S&P 500: Roaring Twenties 2.0 Bullish Harmonic FractalIn the lead up to the 1920s, the US Federal Reserve significantly increased its balance sheet by almost nine times, starting from 700 Million Dollars in December 1916 to 6.6 Billion Dollars by January 1920. This move was presumably to fund the US's entry into the First World War, which led to an increased demand for US government debt globally and loose lending conditions domestically, and low rates thereby encouraging a round of inflation in the US. However, after the war ended, the Fed stopped increasing the balance sheet, and between 1920 and 1922, they began to reduce it from the already elevated $6.6 billion to $4.8 billion, almost a 30% cut in just two years.

This action successfully controlled inflation but did not eliminate it completely, yet the dollar gained significant buying power, resulting in a somewhat disinflationary period. As a response to this, the Fed maintained the balance sheet within a tight range around $4.8 billion for a decade, neither raising nor lowering it much but the federal reserve did continue to significantly lower the interest rates; During this time, equities rallied.

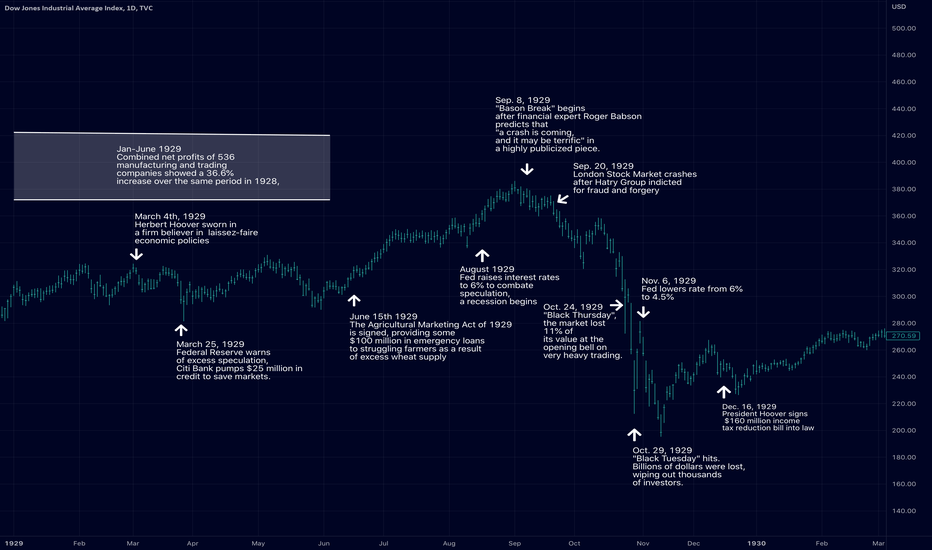

While the 1920s were a period of economic growth and prosperity, there were warning signs of overheating towards the end of the decade. Investors were becoming overly speculative, leading to a surge in stock and real estate prices, while lending standards declined and consumer spending continued to rise rapidly.

To counteract these inflationary pressures, the Federal Reserve implemented policies to tighten credit conditions; They doubled interest rates and also raised reserve requirements for banks, which reduced the amount of money available for lending.

In essence this would kickstart The Great Depression which could have instead been a Simple Recession if only the fed had acted sooner as it wasn't their intention to crush the market but rather they just wanted to cool the market down a bit to contain inflation.

Years deep into the Great depression, the Federal Reserve realized they had gone too far. So, to fix this, they would begin to raise the balance sheet again while also cutting rates drastically in an effort to relieve pressure from the economy and promote new opportunities for economic growth, which then led to a new expansionary cycle.

