stock should rise to at least 160.195 which is the bottom of the larger green box. Three-quarters of all successful signals have the stock rise 2.0335% from the signal closing price. This percentage is the bottom of the smaller green box. Half of all successful signals have the stock rise 3.732% which is the end point of the black dotted arrow. One-quarter of all successful signals have the stock rise 5.295% from the signal closing price which is the top of the smaller green box. The maximum rise on record would see a move to the top of the larger green box. These are the same concepts for the levels in the red boxes as well.

The ends/vertical sides of the boxes are determined in a similar fashion. The peak of the rise can occur as soon as the next trading bar after signal close, while the max rise occurs within the limit of study at 50 trading bars after the signal. A 0.4% rise must occur over the next 50 trading bars in order to be considered a success. Three-quarters of successful movement occur after at least 17.0 trading bars; half occur within 31.5 trading bars, and one-quarter require at least 45.0 trading bars.

The black dotted arrow represents median historical movement. Medians are a good metric, but they are just one of many I use when forecasting future movement.

As always, the stock could decline the very next bar after the signal without looking back (therefore the red boxes would not come into play) or the stock may never decline (and the green boxes may never come into play).

BTC Swing analyzehello friends.

hope u are good.

you can see in my chart that maybe we are in 4th wave

and we can grow till 50% retracement level (or maybe 38.2 or 61.8)

and after that we can fall.

also we can see the RSI trendline breaked up and it can be the buy signal.

we see a divergence between RSI and price that i show it in my chart with

orange circles.

we see the stoch momentum in oversold area.

hope u enjoy my analyze.if you like it plz support me.thanks

(this is not trading advise and you must trade in your own starategy friends.)

WSIENNAUSDT - OversoldThis one will be quick:

1) Look at the RSI. Self explanatory

2) Bollinger bands tightening sharply. Indicating imminent big move.

3) Last time it did 180% in 2 days. Enough said.

4) Project has great fundamentals

Careful with leverage here. Small position only (especially with this BTC volatility). Maybe wait until BTC stops capitulating.

Timeframe: Could be days (week(s) for the bigger targets)

Return: 0.4x - 3.3x (targets: 1.4, 2.4, 3.3)

Amount risked: 5-6% of funds

ETH - Oversold Zone!Hello TradingView Family / Fellow Traders. This is Richard, as known as theSignalyst.

ETH is overall bearish trading inside the brown channel and now approaching the lower trendline acting as non-horizontal support.

Moreover, the green area is a demand zone and round number 1000.0

So the highlighted purple circle is a very strong area to look for buy setups as it is the intersection of demand in green and the lower brown trendline, which I also consider an oversold area.

As per my trading style:

I will be waiting for it to approach the highlighted purple circle (area) to look for possible buy setups (like a double bottom, trendline break, and so on...)

If you like the idea, do not forget to support with a like and follow.

Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

$BTC RSI is beautiful right now, let's see if the same happen?$BTC RSI is beautiful right now, let's see if the same happen?

You can see at the last cycle, it broke the RSI downtrend and slowly played around for a few weeks, then back up.

To me, because this current drop is so slow, because we are so oversold, and because other major indicators are showing a sign of reversal within the next month or so, we are close to the bottom.

Of course, anything can happen, but I think that $20,000 BTC will be held and protected.

ANYTHING CAN HAPPEN

DCA your position.

the 4 hr is at critical .5 level and oversold stochfib of bounce gives us about 50% retracement if there is some recovery to tighten in range we could look back up at 22.23-22.48 setting a daily higher low if market decides to gap up friday. if vwma keeps rising and trama flattens out we will have a bounce in semis. if these indicators keep bearish divergence we are likely continuing lower in broader markets. $23 is still a critical level for this trade. $20.96 is the next level if we continue this pop down. semis started this correction only they can get it out.

Riot Blockchain solidified support for a move to the Upside.Riot Blockchain has been overlooked over the last few months. As Clearly seen on the chart, the correlation to Bitcoin's movements is closely correlated.

> I Believe that an ascending support line has been tested multiple times but both Riot Blockchain and Bitcoin.

> With the momentum driven by earnings season in the stock market providing significant upside potential for all equities, especially in the Tech Space.

