Bitcoinmarkets

Betting on Bitcoin: Will BTC Bulldoze Its Way Past $27,000? Unmasking the Potential: Breaking Down the Chances of BTC Breaking Barriers

Hold onto your hats, folks! Bitcoin's wild ride is about to take on a jaw-dropping turn. Let's dive into the rollercoaster of possibilities and unpack whether it's time to go all-in on BTC.

Introduction:

As the cryptocurrency market sets the stage for mind-boggling twists and turns, Bitcoin, the undefeated champion, is defying gravity once again. Speculation is rife about BTC skyrocketing past the elusive $27,000 threshold. In this electrifying article, we'll unravel the enigma behind Bitcoin's current value and challenge you with a gutsy call to action.

Breaking Through $27,000:

A Glimpse into Uncharted Territory: Picture this. The market holds its breath as BTC stands on the precipice of greatness, staring down the fearsome $27,000 resistance level. But hey, before you start betting your prized Magic: The Gathering collection on this feat, let's pump the brakes and cautiously approach this wild ride.

The Capricious Cryptosphere

Market Sentiment: 🤷♂️ When it comes to cryptocurrencies, predictability is about as rare as finding matching socks in your laundry. The market can swing from joyous elation to heart-wrenching despair in the blink of an eye. Don't let emotions be your guide—brace yourself for anything.

Technical Analysis:

📈📉 Forget the traditional stock market indicators you've come to know and love. Bitcoin laughs in the face of the convention! Technical analysis might provide some clues, but make sure you bring your lucky rabbit's foot and a crystal ball for good measure.

Consider Long BTC Position with a Wink 😉

Fundamental Factors: 💪 Amidst the chaos, let's not overlook the fundamentals. Study the trends, scrutinize the news, and consult the experts in the cryptosphere. Knowledge is power, after all.

Call-to-Action:

Time to Go Incognito with Long BTC! 🤫 While we can't predict the future, taking a calculated risk might just be the ticket to virtual wealth. But be warned, fellow adventurer! Approach the cryptosphere like a stealthy ninja, conducting secret research, diversifying your portfolio, and consulting with experts before making your move.

Bullet List:

• 🚀 Strap in for the unpredictable BTC rollercoaster.

• 🛡 Take calculated risks, but don't forget your safety net.

• 🕵️♀️ Do your homework and unleash the ninja within.

• 🌍 The cryptocurrency market knows no borders—everyone can partake.

Quote: "In the world of cryptocurrencies, fortune favors the daring-brave souls who balance risk with reason." - Anonymous

Conclusion:

Brace yourself for the possibility of BTC crashing through the $27,000 barrier, but remember to keep your wits about you. Stay informed, dance with caution, and may the crypto gods smile upon your daring endeavors. Leap, but never forget to land safely. 🪂

Disclaimer: This article serves as an electrifying exploration of possibilities and should not be considered financial advice. Always seek guidance from the pros and conduct your research before entering the cryptosphere's rollercoaster ride.

BTC: HITTING THE SUPPORT ZONE ONCE AGAIN!Hello traders,

I hope everyone is doing well. I want to share an important update about Bitcoin (BTC) in the daily timeframe.

August has been quite surprising for BTC, as usual. We've seen sudden ups and downs in the market. Now, the big question is: Will September be kinder to BTC, or will it be another challenging month? Let's take a closer look at the situation on the chart.

