BITCOIN BACK TO 19999 SUPPORT?We don't know when the ETF from BlackRock will be approved so this is the worst possibility of COINBASE:BTCUSD if this ETF is not approved as soon as possible BINANCE:BTCUSD will return to 19999.19 usd support!

or if it is not strong enough to hold the support at 19999 it will return to 16778, I hope next month it will be approved by the SEC.

Bitcoinidea

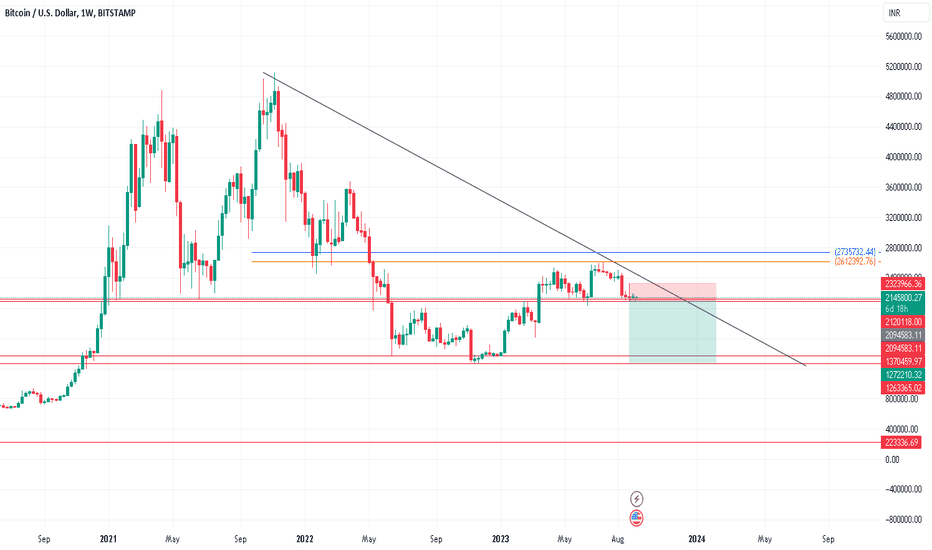

BitcoinWe may see 1270000 again if breaks the support.

Careful upside is very limit as resistance is strong and retested to further fall from here.

Best buying may come next year Jan/Feb 2024..

Stay away from the bitcoin as per technical analysis.

Upside break should be very fast as of now or it will reject and fall in coming weeks or months.

#Bitcoin - thoughts out loud #7Good evening from Ukraine!

Dear colleagues, I am glad to welcome you!

Without logic, there is no way to fall further. For the current period of time.💸💸💸

Because this is my vision of the situation, because these are my thoughts out loud. Thank you.

Thank you all for your attention, I wish you success.

Sometimes you win/sometimes you learn.

P.S.

...Think positive)

#Bitcoin - thoughts out loud #5Good evening from Ukraine!

Dear colleagues , I am glad to welcome you!

Without a logical justification, the vision of the situation I show on the graph may not be realized. The position is set in the range of 25800 - 26300.

Thank you all for your attention, I wish you success .

Sometimes you win /sometimes you learn .

P.S.

...Think positive)

How Could Apple's Market Cap Impact Bitcoin and Crypto Markets?THE APPLE FACTOR

Introduction:

The crypto world is always abuzz with potential catalysts for market movements, and this time, it's not just crypto-related news making waves. Renowned crypto analyst Nicholas Merten, better known as DataDash, recently shared his insights on how a declining Apple market cap could have significant implications for Bitcoin and the broader cryptocurrency markets. In this TradingView article, we'll delve into Merten's analysis and explore the potential consequences for the crypto space.

The Apple Decline: A Cause for Concern?

Apple Inc., one of the world's largest tech giants, reached a milestone in July 2023 when its market capitalization hit an astounding $3 trillion. However, since then, Apple's market cap has experienced a decline, currently resting at $2.79 trillion at the time of writing. Merten argues that this downward trend in Apple's valuation could trigger a chain reaction in financial markets, including cryptocurrencies.

The Domino Effect on Crypto: A 60%+ Drop?

