The Road to $66 for STXUSDT (Stacks)$STXUSD has now beautifully broken out of the triangle after an impressive textbook correction at the 0.618 Fibonacci retracement.

This type of correction is a typical feature of wave 2 in an Elliot wave count, which indicates that $STXUSDT is now ready to embark on its third impulsive wave, often referred to as the most explosive one.

Considering the increasing volume, an explosive surge in the number of transactions on the network, and the oscillators, we can expect a swift development in the price towards the following resistance levels:

— 0.57

— 1.06

— 2.85

— 5.96

— 8.16

— 13.17.

#stxusdt #stxusd #BNS #DeFi #BitcoinNFTs #Stacks

BNS

$BNS Stock Up 1.72% in Pre-Market Trading on Q2 Estimates Beats The Bank of Nova Scotia ( TSX:BNS ) reported second-quarter earnings that narrowly beat analyst estimates, but profits fell year-over-year due to uncertainty around interest rate cuts and inflation in the U.S. and abroad. Total revenue increased year-over-year to 8.35 billion Canadian dollars ($6.13 billion), up from last year's mark of C$7.91 billion and narrowly above analysts' expectations. However, profit fell to C$2.09 billion, or C$1.57 per share, from the C$2.15 billion and C$1.68 per share Scotiabank reported last year. Analysts expected net income of C$2.05 billion, or C$1.55 per share.

Scotiabank saw net income increase in its wealth management division and international operations, while profit dropped about 4% year-over-year in the bank's Canadian operations due to higher provision for credit losses (PCL) and expenses. The bank also declared a quarterly dividend of C$1.06 per share, set to be paid out July 29 to shareholders of record on July 3. This will be the fourth consecutive quarter in which Scotiabank pays out a C$1.06-per-share dividend.

Scotiabank and other Canadian banks report earnings to close out the month, with Toronto-Dominion Bank reporting earnings that also beat estimates last week. Scotiabank shares on the New York Stock Exchange (NYSE) were up 0.9% to $48.23 about 90 minutes before the opening bell but are down slightly since the start of 2024.

Technical Outlook

TSX:BNS stock is up 1.72% in Tuesday's Pre-market trading. Despite profit drop of 4% YOY, the stock managed to capitalized its profit as the ticker is performing well today.

💾 Bank Of Nova Scotia Bearish | Cryptocurrency Can Save You!I like this bank, I personally use it and they have been around for more than 100 years I think...

I can see now why they are panicking but should they be worrying after being around for so long?

The market moves in cycles... After a crash down comes a wave up.

Anyway, the main support for the Bank Of Nova Scotia (BNS) is the Fib. retracement level at 64.95.

Closing below it will lead to a major drop leading to 56.78 as the next support.

This can go on and on until the bigger cycle unravels completely.

Many banks will die forever but many will survive, adapt and change, adopt some form of Cryptocurrency technology and continue playing this game.

The ones that will survive will be the ones that are willing to change and adapt to the current times.

The ones that will die will be the ones that refuse to accept reality.

Life is always changing.

Everything is always changing.

Imagine how everything looked like just 50 years ago... Imagine 80 years ago.

If the companies of the past did not adopt the technology, all technologies, these are gone.

The companies that bought computers, the Internet, setup a website and email, are the ones that went to the top.

Just as you needed floppy disks and an Internet connection through a land line to stay on top...

In the present day, 21st century my friends, you need to accept Cryptocurrency to stay on top.

Namaste.

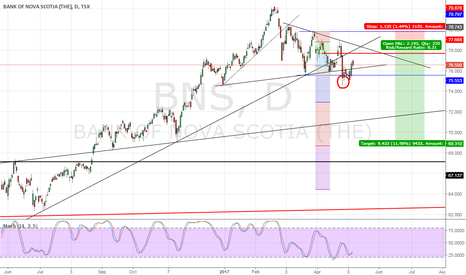

BNS Momentum Trade " After Earnings"TSX:BNS

After we are clear of earnings, I'll be looking for the price to pull back to the Nov 28 resistance of 71.50 near the 50 SMA and 50 EMA (old resistance becoming new support). If we can get confirmation with a reversal pattern double/ triple bottom or inverted Head and Shoulder, I'll be looking to enter with Real Life Tradings momo indicator.

