Junior Gold Miners: ZOOM OUTJunior gold miners have been consolidating in a tight flag above a major breakout level (around $50) that represented a price ceiling since 2013.

Long term ranges precede high probability big winners.

There could be a deeper shake out in play, but I ultimately expect prices to be supported above the 200 day moving average which currently sits at ~$48 and eventually breakout toward $70 per share.

The question for a trader/manager is not whether the price of GDXJ will trade higher or not. It's a question of opportunity cost. Do I hold the asset while it potentially does nothing and continues consolidating while other markets do well? Or do I wait for a proper signal and pay a premium? I'd rather wait for a strong signal and pay up.

FYI: I used the 7D time frame just to fit everything on the screen

GDXJ

Confluence abound, expecting a bounce-Daily 200 SMA/EMA

-Bottom of primary trend channel

-Fib 1.618 of lower Distribution (or Reaccumulation) phase

-2012-2013 triple top (previous bull market top if you discount the initial blow off top)

-Fib 1.272 extension of BC to AR Distribution (or Reaccumulation ) phase

-Supply zone at ~1800

-Lowest 4Hr RSI since Aug-2018 (Wyckoff spring and start of current bull market)

-Bottom of Fall season channel

-1800 nice round number

I'm expecting a bounce or a bottom here...

THE WEEK AHEAD: LB, ARMK, TGT EARNINGS; XOP, GDXJ, KRE, IWM/RUTEARNINGS-RELATED VOLATILITY CONTRACTION PLAYS:

LB (7/69/16.0%):* Announcing Wednesday after market close.

ARMK (11/56/13.1%): Announcing Tuesday before market open.

TGT (30/39/8.6%): Announcing Wednesday before market open.

Honorable Mentions:

LOW (23/39/8.6%): Announcing Wednesday before market open.

HD (17/31/6.7%): Announcing Tuesday before market open.

WMT (24/30/6.4%): Announcing Tuesday before market open.

Pictured here is an LB December 18th (34 days) 29/39 short strangle paying 1.99 at the mid price as of Friday close (.99 at 50% max) with 2 x expected move break evens.

EXCHANGE-TRADED FUNDS RANKED BY BANK FOR YOUR BUCK:

XOP (14/54/12.7%)

GDXJ (15/46/11.3%)

KRE (26/45/10.6%)

USO (6/50/10.3%)

BROAD MARKET RANKED BY BUCK BANG:

IWM (25/31/6.9%)

QQQ (23/29/6.3%)

SPY (16/23/4.9%)

EFA (17/20/4.6%)

* -- The first number is the implied volatility rank or percentile (i.e., where 30-day implied volatility is relative to where it's been over the past 52 weeks); the second, 30-day implied volatility; and the third, the percentage the December at-the-money short straddle is paying as a function of stock price.

Gold and the next leg upGold looks like it's about to make a new leg higher but will it also drop 5-7% first? The dollar and gold tend to create very distinctive price cycles if you know how to look for them. Renko helps to see these price cycles and time seems irrelevant to them. I am seeing a cycle low in the works now but I'm not sure if it's complete yet. I will venture to say it's going to drop down into the 1700's before the next leg up but I'm not sure if we'll get that lucky. See my forecast on GDX (gold miners) and how this analysis could agree with that one. Smart money likes to flush the boys out so I am just expecting a wild ride here soon.

Goldaholics AnonymousGold is zooming.

Why?

The DXY.

As we can see on the monthly DXY chart, the developing pattern parallels history.

1. It bounced off the 200 EMA

2. It broke trend, retested, and failed

3. It collapsed

The RSI and MACD are weak

What happened to Gold last time DXY collapsed?

Trading Signals

Buy Signal: Weekly RSI lows

Sell Signal: Weekly RSI highs

See previous posts for fibonacci extension targets.

Long MGC futures Feb(G)2021

Trading is risky and should not be attempted, ever.

Year End Up MoveThis is what I expect for the next three months, and this is what I am betting.

1) If the Impulse has the same momentum as 2019, target in length and strength will led us to 82 at the end of January, and Gold about 2.200 $

2) If the impulse has the same momentum as 2020 (summer), target is 78 or so at the end of the year.

There is no so much difference in both targets, and there is a month or so in time. That means several things for me:

1) The most conservative target would be 78 $, which is a 30% rise from current levels in a few months (60% in JNUG)

2) If the move ends in January, the pace would be "slow", which means corrections of 7 % or 8 % for some days. So deal with it.

