Uptrend & Downtrend Bullish Falling Wedge Pattern TutorialA bullish falling wedge is a charting pattern that signals a potential reversal from a downtrend to an uptrend. Here's a breakdown of its key characteristics:

Shape: The pattern forms a wedge that slopes downward, with the upper trendline connecting the highs and the lower trendline connecting the lows. The key is that the highs and lows get closer together as the pattern develops.

Trend: It typically forms during a downtrend, indicating that selling pressure is decreasing.

Breakout: The pattern is bullish when the price breaks above the upper trendline. This breakout suggests that the downward trend is losing momentum, and an upward trend may follow.

Volume: During the falling wedge formation, volume tends to decrease, which supports the idea that selling pressure is diminishing.

Retest: After the breakout, it's common for the price to retest the upper trendline, and if it holds, it provides further confirmation of the bullish reversal.

Example

Imagine a stock that has been falling for several months. The price forms lower highs and lower lows, creating a narrowing wedge. Suddenly, the price breaks above the upper trendline with increased volume, signaling a potential reversal and the start of an upward trend.

Bullishfallingwedge

AUDUSD - Bullish Scenario 📈Hello Traders !

On The Daily Time Frame, The AUDUSD Price Reached a Strong Resistance Level (0.64532 - 0.65222).

-The AUDUSD Formed a Bullish Falling Wedge Pattern.

Currently, We have a Bullish Scenario :

If The Market Breaks The Resistance Level and Closes Above That,

We Will See a Bullish Move 📈

-----------

TARGET: 0.65710🎯

NZDCHF - Bullish Falling Wedge 📈

As We Talked in The Previous Analysis:

-The NZDCHF Price Reached A Support Level (0.51902 - 0.52084).

-The Resistance Level (0.53330 - 0.53574) is Broken and Becomes a New Support Level.

Currently,

-The Price Pull Back to 0.5 Fibonacci Retracement Level !

-and Formed a Bullish Falling Wedge

-and Now it Will Continue its Bullish Movement !

-----------

TARGET: 0.54075🎯

BTCUSD/SPX - Bullish Falling WedgePotential bullish wedge.

Could not hold the blue scenario.

On lower timeframe a bearish retest and we will continue to drop more?

Keep in mind this is a log chart.

(Maybe we will climb up again and the UST/LUNA scenario was a type of black swan event causing this in the first place, this chart shows how btc outperforms the stock market. With an enormous influx of negative news we could see this as some sort of black swan event.)

If stocks drop even more what will happen to bitcoin? In the past not seen before thats why we might see some type of bullish wedge of people dumping their bitcoin to secure more fiat. Longterm Bitcoin always outperformed greatly overall.

WAVESUSDT WAVES#Crypto Idea ; 037

#Exchange ; Binance

@khancryptoschool

#WAVESUSDT

#WAVES

There have Bullish Falling Wedge

BINANCE:WAVESUSDT

Be greedy when others are fearful.One of Warren Buffett's most famous investment sayings is “Be fearful when others are greedy. Be greedy when others are fearful.”

Bullish falling wedge looks ready to brakout!

The Falling Wedge is a bullish pattern that begins wide at the top and contracts as prices move lower. This price action forms a cone that slopes down as the reaction highs and reaction lows converge. ... However, this bullish bias cannot be realized until a resistance breakout occurs.

First target is 42000$

Gold rejected on BIG demand and BIG supportAfter 8 months of bearish trend, as you can see gold made bullish falling wedge pattern. And it has reached good support and good zone also rejected on it. What a good setup. XAUUSD is on a price which can be beginning of uptrend for next few months. And don`t forget it is an idea, not a signal. Hope you guys enjoy it.

Potential long set up on CLOVHere is hourly chart of CLOV. Clear bullish falling wedge and positive divergent on both RSI and PPO. It is in over sold territory on RSI as well. Breaking up front the wedge would be the first objective entrance. Back test of the wedge would be the second. Stop should be placed according to the upside target. There is no guarantee but it may be worth taking a shot.

Have a good trade,

T.

Wayfair Bullish Falling WedgeIf price bounces off support line I will buy on the expectation it will easily hit target 1:$260... If it hits resistance here, sell and take profits however, if there is a strong breakout of resistance line we could see some really nice upside. I am watching closely over the next couple days and will consider buying call options if the right opportunity presents itself.

