Bitcoin analysis in daily timeConsidering that extraterrestrial beings also use Bitcoin for their financial transactions, we should not be left behind...

Bitcoin will definitely have a temporary drop and then a significant rise.

We are waiting for shopping areas for spots. Two areas are considered. In the lower area, we reduce the average purchase price.

The minimum profit of this business is 40%.

We will definitely act smarter than the UFO owners.

Not financial advice

Bitcoinforecast

TheKing Still Bullish- Despite the silvergate mini Fud, BTC still on his consolidation trend.

- this Fud just caused a faster mini retracement but it would have happened anyway.

- Next Fud could concern Stables Coins, They are trying hard, no smoke, no fire.

- Whatever, at one point BTC will go his natural way. up!

-----------------------------------------------------------------------------------------------------------------

- For now look at the Graph :

-- BTC still evolving and bouncing on Tenkansen (Yellow Line)

-- Senkou Span is making a flat line around 32k ( Violin Line)

-- can notice a first support around 21.3K (Tenkan) ( Fibo 38.2% Retracement )

-- can notice a second support around 19.2K (trend) ( Fibo 61.8% Retracement ) (CME GAP 20.9k -19.9k)

-----------------------------------------------------------------------------------------------------------------

- imo not a time for trading for a long term investor, just watch.

- if you are a Scalper, that's fine, just use a tight SL.

- Any Fuds coming and any lower prices are fire buy at the good zones.

- i will comment this post with some older analysis so you will get the scheme more clearly.

Happy Tr4Ding !

Price Pattern Repeat! Quick #BTC chart analysis 📈Today, we're comparing the current price chart with the 2015 - 2017 cycle.

The cycle of 2015 - 2017 is highlighted in green, juxtaposed with the current cycle. Just observe how the modern price dynamics are mirroring the prices of 2015 - 2017. Our correlation coefficient? A staggering 80% plus. 😮

Without any extra strain, the resemblance in price charts is striking. In the past, price consolidation was a long game (it was a sideways trend), followed by a strong pump and liquidity collection above local maximums.

As of now, the price is also consolidating over a significant stretch of time. If the price dynamics continue to follow the fractal of 2015-2017, we're looking at a potent price movement in the very near future. Should the movement be upwards, which is the more likely scenario, our potential target rings up at $42 - $48k. However, if the movement tracks downwards, an approximate level of $22k will be the movement's target, also serving as an ideal opportunity for an advantageous buy. 👍

P.S. The bull market is still a bit undercover, but a careful glance at the chart reveals it's been on the roll for half a year already. Day by day, growth is set to accelerate, making the upcoming 1.5 years the perfect period for capital augmentation. Time to strap in for the 🚀🚀🚀 ride, folks!

All my 6 years of trading experience, knowledge, developments, and indicators I share them here in ideas for free. In return I will ask you just follow me, like this post and leave a nice comment, it will allow me to move faster and make more useful content! 💚💚💚

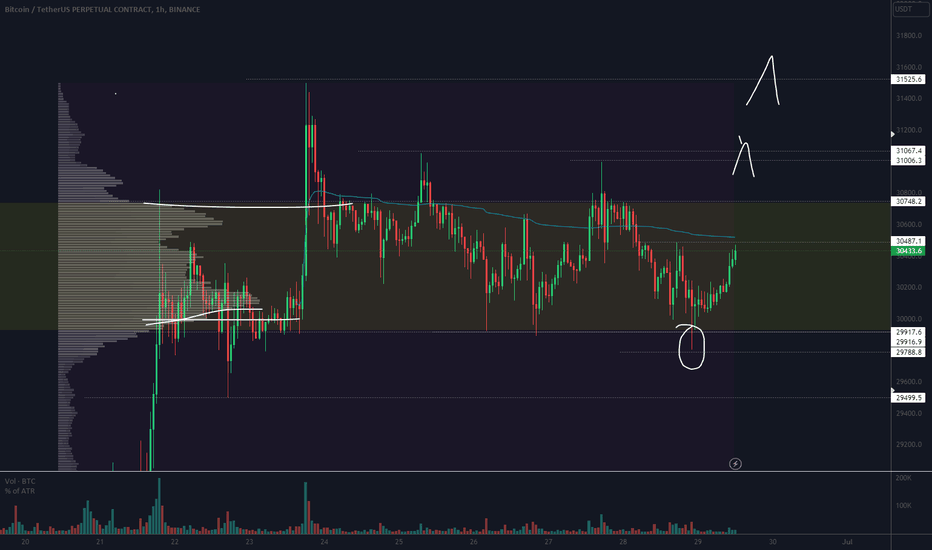

Bitcoin prediction in 1H time frameDefinitely, the price support of 29,500 Bitcoin is a fake support and will be broken soon.

