443% up in 10 days!!! SIMLIt's taking off. Simlatus Corp makes industrial CBD extraction equipment. Just inked some distribution deals.

Mj

ACB & CGC: Trending?Both these stocks have massively bullish monthly charts, and are probably reaching the euphoria phase where investors pile into them like crazy, forming a blow off top, followed by a lengthy consolidation after the bubble peaks...Daily charts give excellent trading setups using 'Key Hidden Levels' and 'Time@Mode' Techniques, created by my mentor, @timwest.

I'm long from this zone, was long from 6.26 on $ACB, and sold at 8.08:

Was long $CGC from 47.4, and sold at 49.33, then bought back recently near support, selling in profit on Friday once again.

We reentered today, and looking to profit from the next uptrend, that might confirm if $ACB earnings make the stocks gap up tomorrow.

Tread carefully, this trend might be similar to jumping into crypto by the time $BTCUSD shot from 10k to almost 20k in late 2017. Retail traders starting to get involved, institutional investors getting more confident and adding.

Best of luck,

Ivan Labrie.

But... But.... We were supposed to get high...Long of course on MJ, but if we don't keep the support, we're in for a crash and a nap.

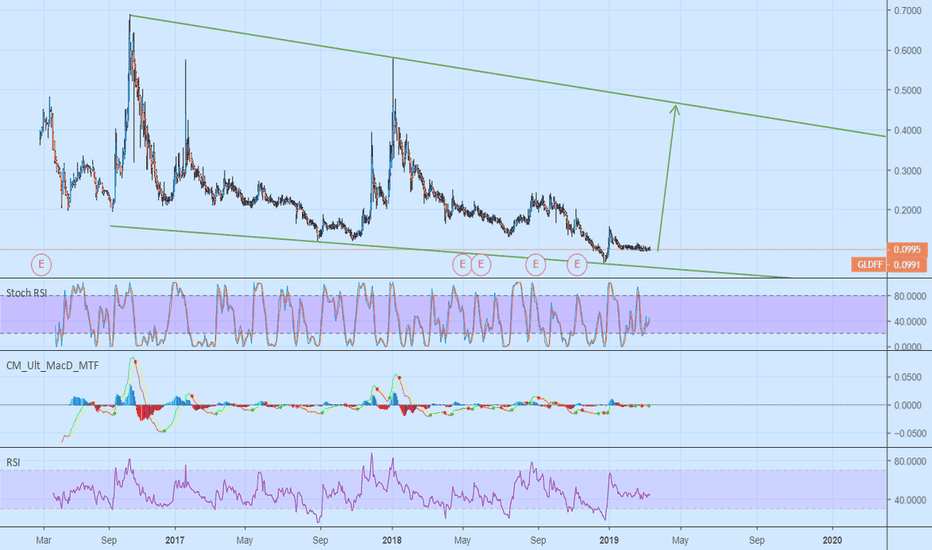

Gold Leaf - Icould see a nice pop happening soon.The periodic rocket pop is due soon.

This is not advice. Education only.

PHOT - GrowLife breakout potential.Consolidated triangles ready for breakout. New trend reversal in place. This company sells growing products such as lights for cannabis industry. This whole sector is ready to breakout.

Information purposes only. Not advice or recommendation. This is my humble opinion. I have 20,000 shares at $0.00835.

MJ Index out of consolidation and back to uptrendLittle early yet, but MJ index may be trying to trend up again. Still believe further consolidation may be needed, but this may be the best looking sector at moment w/ most other markets looking at consolidation. (For future growth and review purposes mainly here.)

CGC - looking for an entryCGC is looking strong in the longer term, but I'll be watching for a pulback to the trendline resistance hovering just above the 50-day EMA before making a move. We've dipped below both the 12 and 26. Stoch is picking up but RSI is neutral. Any move up would need to come with a significant increase in bullish volume to invalidate this set up. Breaking below trendline and 50 EMA resistance could spell a huge drop into the 30s before finding support again.

$LRSV To Go Current. Now Fully Integrated in the Pet CBD MarketThe company has stated that they will be fully current within the next 10 business days. The company has been posting CBD and marijuana oriented tweets and with their brand new website stating; “LinkResPet, a subsidiary of Link Reservations Inc, Produces a line of CBD products specifically tailored for cats, dogs and horses.” The website can be viewed here: www.linkrespet.com .

The chart shows that the William volume accumulation indicator points bullish, volume price trend points bullish and the MACD is also bullish making this a great chart play and potential RM play in our opinion.

Mid-Term Prospects for POT EFT MJWeed is the future, or so they say. 2018 saw a ton of overweight equities, but they have proven to be some of the most resistant names in today's market. Therefore, it stands to reason that if names like CGC, TLRY, and CRON will continue their rise, this ETF will reflect that success. It needs to retract, but will offer a great buying opportunity in the next 1-2 weeks.

Weed - RSI Overbought, hitting previous resistance at $65Weed - RSI Overbought, hitting previous resistance at $65. I was wrong with my short at $58 level. Short interest went up 4x from jan 1-16th, shortdata.ca. Earnings is Feb 14th, so I am on sidelines and will wait post ER. If spy breaks over 270 next week, weed can go higher! FOMC is Jan 30th. Holding $TGOD shares from 2.99. Safe trading!

Weed - Hit .618 Fib level, pull back on 4 hour chart to $55Weed - Hit .618 Fib level, pull back for higher low. Look for back test $54.62 on 4 hour chart as support. RSI overbought, good news about hemp facility in NY. I will wait for support level to buy more shares. Picked up some TGOD for long hold last week at $2.99. Good luck!

CRON Cup and Handle - Watching for breakoutI have been playing with options for CRON for a little and personally I like the company a lot and see tons of potential for future growth.

A textbook cup and handle pattern forming on the 1h. RSI and MACD showing signs of upward momentum but volume is lower than I would like.

If it is able to break out I can see this going to $16 and I have a target of at least $20 by year end.

$weed looking for pull back on daily chart , RSI OB, Fib level$weed looking for pull back on daily chart , RSI OB, Fib level closed right around .382 level or $50.80. Looking for consolidation and higher low, volume is not bullish and $spy is hitting resistance at $259. Tech Earnings next will set market direction. *own canopy shares, $nbev calls and bought $pyx feb calls friday. Shortdata.ca for short interest information. Good luck, happy trading!

Cron may be starting long descent.Slightly overbought on the Daily and near the top of the channel. CRON is getting ready for a large pullback.

I will be looking to buy in the $12 range which would start forming a nice equalizing pattern, though it will largely depend on what the indicators look like at that time.