With that all being said, it would appear that the Fed is doing now what it was doing back then. Over the last decade, they raised the balance sheet by 900% and lowered interest rates by over 95%. Only over the last year, they have begun to reduce the balance sheet by about 10% while raising rates by over 1500%. If we are to go off of the Harmonic Fractals on the chart, then we are likely nearing a point in time where the Fed will begin to loosen rate policy and bring the balance sheet back to all-time highs. This would align with the S&P reaching a 2.618 - 4.00 Retraces as the Fed attempts to keep policy as loose as possible in the hopes that inflation won't come back to bite them. But once we reach harmonic targets, we will likely see inflation return in a great way, which would then force the Fed to induce another Great Depression in the next several years rather they want to or not.

Technical Argument: ABCD BAMM, after breaking a long accumulation range and entering a long term expansionary cycle, we are now in the later phases of said cycle while showing heavy amounts of MACD Hidden Bullish Divergence and harmonically have room to go up significantly higher before it ultimately reaches D and comes to an end.

History

Learn the Long History of Forex!

💶The history of the foreign exchange market (forex) dates back centuries, with evidence of currency exchange dating back to ancient civilizations. Here is a brief overview of the ancient history of forex:

• Ancient Mesopotamia: The Mesopotamians, who lived in present-day Iraq, are believed to have been the first civilization to use a form of currency. They used clay tablets to record transactions of goods and services, and it is believed that they also engaged in foreign exchange transactions.

• Ancient Egypt: The ancient Egyptians used a bartering system to trade goods and services, but they also used a form of currency in the form of metal rings. Foreign exchange transactions likely occurred between ancient Egyptian traders and merchants from other civilizations.

• Ancient China: The Chinese began using metal coins as a form of currency as early as the 7th century BC. They also engaged in foreign exchange transactions with merchants from other civilizations, such as the Greeks and Romans.

• Ancient Greece: The ancient Greeks used a bartering system to trade goods and services, but they also minted coins made of precious metals. Foreign exchange transactions likely occurred between ancient Greek traders and merchants from other civilizations.

• Ancient Rome: The ancient Romans minted coins made of precious metals, which were used as a form of currency. They also engaged in foreign exchange transactions with merchants from other civilizations.

💴It's worth noting that these ancient foreign exchange transactions were likely not as frequent and organized as they are today, and were conducted primarily through bartering or physical money exchange. The invention of paper money and the rise of banks in the Middle Ages led to the development of more organized foreign exchange markets.

💵And Here is the overview of modern history of forex:

• The modern foreign exchange market began to take shape in the 1970s, after the collapse of the Bretton Woods system, which had pegged the value of currencies to the price of gold.

• Prior to the 1970s, currency trading was primarily conducted by governments and large institutions, but with the emergence of floating exchange rates, the market became more accessible to smaller investors and traders.

• In the 1980s, electronic trading began to take hold, with the introduction of new technologies such as the Reuters Dealing 2000-2 system, which allowed traders to conduct transactions electronically. This led to a significant increase in the size and liquidity of the forex market.

• The 1990s saw the continued growth of the forex market, with the introduction of new technologies such as the internet, which made it possible for individuals to trade forex online.

• In the 2000s, the forex market saw a surge in popularity as a growing number of retail traders and investors entered the market. The introduction of online trading platforms and the ability to trade on margin further increased the market's accessibility.

💰Today, the forex market is the largest and most liquid financial market in the world, with a daily turnover of over $6 trillion. It's accessible to a wide range of participants, from large banks and institutional investors to small retail traders. The forex market operates 24 hours a day, five days a week, allowing traders to participate at any time.

❤️Please, support our work with like & comment!❤️

What do you want to learn in the next post?

History doesn’t repeat, but it does often rhyme!So far I’d say we’re leaning more towards repeating. Coming into the local resistance around the same time as the Shanghai upgrade. Will that be the catalyst to slow this rally down? Sending ETH back down to confirm the June 2022 lows as support, and play out exactly like the bear market of 2019? If so, it will be about the same time from the local top to the next Bitcoin halving 11 to 12months. Shockingly similar if you ask me and makes total sense. Perfect price action. To accumulate into the always bullish for all of crypto, the BTC halving. Good luck everyone and be careful!