Nicholas Merten suggests that if Apple continues on this path and contracts from a $3 trillion company to a $1.5 trillion company, it could have profound consequences for Bitcoin. He argues that this impact could surpass even major crypto events like halving or the approval of a Bitcoin ETF.

In his own words, Merten states, "If that scenario plays out, you can easily see Bitcoin coming down here to new lows at around $10,000 to $12,000." While he emphasizes that it's not a guarantee, it's a scenario that traders and investors should take seriously.

Why Does Apple Matter?

The significance of Apple's decline goes beyond its sheer size. Apple's market cap decline has a cascading effect on other equities, including tech giants like Microsoft and the famous FANG stocks (Facebook, Amazon, Netflix, and Google). Additionally, it could impact the broader stock market and, crucially, the cryptocurrency space, from Bitcoin to various altcoins.

As Merten puts it, "Those small percentage declines, while they seem small, are magnified when you consider Apple’s valuation and the weighted impact it’s going to have on other equities."

Conclusion: Navigating Potential Storms

The crypto market is no stranger to volatility, and external factors often play a significant role in shaping its trajectory. Nicholas Merten's warning about the potential repercussions of Apple's market cap decline is a stark reminder that the crypto world is interconnected with the broader financial ecosystem.

While it's essential to stay informed and heed expert advice, it's equally crucial for traders and investors to maintain a diversified portfolio and be prepared for various scenarios. The relationship between Apple's fortunes and Bitcoin's fate is a fascinating topic to watch, and its evolution may offer valuable insights into the future of both traditional and crypto markets. As always, the key to success in trading and investing is a combination of vigilance, knowledge, and adaptability.

BTC September Spike then Slump! Probable death-cross retestsGm crypto fam.

This is a simple, yet powerful chart showing two MAJOR death crossed lining up.

One is a Bitcoin lifetime first (!), the 20-month crossing down on the 50-month (grey/black).

The other one is our classic 50/200D (light blue/dark blue).

Green dots show where crosses are forming. Ready to be retested on a spike.

September Spike then Slump!?

Brought to you by:

PIK analyst team at EXMO Study

Starting to buy bitcoin again on a possible diamond bottomStarting to re-add to bitcoin here around 25700 in what could be the beginnings of a diamond bottom formation on the hourly charts (which is a reversal patten bottom indicator after a bear downtrend).

The larger technicals are showing a higher low on the weekly chart here still so its worth adding here and see what happens, stop loss is nice and tight at the bottom of the diamond.

Weekly nice and oversold so its worth trying to go long here imo

BTC Hits New Support Level at $24800Introduction:

In the ever-volatile world of cryptocurrency, Bitcoin (BTC) has recently encountered a significant shift as it reached a new support level at $24800. This sudden development has raised concerns among traders, prompting a need for caution and careful evaluation of the market conditions. In this article, we will delve into the implications of this support level and emphasize the importance of waiting for clarity before resuming Bitcoin trading.

The Importance of Support Levels:

Support levels play a crucial role in technical analysis, indicating a price point at which an asset is expected to find buying interest and reverse its downtrend. They act as a safety net, preventing prices from plummeting further. The recent establishment of a support level at $24800 for Bitcoin suggests a potential stabilization in its value. However, it is essential to remember that these levels are not guarantees but indications of possible reversals.

The Concerning Tone:

Traders, we find ourselves in uncertain times. The cryptocurrency market has always been known for its volatility, and the recent developments surrounding Bitcoin only add to the confusion. As we navigate through uncharted waters, it is crucial to approach this situation with a concerned tone. Instead of hastily jumping into trades, we must exercise patience and wait for clarity to emerge.

Why Pause Bitcoin Trading?

Given the current circumstances, it is prudent to pause Bitcoin trading until we understand the market's direction. Here are a few reasons to consider:

1. Market Sentiment: Establishing a support level at $24800 is a positive sign but does not guarantee an immediate upward trend. Assessing market sentiment and observing traders' reactions to this new support level is crucial before making any hasty decisions.

2. Volatility and Risk: Bitcoin's recent volatility has left many traders on edge. Sudden price swings can result in significant losses if not approached with caution. We can minimize the risks associated with uncertain market conditions by pausing trading.

