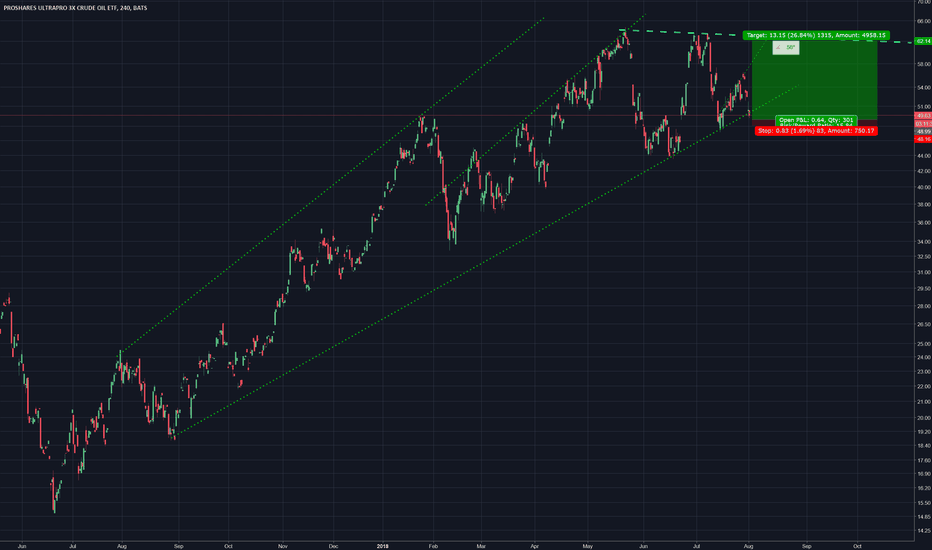

Oilusd

$bxeLike the look of the EMA ribbon, very aesthetic

Doubled my position at .98, still looking for another bullish drive up.

no SL... letting it ride for now, as I say... scared money don't make money

Crude Oil (WTI), long from correction to 63.81.A volumetric analysis based on the X-volume indicator indicates active purchases at lower prices and an inefficient distribution at a low volume. Therefore, the growth to the resistance level of 63.81 is most likely. Levels by X-Lines indicator. Both indicators you can find in my list of scripts.

Good Ol Black GoldBased upon data and the continued negative sentiment regarding oil supplies.

I believe USO will continue degradation.

The first short target is 11.02 and the second is 10.46.

March Puts at 12.00 are in play.

I expect a bounce at .686 Fib and then continued downtrend until capitulation of oil rigs in the fall. I expect crude to succumb to pressure until 55bbl is reached. The Oil Rally is over.

And what about Crude Oil?Less and less attention to oil of late. Also, it's a summer time and this also affects the demand.

The Market showed us good price level to open positions, so we have a good route to use them all.

- Sell from now for few hours

- Sell from resistance lines for 15 min

- Sell till the end of the day

- Sell till the end of the week