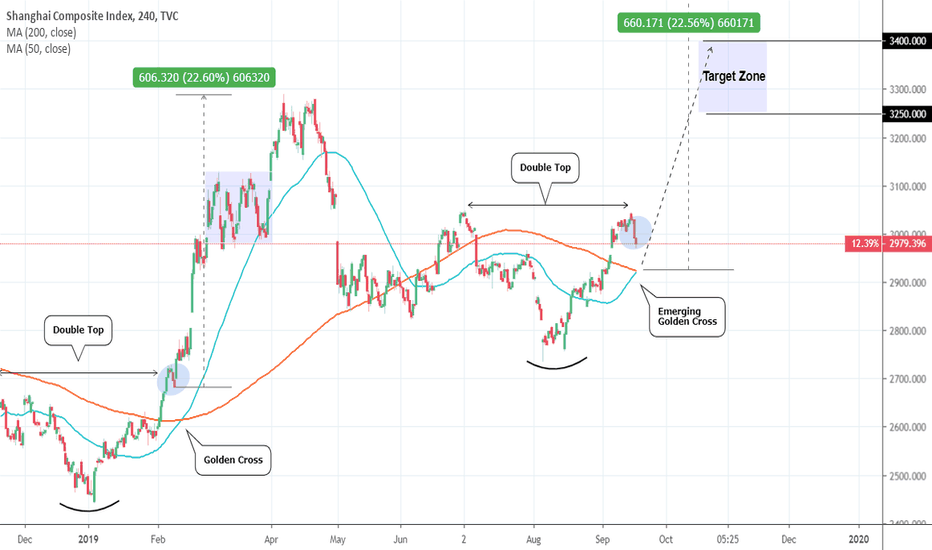

Shanghai Composite: Golden Cross. Potential for an strong rise.SHCOMP is currently pulling back off a Double Top formation near July's 3,050 Resistance. The key development here is the potential to have a Golden Cross formation on 4H.

Last time this pattern emerged was in mid February 2019, when again the price was pulling back after a Double Top. The result was an aggressive jump of +20%. Medium term investors can wait for the Golden Cross to take place, catch the low and then go long on the medium term. Target Zone: 3,250 - 3,400.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

Chinastocks

Shanghai A composite, in the key resistance levelHello, Dear friends

China Shanghai A composite index just break the key level ~ 3000, but huge resistance in above, and 4H&1D RSI running in over bought region.

my strategy is retest the below key support level ~ 2830, to see if a reverse H&S could be formed or not.

China 50 Head and Shoulders?Seeing some weakness here on the China 50, as the buyers bid to make a new higher low has yet to succeed. If we break this 13800 zone, it will be a break of a flip/support zone. Indicating there is no strength with this break out. Be patient and await for the candle close.

Here is how it looks like on the 2 hour chart:

The head and shoulders is very clear. Still would await for a nice and strong close below this zone.

13500-600 is where I would see another flip zone acting as support.

Strong Close but Can FFHL Continue Higher?HUGE day today but I'm not sure if this news is enough to make a reason to keep this on the radar or not. I'm sure after today, the weekend warriors will notice this volume and price move.

"This is what happens when penny stocks release news afterhours. Just because the closing bell rings at 4PM EST, doesn’t mean you stop watching the market. Those who had access to aftermarket trading on Thursday could have reacted to the companies latest announcement. FuWei reported its quarterly and 6-month results, which seems to be the spark that lit this fuse."

From Top 3 Penny Stocks To Watch On Friday on PennyStocks.com

Results:

FuWei reported 10.7% growth in sales compared to the same quarter last year. It also saw EPS come in at $0.04 per share versus last year’s period of a $0.4 loss per share. The company’s plastic film products are widely used for food, medicine, cosmetics, and even tobacco.

NASDAQ:FFHL

600276, Jiangsu Hengrui Medicine Co. Ltd - Cup & HandleSSE:600276

Classic pattern, Cup & Handle, which in this case acts as a figure of continuation of the primary trend.

Let's take advantage of this breakout of resistance level.

Statistically as we know from our backtest based on our Entry Points, Stop Loss, Take Profit, we have a % positive realization of this trade equal to 35%.

China 50 Possible Head and Shoulders PatternWe have had a recent downtrend to the 13400 zone where it looked like we could see an inverse head and shoulders to the downside.

However, we failed to break below. Now we are attempting to create a head and shoulders pattern to the upside. Waiting for a break above 13700 with a nice close.

