GBP/EUR - Overall DowntrendGBP/EUR is in an overall downtrend. Double top setup is in place. Price has retested neckline. Now price will probably consolidate considering that it is now hitting a key level. Ideal move: Price breaks key level and falls to the downside. I think the probability of price going to the upside is about 25% and price to the downside is about 75%.

Trading Journal #5

- Austin S.

Entrypoint

BTCUSD 1D TRADERS DYNAMIC INDEX STRATEGY ENTRY RULESTraders Dynamic Index Strategy Entry Rules

1- Red Line break above Yellow Line

2- Green Line break above Yellow Line

3- Neither Line break above Blue Line

4- Buy when Green Line close above Yellow Line

5- SL below SwgLow or 1,5xATR (min 10 pips)

6- TP when Red & Green cross below 70 level

GOLD SELL from 1295descending wedge and lines of support and resistance suggest entries for sells and buys following negative trendline. Descending wedge suggests a longer term bullish trend so a break from 1255-1240 for the upside and highs forecasted by Goldman Sachs of 1450 line up with this hypothesis

www.fxstreet.com

Purely educational not advice

Woods BIG win to push $NKE Higher?Taking a shot on this swing to the upside with Tiger Woods getting a win. Hes the poster-boy for Nike Golf and he just caught himself a big win. For some reason I just see every "Middle Age'd Guy in America", waking up tomorrow morning and saying - "Hey you know what, that Nike looks like a good investment bois."

Will set limits as noted and update trade first thing tomorrow morning.

BCH/BTC - small retrace and then pump!BCH/BTC looks like its headed down to the bottom of the range before picking up speed again. In this one I decided to post the chart showing how I placed the gann fans. Feel free to try it out for yourself and please give me a follow if it helps you :)

Target: 0.0490

Blue triangle indicates the current range.

Green box is buy.

Red box is sell.

Blue line indicates major resistance.

Yellow line indicates t/p.

This is a log chart.

This is not financial advice.

GBP/JPY intraday trading analyseGBP/JPY shows us after today bounce for over 0.80% that RSI is overbought or just is in a lasting uptrend .

Brayzil team preferences is : the upside prevails as long as 143.96 is support , below this level we looking a return back to 143.5 as 1st target and 143.15

The configuration for this pair is positive at the moment .

All attention on Brexit , "Deal " or " No -Deal" .

Thank you .

If you like our chart , you can find more on our instagram channel : @FX , bearish vs bullish

TXN - Analog Chip maker investing in new technologyTXN shows a cross-over on MACD at Fibonacci Retracement 0.500 and on 1 hr. chart likely having a short dip below $97 entry area. Recently increased their dividend nicely over last 5 years as well.

Been watching them invest in R&D and they have chips in growing markets for 5G, automotive, communication and industrial.

In the last 12 months, TXN has returned all of free cash flow back to shareholders and increasing the dividend by 24% and repurchasing another $12B in its own stock.

Investors come to own conclusions. More VIX challenges ahead on the short likely. $US still holding.

Energous wireless power using nanocrystalsWATT has Intellectual Property for high growth, sales and issue is cash flow and time to profitability, as well competitive players which a couple exist.

Watch for weekly candles, MACD cross (blue over orange), and CCI crossing 0. Volume would also be a good signal on this one for cash flow.

SEDG - Solaredge Technologies12/26 MACD cross-over with CCI entry crossing 0 on weekly candlestick chart.

Solaredge Technologies is down from peak of $68 and showing entry point at $38.03 on chart.

Market Cap value $1.65B

Enterprise value $8.4B

Total debt -0-

Free cash flow $150M

Sales growth rate: 22%

Expected value: $3.3-3.5B

About: SEDG

Israeli Solar company SolarEdge Technologies, Inc. offers an inverter solution for a solar photovoltaic (PV) system. The Company's products include SolarEdge Power Optimizer, SolarEdge Inverter, StorEdge Solutions and SolarEdge Monitoring Software. Its product roadmap consists of categories, including power optimizers, inverters, monitoring services, energy storage and smart energy management. The Company's power optimizers provide module-level maximum power point (MPP) tracking and real-time adjustments of current and voltage to the optimal working point of each individual PV module. The Company's solution consists of a direct current (DC) power optimizer, an inverter and a cloud-based monitoring platform that operates as a single integrated system.

Recently partnered with Google using Google assistant for EV charging and 6x faster charging. World's first EV Solar Inverter.

Request needed for a 10-year back-up battery for 10-hr. house charge and ability to rapid charge EV, we're almost there.