3. Clarity is Key: Waiting for clarity is essential to make informed trading decisions. It allows us to evaluate the market trends, monitor price movements, and analyze the impact of external factors that may influence Bitcoin's trajectory. We can avoid impulsive actions driven by fear or uncertainty by exercising patience.

The Call to Action:

Traders, in these uncertain times, must prioritize caution and prudence. It is crucial to continue pausing Bitcoin trading until clarity emerges and a clear upward trend is established. By doing so, we can mitigate potential risks and make informed decisions based on market stability.

Remember, the cryptocurrency market is highly unpredictable, and impulsive actions can lead to significant losses. Take this opportunity to educate yourself, stay updated with market news, and seek guidance from trusted sources. Together, we can navigate this challenging period and position ourselves for success when the market stabilizes.

In conclusion, let us exercise patience and restraint until the market provides a more straightforward path. We can make informed decisions and protect ourselves from unnecessary risks by waiting for clarity to show a definitive upward trend. Stay informed, stay cautious, and most importantly, stay resilient.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always conduct your research and consult a professional before making investment decisions.

BTC Bitcoin Technical Analysis and Trade IdeaBitcoin is presently positioned within critical daily, weekly, and monthly price levels. An evident trend on the chart indicates that Bitcoin has been subjected to significant bearish pressure, prompting us to consider the potential for a selling opportunity. Nevertheless, there are noteworthy chart elements that demand our careful scrutiny, and these have been thoroughly examined in the accompanying video. In the video presentation, we conduct a comprehensive analysis of the prevailing trend, price fluctuations, market structure, and other essential facets of technical analysis. It is worth reiterating that our video provides lucid explanations, but it is imperative to underscore that the information presented should not be misconstrued as financial advice.

Bitcoin analysisHello friends

In the major period and in the weekly time frame, if we accept that at the price of $69,000, the 5-wave bullish Bitcoin has ended, we can imagine that we are still taking corrective steps.

Also, by hitting the supply area of 30-33 thousand dollars, we saw the breaking of the Rising Wedge pattern, which makes the above analysis more likely to be correct.

If the price level of 24800 dollars is broken, the final confirmation will be issued to continue the decline.

Based on this, my overall view on Bitcoin is bearish

Bitcoin Time to be Cautious with Bearish Signs ShowingHi Guys! This is a Technical Analysis on Bitcoin (BTC) on the 3 Day Timeframe.

We've attempted since April 2023 to try and break ABOVE the Resistance Trend Line

From End of June to Mid July, we attempted to Re-test the Resistance trendline for couple weeks BUT Failed with a REJECTION.

Which brought Price Action to test SUPPORT on the 21 EMA (Purple line), before finally breaking through the 21 EMA and 50 SMA (Green line) with an ENGULFING BEARISH CANDLE.

Bringing us below the 0.786 FIB level.

But pay attention to the Volume, we initially have a spike in VOLUME during the break down but there has not yet been signs of follow through so wtch closely.

2 Major patterns have shown up that makes me CAUTIOUS with BTC atleast for the short term.

If they play out could bring BTC to test the 0.618 FIB level @ $24200

***1st is the fast approaching DEATH CROSS, where the 21 EMA crosses below the 50 SMA.

If you look left ( on your own time) as i have not zoomed out on the chart.

There are MIXED scenarios where some indicate massive bear markets and other times where we have price declines that last only couple months.

I think the later is more likely where we have a correction for some weeks to couple months before having a GOLDEN CROSS and continuing back into a BULL market.

***2nd is the BEARISH DIVERGENCE forming in the charts.

This is when Price action shows HIGHER LOWS but Indicators show LOWER LOWS.

AND that 2 Indicators are showing such signs.

It normally leads PRICE ACTION to mirrow the indicators by also forming a Lower Low.

Thus having the 0.618 FIB level be that LOWER LOW Target.

ALso i would love to see in the Indicators:

1. RSI Move back ABOVE Red Horizontal Line

2. MACD Move back ABOVE 0 level

If we dont, we can see further price DECLINES adding to the risk of seeing that 0.618 FIB Level.

This 2 Bearish Signs merit CAUTION in BTC, i would not take positions here but wait out to see how things play out.

__________________________________________________________________________________

Thank you for taking the time to read my analysis. Hope it helped keep you informed. Please do support my ideas by boosting, following me and commenting. Thanks again.