> Combined with Bitcoin's Recent strong upwards momentum from yet another confirmation of strong support.

> We are likely to see a rapid rise in the price of Riot over the next few weeks. I think this is an ideal range to DCA at the lowest risk level we have seen Riot Blockchain range in for a significant time.

1) Be greedy when others are fearful.

2) If you believe in a Companies business and promising future outlook. Don't let a discount be the reason NOT the DCA in lower to a stock you believe will be significantly higher in the long term.

3) The fundamentals are one, if not the strongest in the mining business. With huge mining capacity coming online over the next few months.

>>> Eyes on the Medium to Long Term Chap <<<

Just one Long term focused Investor/Traders Opinion, not financial advice.

pop, pop, fizz, fizz-- no more yield curve inversioni think this is headed for a terminal thrust or wave 5, and abc will correct on some support in the given lower ranges TLT. after seein all time highs, i believe the 10 year will fade if it enters weekly consolidation, and fails some break out level forming a false breakout of upper 90% range. TLT is on watch for bullish divergence macd, stoch, rsi monthly

Soooooooo... CONTINUATION?! Or nah...I think everythings gonna keep moving the same way! I mean, AJ might've roc'd me a bit but that 200pip move on gold was saucy! EU did me som justice too. They also BLEW TF UP AGAIN! But, its not about trading all the time, its about trading well often ;)

So with that being said, make it do what it do my trading family!! Happy trading <3

Bitcoin short-term view - RSI oversold - recovery likelyBitcoin short-term view - RSI oversold - recovery likely

Since the volume level $30.630 was ignored the last two times I am pretty sure price will remember and a likely correction might get there.

Would mean a touch of the SMA200 as well.

Another downside move can find support at $28.728.

What do you think dear Crypto Nation?

Drop me a nice comment.

*not financial advice

do your own research before investing

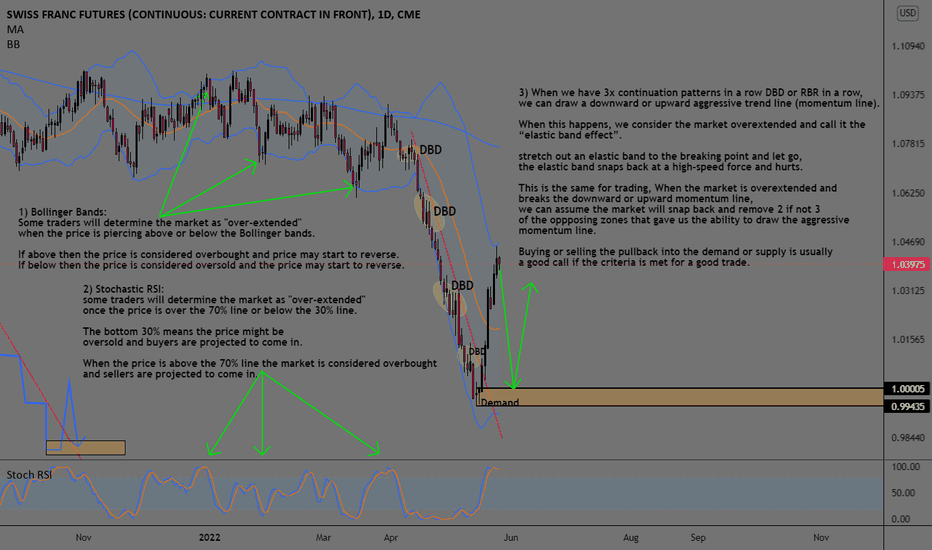

Overextended Markets (Overbought And Oversold)1) Bollinger Bands:

Some traders will determine the market as "over-extended"

when the price is piercing above or below the Bollinger bands.

If above then the price is considered overbought and price may start to reverse.

If below then the price is considered oversold and the price may start to reverse.

2) Stochastic RSI:

some traders will determine the market as "over-extended" once the price is over the 70% line or below the 30% line.

The bottom 30% means the price might be oversold and buyers are projected to come in.

When the price is above the 70% line the market is considered overbought and sellers are projected to come in.

3) Supply And demand

When we have 3x continuation patterns in a row DBD or RBR in a row, we can draw a downward or upward aggressive trend line (momentum line).