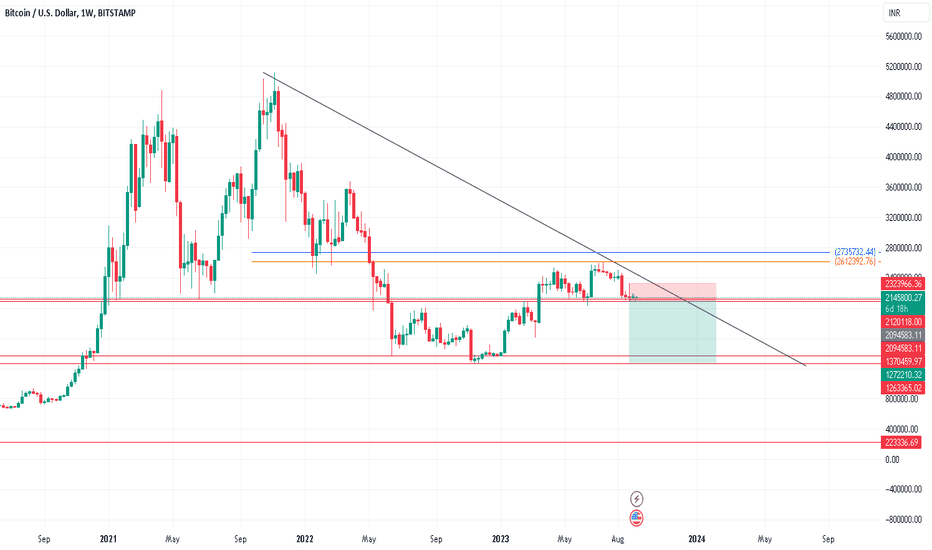

After all the price ups and downs, BTC is currently stable at $25.7k, which is close to a support zone marked by the blue box. Based on my analysis of both the weekly and daily charts, I anticipate that BTC should start a recovery from this support level soon. If BTC were to drop further, I expect it might go down to $24k before rebounding. However, if the price closes below $24k, it could indicate a different market scenario.

That's the latest from me. If you have any thoughts about the market, please feel free to share them in the comments. I appreciate you taking the time to read this update.

Best regards,

Team Dexter

BTC (Weekly Timeframe) The Signs Were Always There...

The signs were always there. Notice the momentum Top signals on the daily timeframe. The silver triangle "T"'s showing up at key levels like clockwork on the daily time-frame.

- Red Diamonds ♦️

- Red Trend-line 📈

- Downward compounding red Volatility momentum.

- A Golden reversal Diamond thats failing to confirm.

We now have compounding volatility momentum on the weekly timeframe, with red diamonds and a red track-line fighting off a downtrend. These are our ranges for now.

We've spent 6 months turning 24.5-25k into support. I expect that this will be our boss battle. In order to break through support and slay this dragon , we'll need several retests, or a cataclysmic news event.

Bitcoin's 5% Spike: An Early Rally or Cause for Caution?I wanted to bring your attention to the recent spike in Bitcoin's value, which has surged by an impressive 5% in a relatively short period. While such a surge may initially seem like an early rally, I urge you to exercise caution and consider pausing your Bitcoin trading activities for a moment to evaluate the situation.

Bitcoin, as we all know, has been subject to significant volatility in the past, making it both an exciting and risky investment. This recent spike, while enticing, could potentially be a sign of a larger market trend or a temporary fluctuation. It is crucial to take a step back and assess the situation before making any impulsive trading decisions.

Here are a few factors to consider before deciding your next move:

1. Market Sentiment: Analyze the overall market sentiment and observe if this spike aligns with any significant news, events, or market indicators. Understanding the context behind the surge can provide valuable insights into its sustainability.

2. Volume and Liquidity: Evaluate the trading volume and liquidity associated with this spike. A sudden increase in trading activity may indicate a short-term surge driven by a limited number of participants, potentially resulting in a subsequent correction.

3. Technical Analysis: Employ technical analysis tools to identify any patterns, support levels, or resistance points that might help you gain a better understanding of the market dynamics. This analysis can assist in determining whether the spike is part of a larger upward trend or merely a temporary anomaly.

4. Risk Management: Always prioritize risk management strategies, such as setting stop-loss orders or diversifying your portfolio. These measures can help mitigate potential losses and protect your capital, especially during times of increased volatility.

Considering the points, I encourage you to take a moment to pause your Bitcoin trading activities and reassess your strategy. It is crucial to approach such significant market movements with a level-headed mindset and not succumb to impulsive decision-making.