The power of the fractalI analyse price action of the past a lot. Finding fractals that rhyme can say a 100 times more than indicators do. The market is like human psychology, it always repeats the same.

In the past 5 years of trading crypto some fractals i found played out almost 1 to 1, from now on i will publish the one's i really like compared to current BTC's price action in this idea, also on low time-frames. I hope i can prove you the power of the fractal

On this day, 13 years ago, Satoshi Nakamoto updated the BTC logo🎯 Today marks the 13th anniversary of an iconic moment in the history of Bitcoin. It was on this day, 13 years ago, that the creator of Bitcoin, Satoshi Nakamoto, updated the Bitcoin logo by embedding the symbol '₿' within a gold coin. This logo has since become synonymous with the world's first cryptocurrency and has become an iconic symbol of the digital currency revolution.

🎯 The logo update not only marked a milestone in the development of Bitcoin, but it also cemented the currency's status as a legitimate form of currency. The use of the gold coin design was a nod to the currency's potential as a store of value, while the '₿' symbol within it represented the currency's digital nature.

🎯 Today, we can still appreciate the elegance and simplicity of the Bitcoin logo. The logo has become an iconic symbol of the cryptocurrency movement and is recognized around the world. It has become a visual representation of the power of blockchain technology and the potential of decentralized finance.

🎯 As we look back on this momentous occasion, we are reminded of the incredible journey that Bitcoin has taken since its inception. From a white paper to a global phenomenon, Bitcoin has come a long way in just over a decade. Today, it continues to be a leading force in the cryptocurrency space, inspiring new innovations and driving forward the adoption of blockchain technology.

🎯In conclusion, the Bitcoin logo update of 13 years ago was a defining moment in the history of cryptocurrency. The simplicity and elegance of the logo have made it an iconic symbol of the digital currency revolution. As we look ahead to the future, we can be confident that Bitcoin will continue to lead the way in transforming the world of finance.

Happy 13th anniversary, #Bitcoin! Let's continue to drive innovation and adoption in the cryptocurrency space. #cryptocurrencies #blockchaintechnology

THE HISTORY OF FOREXHello everyone!

Today I want to dive into the history of the Forex market.

Knowing history is useful, because sometimes history repeats itself.

The one who knows history will not make the mistakes of the past.

The beginning of the story

With the advent of markets, the question arose how to pay for the goods.

In ancient times, the first way was barter.

People exchanged some goods for others.

This method developed and at some point salt and spices became popular means of exchange.

In the 6th century, people realized that they needed to come up with something universal, so the first gold coins came to replace spices as payment.

Gold coins differed from spices and other trading methods in important features: portability, durability, divisibility, uniformity, limited supply and acceptability.

The Gold Standard

For a long time, gold coins were used as payment.

The problem was that they weighed a lot and it was extremely inconvenient to carry them in large quantities.

So, in the 1800s, countries adopted the gold standard.

The idea was that the government promised to redeem paper money if someone decided to exchange it for gold.

The amount of gold is limited and its extraction costs money and time, in difficult times it has become difficult to get enough gold to print a new volume of paper money.

During the First World War, countries had to suspend the gold standard, because more money was needed to wage war, and right now.

The Bretton Woods system

After the Second World War, representatives of the United States, Great Britain and France to create a new world order.

The whole of Europe suffered from the war and only the United States was able to emerge victorious, because the dollar had only become stronger by that time.

The adoption of the Bretton Woods Agreement was aimed at creating a regulated market with a currency peg.

A regulated fixed exchange rate is an exchange rate policy in which a currency is fixed against another currency.

All countries fixed their exchange rate to the dollar, and the dollar was pegged to gold, since after the Second World War, the SS owned the largest reserves of gold.

In the end, the old gold problem loomed over the market again. More money was needed, and there wasn't enough gold for that. Therefore, in 1971, Richard M. Nixon put an end to the Bretton Woods system, which soon led to the free floating of the US dollar against other foreign currencies.

