Gbpusd_forecast

GBPUSD SHORT ACTIVE: M15I'm trying to keep my trading as simple as possible and just constantly keeping an eye on OF.

1. This was my POI this morning on the M15 for limit short as this is the zone that led to the previous BOS. (cs x1)

2. We have CH which pushed into the SZ you can also see the same thing happening with my previous trade.

3. The market also moved into the premium. (cs x2)

4. In plan to take 80% of my trade at the weak low.

5. Im going to let the trade run to see if it heads towards my H1 DZ.

-------------------------------------

Daily perspective:

1. This daily DZ has my H1-DZ nested within it, could be a powerful move however it has been mitigated so there could be a short-term reaction and then a further push down.

2. This daily DZ has also been mitigated.

3. I think this daily DZ would be a prime choice to push the market back to the upside because there is buy-side liquidity here, not only that it pushes just out of discount prices and would break a strong swing low which led to the previous BOS.

GBPUSD (ROAD MAP with detail)hello dear traders

In a bearish Qml (Quasimodo Pattern) target was previously violated high when price was forming a higher high and used as an entry point for a sell setup.Advance QML Trading In Forex | Advance Quasimodo Pattern

Advance QML (Quasimodo Line) trading is an advanced trading concept that aims to improve the probability of winning in trading by incorporating high-probability trading strategies such as order blocks and fair value gaps, along with other institutional trading techniques. This concept was introduced by GhostTraders back in 2018 after discovering ICT (Inner Circle Trader) trading concepts as a Quasimodo Line trader.

GhostTraders blended ICT trading concepts with Quasimodo Line trading concepts to develop the concept called Advance QML Trading. The purpose of this blending was to create a simplified and professional approach to trading, leveraging the proven strategies and methodologies used in institutional trading to increase the likelihood of successful trades.

stoploss need for any position

good luck

mehdi

GBPUSD: Bounces off over one-week low!In the Asian session on Friday, the GBP/USD pair is making a slight upward movement, distancing itself from the previous day's low of around 1.2840-1.2835. However, there isn't much momentum in spot prices and the market is currently trading near 1.2880, with a modest increase of just over 0.10% for the day.

Crunch Time: Will Sellers Break the Barrier? GBPUSD in Focus Traders are heavily bullish on the British pound, with net long positions exceeding a whopping $4.7 billion as of July 11, the highest level since mid-2014. Traders are ramping up their expectations for the Bank of England to implement additional interest rate hikes while increasingly under the impression that U.S. rates are on the verge of reaching their peak. Notably, the US Federal Reserve has entered a "blackout period" ahead of their July 26 meeting. As a result, this sentiment could put downward pressure on the U.S. dollar.

Meanwhile, the UK's inflation figures are a major risk event to watch for this week. Although there is an expectation for a drop in the inflation rate (from 8.7% to 8.2%), it is anticipated to remain four times higher than the Bank of England's official target. UK inflation data is due at 2 am (NY time) on Wednesday.

On the chart, the GBPUSD continues to explore lower levels following a test of a high target near 1.31465 on the daily chart last Friday. The market saw a modest corrective downward move last Friday, and again the first trading day of this week. This allowed the 20-day moving average to catch up with the price action. The big question now is whether sellers can push prices below the psychologically important level of 1.3000 ahead of the release of UK inflation data. The presence of buying pressure adds uncertainty to the situation.

GBP/USD Breakouts as UK Battles Inflation and Economic ChallengeRecent reports have indicated that the United Kingdom is facing its highest inflation levels in years, with various factors contributing to this uptrend. While this may raise concerns for some, as astute traders, we know that volatility often presents opportunities for substantial gains. The GBP/USD pair has become an enticing market to explore, reflecting the ongoing struggle between inflationary pressures and economic data.

You might be wondering, "Why should I consider adding GBP/USD market orders to my trading strategy?" Well, dear traders, the answer lies within the potential for significant profits derived from this exciting market. By closely monitoring the UK's economic landscape and keeping a keen eye on inflationary trends, we can seize the moment and capitalize on the fluctuations of the GBP/USD pair.

So, let's dive into the call to action! I encourage you to take advantage of this moment and consider adding GBP/USD market orders to your trading repertoire. By doing so, you position yourself to potentially reap the rewards of the UK's highest inflation levels and the impact of poor economic data on the pound. As we navigate these challenging times, let us remember that adversity often breeds success for those willing to take calculated risks.

To maximize your potential gains and minimize risks, I recommend conducting thorough research, staying updated with the latest news, and utilizing technical analysis tools to identify breakout points and establish appropriate stop-loss levels. Remember, knowledge is power, and a well-informed trader is successful!

FOMC Minutes in the Charts: EUR/USD & GBP/USDDuring their June meeting, minutes released on Wednesday indicated that almost all Federal Reserve officials expect further tightening in the future. Despite the majority's belief in upcoming rate hikes, policymakers chose not to increase rates due to concerns about over-tightening. They acknowledged the delayed impact of previous policies and other factors, which led them to skip the June meeting after implementing ten consecutive rate increases.

Out of the 18 participants, all but two anticipated at least one rate hike to be appropriate within this year, while twelve members expected two or more hikes.