Please remember that trading cryptocurrencies involves inherent risks, and it is essential to stay informed and make well-informed decisions based on thorough analysis.

Long Bitcoin Here I always have a core btc position like a responsible adult, but am opening more longs here in trade account, honestly this is either the easiest short in the world or a super obvious bear trap. Lets see what happens, tight stops. I will always long a 0 0 Weekly Stochastic RSI, just a matter of time before mean reversion. Not advise, good luck.

BITCOIN BACK TO 19999 SUPPORT?We don't know when the ETF from BlackRock will be approved so this is the worst possibility of COINBASE:BTCUSD if this ETF is not approved as soon as possible BINANCE:BTCUSD will return to 19999.19 usd support!

or if it is not strong enough to hold the support at 19999 it will return to 16778, I hope next month it will be approved by the SEC.

BitcoinWe may see 1270000 again if breaks the support.

Careful upside is very limit as resistance is strong and retested to further fall from here.

Best buying may come next year Jan/Feb 2024..

Stay away from the bitcoin as per technical analysis.

Upside break should be very fast as of now or it will reject and fall in coming weeks or months.

#Bitcoin - thoughts out loud #7Good evening from Ukraine!

Dear colleagues, I am glad to welcome you!

Without logic, there is no way to fall further. For the current period of time.💸💸💸

Because this is my vision of the situation, because these are my thoughts out loud. Thank you.

Thank you all for your attention, I wish you success.

Sometimes you win/sometimes you learn.

P.S.

...Think positive)

BTC Bears Persists so Explore Other Profitable AssetsI must admit that the current state of Bitcoin (BTC) has left a somber tone in my words. As we navigate through these challenging times, it is with a heavy heart that I inform you about the ongoing bearish momentum that continues to plague BTC.

Despite our hopes for a swift recovery, BTC's price remains significantly below the Simple Moving Average 200 (SMA 200), casting a shadow of uncertainty over its future. The market sentiment surrounding Bitcoin has been marred by persistent selling pressure, causing distress among traders and investors alike.

While it is disheartening to witness this prolonged downturn, I believe it is crucial to consider alternative investment avenues that may offer more promising prospects. As traders, we must adapt to the ever-changing market dynamics and seek opportunities beyond BTC.

Therefore, I encourage you to explore other profitable asset classes that have shown resilience during these challenging times. Diversifying your portfolio with assets such as stocks, commodities, or even emerging cryptocurrencies might provide a glimmer of hope amidst the current market turbulence.

Remember, the trading world is not limited to a single asset, and countless opportunities await exploring. By broadening our horizons, we can potentially discover new avenues for profit and safeguard our investments against the uncertainties faced by BTC.

While feeling disheartened by BTC's current state is natural, let us not lose sight of the bigger picture. History has shown that markets are cyclical, and what goes down eventually comes back up. However, we are responsible for adapting and making informed decisions that align with the prevailing market conditions.

In conclusion, I urge you to reflect upon your trading strategies and consider diversifying your portfolio to include other potentially profitable asset classes. Let us not be disheartened by BTC's bearish momentum but use this as an opportunity to explore new avenues for growth and prosperity.

Please do not hesitate to comment if you require any assistance or guidance in exploring alternative asset classes. Together, we can navigate these turbulent times and emerge more robust and resilient.

#Bitcoin - thoughts out loud #5Good evening from Ukraine!

Dear colleagues , I am glad to welcome you!

Without a logical justification, the vision of the situation I show on the graph may not be realized. The position is set in the range of 25800 - 26300.

Thank you all for your attention, I wish you success .

Sometimes you win /sometimes you learn .

P.S.

...Think positive)

Bitcoin Reaches Close to Death CrossI write to you with a cautious tone as a significant development is occuring in the Bitcoin market: the dreaded "death cross."