The beginning of a free-floating system

European countries were not happy with the dollar peg, so in 1972 an attempt was made to get rid of the dollar.

The agreements created by the Europeans, like the Bretton Woods Agreement, collapsed in 1973 and all this led to the transition to a free-floating system.

Plaza Accord

In the 1980s, the dollar rose strongly, exporters did not like it.

In the early 1980s, the dollar rose strongly against other major currencies. It was hard for exporters and the subsequent US balance of payments.

The US dollar weighed on third world economies and led to factory closures.

In 1985, a secret meeting was held between representatives of the largest economies, but information about the meeting leaked to the media, which forced the countries to make a statement encouraging the strengthening of non-dollar currencies.

This event was called "Plaza Accord", after which the dollar began to fall sharply.

EURO

The Second World War broke up the countries of Europe, creating many economic problems for the region.

Wanting to save the region, many treaties were concluded, but the most fruitful was the 1992 treaty called the Maastricht Treaty.

The introduction of the euro has given European banks and businesses a clear benefit from eliminating currency risk in an ever-globalizing economy.

Online trading

In the 1990s, the world began to develop rapidly.

What used to require more time and human resources was now being done faster and cheaper thanks to the Internet.

Money began to flow quickly from hand to hand, between continents, volumes grew rapidly.

The fall of the Berlin Wall and the collapse of the Soviet Union made the world open, there was an opportunity to trade Asian currencies that were previously inaccessible to traders.

Online trading has started to reach a new level.

Liquidity has increased dramatically due to the congruence of markets, spreads have decreased due to the competition of online brokers and new technologies.

The time has come when anyone could enter the forex market and try to make money.

The volume of funds in the market grew at an incredible rate.

The future of the Forex market

The forex market is growing from year to year.

Volumes are increasing.

There are more and more opportunities.

Trading is evolving, as is the currency, which has led to the creation of cryptocurrencies and the crypto market, the development of which is striking in its rapidity.

Never in history has a person had such an opportunity to earn a lot of money sitting at home.

But do not forget about the risks, study the market and trading methods and then you will be able to grab your piece of the big pie.

Good luck!

Traders, if you liked this idea or if you have an opinion about it, write in the comments. I will be glad 👩💻

🟨 Months to Bottom after FED ✂️Today we have FOMC FED announcement! This is likely going to create volatility in the market.

If we measure the how long it takes for a market to reach bottom we can see that the average time after the first FED cut is 9 months.

From previous post we saw that the first RAISE was in 11 May 2022. Now if the FED pauses or cuts rates will start our timing of the average of 9 months

Remarkable similarities to February2020 & August-September 2008 The current rollover in the market, featuring a clear double top with negative RSI divergence, is remarkably similar to the February 2020 & August-September 2008 rollovers. My opinion is that the current rollover will resolve with a large move to the downside in similar fashion to the aforementioned time periods.

🟨 Bear Markets - History & AnalysisThe calculations use the S&P Dow Jones Indicies.

"The past doesn't repeat itself but it rhymes"

WHAT IS THIS IDEA

It plots all Bear Markets from 1900 to present day and separating them with those who have coincided with Recessions and those who are independent of recessions

Analyse the current Bear compared to previous precedents to determine the probability of the move of the general market

HOW TO USE IT

We can see that there is a clear correlations between the depth+length of the Bear market and the times we are in recession;

We can see that IF there is no recession on the market than the current Bear is becoming quite mature (299 days vs 212 days average) and we can expect that we will not violate the current lows;

If the economy is announced to have a technical recession, we will be likely go deeper and violate the lows (-31% vs 34.6%).