Equities seem to be ready to get a boost from world central markets with the promise of more cheap money. The ECB is tomorrow and they are likely to cut rates even negative and provide more stimulus. The US Federal Reserve is then on tap to do the same next week on the 31st.

The Chinese markets may have other issues. Talks of a banking crisis with Baoshang bank, and other economic problems...China's last GDP reading of 6.2% was the lowest in 27 years.

Long IqTradingView

Open position at $18.5

Stop loss at $17.5

Take profit at $20

Why this play?

As much as i would love to see a triple bottom for a long, I'm not sure we would get it. The china related stocks has been very beat up, especially IQ.

I have a seen a few of them reversal off already but iq hasn't really reacted much yet.

if we expect positive news on china trade deal, this would be a pretty good stock to go on long.

China Mobile buy signalsChina Mobile (CHL), Monthly chart: 10 years long(!) support zone + "Harami" candle pattern + Side of Bollinger bands (120,2) + Extended divergence on RSI(14)

China Mobile (CHL) buyChina Mobile (CHL), D1: Support zone + Convergence & Oversold on RSI(14) + Powerful mirror level on MN.

Chinese Growth Rebound? The chattering class is clearly leaning towards the sentiment that Chinese growth is stabilizing as GDP growth was strong (compared to its 6.0 to 6.5 percent range) in conjunction with strong PMI numbers and, as can be seen by the Shanghai Composite, strong capital markets.

While Europe is unsure what to do with the euro from the prospect of Brexit still on the table and the United States obsessed with the Mueller Report being released today, China is considerably devoid of these types of political risks that are mostly distraction. The market is much more focused on fundamentals and while the political risk in Europe or the US is not likely to significantly shift markets today per se, the Chinese are technocratically attempting to solve their financial problems.

China's Large Cap: Ready to test the 10 year Highs?With the U.S. - China trade deal developments ongoing and reportedly staying on positive grounds, the stock markets are globally on the rise in 2019. This is a good time to examine how the heavy Chinese companies are performing.

FXI is the index that tracks China's stocks with the largest capitalization. On the monthly (1M) chart we see that since the 2009 crash, it has been recovering on Higher Highs and Higher Lows, effectively constructing a Channel Up on 1M (RSI = 56.535, MACD = 0.600, Highs/Lows = 0.3822). These indicators show that it recently hit a low point and is on the early stages of a new bullish leg. On the chart this is evident by the January 2019 bounce on the inner lower Higher Low trend line (indicated in dash). What is also evident are the 1M Support Zone (28.20 - 28.70) and 1M Resistance Zone (52.90 - 54.00). The 1M Resistance Zone is our immediate target although the 10 year Channel Up suggests that it may break it and peak as high as 61.00.

In our opinion it is definitely a time to start looking at China's Large Cap more favorably.

We have already warned of this upcoming bullish leg on the Shanghai Composite Index on December 2018:

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

Hang Seng Set for Renewed UptrendUS China trade war resolution more forcefully impacts Shanghai Composite and Shenzhen Component, but Hang Seng should also see some gains. Moreover, we have seen a bit more progress in the negotiations apparently with tech transfers, tech war. Let's see if it pans out though. For more, check out www.anthonylaurence.wordpress.com

Tides May Turn for USDCNHJust minutes ago, Reuters reported that Lightheizer and Mnuchin are going to Bejing for talks. However, trade war detente is now not on the table until June. Trump threatens to keep tariffs on if China won't hold up their end of the deal on intellectual property. Honestly its not looking good. It is difficult to tell if this trend will continue to go negative and if Trump holds an all out assault in the trade war against everyone and anyone he can get his hands on. This may be the world we live in by the end of 2019. Who knows. But clearly, the talks are no longer going as well as we once thought and also let's keep in mind how Trump walked away from Kim Jong Un in Hanoi. This is what we are trending towards now which would be quite detrimental to markets in spite of Trump's desire for a deal which is quite strong and in spite of his sensitivity towards the stock markets which we also know he is quite sensitive to as well. However in the end, in order for these negotiations to go well Trump needs at least the idea that he can create a positive message at the end.

That's the fundie picture. I'll much more briefly talk technicals. Overall, we are trending towards oversold with the USD even though the momentum is still trending in that direction. If you like my analysis, read some more words and check out some more charts here: www.anthonylaurence.wordpress.com