As many of you may already know, the death cross is a technical pattern that occurs when an asset's short-term moving average crosses its long-term moving average. In simpler terms, it signifies a potential shift in market sentiment from bullish to bearish. Unfortunately, our beloved Bitcoin has just experienced this ominous event.

While it is crucial to acknowledge that technical analysis is not always an accurate predictor of future price movements, the death cross has historically been associated with increased selling pressure and a potential downtrend. This pattern has caused concern among traders, prompting us to take a momentary step back and reevaluate our strategies.

Considering this development, I encourage you to exercise caution and consider pausing Bitcoin trading. It is essential to reassess your risk tolerance, evaluate your investment goals, and diversify your portfolio to mitigate potential losses. Remember, preserving capital is just as important as generating profits.

As seasoned traders, we understand the allure of cryptocurrencies and the potential for significant returns. However, it is crucial to remember that the market is highly volatile and subject to rapid changes. Taking a momentary pause to analyze the situation and gather more information can be wise.

I urge you to stay informed about the latest market trends, news, and expert opinions. Consult financial advisors or trusted sources to gain insights and make informed decisions. Remember, knowledge is power in the world of trading.

While feeling uncertain during such times is natural, it is also important to remain level-headed and disciplined. As the saying goes, "The market is always right." By exercising caution and adapting our strategies accordingly, we can navigate through these challenging times and position ourselves for future opportunities.

In conclusion, I encourage you to pause Bitcoin trading, reevaluate your approach, and gather more information before making any hasty decisions. Let's take this moment to reflect, learn, and adapt our strategies to the current market conditions. Together, we can navigate these uncertain times and emerge stronger.

BRICS Using.... BITCOIN ? 😨Hi Traders, Investors and Speculators of Charts📈📉

Bitcoin is now political. (if it wasn't already before, it definitively is now).

In a recent development, official news leaked that that BRICS nations may look at using BTC to undermine the Dollar as a reserve currency. At the same time, many nations have drastically reduced their USD exposure.

China's holdings of US treasury bonds decreased significantly to $835.4 billion in June 2023, marking a substantial drop of approximately $103.4 billion within a year. ( Despite this reduction, China remains one of the largest creditors to the United States, with Japan holding the top position at $1.105 trillion. )

Additionally, the BRICS nations, a group consisting of Brazil, Russia, India, China, and now Saudi Arabia, are exploring the idea of using Bitcoin as an alternative to the US Dollar for international trade and exports . This suggests a growing desire among these nations to reduce their reliance on the US currency.

Saudi Arabia, a new member of BRICS, also decreased its holdings of US debt by $11.1 billion during the same period, now holding $108.1 billion. These moves by BRICS nations reflect their increasing opposition to the dominance of the US Dollar in the global economy.

Even though the bears have undoubtedly taken control of BTC short term, this is very provocative news that will definitely affect the Bitcoin price. The two main outcomes I see:

👉 Sellers drop the price lower to an entry point that is more acceptable for whale buyers in BRICS countries. BTC trades range for months.

👉 Considering USA holds most of the BTC supply by country, we see a price increase to make it harder / less affordable for BRICS countries to accumulate BTC. Lot's of volatility as BTC buyers vs sellers fight for macro dominance

Although, having been in this space for a while, I'm leaning more towards the first option considering that was what happened when El Salvador made similar claims.

As of March 8, 2023, Top Countries with BTC holdings are :

1) United States (805,810 BTC)

2) Russia (129,210 BTC)

3) Germany (108,150 BTC)

4) Switzerland (105,000 BTC)

5) Netherlands (88,400 BTC)

6) Canada (70,000 BTC)

7) United Kingdom (58,000 BTC)

8) Sweden (52,000 BTC)

9) Japan (42,000 BTC)

10) Australia (38,000 BTC)

Ziad Daoud, Chief Emerging Markets Economist for Bloomberg, suggests that Saudi Arabia's (a large oil nation) shift towards riskier assets could influence the Federal Reserve's stance on interest rates, both domestically and globally. This could potentially lead to higher US interest rates.