The prevailing consensus that the US central bank will raise borrowing costs by 25 basis points at the end of the July policy meeting has lent some strength to the US Dollar and exerted downward pressure on the GBP/USD and EUR/USD. The DXY (US Dollar Index) surged above 103.30, reaching its highest level of the week.

EUR/USD further declined to the 1.0850 region. The outlook for the Euro has turned negative as the EUR/USD pair dropped below the 20-day simple moving average (SMA).

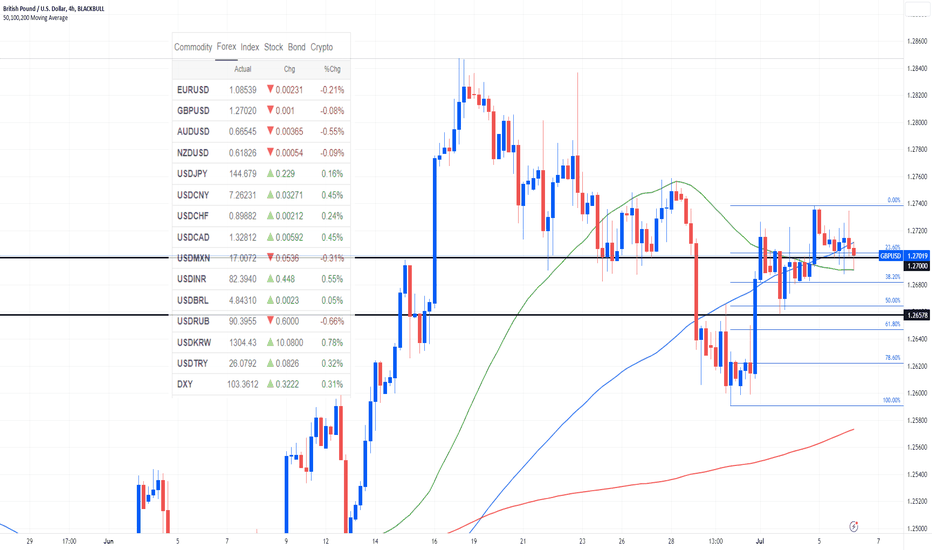

If the GBP/USD pair falls below 1.2700 and confirms that level as resistance, the next potential bearish targets could be 1.2680, 1.2658, 1.2647 according to fib retracement levels and previously pivot points.

#GBPUSD-700+ SELLING SETUP❤️TRADERS, we still believe GBPUSD price will come to this region before it start dropping heavily, let's not miss out on this great opportunity. Price dropped recently due to bullishness of the DXY though next week NFP is our target. Which will help a lot.

Like and Share.

Thanks all, as always ❤️

GBPUSD Strong correction before the declineHi, According to GBPUSD Market Analysis. There is a high probability of further decline. With the pair retreating from a very strong resistance at the level of 1.25500, and a strong correction of the golden ratio of 0.61%. We also notice a downward channel. The price has broken the upward trend. in green, as shown in the analysis. Good luck everyone .Note: If you like this analysis, please give your opinion on it. in the comments. I will be happy to share ideas. Like and click to get free content. Thank you

GBPUSD ascent is overHello, traders. According to my analysis of the GBPUSD pair. There is a high probability of going down. With the price reaching a very strong resistance. At the level of 1.26300. There is also a trend of the ascending channel that came in this area. The candles are very negative for the daily time frame. They indicate the strength of the sellers. good luck for everbody .Note: If you like this analysis, please give your opinion on it. in the comments. I will be happy to share ideas. Like and click to get free content. Thank you

GBPUSD Heading downhello, according to my analysis of gbpusd pair. The pair is still in a negative position, with breaking the strong support at 1.24000. With a negative candle on the daily frame. The pair is heading to the 1.2200 area. good luck for everbody. Note: If you like this analysis, please give your opinion on it. in the comments. I will be happy to share ideas. Like and click to get free content. Thank you

From phase to phaseDistribution phase influenced a change in market structure after price broke out of the the. The market formed a low volume bearish order flow. At level 1.23919 the market started to consolidate, created accumulation phase and pushed to the upside. With this pullback in place, we should expect price to tap into the order block in order to give an impulsive move to the 4h order block at 1.25649…

GBPUSD 18May2023According to the previous analysis, when the price drops more than the red line, there is a high probability of a reversal. I readjusted wave analysis notation. Corrections that occur can occur simply by looking at the current bullish DXY analysis conditions. I am looking for an area to sell with the upper limit of the invalid area, when the price suddenly rises and penetrates the invalid area then this analysis will be invalidated

GBPUSD: The influence of the dollar!Fundamental Overview of me

Last week, GBP/USD suffered a loss of almost 200 pips. However, the new week has started on a positive note for the pair as it has made a recovery towards 1.2500. As there are no major data releases planned, the pair's movement for the day will depend on the risk perception.

During the second half of the previous week, GBP/USD was continuously under bearish pressure, as USD gained strength from safe-haven flows. Additionally, the cautious approach of the Bank of England towards further rate hikes and Governor Andrew Bailey's positive outlook on inflation added to the burden on Pound Sterling.

Plan trade in the intro