This one-hour bullish correction is only to collect the energy of the next bearish rally at this time.

Let's not forget that Bitcoin is still bullish on the daily time frame and targets of $38,000 are available.

Not financial advice

Bitcoin is Unlikely To Outperform The Stock Market Again Above, you can see that Bitcoin is currently back to 2017 ATH levels when weighted against the S&P 500. In addition, Bitcoin has also sustained a breakdown below both long term trendlines against the index. I can't really be more generous than that. Even if stocks have already hit bottom, I think Bitcoin is unlikely to outperform again, at least for many years. If this is the case, can Bitcoin survive based on pure utility? Or is its utility also its value? This could imply that it is self-defeating.

In the summer of 2021, I still speculated that Bitcoin could have a final blow-off top. Bitcoin bounced from the first trendline and made a brief new all-time high, but did not manage to have the blow off moment many were expecting. Here is the original post, which was my first article to be featured on the front page of TradingView.

I also made a post in August, 2021 about Bitcoin's performance against different assets, noting its weakness against Tesla and relative strength against Gold. Now, Bitcoin is lingering right on the long term trend against Gold, and I would not be surprised to see that break down as well.

Even then, I was thinking Bitcoin could achieve Gold's market cap this cycle. This is why it's extremely important to be adaptive when investing. As I began noting towards the end of 2021, some warning signs started to crop up. Had I ignored these signs of weakness, I would now be staring at altcoin bags that are 50-95% down from where I sold them back in January, leaving a lot of profit on the table. Now I'm cash heavy, but what to buy? Crypto no longer seems particularly attractive to me from a medium-term standpoint. I think the speculation phase is over, and if crypto can't prove itself "necessary" for society, it can just fade away. These breaking trends tell me as much. Even Ethereum failed to make a new high against Bitcoin this cycle, essentially proving the entire altcoin market as a grand charade. The implications of these failing trends are quite awful for Crypto, unfortunately.

This is what has happened to Bitcoin since it broke down from the long term uptrend against TSLA:

This is especially concerning, considering many would also argue that TSLA itself is overvalued. This implies logically to me that Bitcoin can fade to extremely low levels, particularly if traditional markets have not yet found bottom.

You can make as much hopium TA as you like, but I think this simple observation will weigh on long term sentiment for market players as they slowly take notice. Institutions and billionaires have piled into the new asset class because it experienced some years of outperformance. This chart shows that this current period of underperformance is likely to continue.

I think this is incredibly important, because it impacts where people decide to invest, once all the dust settles. Based on the trends I noted above, I think other investments will perform better. I believe there will be plenty of time to figure this out as we experience a massive re-allocation of capital. Now is not necessarily the time to rush into any investments. There are lots of losers during this downturn, but if one managed to profit from the big run up this seems to be a good time to sit back and re-evaluate priorities. That's what I'm doing.

This is entirely my own opinion and should be used for speculative and entertainment purposes. Not financial advice.

-Victor Cobra

The Market Requires A 100%+ Move - Will Buyers Save Bitcoin? Here on the left, I've shown the BLX chart (Bitcoin index with the longest price history, plus its log curve) and the broken long term uptrend on the Litecoin chart on the right. Why Litecoin? Well, the 2017 bull market was characterized by astronomical gains for Bitcoin alternatives. At that time, it was about which functioned as the best currency. Litecoin and others were seen as faster, cheaper alternatives to Bitcoin. Litecoin supporters mark a bit of a cross-over between those who believe proof-of-work offers the most secure, stable network and those who prioritize cheaper transactions. Although Litecoin and other currency competitors did well in 2017, they underperformed in 2021, outclassed by coins associated with DeFi, memes, NFT's, the metaverse, and staking. This past bull run was characterized by which had the best "value" proposition and/or the best memes. Needless to say, much of this has already gone up in smoke.