3) Both moves are in the channel. And depending on how gold does, we could move up the upper line of the channel, but that would be in January, although we could have some clues during December. Then, targets would be GDXJ 96 of something similar. But that would be like a good desert after a nice meal.

4) I´m much more confidence that the move will last until the end of January, because of other factor and indexes.

So, prepare for a bull or be ...

www.youtube.com

Have a nice and profitable week.

THE WEEK AHEAD: DKNG, BYND, LYFT EARNINGS; XOP, GDXJ, SLV, QQQEARNINGS ANNOUNCEMENT VOLATILITY CONTRACTION PLAYS:

WKHS (18/146/38.8%),* Monday, before market open.

PLUG (32/100/25.6%), Monday, before market open.

DKNG (32/89/23.6%), Friday, before market open.

CGC (39/132/23.5%), Monday, before market open.

BYND (32/77/18.9%), Monday, after market close.

LYFT (16/71/18.0%), Tuesday after market close.

Pictured here is a BYND December 18th 130/200 short strangle that was paying 7.95 at the mid price as of Friday close, with the short legs camped out at the 18 delta. This yields at or greater than two times expected move break evens and a delta/theta metric of -.58/23.86.

Alternative Defined Risk Setup: BYND December 18th 125/130/200/205 iron condor, paying 1.59 at the mid price as of Friday close with break evens at the expected move on the put side/greater than 2 x the expected on the call and delta/theta metrics of .96/2.45.

Unfortunately, WKHS, PLUG, and CGC all announce on Monday before the open, so any play would've been best put on before the end of Friday's session, although they could still be playable after they make their earnings announcement move.

LYFT: Short straddle or iron fly.

DKNH: Short strangle or iron condor.

EXCHANGE-TRADED FUNDS RANKED BY PERCENTAGE OF STOCK PRICE THE DECEMBER AT-THE-MONEY SHORT STRADDLE IS PAYING:

XOP (14/53/14.1%)

USO (9/57/13.4%)

GDXJ (16/47/12.9%)

SLV (38/50/12.7%)

GDX (16/39/10.9%)

EWZ (17/41/10.7%)

XLE (25/41/10.6%)

BROAD MARKET RANKED BY PERCENTAGE OF STOCK PRICE THE DECEMBER AT-THE-MONEY SHORT STRADDLE IS PAYING:

QQQ (25/30/7.2%)

IWM (24/29/7.2%)

SPY (19/24/6.0%)

EFA (21/21/5.3%)

IRA DIVIDEND EARNERS RANKED BY PERCENTAGE OF STOCK PRICE THE DECEMBER AT-THE-MONEY SHORT STRADDLE IS PAYING:

SLV (38/50/12.7%)**

EWZ (17/41/10.7%)

XLE (25/41/10.6%)

KRE (22/39/10.5%)

* -- The first metric is the implied volatility rank or percentile (i.e., where 30-day implied volatility is relative to where it's been over the past 52 weeks); the second, 30-day implied volatility as of Friday close; and the third, what the December at-the-money short straddle is paying as a percentage of stock price.

** -- Neither SLV nor GLD pay a dividend.

THE WEEK AHEAD: ROKU, WYNN, SQ EARNINGS; XOP, USO, GDXJ, EWZEARNINGS ANNOUNCEMENT VOLATILITY CONTRACTION PLAYS:

... Screened for options liquidity and 30-day implied greater than 50% and ranked by "bang for your buck":

ROKU (38/31/16.4%),* announcing Thursday after market close.

WYNN (27/76/14.7%), announcing Wednesday (no time specified).

SQ (43/74/14.3%), announcing Thursday after market close.

PYPL (56/60/11.6%), announcing Monday after market close.

GM (20/59/11.4%), announcing Thursday after market close.

QCOM (45/54/10.9%), announcing Wednesday after market close.

BABA (65/55/10.5%), announcing Thursday after market close.

Pictured here are two 2 x expected move setups in ROKU, one in November (19 days 'til expiry), and one in December (47 days 'til expiry).

The November setup was paying 8.55 at the mid price as of Friday close, with delta/theta of -.89/51.22; the December: 10.13 at the mid price as of Friday close, with delta/theta of -.95/27.88. I could see doing either, with the primary benefit of the shorter duration being that the volatility contraction tends to be more rapid, and with the primary benefit of the longer duration one being that you've got a little bit more room to be wrong.

If you're of a more defined risk bent, look for an iron condor setup paying at least one-third the width of the wings in credit, such as the November 20th 160/165/265/270, paying 1.63.

Look to put this on in Thursday's session prior to market close, adjusting strikes as necessary to accommodate movement between now and then.