Stay tuned for more updates on BTC in the near future.

If you have any questions, do reach out. Thank you again.

DISCLAIMER: This is not financial advice, i am not a financial advisor. The thoughts expressed in the posts are my opinion and for educational purposes. Do not use my ideas for the basis of your trading strategy, make sure to work out your own strategy and when trading always spend majority of your time on risk management strategy

Bitcoin Price Action & Trade UpdatesTraders,

My followers know that during the last price pump by BTC to the 200 day moving avg., I took 50% off ALL trades, altcoins included. I then moved all my stops up to just above breakeven. I have been out of the office since Wed. and came back to notice that some of these stop limits have been triggered.

XRP at .50

ETH at $1638

BTC at 26403

LTC at 65

SAND at .33

And my followers know that I took100% off on my JOE trade with 35% profit on that trade. Congrats to all who followed me in that trade!

My remaining trades are APE, just because I never sold when I was actually in profit and thus I am waiting for either the original target or SL to be triggered.

I am also in COMP with a SL of $30

This is not financial advice. Just showing you all what I am doing here.

Now, as far as TA goes on BTC, you will notice we are back down to my original Inverse H&S neckline at 25,200. If this breaks, we have support just below that from Dec. '21. However, breaking both of those would be trouble and I would then anticipate our March 23 BTC CME futures gap to be filled at around 20k

Stay tuned and I will try to put out a video update on Monday.

Best,

Stew

BITCOIN Moving Lower to $21,500BTC Weekly Quick Analysis

What Seems Legit?

A move lower. Look bruv we gotta get honest here. We want a BTC Moonsoon too, but, BTC broke it's trend line lower on a clearly defined candle. It has retested and rejected the trend line with selling pressure; the candle hasn't closed but it's not looking good bruv. The RSI has a clear divergence from the price and has also moved below the 50 level. and.. it's retesting our only hope of a support.. again.

Chart Key

Yellow Solid = Major Trend Line

Aqua Solid = Divergences

White Dotted = Support / Bounce Area

Green Boxes = Supports / Target Areas

Bitcoin | I Give the 28000 level for ShortI think the price has to get fuel from below to keep going up.

With the positive decision to be announced on September 2 soon, the market maker will again demand the 30.200 level, creating a long bias.

In short, I was involved in the run down to the level I expected 23,200 at 28000 (you can see the proof of this in the analysis below i said 28000 to short in the comment of the analysis before the spike) and I'm out right now.

Next days will be very volatile in my opinion.

I will probably create a short position on 29.200-29.800-30.600 and stop at 31.800.

23.400 will be my tp and I'll take one 1R risk on every price point. Total risk will be 3R.

BTC Falls Below SMA 200 After Grayscale ETF VictoryIntroduction:

The recent news of Grayscale's ETF victory has sent shockwaves through the cryptocurrency market. Bitcoin (BTC), the flagship cryptocurrency, experienced a significant drop below its Simple Moving Average 200 (SMA 200) following this development. As traders, it is crucial to approach this situation cautiously and carefully assess the potential risks and rewards. In this article, we delve into the implications of BTC's decline and present a cautious call to action for those considering shorting BTC.

Understanding the Grayscale ETF Victory:

Grayscale's ETF victory has undoubtedly generated excitement among cryptocurrency enthusiasts, as it promises increased institutional adoption and market liquidity. However, the immediate aftermath has seen BTC's price plummet below its SMA 200, a key technical indicator widely used by traders to gauge market trends. This development raises concerns about a potential bearish trend reversal, urging traders to exercise caution and consider alternative strategies.

Analyzing the BTC Price Drop:

The fall below the SMA 200 is a significant technical event that cannot be overlooked. It indicates a potential shift in market sentiment, with selling pressure overpowering buying interest. Traders must recognize that this decline may increase volatility and further downside potential for BTC. Therefore, evaluating the market dynamics and adopting a cautious approach to trading becomes crucial.

A Cautious Call-to-Action: Shorting BTC:

Considering the current market conditions, traders may cautiously explore shorting BTC as a potential strategy. Shorting involves borrowing BTC and selling it at the current market price, expecting to repurchase it at a lower price in the future, thus profiting from the price difference. However, it is essential to note that shorting carries inherent risks and requires careful risk management.

