NQ - Nasdaq100 S/R zonesHello traders,

Description of the analysis:

I have identified important s/r levels that the market should respect and respond to.

Be careful to trade and invest sparingly!

About me:

Hi, my name is Jacob Kovarik and I´m trading on stock exchange since 2008. I started with a capital of 3000 USD. My first strategy was based on OTM options. (American stock index and their ETF ). I´ve learnt on my path that professional trading is based on two main fundaments which have to complement each other, to make a bussiness attitude profitable. I´ve tried a lot of techniques and many manners how to analyze the market. From basic technical analysis to fundamental analysis of single title. My analytics gradually changed into professional attitude. I work with logical advantages of stock exchange (return of value back to average, volume , expected volatility , advantage of high stop-loss, the breakdown of time in options, statistics and cosistent thorough control of risk). At the moment, my main target is ITM on SPM index. Biggest part of my current bussiness activity comes from e mini futures (NQ, ES). I´m trader of positions. I´m from Czech republic and I take care of a private fund (4 000 000 USD). During my career I´ve earned a lot of valuable experience, such as functionality of strategies and what is more important, control of emotions. Professional trading is, in my opinion, certain kind of mental training and if we are able to control our emotions, accomplishment will show up. I will share with you my analysis and trades on my profile. I wish to all of you successul trades.

Jacob

Nq100

Nasdaq recovery in progresslooking at the market today.

It seems we are coming from a bottom looking top find a new top.

In 4Hr we still see a possible range, were the market its looking to go up./

possible entry points are in blue and targets are in green.

risk reward 3 / 1 .

trade to trade well not to make money.

stocks must look down.as we see some good news in the USA and tech sector. The economy is still very hurt, and optimism cannot last more than realism.

looking at the market we have completed a range in the daily levels.

so im looking for a short. I bounce in the levels marked in blue.

green lines are possible targets.

trade to trade well not to make money.

9432 is on our radar in NQ100NQ100 continues to rise. US President Trump’s acquittal in the Senate, as expected, and the news that a new antiviral drug will help patients with the coronavirus help bullish trend in global indices. 9432 is still a significant level for the continuation of the upward movements in NQ100. If the upward movements exceed this level, we will closely follow 9480 level. In possible retreats, on the other hand, 9370 and 9300 areas will be our support levels.

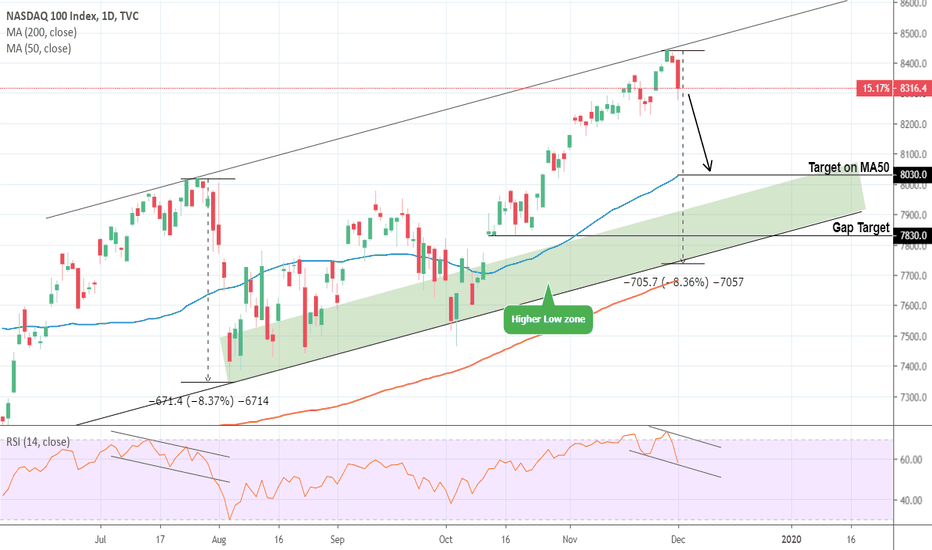

Nasdaq: Sell opportunity towards the 1D MA50.NDX has been trading within a Channel Up since July (1W RSi = 64.749, MACD = 236.300, Highs/Lows = 208.4773). Last week that pattern touched the Higher High trend line giving the first Sell Signal. The 1D RSI is on a bearish divergence similar to the late July Higher High.