With the exception of GM, the remainder of the underlyings can be short strangled or iron condored, but would go short straddle or iron fly in GM due it's size (34.53 as of Friday close).

EXCHANGE-TRADED FUNDS RANKED BY PERCENTAGE OF STOCK PRICE THE DECEMBER AT-THE-MONEY SHORT STRADDLE IS PAYING AND SCREENED FOR THOSE PAYING >10%:

XOP (23/69/18.7%)

USO (14/71/17.5%)

GDXJ (22/56/15.7%)

EWZ (29/56/15.5%)

XLE (38/57/14.9%)

GDX (23/46/13.3%)

SLV (28/48/13.0%)

XBI (36/44/12.1%)

EWW (35/49/11.6%)

IWM (42/42/10.8%)

SMH (28/42/10.9%)

QQQ (43/40/10.8%)

BROAD MARKET:

IWM (42/42/10.8%)

QQQ (43/40/10.8%)

SPY (38/38/9.6%)

EFA (33/30/8.4%)

IRA DIVIDEND-EARNERS RANKED BY PERCENTAGE OF STOCK PRICE THE DECEMBER AT-THE-MONEY SHORT STRADDLE IS PAYING AND SCREENED FOR THOSE PAYING >10%:

EWZ (29/56/15.5%)

XLE (38/57/14.9%)

KRE (32/50/14.1%)

SLV (38/48/13.0%)**

XBI (37/44/12.1%)

* -- The first metric is the implied volatility rank or percentile (where 30-day implied is relative to where it's been over the past 52 weeks); the second, 30-day implied volatility; and the third, the percentage of stock price the November at-the-money short straddle is paying.

** -- SLV does not pay a dividend.

Suffering with my long Position GDXJ I would like to share my thought about our current stage, as things seems to go wrong.

1) So far, the long term view has not been damaged. That means, I still see a new up leg. The base, that means the consolidation, has taken more that I thought. So It went out of the two parallel lines of the channel. So as it is said: the larger the base, the larger the move.

2) We are at a critical juncture. Historically, these lines have been good supports, even in the previous bull market (2000-...) So I'm confident that they will remain as supports.

3) Correction should have ended today. Although i don't have confirmation until tomorrow. I am not selling. I don't expect more falling. A new 4-5 days move up should start tomorrow and some gaps up (if not all) should be filled

4) During the previous consolidation, we also have a day under the line.

5) That's my point, and I don´t want nobody to suffer if I´m wrong, so please be care always. I've wrong in the pass and I will be wrong again, hope not this time.

GDX I'VE BEEN WAITING FOR THIS$nugt $dust $gdxj $jnug $jdst $slv $gld

Renko is not playable in published ideas so I'll update this chart. My last post got little attention and I've been warning people about a sudden drop in gold, silver, miners. We're setting up a new buying opportunity but how low does it go? I would like to see GDX between 28-32. Hold fast.

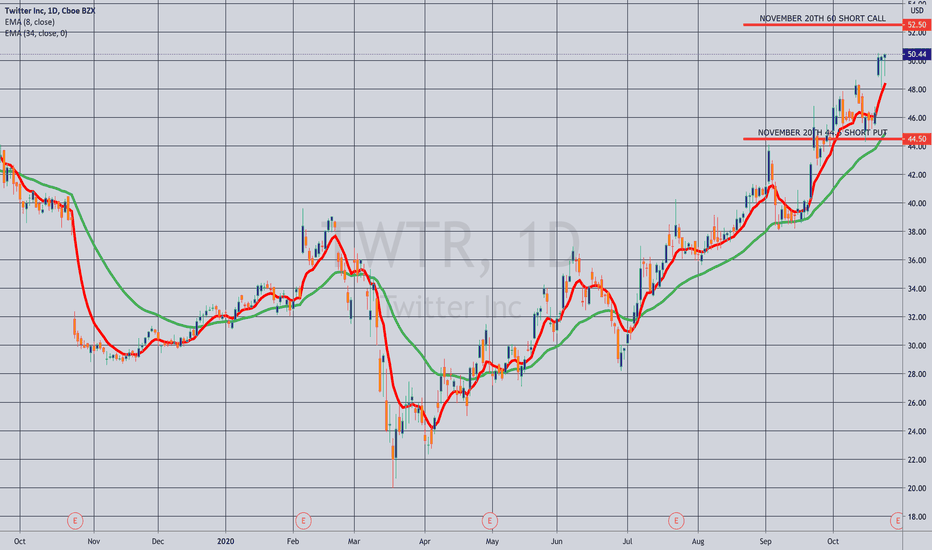

THE WEEK AHEAD: TWTR, MGM, AMD EARNINGS; JETS, XOP, GDXJEARNINGS:

If you like to play earnings for volatility contraction, there are a ton this coming week. Here are the ones that made my cut for volatility contraction plays based on options liquidity and bang for your buck as a function of stock price:

TWTR (49/73/15.9%),* announcing Thursday after market close.