1. Conduct Thorough Research: Before initiating any short positions, traders must conduct thorough research and gather insights from reliable sources. Analyze the market sentiment, technical indicators, and fundamental factors that could influence BTC's price movement. Remember, informed decisions are crucial in managing risks effectively.

2. Define Risk Tolerance: Clearly define your risk tolerance level and set appropriate stop-loss orders to limit potential losses. Volatility can be unpredictable, and it is essential to protect your capital by implementing risk management strategies.

3. Diversify Your Portfolio: Avoid putting all your eggs in one basket. Diversify your trading portfolio by exploring other cryptocurrencies or traditional assets to mitigate the risks of shorting BTC. This approach can help balance potential losses and enhance overall trading performance.

4. Stay Updated and Adapt: The cryptocurrency market is dynamic and subject to rapid changes. To make informed decisions, stay updated with the latest news, market trends, and regulatory developments. Be ready to adapt your trading strategy accordingly.

Conclusion:

BTC's fall below the SMA 200 after the Grayscale ETF victory presents traders with an opportunity to consider shorting BTC cautiously. However, it is crucial to approach this strategy with utmost care, conducting thorough research, defining risk tolerance, diversifying your portfolio, and staying updated with market dynamics. Remember, trading involves risks, and exercising caution and adopting responsible practices is essential.

Note: This article does not constitute financial advice. Traders should seek professional guidance or conduct further research before making investment decisions.

Bitcoin Catching up to Traditional FinanceBar chart = S&P500, red MA = 111W MA for S&P500 (taken from PI Cycle Indicator)

Orange line chart = BTC, orange MA = 111W MA for BTC

Key takeaway: Notice how we are dipping much lower from the 111 and we are still lagging roughly 8 months behind on the "catch-up" move to traditional markets.

Grayscale Victory Funded by Perpetual Future BTC TradingIn the ever-evolving world of cryptocurrency, Bitcoin (BTC) continues to dominate the market, attracting both seasoned traders and new investors. Recent developments surrounding Grayscale's victory have shed light on the influence of perpetual future trading in shaping the BTC landscape. Today, we delve into this topic cautiously, urging traders to be wary of who trades BTC and to exercise prudence in their investment decisions.

Unveiling the Grayscale Victory:

Grayscale, a digital asset management firm, recently made headlines with its monumental victory in the SEC's lawsuit. This victory has solidified Grayscale's position in the market and highlighted the role of perpetual future trading in funding such endeavors. Endless future trading refers to a trading strategy where traders enter into contracts that do not have an expiration date, enabling them to hold positions indefinitely.

The Influence of Perpetual Future Trading:

While perpetual future trading has merits, it also introduces volatility and uncertainty into the BTC market. The ability to hold positions indefinitely allows traders to exert significant influence on the price movements of BTC. This influence, coupled with the vast resources at their disposal, can potentially distort the market and impact the decisions of other traders.

A Call for Caution:

Given the increasing prevalence of perpetual trading, BTC traders must exercise caution and remain vigilant. Here are a few points to consider:

1. Research and Verify: Before making any investment decisions, thoroughly research and verify the credibility and intentions of the parties involved. Look beyond the surface and explore the trading strategies employed by BTC entities.

2. Diversify Your Portfolio: Instead of relying solely on BTC, consider diversifying your portfolio with other cryptocurrencies or traditional assets. This approach can help mitigate risks associated with the influence of perpetual future trading on BTC.

3. Stay Informed: Regularly stay updated with the latest news and developments in the cryptocurrency market. You can better assess the impact of perpetual future trading and make informed investment decisions by keeping yourself informed.

Conclusion:

As BTC continues to gain popularity, traders must be cautious and discerning in their investment choices. The recent Grayscale victory, funded by perpetual future trading, is a timely reminder of the potential risks associated with this trading strategy. By researching, diversifying, and staying informed, traders can confidently navigate the BTC market and protect their investments.

Call-to-Action:

In this volatile landscape, it is crucial to remain cautious when trading BTC. Take the time to understand the motivations and trading strategies employed by entities involved in the market. By doing so, you can safeguard your investments and make informed decisions. Stay informed, diversify your portfolio, and trade responsibly.