US Federal Funds Rate (FF) vs the SPXIncreases in the US Fed Funds rate during the FED's hiking cycles have always preceded a recession.

A simple analysis of the most recent recessions, the amount of rate hikes preceding them and the downward trending channel in which FED Fund Rates have moved suggest the FED only has room for 150bp worth of hikes (or a total of 6 hikes).

OANDA:SPX500USD FRED:FEDFUNDS

FEDFUNDS

One of the Most Important Charts You Will Ever SeeThe bond market often has an inverse relationship with the stock market since it is considered a 'risk off' asset. Bonds generally yield more interest for longer maturities. For example, a bond investor in a healthy economy would expect a greater yield for a 10 year treasury compared to a shorter duration. However, the yield curve can 'invert' (shorter term bond actually pays greater interest) when bond traders believe a recession is imminent. Since the Fed's reaction to a recession is to drop short-term rates to 0% and recessions cause 'risk on' assets like stocks to drop, the smart money will rotate from higher risk stocks (like tech, since it's future cash flows are highly sensitive to the cost of capital) and hide out in bonds to weather the storm and minimize downside risk.

Yield inversion info: www.investopedia.com

This chart shows the interest spread between 10 and 2 year treasuries in blue.

Shaded vertical boxes show where the yield curve inverted in the past.

The S&P is in red (at least I think it's red. I am color blind). Note how the shaded boxes start just prior to the dot.com peak, the GFC peak, and even the Covid recession.

Currently the interest spread is heading back towards zero as the Fed is set to hike short-term rates to combat inflation, likely beginning in March. At it's current drop rate, the spread will invert in ~Q4 of this year, which means a recession is on the table for the first half of 2023.

Keep checking back for updates as I will be watching this one VERY closely.

The Credit Cycle - QTM The Business Cycle has not been the Cumulative Driver of Economic Expansion.

And why the Quantitative Theory of Money is at best incomplete.

________________________________________________________________________

We are in an Extension of the Credit Cycle - an Experiment gone horrifically wrong.

_________________________________________________________________________

Typically the Equity Complex adjusts to what is perceived as too much tightening.

The Federal Reserve knows it must pace itself and they will. The wording on January, 26th

will be Key - as If the Raven comes off too aggressive, Participants will look forward initially

and perceive a Shock.

The assumption within the Model is one of declining Prices once the FED begins to tighten.

Not going to happen, Prices will continue to Rise in REAL TERMS and Purchasing Power Parity

will continue to be reduced by ever more insidious amounts.

__________________________________________________________________________

Perception Management is the FEDs Agenda for managing their Domain.

Cui Bono?

Up to you to provide our own answer(s).

M2 never declines.

Velocity can increase when price increases cause a reactionary chase to hoard what will

be perceived to be higher in price in the Future, then and only then will we see M2 Velocity

Increase.

___________________________________________________________________________

Productivity of Capital - The average credit cycle is longer than the business cycle in duration

as TIME requires a weakening of corporate fundamentals and property values, the 2 indicators

most closely followed with respect to ASSET Valuations.

Extreme extensions of credit in terms of amount and period in conjunction with Fiscal Policies

can further Distort and Distend the Malignant System.

____________________________________________________________________________

Presently, the ONLY thing keeping this dysfunctional system together is the Federal Reserve.

The rest of it is for Historians to sort out, as it has all been dumped on its collective head.

Functioning, or properly functioning Markets that are efficient and open to information flow.

We do not nor have not seen in a very long time.

Playing Poker with a Blindfold is not "Investing" it is speculating everyone else is wearing

one as well.

They are not.

FEDFUNDS - Will See Light Again!I am not a fundamental expert (nor an economist) but I found FEDFUNDS chart really interesting!

I never thought that basic technical analysis tools can also be applied to such economic instruments!

From a technical perspective, FEDFUNDS has been bearish for a while making lower lows and lower highs.

For the momentum to be shifted from bearish to bullish, as mentioned in the title "see light again", FEDFUNDS has to break above the last swing high. (highlighted in gray as trigger)

It would be interesting to hear your thoughts on this one.

~Rich

Zero/Negative Rates Don't Work - Savings Rate - BuybacksQuick one here, given the world looks set to resume it's ludicrous experiment with negative rates in order to spur "growth" and encourage spending.

I thought it was only reasonable to see what effect the past decade of ZIRP (Zero Interest Rate Policy) has had on the personal savings rate.

Before we begin, i understand that the fed funds rate is not the explicit rate at which retail individuals are able to take loans out, but it is the internal cost of money for banks, i.e. the lower the fed funds, the lower the rate at which the banks would need to make loans in order to be profitable (in theory).

As we can see, the savings rate and the fed funds rate moved, very loosely in the same direction all the way up to the GFC.

At this point the fed started QE and introduced ZIRP in an attempt to coax the public into taking on more debt and going into the real economy and spending money. But rather, the public began to increase their savings rate, in other words, the fed's plan backfired.

In fact, the only real boost from the low rates has been from corporate buybacks, with buyback programs and corporate stock purchases being the largest contributor to the (now dead) bull market.

So one has to wonder, what was the purpose behind the artificially low rates?

I adhere to the view that if you are in doubt as to the motivation for a particular action, look at the consequence and infer motive from the outcome.

When viewed through this lens the fed's motive for lowering rates was to bailout corporate America and further enrich the executives, CEOs and directors, aided by free money with which they gave themselves golden parachutes, share buybacks and generous bonuses.

Hmm...

I guess ZIRP, QE and the other programs the fed rolled out in 2008 onwards was a stunning success then.

-TradingEdge

Corporations buying their stock back

www.zerohedge.com

Macro Deep Dive - SPX, Initial Claims, Yield Curve and Fed FundsCharts:

- Top left = SPX

- Bottom left = Initial jobless claims (unemployment metric)

- Top right = US 10 year and US 2 year spread (Yield curve inversion metric)

- Bottom right = Fed funds rate (short-term interest rates)

It is no secret that US equities are grossly overvalued, from Warren Buffet to Stanley Druckenmiller to Ray Dalio, the smart money has made their case for why US stocks simply cannot justify their valuations indefinitely.

Yet Stocks continue higher, largely due to massive CB liquidity, spurred on from fears of a global slowdown and the ensuing economic impact this would have on such indebted nations and consumer, this coupled with the supply chain shock that the Corona-Virus is undoubtedly having on global trade is a recipe for disaster.

So what are the macro/ recession indicators saying?

They are flashing red.

The Initial claims are at record lows, which sounds fantastic, until you realize that most major recessions and even depressions are accompanied with low, not high, unemployment. Recessions strike when everyone is complacent, when they are fat and happy and when they have their blinders on.

I will be watching the initial claims and will look for the the claims to spike and reverse trend, as this is a much stronger indicator of structural weakness within the economy.

Moving over the the US10y/ US02y spread, it is well known that the yield curve briefly inverted in 2019, however, the initial inversion is not the point to sell, this is due to the yield curve inversion being a leading indicator of recession. Historically, from the point of first inversion to the inevitable decline in equities, is roughly 12 months to 18 months.

We are 7 months into the initial inversion and the yield curve looks like it is going to invert yet again.

Finally we have the Fed funds rate, the targeted overnight lending rate for the Federal Reserve.

The trend is clearly down, down, down with rates this has been rocket fuel for bonds which are now traded akin to equities for capital appreciation, rather than the interest bearing assets they were designed as.

Furthermore, and perhaps most interestingly, it is not the point where rates are raised that signal trouble for stocks, but rather once the Fed pivots and reverses course and begins easing and lowering rates, THIS, not the rate hikes is the signal to watch for.

It comes as no surprise then, that interest rate cuts have not only begun, but are in full swing, with further rate cuts this year, already being priced in.

The macro outlook looks bleak, this bubble CANNOT last forever, however i firmly believe that the Banksters will not let this bubble burst without a fight, a global slowdown, coupled with global equity markets crashing would cause widespread panic and in some places, riots.

So keep an eye out for the helicopter drop of money coupled with bail ins, bail outs and of course, more QE.

-TradingEdge

Fed Funds RateGoing to 0 and beyond. One of the few charts that can go in the negative. Lower highs and lower lows for 30 years. Once the market catches wind of lower interest rates it can't get enough. It's a race to the bottom for all developed world interest rates. To full investment and then what happens? The real problem is the velocity of money keeps dropping with every drop in interest rates. Why sell something if it is always going to be worth more?

The only answer is to buy Bitcoin of course.

Gold's Reaction to a dovish FedOutlined in the chart is gold's reaction to 3 fed dovish fed announcements

1. A end of "autopilot" rate hikes

2. A quarter point rate cut

3. A second quarter point cut

Each of these decisions lead gold higher in the medium term. In the very short term, it has formed the same pattern. An initial dump in the price of gold, followed by a small cupping shape and then a quick breakout. Gold should continue on another rally similar to the previous 2 fed decisions.

$SPX 1M Inverted, $FEDFUNDS/$US10Y OverlayMarket curve turned decidedly parabolic after FED interest rate peak around 1981.

The parabolic growth of the S&P500 Index and broader stock market over the past 28 years appears to correlate with progressively declining interest rates.

Every major reversal (rate increase) in the rate decline has been followed by a stall or decline in the value of $SPX.

The most recent reversal in rate decline has a few unique characteristics which are unprecedented:

1. It is far less steep than all previous rate increases.

2. It is a reversal from the LOWEST and LONGEST rate plateau in history.

3. If the last rate decline had followed form to the others, it would have dropped to -0.44%, already reversed, and resumed decline on the way to -1.98%. Central bankers avoided targeting negative rates, but at the cost of having to hold the rate just above ZERO for far longer.

4. It's a matter of scale/perspective of course, but $SPX and $FEDFUNDS have now crossed with greater divergence than has been seen in almost 30 years.

Note also the decline in $VIX and in $SPX volume in recent weeks.

I predict the next market reversal to be far more violent than 2008. I predict that it will trigger in the next 6-12 months unless the FED lowers interest rates significantly.

If the correlation between $FEDFUNDS and $SPX is a causal relationship, then the FED is stuck between targeting negative interest rates indefinitely and accepting the start of a deep recession lasting not less than 12+ years.

I am NOT advocating for negative, or even lower interest rates.

I would instead call for a return to sound money.

Buy bitcoin.

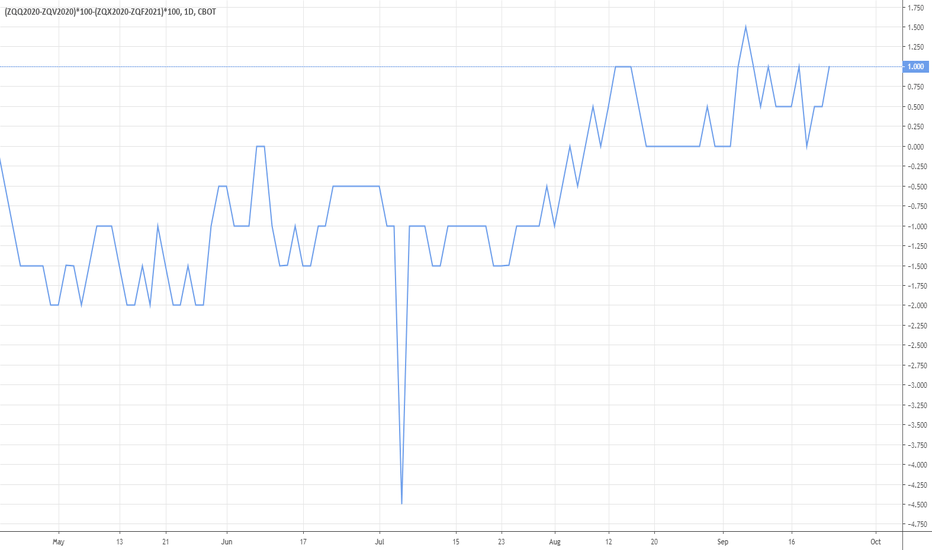

FED FUNDS CONDOR AUG19-OCT19 vs NOV19-JAN19FED FUNDS CONDOR AUG19-OCT19 vs NOV19-JAN19

(FFQ2019-FFV2019)*100-(FFX2019-FFF2020)*100

USD STIR RALLY PUTS USD BACK ON BID: FED ROSENGREN SPEECHFed Funds Rallied up from 18% to 33% on the day with Fed rosengrens hawkish comments the only likely impetus.

Imo DXY here at 95 mid has an easy 50bps of topside left in it if rates can hold here at 33%, UST also seen higher across the board with the bench mark 10y yield breaking pre-brexit levels.

Long DXY, and shorting $yen on rallies is the way I intend on playing this, yen from a risk-off perspective imo is still cheap whilst USD been heavily offer for the past week.. rates need to hold up though so this is tactical positioning rather than a structural 21st Sept Fed bet. SPX likely to remain underpressure too whilst rates trade here so short positioning is paying off though i still like SPX lower to 2000s and will be holding for this.

Fed Rosengren Speech Highlights:

Fed's Rosengren: Gradual Interest Rate Increases 'Appropriate'

Rosengren: U.S. Economy Resilient Despite Drag From Overseas

Rosengren: Could Reach or Exceed Full Employment 'Over the Course of the Next Year'

Rosengren: 'Reasonable Case' for Gradual Interest Rate Increases

Rosengren: Weakness in Recent GDP Readings Reflects Inventory Adjustments

Rosengren: Expects Growth to Exceed 2% Next Two Quarters

Rosengren: 80,000 to 100,000 Jobs a Month Needed to Keep Unemployment Rate Constant

Rosengren: Stock Prices, Volatility Gauge Show U.S. Resilience

Rosengren: Commercial Real Estate Prices Have Risen Rapidly

Rosengren: Risks to Forecast 'Increasingly Two-Sided'

Rosengren: Waiting Too Long to Raise Rates Could Lead to 'More Pronounced' Slowdown in Growth

DXY: Interesting weekly shortThis is a follow up trade to my prediction of the top for the Dollar.

Check related ideas for my previous forecast.

We have a very good trade setup here and the target and expected ETA is on chart.

The lackluster reaction to the Fed's rate hike and the current sentiment readings make me think that this trade setup is of high probability, making it an ideal trade to take asap. When fundamentals and technicals align, we get the best results.

Good luck!

Ivan Labrie.