Technically the index must touch at least the 1D MA50 before it resumes the bullish trend, so 8,030 is a moderate Target. Traders who can tolerate more risk may extend all the way to the Higher Low zone (green) and the 7,830 Gap Target.

See our recent successful trades on Nasdaq using this Channel:

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

"Nasdaq: on the All Time High Zone" by ThinkingAntsOkDaily Chart Explanation:

- Price is on an Ascending Trendline.

- Price is, one more time, facing the ATH Zone.

- Bearish Divergence on MACD on each New High.

- If price starts its down move from here, it should retest the Ascending Trendline and, in case it breaks it, there is potential to move down towards the Support Zone.

Weekly Vision:

We are looking for sell setups on lower timeframes. Updates coming soon!

Nasdaq 100 Thousand tick bear moveThe NQ Daily time frame has created a sideways

movement. When the market hits the top of the

resistance level around 8000.00 the market is

having a +1,000 tick sell off. I am waiting for the

market to hit 8000.00 price point then looking

for the sell towards the up trend line about +1,000

ticks of bearish movement.

NQ1!, Broken Support, Back to Old SupportA headline helped to break the previous support, now resistance, and led to a liquidation move back to the old support. There is a positive divergence that may play out . However, it is better to watch on a smaller timeframe a reaction first before engaging on the long side. Watch for headlines. I won't be surprised to see attempts to stop the downfall especially when they price is at inflection points. The timing is impeccable.

One can see that the price is confined within a large range and offers advantage to active traders only.

This type of the market and price action has obvious benefits for traders who are patient and enter the market at major inflection points. This allows to ride the short term trend all day long to the next inflection point.

Short term note: Observe a new wedge that is being formed while having a positive divergence.

10/8/2019

NQ1!, Potential Wedge Breakdown. Today, the price advanced to retest the resistance and the first test attracted responsive sellers. One can see from the chart that negative divergence increased the odds. The price broke the trend line but ended up at the support. At this point we need to see a follow through and break of the support if not then the market is going to enter a consolidation phase between those two inflection points.

10/7/2019

NQ1!, False Breakdown, Positive Divergence, Trapped ShortsA strong move down driven by a headline with a strong reversal is today's theme. There are a few reasons for a strong bounce (look at a weekly chart) :

- a failed attempt to breach a weekly trend line.

- 50% retracement Fib level

- notable positive divergence

I did not expect a strong reversal, however, on my chart I had 7577 support level and put a limited order to buy ahead.

Both short and long opportunities were available today.

The market is back above the existing support level and most likely would balance and grind to the resistance above. Tomorrow is NFP and end of the week. Anything may happen :) But an expectation is for the market to hold the support.

Stay nimble.

10/3/2019

NQ1!, Consolidation at Low Prices, Month End JitteryOn Friday the bulls tried to hold the trend line but eventually lost it. That led to a liquidation move and retest the support below which was taken out thanks too headlines. Price came down to retest low prices where responsive buyers were active. The last push up happened into the closing which may suggests a short covering rally ahead of the weekend. The market closed at the broken support now resistance. There is a slight positive divergence which may play out if the market comes down to retest the lows and forms a double bottom pattern. If the price comes to retest the support below it would be even more attractive for the bulls. Oversold market at the support is a gift.

For now, I expect some consolidation to take place on Monday and perhaps month end chop.

9/28/2019

NQ1!, There is no Better Buyers as Trapped SellersA potential rally was suggested in the previous post. A fake breakdown of the support followed by a strong reversal. Notice positive divergences on the indicators. The trapped sellers had to cover and flip positions. A breakout of the smaller balance to upside added more fuel to the move. Now, the price is at inflection point while being overbought short term. We may see a potential profit taking in the overnight session or tomorrow. The bearish case is not dismissed. This is a retest of the broken balance.

Enjoy the rides of this wild market. Stay nimble and rely on technicals and market structure.

9/25/2019

20190918 US Nasdaq trade idea

as shown... limited upside from current level until trend line breaks....

Don't forget to hit the like/follow button if you like this post ;)

That's the best way to support me

Disclaimer: This information is for entertainment only, it may be incorrect and should not be used for your investment decisions.... I just post things for fun based on what I've learned and that may be incorrect. Seek help from a REAL certified financial adviser (NOT who I am - I'm nobody) for your investment or trading decisions involving real money .