MGM (16/69/15.2%), announcing Thursday before market open.

JBLU (22/73/14.6%), announcing Tuesday before market open.

TECK (20/64/14.1%), announcing Tuesday before market open.

AMD (30/62/14.0%), announcing Tuesday after market close.

BA (19/59/12.4%), announcing Wednesday after market close.

FB (47/52/11.1%), announcing Thursday after market closes.

Honorable Mentions:

AMZN (63/51/11.2%), announces Thursday after market close. (Option illiquid).

AAPL (36/47/9.8%), announces Thursday after market close. (November 20th short straddle paying less than 10% of stock price).

GOOG/GOOGL (40/40/8.6%), announce Thursday after market close. (Options illiquid).

MSFT (32/40/8.2%), announces Tuesday after market close. (November 20th short straddle paying less than 10% of stock price).

Pictured here is a TWTR short strangle in the November 20th expiry (26 days) with the short options camped out at the 22 delta. Paying 2.72 at the mid price as of Friday close, it has -.55/10.56 delta/theta metrics and break evens wide of 2 times the expected move on the call side, between the expected and 2x on the put.

For those of a defined risk bent, the uneven winged** November 20th 40/44.5/60/65 iron condor pays 1.50, has delta/theta metrics of 2.53/3.43, and has a 2x expected move break even on the call side and an expected move break even on the put.

MGM: Short straddle or iron fly with risk one to make one metrics; 25% of credit received take profit.

JBLU: Short straddle or iron fly with risk one to make one metrics; 25% of credit received take profit.

TECK: Short straddle or iron fly with risk one to make one metrics; 25% of credit received take profit.

AMD: Short strangle with 2 x expected move metrics; iron condor paying one-third the width of the wings; 50% of credit received take profit.

BA: Short strangle with 2 x expected move metrics; iron condor paying one-third the width of the wings; 50% of credit received take profit.

FB: Short strangle with 2 x expected move metrics; iron condor paying one-third the width of the wings; 50% of credit received take profit.

EXCHANGE-TRADED FUNDS RANKED BY BANG FOR YOUR BUCK AND SCREENED FOR THE DECEMBER AT-THE-MONEY SHORT STRADDLE PAYING >10% OF STOCK PRICE:

JETS (12/50/16.1%)

XOP (15/56/16.0%)

GDXJ (17/49/15.1%)

SLV (36/48/13.9%)

EWZ (17/43/13.3%)

XLE (26/44/12.6%)

GDX (16/40/12.6%)

XBI (30/41/11.6%)

SMH (21/35/10.3%)

EWW (23/35/10.0%)

I threw JETS in here due to continued high implied volatility in airlines which is sticking in there even for names that have already announced "earnings" (or lack thereof) (e.g., DAL (63.5%), UAL (80.7%), AAL (106.6%)).

BROAD MARKET:

QQQ (30/34.9.7%)

IWM (29/33/9.0%)

SPY (23/27/7.6%)

EFA (23/24/6.3%)

IRA DIVIDEND-PAYERS SCREENED FOR THE DECEMBER AT-THE-MONEY SHORT STRADDLE PAYING >10% OF STOCK PRICE:

KRE (25/45/13.3%)

XLE (26/44/12.6%)

EWZ (17/43/13.3%)

* -- The first metric is the implied volatility rank (where 30-day implied volatility is relative to where it's been over the past 52 weeks); the second, implied volatility in expiry nearest 30 days until expiry; and the third -- for earnings: what the November at-the=money short straddle is paying as a function of stock price; for exchange-traded funds, broad market, and IRA dividend-payers, what the December at-the-money short straddle is paying as a function of stock price. For lack of a better term, I've dubbed this last metric as the "bang for your buck".

** -- Only 5-wides are available on the call side.

Gold Junior Minors, when to get on the trainLooking for GDXJ to break above 60 for a potential bull breakout with a target around 90

Or, a breakdown to the 200 day moving average to 42 to 48. It's harder to predict this bottom because of the expected upcoming volatility, so buy orders spread throughout this lower range is a good strategy to catch some (if not all) of that bottoming activity before the great bounce.

Of course there is always the chance it would break down even lower, but as always this is not financial advice, don't risk more than you can loose, etc.