LEGEND

🟢 Bear Markets without Recessions (avg. -25% Loss, 212 Days)

🔴 Bear Markets with Recessions (avg. -34.6% Loss, 353 Days)

⚫️ Current 2022 Bear Market (avg. -31.0% Loss, 299 Days)

🟩 Anticipating FED pause - BullishThe market is a forward discounting mechanism and looking back my stance is that the stock market are anticipating a pause in the FED stance. Hinted on Wednesday by FED Chairman Powell who said "smaller rates increases are likely ahead" as soon as December.

If the market is anticipating a pause, THE GENERAL MARKET INDECIES are likely to push forward. This of course is different to the actual stocks pushing up. So my stance is Discipline until I get good enough traction.

The real question is HOW MUCH HAS BEEN DISCOUNTED already?

🟨 VIX Study 3/3 - Volatility analysisIDEA 3 OF 3

As the market transitioned from high volatility bear market to a low volatility bull market we saw that the VIX was transitioning and once it pushed BELOW the 20 level it stayed long term there giving ability for the market to rally up.

We want to use this precedent to study the current market and determine probable direction.

History Repeats Once More...?The markets are currently in flux. Trapped between what history shows and what the current macroeconomic environment suggests. Reading between the lines, and understanding what factors will ultimately shift prevailing sentiment will become increasingly difficult to decipher. Regardless, I will attempt to examine what led us here, where we are now, and what is to come.

HISTORY...?

Many economic theorists posit that the current macroeconomic environment indicates that we are currently in a market that seemingly aligns with behaviors observed in 1929, 2000, and 2008. Therefore, our current market may be operating in some grey area that holds qualities of a combination of these historic economic crises. Although many believe that we can use historical charts to predict the exact movement of the current market, I do not believe this to be true. Although there may be some truth to this belief, the mechanism behind the euphoric rise of our current economic conditions are relatively unprecedented. The scale and magnitude of stimulus injected into financial entities, consumers, and creditors through direct stimulus, loan originations, and low-interest rates have no historical equivalent. In theory, we have no accurate true historical equivalent to current market mechansisms .

As individual investors at a retail level, the layman trader has no easy way of obtaining information that may offer insights into the true systemic risk of a financial system. The SEC EDGAR system does allow access to corporate financial statements, but these statements may not provide a full or clear picture during times of crisis www.sec.gov . Regardless of this, it is still what I use most often to analyze corporate balance sheets to determine current or impending threats to their debt, liquidity, and valuation. The unfortunate truth, however, is that we will most likely not know the severity or extent of any theoretical "rot" until it is already too late. So with this in mind, how does one navigate such a tumultuous economic landscape?

As individuals, we often look for patterns and cues that are often repeated. This is what makes history such a useful tool in the field of economics. The flow of money, greed, and fear of loss are constants throughout history that boast an unwavering track record. These are innate to human behavior and rarely change with time. When we examine the flow of money (Who has it, how much of it, and what is it being used for), we can see that there is currently a glut of supply. Between 2020-2022 somewhere between $5-7 trillion dollars of stimulus flooded the markets . Therefore, it is clear that there is plenty of currency circulating. Once financial stimulus of any kind is injected into a system, it is then important to "follow the string" to see where it leads. After the initial stimulus injection, it became clear that the money led to banks, and can be seen in the FRED Economic Data chart fred.stlouisfed.org While this suggests a marked increase in consumer savings, it can also be misleading, as the stimulus checks were most commonly distributed directly into savings or checking accounts and immediately bolstered the rate. Predictably, the rate immediately fell as consumers cashed out the stimulus to spend. This cycle is then repeated with a spike during the second stimulus injection, and a subsequent fall immediately after. So then, the flow of money so far looks like this: US Treasury->Consumer banks->Consumer spending.

Predictably, inflation immediately reared its head. Prices skyrocketed, as corporate metrics adjusted to this new prosperous system of "free cash". Student loan debt payments during this time were in deferment saving an additional ~$393/month (Average student loan monthly payment thecollegeinvestor.com) for consumers to spend on other necessities or purchases, and interest rates remained at near 0%. Although this "Epipen" to the heart of the US economy may have saved consumers from immediately defaulting on credit, the side effects of such an intervention have no reliable historical references to note.