So where does this leaves you, as a Bitcoin trader / speculator? Not in a great place. With these new developments it may be harder than ever before to predict the direction of the price.

My recommendation is still the same since weeks ago.. Altcoins. There are MANY better trading setups within the altcoin market that have better risk/reward setups. I personally won't touch BTC for the moment.

______________________________

Incase you missed it, previous relevant updates here :

BRICS 2023 Summit outcomes :

Capitalizing on BRICS nations stocks:

_______________________

📢Follow us here on TradingView for daily updates and trade ideas on crypto , stocks and commodities 💎Hit like & Follow 👍

We thank you for your support !

CryptoCheck

BTC Update - 17/08/2023BTC needs to protect 27000-27500 Zone to protect bullish pattern.

Disclaimer: The information and analysis provided in this publication are for educational purposes only and should not be construed as financial advice or recommendations to buy, sell, or hold any securities. The author and TradingView are not responsible for any investment decisions made based on the content presented herein. Always consult a financial professional before making any investment decisions.

#BITCOIN= SHOW SUPPORT TO OUR FIRST IDEA.Hey Everyone,

Price have accumulated since last few weeks and now we are expecting price to continue the bullish trend until $62000 which is our primary target, it is worth noticing that price have potential to reach that target as economic and other factors are supporting the idea.

Thanks for your support in advance :)

"BTC: A Bearish Omen Looms - Could Bitcoin Drop to $20K?"Bitcoin (BTC) has just unveiled a potentially ominous signal - a head and shoulder pattern. This pattern suggests a looming drop in BTC's value, potentially reaching as low as $20,000.

What makes this intriguing is that these technical patterns often await a major negative development in the crypto world before they swing into action. Keep a close eye on the market, as exciting yet unpredictable times could be ahead.

Bitcoin | I Give the 28000 level for ShortI think the price has to get fuel from below to keep going up.

With the positive decision to be announced on September 2 soon, the market maker will again demand the 30.200 level, creating a long bias.

In short, I was involved in the run down to the level I expected 23,200 at 28000 (you can see the proof of this in the analysis below i said 28000 to short in the comment of the analysis before the spike) and I'm out right now.

Next days will be very volatile in my opinion.

I will probably create a short position on 29.200-29.800-30.600 and stop at 31.800.

23.400 will be my tp and I'll take one 1R risk on every price point. Total risk will be 3R.

BTC Falls Below SMA 200 After Grayscale ETF VictoryIntroduction:

The recent news of Grayscale's ETF victory has sent shockwaves through the cryptocurrency market. Bitcoin (BTC), the flagship cryptocurrency, experienced a significant drop below its Simple Moving Average 200 (SMA 200) following this development. As traders, it is crucial to approach this situation cautiously and carefully assess the potential risks and rewards. In this article, we delve into the implications of BTC's decline and present a cautious call to action for those considering shorting BTC.

Understanding the Grayscale ETF Victory:

Grayscale's ETF victory has undoubtedly generated excitement among cryptocurrency enthusiasts, as it promises increased institutional adoption and market liquidity. However, the immediate aftermath has seen BTC's price plummet below its SMA 200, a key technical indicator widely used by traders to gauge market trends. This development raises concerns about a potential bearish trend reversal, urging traders to exercise caution and consider alternative strategies.

Analyzing the BTC Price Drop:

The fall below the SMA 200 is a significant technical event that cannot be overlooked. It indicates a potential shift in market sentiment, with selling pressure overpowering buying interest. Traders must recognize that this decline may increase volatility and further downside potential for BTC. Therefore, evaluating the market dynamics and adopting a cautious approach to trading becomes crucial.

A Cautious Call-to-Action: Shorting BTC:

Considering the current market conditions, traders may cautiously explore shorting BTC as a potential strategy. Shorting involves borrowing BTC and selling it at the current market price, expecting to repurchase it at a lower price in the future, thus profiting from the price difference. However, it is essential to note that shorting carries inherent risks and requires careful risk management.