20190918 US Nasdaq trade idea (Update 20190920)Previous Nasdaq analysis....

Don't forget to hit the like/follow button if you like this post ;)

That's the best way to support me

Disclaimer: This information is for entertainment only, it may be incorrect and should not be used for your investment decisions.... I just post things for fun based on what I've learned and that may be incorrect. Seek help from a REAL certified financial adviser (NOT who I am - I'm nobody) for your investment or trading decisions involving real money .

NQ1!, Market is at an Inflection PointIn my previous post I shared the idea to watch the channel resolution. Today, the channel got broken during the morning day session. That led to a liquidation move to the next support. The market ended the session at the inflection point again. One can see how the price travels from one level to another.

The chart shows clean break of the channel and the levels the price reacts. When day trading it is easy to get lost in the noise of smaller timeframes and numerous smaller moves and fake outs initiated by Algos in both directions. The best is to pick a larger timeframe with your analysis and watch patterns development. The entries could be confirmed on smaller timeframes.

I personally prefer to watch Renko, Range, Reversal bars that reflect only price action helping to see the patterns . The unwarranted data gets filtered out.

The market is at inflection point. This is a support until broken. Watch for a small balance shown on the chart. If it get broken to downside it would add odds for that breakdown to reach the next support. The RSI is showing a positive divergence and practically oversold. We may see some consolidation first. But if the support gives up - no indicator would help. The price action comes first.

Stay nimble. The market offers opportunity every day. It does not matter why it moves up or down. Humans are suckers for narratives. They need to know why. In reality it does not matter. All the information is presented on the chart. Playing odds at inflection points is the only proven technique to trade the market.

9/20/2019

NQ1!, Post FOMC BounceFrom resistance to support and back. The story of the pre/post FOMC action. The market structure remains intact. Both short and long opportunities today. The pre-FOMC action was quite slow and required enough patience to sit through. In fact, the recent day ranges start to shrink suggesting lack of participation.

Eventually an important support was tested and provided a very strong bounce indicating that the buyers mean business.

Perhaps, something was said during the conference call but from technical chart perspective it was a decent support.

As long as the buyers stay above the inflection point they have a chance to reach the next resistance level above which is a confluence with the broken trend line. As you can see the bias remains neutral and the price moves within the larger range from one inflection point to another. There are no changes that could provide a hint where this market is going.

Stay nimble.

9/18/2019

NQ1!, Breakout Attempt in ProgressA slow choppy day with a bullish skew. The buyers held the position from the overnight session. The sellers were active at the resistance but one could notice no follow up to downside. They had many chances to go low but it did not happen. Eventually, the buyers broke to upside into the closing. This is a Pre-FOMC session and its outcome is not indicative per se. The stats based on 127 days is the following: 69% of the time the market opens higher than the previous day on the FOMC announcement day. It looks like this is going to be one of those days tomorrow.

Nevertheless, the market structure and price action is the only thing I watch and the resistance is broken. That's the fact. If the buyers hold it then I expect to see a retest of the resistance above. If the price starts coming back into the previous range then it would be a warning sign. Post FOMC reaction could be tricky but after the dust settles the market should pick a direction to go.

Stay nimble.

9/17/2019

NQ1!, Buyers Continue to Push Their LuckDriven by headlines the Algos continue to push price higher. This usually happens during the Globex hours where the liquidity is low. However, the day session traders can find plenty of opportunities. One only need to listen to the price action. Regardless of the short term bias the market structure provides objective levels to watch and execute trades. I haven't updated this chart much but one can see the areas identified sometime in the past continue to show reactions. The market has memory.

Today's session offered long and short opportunities. But I personally was cautious about longs and executed a short when the market got exhausted into untested resistance.

The chart shows the negative divergences which is alarming for longs. But one need to confirm entries with price action first.

A rejection from the higher prices may lead to a retest of the trend line and potentially the stronger support below. If today's low holds we may see the buyers pushing higher targeting the all time high. Things can be interrupted by headlines again.

Today is the first day of rollover to December contract. It adds to the overall choppiness.

Stay nimble.

9/12/2019