The issue is, the "currency" coins have not held value either, retreating all the way back to levels from the 2018-2019 bear market, while Bitcoin itself barely maintains its price above the 2017 all-time-high, between $19800 and $20100. Most people did not think this was possible a few months ago. Many were still convinced that Bitcoin would hold above $28800 and maintain a bullish trend. Litecoin has broken its long term uptrend, and arguably needs to go up a whopping 4x in value quickly in order to regain the trend. Yet, a currency does not necessarily need to appreciate in value over time. We're now in the utility phase - cryptocurrencies need to prove they have some sort of necessary use-case outside of value appreciation.

Speaking of long term value - we're now at a moment where if the bottom is NOT in , there's very little historical Bitcoin trend support until nearly $9k, where I've drawn my log curve. And I've drawn it generously - I've noticed that before this crash many were drawing their curve so it cut out the COVID crash, seeing it as an anomaly. But if that was an anomaly, what is today's price action?

For many participants in the crypto market, the bottom MUST be in, or at least we must be very close to it. Bitcoin likely could not experience anything greater than another 50% decline from the most recent low ($17600) before total implosion, at least according to the log curve. Some would argue that the market has already imploded, but it seems merely that the over-leveraged players are getting consumed by those with deeper pockets. Just because the smaller, riskier lenders have fallen, does not mean the market is immune to continued systemic risk. The bigger fish need to attract more buyers ASAP, and the bounce needs to be huge - I'm talking a 100% increase at minimum.

So then, the question becomes: What is the probability that Bitcoin will double from current prices and get back above the $40k level in coming weeks? I believe the market needs to see something like this, in order to prove it has any legitimacy as an "asset class." Otherwise, I think this was the final bubble for Bitcoin and crypto. I mean that seriously. Either of these scenarios would work, to inject confidence back in the market, though of course the blue is more severe.

As I've said in my recent posts, any kind of bounce would be perfectly reasonable from these levels - buyers, you're welcome to that $20k Bitcoin at any point....a lot of people are waiting for you *evil smirk, impersonating big exchanges*. My point is that the bounce needs some SERIOUS oooomph behind it. Rising slowly to $33-34k over the course of several weeks just wouldn't do the trick, and it would provide the opportunity for longer term moving averages to solidify themselves as resistance, and could even allow the 200 week MA to flatline and roll over to the downside.

TL/DR: Bitcoin needs to show buyers have strength to take it back to $40k+ quickly, even if it's just an initial impulse, to inject some confidence and liquidity back in the market.

Now, for the warning signs, and what limits the probability of a 100%+ up move.

BROKEN TRENDS

I'll begin by posting a chart of a seemingly random altcoin - TRX.

I think this one is significant because of Justin Sun's relationship to Binance, his own algorithmic stablecoin (USDD), and its apparent refusal to break down from its distribution range. Of the coins I've followed, its the only one that has not dropped substantially, although it finally broke its own uptrend. This shows there is still significant downside risk in pockets of the market.

Something I've been watching for roughly a year now is the ratio of Bitcoin against the S&P 500 index (SPX). It has now experienced an extended decline, interrupting a decade of outperformance.

Based on the above chart, Bitcoin needs to triple soon (at minimum) to regain the trendline and show strength against traditional assets. My theory (as it stands) was that Bitcoin only outperformed because the market expected it to become mainstream one day, and be touted by billionaires and celebrities. Now that it has achieved fame, there is not much to speculate on anymore.

Bitcoin also needs to move up substantially against Gold, in order to continue capturing the "store of value" market share. Currently, it's below the 2017 all-time high, and resting on the highs from mid-2019. Gold is dropping substantially at the moment, so this provides an opportunity for Bitcoin to show some relative strength. But does it have enough fuel to get back above 18-20x and the long term trendline?

If Bitcoin's value proposition TRULY lay in its scarcity, then why did the market find the need to create thousands of other coins? Humans are greedy and expansionist in nature. Sure, having a limited supply of something and conserving it can teach humans to save and to prepare for the future. But in the end, as I've said numerous times, cryptocurrencies are not a resource. Bitcoin *could* be a commodity, but again, the market does not see it as such, which can be viewed in the simple Bitcoin Dominance metric, and implied by its decline during a period of high inflation.

I find that the Bitcoin Maximalist ethos is really about preparing for disaster. But to me, the most important things one can do to prepare for disaster are: CONNECT WITH YOUR LOCAL COMMUNITIES IN PERSON, develop a valuable skill or trade, and manage your risk.

Interpersonal trust is extremely important. This is how movements and change occur, not by building a hypothetical simulation of trust through algorithms on the Internet.