When this happens, we consider the market overextended and call it the “elastic band effect”.

stretch out an elastic band to the breaking point and let go, the elastic band snaps back at a high-speed force and hurts.

This is the same for trading, When the market is overextended and breaks the downward or upward momentum line, we can assume the market will snap back and remove 2 if not 3 of the opposing zones that gave us the ability to draw the aggressive momentum line.

Buying or selling the pullback into the demand or supply is usually a good call if the criteria are met for a good trade.

BTC weekly, want to see the truth? here it is!I want people to look clearly at this example of RSI!

Every time BTC RSI has been between 33 and 28

look at the bullish move it has made...Im very sick

and tired of seeing professional traders and chartest

totally bypass what this chart is presenting to us...

Dont we use indicators for a reason? Lets say the

TWATTER and all the influencers were not crying

FEAR to everyone?... would the sentiment be different?

I believe so...the RELATIVE STRENGTH INDEX (RSI)

is and always will be king when assets are overbought,

or oversold...BTC has never been lower than 28

and the was back in 2015...if you look at where it

is now, it actually appears to be curling back bullish

on the weekly. The weekly shows us truths about

any asset on a chart...I believe we could dip a bit more,

$28k, then $24k, $20k and then $18k, worst $10k-$13k

but that would be worse case scenario but im in the

camp that regardless, in the next 300 days, we will get passed

all time highs again. If you see the % gains, every time

its bounced, it surpassed the previous %...Im looking

at $80k-$240k levels when this passes 365 days

if this data stands correct. The FEAR meter is low teens...

lets give a breather and know why we look at charts.

BNBUSDT - Short Term AnalysisCHART PATTERN:

The pair appear to be creating an ascending triangle and be prone to a new downturn. We will likely see BNB try the 312 level once more before having any kind of breakthrough.

OSCILLATORS:

Stochastic and RSI are rapidly approaching oversold areas hinting a possible an upward rally in the next few hours/days.

LIKELY SCENARIOS:

- OPTIMISTIC - If the new attempt at 312 level will be successful BNB is likely to rally to 337 level before encountering resistance. Likely if BTC or ETH will soon start to gain traction.

- PESSIMISTIC - If BNB will be rejected we will likely see a pretty huge dump to 267. Likely if new news about regulation and oversight will appear in the immediate future

- INDECISIVE - Both the chart and the market in this period are very undecisive so there is also a non small chance that the pair will keep trading between 312 and 267 while the market in general decide its direction. Likely if nothing major happens and the market just keep idling in the wait of a sign.

A long-overdue small-cap reboundThe small-cap Russell 2000 Index has been the underdog among the four major US indices since last year. Its post-pandemic rally halted in early 2021, and subsequently, it went sideways for more than a year without making new highs. Meanwhile, the tech darlings continued to go north all the way until the beginning of this year.

The first half of 2022 has been marked by widespread risk-off sentiment and a precipitous drop in the US equity market. After being down almost 30% from the high, we now find the Russell 2000 Index at significant technical support levels that we believe a meaningful rebound will likely ensue.

The Index has bounced right at the 50% Fibonacci retracement level near 1700. We also observed bullish RSI Divergence where price made lower lows, but RSI showed higher lows, suggesting the bearish momentum is waning and at the cusp of a reversal.

Entry at 1806, stop above 1680. Targets are 1880 and 2100.

Disclaimer:

The contents in this idea are intended for information purposes only and do not constitute investment recommendations or advice. Nor are they used to promote any specific products or services. They serve as an integral part of a case study to demonstrate fundamental concepts in risk management under given market scenarios.

AUDUSD DAILY:TARGET 0.6987 DONE,OVERSOLD BUT STILL TARGET 0.6776AUDUSD broke below 0.7134 and hit 0.6987 target.

As I said in previous outlook, "Break below 0.7134 potentially target 0.7086 & 0.6987."

AUDUSD hit low at 0.6829. Now, AUDUSD rebound and regain 0.6987.

There is stiil possibility for a move toward 0.7086,

Next resistance at 0.7134, 0.7165 & 0.7266 (former support).

Break above 0.7458 would open the way to retest 0.7555, 0.7616 & 0.7662.

Anyway, while below 0.7266 still bearish.

Break Below 0.6829, bearish continue with target toward 0.6776 & 0.6685.