Stop loss will be placed just below the reversal pattern and the target will be at 100 WMA near $79.00.

I have a few concerns with hitting our target:

1) We might have the 200 SMA as resistance.

2) If The 50 WMA backs up the current resistance at 74.30.

If we are able to break through both resistances this could be a good 2.5r - 3 r trade.

If we fall through the 71.50 level, I'll be looking for a similar setup at the 69.00 and 65.00 areas.

Remember to always manage your risk when trading and have a stop loss.

Happy trading!

BNS possible continuationWaiting for a possible second leg up, or small scalp only. Watch levels on the chart.

Good luck traders

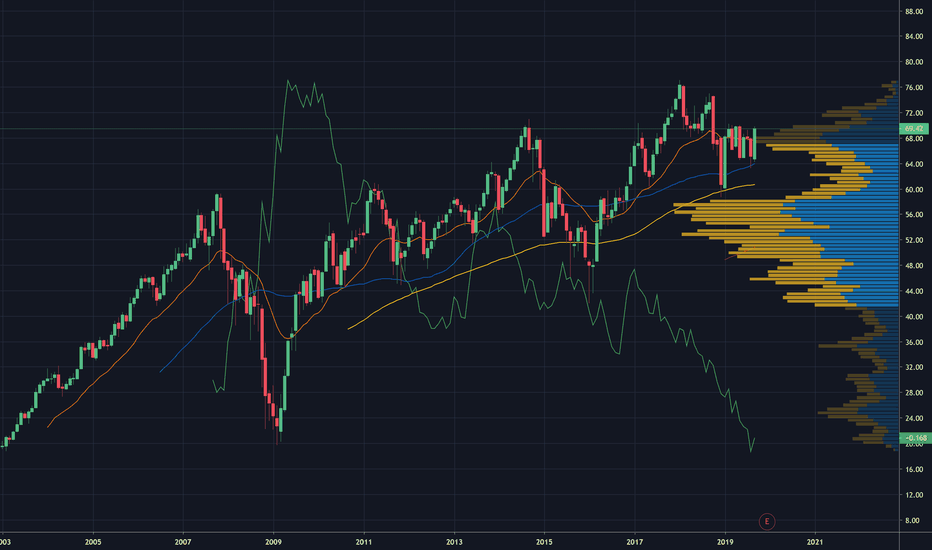

Macro Ascending Triangle for BNS?On the RSI there's noticeably a triple bottom coinciding with three touch points on the upward sloping support of the Ascending Triangle.

If you move the chart left there's the first touch point of four on the upward sloping support of the ascending triangle dating back in 2003.

On a 5 year chart attached to this all time log scale chart there's been a golden cross on the KST that isn't noticeable here, the golden cross is recognizable on a 1 year chart as well.

Following the moving average.Looking at this chart I see a price range between $53 and $50. Watching moving average to act as resistance. $50 being a physiological support.

Scotch RSI looks to be going up so rejection at $53 is very possible in the near feature. If price breaks $53 we could see a test of $60. It seems that currently probability slightly favors bears though its not like all indicators are bearish.

www.tradingview.com

RSI and MACD are basically flat.

BNS IS MUST PORTOFOLIO STOCK!FUBDAMENTALS Summary

1.Bank of Nova Scotia has announced 6 acquisitions in the past few quarters.

2.The company now expects about C$200 to C$250 million of integration costs in the next two years.

3.The bank should be able to achieve significant synergies and improve its operational efficiency through back-end systems improvement.

4.Bank of Nova Scotia should be able to benefit from strong economic growth in Latin America.