Wayfair Inc-Expecting a quick bounce off support line to Target1Should bounce off support and easily climb back to target 1... If price reaches target 1 but hits resistance wait and see if double bottom forms. breaks through target 1 it should easily climb up to target 2 price (which is resistance line). If it does climb to target 2 but fails to break resistance, sell and take profits. If it breaks resistance we can expect an upwards breakout.

US30 26633 - 0.21% SHORT IDEA * STRUCTURE BOUND PATTNSGood Day Everyone

A look at the US30 INDEX currently trading inside a symmetrical triangle range bound in a ascending triangle and we currently have a bullish flag on the index looking to see a push up as we are overbought on most indicators respect the symmetrical structure and see continuation to the down side with the bears...

Good luck and happy trading everyone

_________________________________________________________________________________________________________________________

ENTRY & SL - FOLLOW YOUR RULES ON PENDING ODER & SO FORTH

RISK-MANAGEMENT

PERIOD - SWING TRADE

__________________________________________________________________________________________________________________________

If you like the idea kindly leave a like and a follow will definitely follow back and leave your idea & Comment on the pair in the comment section.

#ethereum - Hitting Target 2 of Bullish WedgeDear Traders,

a short update from my side, today Ethereum surpassed Target 2 of the bullish falling wedge and also trying to overcome it´s yearly Pivot at the same time.

As you can see for this pattern there is still some room left for upwards movement, until we have to throw away this view and recalculate future possibilities.

Despite history, this year started extremely green for crypto assets in general and also alts have picked up fulminantly, looking towards ICX for example.

Currently BTC dominance is decreasing which might indicate that we have at least a good period of time where stability could make us happier than the entire last year.

We all know $200 is psychological mark for ETH, so please keep a good eye out for short-term corrections or sidetrend.

All the best.

Neru

#ethereum - Target 1 retested & #bullishfallingwedgeGood morning traders.

After the weak attempt earlier this week, Ethereum picked up a lot and fulminantly passed the P-Q and Target 1, including retesting the connected Key-Level, which made this breakout a success after all.

For now next Targets are sitting just above $180, where we will approach the Q-R1 and the 3D Cloud as resistance.

The chances are good Ethereum will be able to make it´s way up to the Yearly Pivot just under $200. The entire area between $180 and and $200 is fragile and very important for midterm growth.

Best wishes,

Neru

#ethusd - Ethereum much weaker than BTC, 3DGood morning guys.

Ethereum for now looks much weaker than Bitcoin and also e.g. Gold.

The bullish falling wedge is still in place and ETH did not manage to overcome the resistance cluster situated at exactly where it stopped growing around $148.

The Quarterly Pivot and the upper trend line of the wedge are holding right now. Generally it has to be mentioned that Altcoins did not really follow Bitcoin´s and the overall green market with the same motivation.

This could have to do with the political situation, but also with the fact that traders are simply paying much more attention to what´s happening generally.

Currently Ethereum is maximum a hold if already spot bought mid-term, or needs to be looked at for possible incoming bearish signs.

Ethereum is not a buy at the current stage.

As usual everything you need to know is marked.

Neru

#eurusd - Weekly UpdateEuro/Us-Dollar is currently facing a huge resistance zone between the key-level and the new Yearly Pivot 1.117 and 1.122.

It has overcome a major trend line on the weekly and forming a bullish higher-low pattern.

This area is crucial for the mid- to long term development upcoming. If this neckline area get´s broken upwards and passing the Yearly Pivot, things look much brighter for EURUSD (solely technical, ignoring fundamentals)

Due to the fact, overall market is rather green nature, we need to see if this mentality can be established during January.

As usual I marked the next relevant levels for you. In case this does drop a little, please watch out for the red trend line below the price for possible short opportunities.