Now, as we approach the end of 2022, the global economy appears to finally be experiencing these inevitable side effects. The reservoir of liquidity provided to the US economy and global markets is constricting, and the well is running dry . Corporations have experienced the most ideal and prosperous economic scenario any Black-Scholes model could possibly iterate, and many CEOs are now likely grappling with the impossible question of, where do we go from here? . Global economies simply cannot afford another stimulus injection that matches the scale and volume seen in 2020, and with that comes the harrowing reality that the most prosperous period in generations is coming to an end. Future growth metrics will pale in comparison to those experienced during this time of euphoric intervention, and earnings can only inevitably diminish. Student loan repayments begin again at the beginning of 2023, sucking any last drop of excess capital consumers had left. This, I believe, may lead to a critical turning point where the reality of the end of prosperity is fully realized.

Ultimately, if this thesis plays out, we may experience a period of rapid deflation where companies are forced to either lower prices or find other methods of keeping pace with plummeting consumer spending. Credit will constrict, Credit card defaults will skyrocket, and the US Treasury must suppress treasury yields via treasury buybacks, consumer incentives for holding US debt, or imposing significant taxes on real estate investing. All of this will happen exponentially quickly. Global events and crises will make it difficult for any officials to remain vigilant in any single aspect of the market to prevent a systematic collapse. This degradation in the division of attention among lawmakers in charge of keeping our systems functioning as intended will create the perfect medium by which any previously "undetected" economic instability can proliferate and reach critical mass.

SUMMARY

We are reaching a final "breaking point" in the US economy. The current system built to withstand financial turmoil has never been tested in an environment that has experienced such levels of financial stimulus paired with macroeconomic instability. This will result in a new "mutation" of financial instability that will prove to be significantly difficult to counteract. If a systematic collapse occurs when the government entities typically poised to intervene are experiencing significant turmoil themselves, they must find new ways of stemming the fallout. Although the mechanism by which the US Treasury funds itself creates a type of "perpetual loan" through its treasury issuances and yield payments, illiquidity in the treasury market may force emergency action to save itself. History doesn't necessarily repeat itself, but it often rhymes. And right now, history is about to become the greatest lyricist the world has ever seen.

DJI (1897 to 2022) log channel reality checkCharting all possible events is useful, however unlikely they may be.

Logarithmic channel drawn from 1897.

Overshoot in 1929 and symmetrical undershoot 1932.

Throw-over and rejection 1987.

DJI entered hyperlogarithmic growth post-1995.

Bounce off channel top trendline 2009.

Maximum downside from 2022 high (symmetrical undershoot): -90% loss

- In "no bail-outs" scenario á la Great Depression.

Validity of analysis: These are straight lines roughly drawn for 120 years of data from an arbitrary cutoff point, what do you think?

Probability of risk: Unknown to uncategorizable.

BITCOIN - Long-Term Log View!Hello TradingView Family / Fellow Traders. This is Richard, as known as theSignalyst.

From a long-term perspective, BTC is overall bullish trading inside our green channel.

Moreover, the green zone (10k - 12k) is a resistance turned support.

We are in a correction phase, but the question is, till when / where?

Let's compare this correction to the previous two corrections:

📌 1- The previous correction were around -86%

-86% for the current correction would be lining us with the green trendline and support zone.

📌 2- At the end of every previous correction, MACD shifted from dark red to light red. and then of course broke above the blue EMA.

If we follow the same logic for this correction, we are still waiting for a new light red bar on MACD. Will it be next month?

Meanwhile, we would be bearish and our main rejection would be around the green support zone.

And of course, before we buy, we will need to zoom in to lower timeframes and wait for the bulls to take over by breaking above the last Weekly/Daily major high.

Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich