Eurjpyforecast

EURJPY top-down analysisHello traders, this is the full breakdown of this pair. We will take this trade if all the conditions are satisfied as discussed in the analysis. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

EUR/JPY : SWING PRICE ACTION - PRICE IS GROWING ! LONG SETUP ⚡️Hello Everyone, I hope you'll Appreciate our Price action Analysis !

Our strategy is based on Swing trading with price action Analysis and Advanced Fibos tools.

Please support our page by hitting the LIKE 👍 button to this Idea and Follow us to get NEW ONE!

Feel free to request any pair/instrument analysis or ask any questions in the comment section below.

If you like this idea or have your own opinion about it, please write your own in the comment box . We will be glad for this.

Have a Good Take Day_Profits !

EURJPY: Two Trading OptionsThis is an illustration of the two potential trading scenarios that may present themselves in this region.

Option 1

Price fails here after wiping two previous high liquidity points and comes back to mitigate buyers before rising again.

Option 2

Price pushes higher to regain liquidity from some long term sellers before continuing bearish down to the structural region.

What option are you going for?

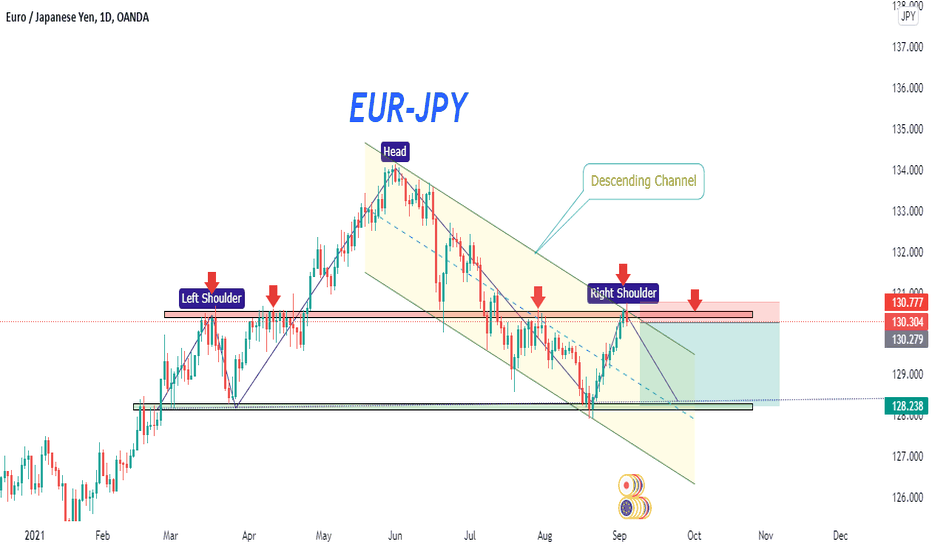

EURJPY-Short#EURJPY

Market has pushed back from resistance level.

In daily timeframe market is repeating history.

Looking forwad that pair will form Heada&Shoulder pattern.

At the same spot i am seeing descending channel and currently market has pulled back into it from resistance.

So all things supporting strong sell. Don't miss opportunity.

EUR/JPY Sell opportunity eur jpy broke the strong zone and went all the way down to 1.28000

now market is at broken structure to retest

look for bearish confirmation on lower time frames and enter short with your own money management

always remember that patience and discipline are the key to become profitable is Forex trading

EURJPY | Perspective for the new week | Follow-up detailsWith over 400pips move in our direction since my last publication (see link below for reference purposes); The selling pressure surrounding the Japanese yen continues to increase in the latter part of last week trading session and It appears that the Euro has finally found support at Y128.000 with a high probability of a Bullish momentum in the coming week(s).