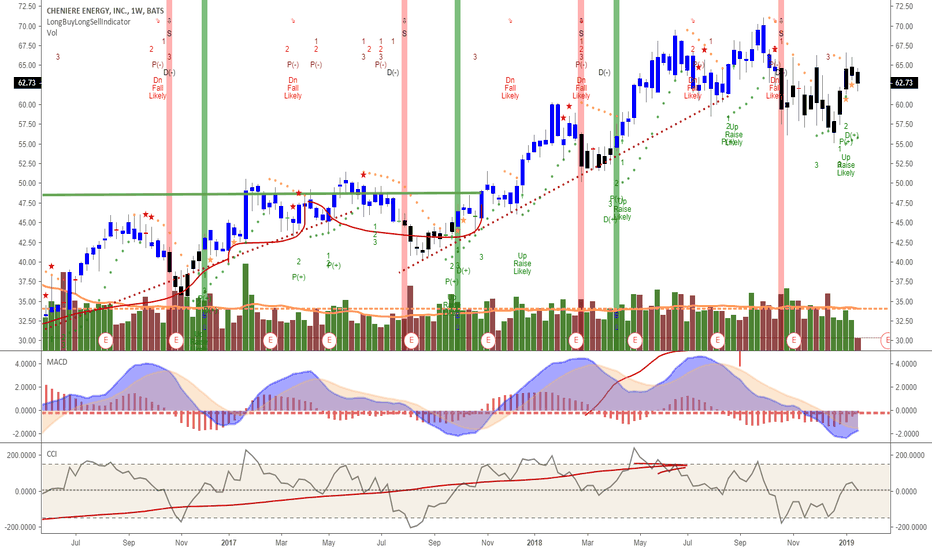

LNG winter fuel use time: MACD and CCI entry signalsOn weekly candlestick chart, MACD is shown crossing over and CCI at 0, but on downward slope at $62.73.

Await 2nd LNG port set-up and exports looking positive as cold weather driving use. LNG will also be a growing industrial energy fuel to replace coal and oil energy plants, as 30% lower CO2.

Nuclear and solar are only better ones and solar equipment costs not net zero CO2. Nuclear has proven solid long term CO2 near zero source (add CO2 output to make plant, deliver fuel).

Tilray nearing full retracement - daily MACD - CCI watch Tilray is currently $71.74/share and falling in this weeks sell off and good chance to drop near full retracement to $65-66 range. Great time to buy half and have standing order 8% below this for full retracement, or just wait.

$65.50 target with MACD cross-over on 12/26 and CCI about to cross positive.

TDOC - 618 Fib Retracement Entry on MACD Cross-over on weekly chTeledoc medical billing is crossing over the weekly MACD after recent drop. Entry point just over $63 on 618 Fibonacci Retracement.

Software + Medical billing.

Make own decisions and let me hear your opinion on this company. Total debt <$10 of Mkt Cap, no dividend, and healthcare through any mobile device.

BITCOIN INDICATOR - ALL MARKETS/TIME FRAMES - BOTH DIRECTIONSBitcoin Signal Indicator trades all markets and time frames

Bitcoin Signal Indicator trades both directions

Bitcoin Signal Indicator finds Entry Point - TP - SL

Bitcoin Signal Indicator SL will adjust to a trailing stop as trades profits

PM me if you have any questions i can help you with on our Bitcoin Signal Indicator

USD/CHF SHORTLooking at past swings in the market to get an idea of where the market is heading. ( prices usually relates to prior swings - the coloured orange and pink lines are SWINGS)

measure the length of a pull back ( orange ) chances are that will be the length of other pullbacks which you can use to mark out your level of entry.

the orange lines are patterns as well as the pink lines.

i drew out the length of the down trend ( pink ) and duplicated the exact same trend line to see if it would fit anywhere else and it does. i then use both pink and orange lines to help me predict where the next possible entry will be.

i finally added Fib to see where price lines up to give more confirmation/ relation

Follow my instagram : Vellly and join my trading team for guidance, updates & 1-1 mentoring.

Create your own trading system: entry point number 1We start looking for your entry points into the market. To do this, try different points of entry into the market and leave only those that you understand.

I propose to consider the point of entry into the market on the indicator Bollinger band. We will not study its meaning and calculation formula, because you can find this information yourself on the Internet.

Select timeframe and indicator parameter

To work with the Bollinger band indicator, you need to choose the right parameter. A value of 100 with a deviation of 2 is suitable for timeframes below H4, and a value of 50 for D1 and higher.

Rules for entry into position:

We buy if:

The closing price of the asset was below the lower Bollinger band (case 1);

After that, the asset's closing price crossed the middle Bollinger band from bottom to top (case 2);

Open a position to buy an asset after the second intersection of the middle Bollinger band from the bottom up.

Do not enter the purchase, if there were no cases 1 and 2.

We Sell if:

The closing price of the asset was above the upper Bollinger band (case 1);

After that, the closing price of the asset crossed from the middle Bollinger band from top to bottom (case 2);

We open the position to sell the asset after the second intersection of the middle Bollinger band from top to bottom.

Do not go on sale if there were no cases 1 and 2.

The main regularity of this entry point is to enter the trade after a strong impulse on the new wave.

In its pure form, this entry point does not apply to trade, as additional filters are needed. But, it is needed as a simple and probable way to enter the market.

Exit position:

A probable exit from positions is possible at the intersection of the closing price of an asset of the upper / lower Bollinger bands.