Neru

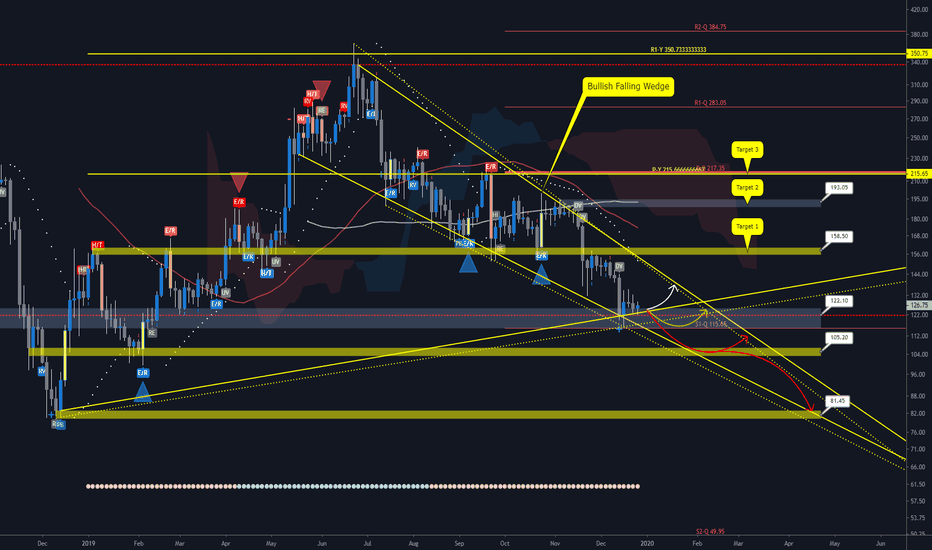

#ethereum - 3D outlook, #bullishfallingwedgeHello guys,

been a while since I updated Ethereum, so here we go on a higher timeframe, my favourite the 3-Day.

As you can see, the gigantic bullish falling wedge is still forming out. The big question is: Has it found bottom now, or is it going to go lower, even down to levels such as $80.

Recently the Quarterly Support 1 Pivot has given Ethereum some form of stability to maybe able to grow back to the out falling trendline, where the next decision hotspot is located.

I have marked possible ways and all significant levels for you as usual.

If ETH is going to lose key-level in this area, it is very likely we will see the minimum $100 as psychological possible turn around, this is entirely open and strongly depends on Bitcoin´s

start of the Year 2020. Please be aware the last falling wedge resolved bullish and went to target 2on Daily.

_________________

Neru

The Insider and systematic dumpHello fellas, here is my opinion about bitcoin based on the dominance side of the crypto market. I hope you enjoy this technical analysis!

The daily chart for Bitcoin dominance shows that Bitcoin is fighting hard to retain its dominance of the cryptocurrency market. Recently, Bitcoin dominance broke out of a falling wedge and found temporary support on the 50% fib retracement level. However, I believe that this level won't hold from further decline. traders need to be very careful here as this is not the time to be bullish.

It is premature to say that this move to the upside has come to an end. We are certain that a decline is going to follow sooner or later but short term further manipulation could be around the corner. We recently saw Bitcoin pump by more than 43% in two days. There have been times when we have seen similar pumps in the altcoin market follow soon after. I wouldn’t discount the possibility that this could be one of those times which is why it is not a good idea to be short on the altcoin market just yet. However, despite what happens short term, Bitcoin is ready to decline below $8,000 and it could happen in a matter of days.

The cryptocurrency market is in trouble and insiders have known this for a long time. They have been dumping systemically but as more and more retail investors begin to catch up with what is really happening, they are now in a rush to get out of their positions. This is why we have seen such naked manipulation in the past few days that shook out most of the retail bears and got the bulls really excited. The bulls are still quite excited and expecting further. The Fear and Greed Index is still in the neutral zone but traders could soon get even more optimistic with another fake out. In my opinion, it is very likely that we might see another fake out near term

USDJPY - Bullish Falling Wedge - BreakoutWe still see USDJPY moving higher after it has broken above the 106.8 resistance level mainly we believe on the back of an easing of tensions in the US/China trade war. However, there could be a significant amount of price action post payrolls and average hourly earnings as weak data could indicate a higher probability of FED rate cuts.

USDJPY - Long - Bullish Falling Wedge BreakoutWe still see USDJPY going up despite slow price action and our first target for the Bullish Falling Wedge Breakout is the resistance level at 106.878. A bounce in equity markets after an easing of US/China trade relations could lead to increase in risk off sentiment but there could be key price action on the back of key US data this week starting with US ISM manufacturing tomorrow.

#ethereum - Falling Wedge & Key-Support "D"Ethereum did not manage to overcome the "BO-Level" after it bounced off a former breakout-bevel and is yet not showing any signs of recovery. It´s the opposite, producing a trend-follow H/T right now, was not a very good start also maybe printing a hidden bearish divergence today.

No reversal signs are seen on Daily so far. Although passively sitting on a rather bullish falling wedge, this does not mean we cannot go lower to the key-support around $163, where also S1 Quarterly and Monthly S1 Pivot sit and wait for the price to touch the ground.

As usual, I have labeled important prices. The trend is not yet grown up bearish on Daily.

_______________

Warm regards,

Neru

----------------------

Charts made with:

Key-Levels & Trendlines