Tendency: Uptrend (Bullish)

Structure: Breakout | Supply & Demand | Trendline

Observation: i. The Euro remains extremely Bullish from the long term perspective (see weekly chart).

ii. Since hitting a peak @ Y134.000, the bears have been dominating the EURJPY market for the last couple of months (since June 2021).

iii. Bearish Trendline: A visual representation of a line drawn over pivot highs revealed the prevailing direction and speed of price in the last two months.

iv. With selling pressure respecting the Bearish Trendline since June 2021, the sudden Breakout of Trendline on Thursday (25th of August 2021) which also shares a confluence with the Key level @Y129.000 may have incited the idea that seller has finally lost their momentum hereby giving room for buyers to take their stance.

v. Y128.000 level can be identified on the chart as a significant level that has held price strongly "supported" (Demand zone) since March 2021 hereby giving me a conviction that another bullish momentum is right at the corner.

vi. In this regard, I am ready to join the rally in the coming week as long as the price remains above the Key level @ Y129.000 (psychological level).

vii. Another opportunity to add to our existing position shall arise as soon as price breakout/retest Y130.700... Trade consciously!😊

Trading plan: BUY confirmation with a minimum potential profit of 350 pips.

Risk/Reward : 1:5

Potential Duration: 10 to 20days

NB: This speculation might be considered to make individual decisions on the lower timeframe.

Watch this space for updates as price action is been monitored.

Risk Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

EUR/JPY:FUNDAMENTAL ANALYSIS+PRICE ACTION|NEXT TARGET|SHORT🔔🔔The Preliminary Japanese Jibun Bank Manufacturing PMI for August was reported at 52.4, the Preliminary Japanese Jibun Bank Services PMI at 43.5, and the Preliminary Japanese Jibun Bank Composite PMI at 45.9. Forex traders can compare this to the Japanese Jibun Bank Manufacturing PMI for July, reported at 53.0, the Japanese Jibun Bank Services PMI reported at 46.4, and the Japanese Jibun Bank Composite PMI reported at 48.8.

The Preliminary French Markit Manufacturing PMI for August is predicted at 57.3, the Preliminary French Markit Services PMI at 57.0, and the Preliminary French Markit Composite PMI at 56.5. Forex traders can compare this to the French Markit Manufacturing PMI for July, reported at 58.0, the French Markit Services PMI reported at 56.8, and the French Markit Composite PMI reported at 56.6.

The Preliminary German Markit Manufacturing PMI for August is predicted at 65.0, the Preliminary German Markit Services PMI at 61.0, and the Preliminary German Markit Composite PMI at 62.2. Forex traders can compare this to the German Markit Manufacturing PMI for July, reported at 65.9, the German Markit Services PMI reported at 61.8, and the German Markit Composite PMI reported at 62.4.

The Preliminary Eurozone Markit Manufacturing PMI for August is predicted at 62.0, the Preliminary Eurozone Markit Services PMI at 59.8, and the Preliminary Eurozone Markit Composite PMI at 59.7. Forex traders can compare this to the Eurozone Markit Manufacturing PMI for July, reported at 62.8, the Eurozone Markit Services PMI reported at 59.8, and the Eurozone Markit Composite PMI reported at 60.2.

Advanced Eurozone Consumer Confidence for August is predicted at -5.0. Forex traders can compare this to the previous Eurozone Consumer Confidence for July, reported at -4.4.

The forecast for the EUR/JPY remains bearish despite the massive sell-off, as inflationary pressures, supply chain disruptions, and the delta variant of Covid-19 keep downside pressure on the global economy.

Can bears remain in control over the EUR/JPY and force more selling?

You can find our Website/Telegram Links in Description Below ↓↓↓

EurJpy- Continuation to the down side?Since the beginning of June, EurJpy has started to drop, putting in lower highs and lower lows on our daily chart.

At this moment the pair is consolidating in a symmetrical triangle and we can expect continuation.

127 could be a good target for swing traders and only sustained buying pressure above 130.50 would put a pause to this scenario.

EURJPY Forecast1) Top-down analysis

Monthly - Previous monthly closure, Potential Inside bar and does not fill the wick of previous candlestick

Weekly - Previous weekly candle closure, closed with doji candlestick and Closed inside the range inside of the previous candlestick

Daily - Two candlestick rejection on 130.500 (Major psychological level)

The bias is still upside due to doji from last two weekly candle. But still it has a high probability that it will go down further first to get some liquidity before going upside.

Confluences for downside movement;

a. Main trendline third touch

b. Major psychological level 130.500

c. 4H Corrective