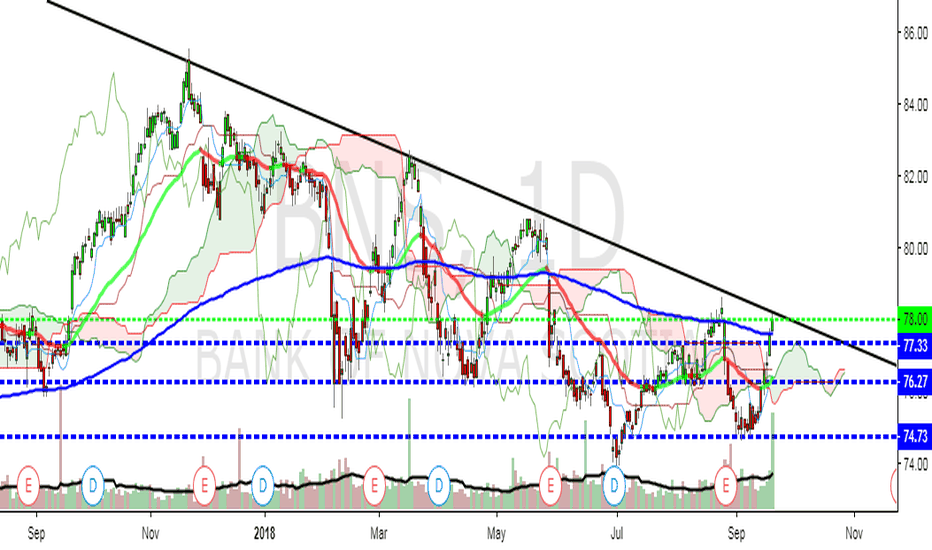

TECHNICAL OBSERVATIONS

1.We have a descending trendline that will give us the sign for a change of trend if of course we have a break above and a re-test.

2.We can see that price moved above the 200 EMA but the EMA has still negative slope and every time price did that failed to validate it moving again below it.That's why a double confirmation should give us a high probability sign for a buy.

3.We can also see that the EMA strategy we are in consolidation phase on daily chart,but looking under more longterm scope on a monthly chart is a nice buy after a pullback to the mean.

4.Ichimoku clouds are not giving a reliable sign as we are in consolidation phase and they are nor respected.

POSSIBLE TRADE

ENTRY AT RE-TEST OF BROKEN TRENDLINE ABOVE 200EMA

STOP LOSS AT 73$ MONTHLY LOW AND BREAK OF ASCENDING TRENDLINE

FIRST TARGET AT 85,50$ PREVIOUS HIGHS

SECOND TARGET WILL BE UPDATED IN NEXT ARTICLE!

THANKS FOR SUPPORT!

KEEP FOLLOWING FOR MORE PROFITS!

PLEASE LEAVE A COMMENT,YOUR OPINION OR EVEN A QUESTION YOU MIGHT HAVE!

STOCKS IM BUYING THIS WEEKI think last week's pullback in equity markets was a good thing. The market got overheated and it gave us a reminder that stocks don't always rise. Memories and patience are short in the finance industry especially with some recent trends (blockchain) skewing people's perception that building wealth gets built overnight. Not the case, in the past 50 years of the SP500's history, it has NEVER had a stretch of over a year without a 5% correction or more. So relax, this is not doomsday, it is the ebbs and flows of Mr. Market playing his tricks.

Here is the list of stocks I'm buying or adding a position too.

- Icahn Enterprises (see earlier post)

- Scott's Miracle Grow (post coming this week)

- Bank of Nova Scotia

- Bank of Montreal

- Citigroup

- Home Capital Group (post coming next week)

- Canadian Imperial Bank of Commerce

- Valeant Pharmaceuticals

- Equifax

BNS, BMO, CM are banks I own in a fund and will simply be buying more of the fund (FIE.TO), but BNS and BMO are the two banks I would buy, if you go back one year and look at the worst performing Canadian bank, it's a pretty safe bet that the next year will be better. As well: www.theglobeandmail.com

I apply this same rationale to Citigroup , one of the less fortunate American banks from last year.

EFX was a stock I bought down around $90 when it sold off following a security breach announcement. I think the firm, fundamentally, is strong and will continue to regain ground. VRX is also one of those contrarian stock picks, after some allegations a couple of years ago for fraud and insider trading, I think they've found their bottom. They've also started to pay off debt which is never a bad thing for a recovering company.

I'm in the process of putting a valuation on HCG and SMG and will make a post in the coming week, this will be a buy and hold value-pick. I'm liking what I'm seeing so far.

Long BNS based USDCAD correlationBNS has been tightly correlated with CAD since July 2014. Specifically, the relationship appears to be:

(daily % change in BNS) = 2x(daily % change in CADUSD)

CAD itself is correlated with oil.

I originally planned to buy CAD for an upcoming oil rally. But I ended up buying BNS instead. It pays a 5% dividend.