1. Conduct Thorough Research: Before initiating any short positions, traders must conduct thorough research and gather insights from reliable sources. Analyze the market sentiment, technical indicators, and fundamental factors that could influence BTC's price movement. Remember, informed decisions are crucial in managing risks effectively.

2. Define Risk Tolerance: Clearly define your risk tolerance level and set appropriate stop-loss orders to limit potential losses. Volatility can be unpredictable, and it is essential to protect your capital by implementing risk management strategies.

3. Diversify Your Portfolio: Avoid putting all your eggs in one basket. Diversify your trading portfolio by exploring other cryptocurrencies or traditional assets to mitigate the risks of shorting BTC. This approach can help balance potential losses and enhance overall trading performance.

4. Stay Updated and Adapt: The cryptocurrency market is dynamic and subject to rapid changes. To make informed decisions, stay updated with the latest news, market trends, and regulatory developments. Be ready to adapt your trading strategy accordingly.

Conclusion:

BTC's fall below the SMA 200 after the Grayscale ETF victory presents traders with an opportunity to consider shorting BTC cautiously. However, it is crucial to approach this strategy with utmost care, conducting thorough research, defining risk tolerance, diversifying your portfolio, and staying updated with market dynamics. Remember, trading involves risks, and exercising caution and adopting responsible practices is essential.

Note: This article does not constitute financial advice. Traders should seek professional guidance or conduct further research before making investment decisions.

Grayscale Victory Funded by Perpetual Future BTC TradingIn the ever-evolving world of cryptocurrency, Bitcoin (BTC) continues to dominate the market, attracting both seasoned traders and new investors. Recent developments surrounding Grayscale's victory have shed light on the influence of perpetual future trading in shaping the BTC landscape. Today, we delve into this topic cautiously, urging traders to be wary of who trades BTC and to exercise prudence in their investment decisions.

Unveiling the Grayscale Victory:

Grayscale, a digital asset management firm, recently made headlines with its monumental victory in the SEC's lawsuit. This victory has solidified Grayscale's position in the market and highlighted the role of perpetual future trading in funding such endeavors. Endless future trading refers to a trading strategy where traders enter into contracts that do not have an expiration date, enabling them to hold positions indefinitely.

The Influence of Perpetual Future Trading:

While perpetual future trading has merits, it also introduces volatility and uncertainty into the BTC market. The ability to hold positions indefinitely allows traders to exert significant influence on the price movements of BTC. This influence, coupled with the vast resources at their disposal, can potentially distort the market and impact the decisions of other traders.

A Call for Caution:

Given the increasing prevalence of perpetual trading, BTC traders must exercise caution and remain vigilant. Here are a few points to consider:

1. Research and Verify: Before making any investment decisions, thoroughly research and verify the credibility and intentions of the parties involved. Look beyond the surface and explore the trading strategies employed by BTC entities.

2. Diversify Your Portfolio: Instead of relying solely on BTC, consider diversifying your portfolio with other cryptocurrencies or traditional assets. This approach can help mitigate risks associated with the influence of perpetual future trading on BTC.

3. Stay Informed: Regularly stay updated with the latest news and developments in the cryptocurrency market. You can better assess the impact of perpetual future trading and make informed investment decisions by keeping yourself informed.

Conclusion:

As BTC continues to gain popularity, traders must be cautious and discerning in their investment choices. The recent Grayscale victory, funded by perpetual future trading, is a timely reminder of the potential risks associated with this trading strategy. By researching, diversifying, and staying informed, traders can confidently navigate the BTC market and protect their investments.

Call-to-Action:

In this volatile landscape, it is crucial to remain cautious when trading BTC. Take the time to understand the motivations and trading strategies employed by entities involved in the market. By doing so, you can safeguard your investments and make informed decisions. Stay informed, diversify your portfolio, and trade responsibly.