In addition, BACK TO LITECOIN - this thing has now dropped all the way back to its accumulation range from the previous bear market, showing that the last halving did nothing to increase the long term price floor for the asset. Will the same happen to Bitcoin? Litecoin appears to be in danger of heading back to somewhere below $10, should it not QUADRUPLE in the coming weeks.

What does this all mean to the buyer?

This means it's time to position oneself relative to risk tolerance. If you feel there is even a slight probability crypto will be saved by the big buyers, then now seems a decent time to allocate whatever percentage of your liquid capital to this crazy market and just hope for the best. For me at the moment, that's a little under 5%. For some, 5% might be a lot, for others, not so much. The way I see it - if I'm going to increase my exposure back to something like 10%, that's risking 10% for the potential to double my entire capital, since many altcoin projects could rebound 10x from here. That's my absurd logic, and is clearly only gambling. So, in my trading, I'm still considering putting a little bit back into the market near current levels. Yet, something holds me back - I think it's that my belief in the space has waned over the last couple years and I don't see much meaning in buying anything for the long term at this point. I'd rather focus my resources elsewhere. Nevertheless, I continue to post on here, cataloguing my ever-evolving thoughts on the market, and the fascinating history of humankind.

This article represents the opinion of the author, and is not meant as financial advice. It is meant for speculation and entertainment only. Please consult with a professional financial advisor before making significant financial decisions.

-Victor Cobra

The Bitcoin ETF news will not generate new highs (for now)Bitcoin has one clear level to break, which is the resistance of 30k to 32k. I'm observing that more people are starting to become bullish on Bitcoin, especially now that there is bullish news coming out, regarding the ETF of the biggest crypto today. I do believe that it is too early to celebrate.

As we can see on the chart, Bitcoin has already tried to break reisstance for the past 4 weeks. It failed to 4 times in a row and it looks like we're staring at the finaly rejection before the bigger correction.

I am still bullish on Bitcoin and i'm not trying to spread FUD. Only for the short term, I expect Bitcoin to experience a correction.

BTCUSDT/ Bitcoin will go downBINANCE:BTCUSDT

I really hope that in the near future we will see a rebound in order to take out all the shorts and only then go down. I am deeply convinced of the realism of this picture, I did not think that everything would come so early, I expected such sharp downward movements closer to autumn. Not an investment idea. All profitable trades. Follow me and more likes please ❤

Preparing for A "Best-Case" Scenario As I've been talking about over the last several weeks, the market SEEMS overdue for some sort of relief rally. Although I believe crypto has begun a longer term downtrend and likely will not see all-time highs in the foreseeable future, it is not unreasonable to expect some hope to be injected into the market before further sustained downside. Of course, the market can also continue its death-spiral, but I'm seeing what usually constitute bottoming signals:

1) Overwhelming negative sentiment

2) Retail traders becoming interested in shorting

3) Extremely negative articles in the news

4) Low Bitcoin exchange balance - this one may not mean much since supply doesn't need to affect traded price, but historically the balance goes UP along with major distribution, not down.

5) Indicators. The MACD, Ultimate Oscillator, and Stoch all leave room for several weeks of upside, even if it's a slow grind.

Unfortunately, many of these "bottoming" signals already presented themselves at the three previous "floors," at $32k, $28k, and now $17.6k.

Most traders trying to time a bottom still expect the crypto market to reach a new all-time high eventually. I do not operate under this assumption anymore. I think most of those people will get rekt and throw good money after bad. This would be the phase where the larger exchanges assume even more risk to keep the market afloat, and the next leg down begins when those larger firms capitulate as well. I think the biggest crypto bulls (C.Z., Michael Saylor, etc.) will be forced to admit defeat before bottom is reached. This is just my brazen opinion.

What's Different This Time??

The only thing that *could* be different this time is that declining oil prices may alleviate liquidity constraints across markets. We may even get a rapid deflationary period, kind of in a whipsaw reaction to easing supply bottlenecks and fuel price relief. Michael Burry mentioned something about this recently. Deflation could lead to momentary relief in markets, as people buy back some riskier assets. However, it may also be accompanied by declining profits for companies, and eventually severe layoffs. Optimistically, this could improve the outlook for small businesses and community organizations, but cause mayhem for large corporations. All of this is speculation, of course, since there are so many interacting variables with unpredictable behavior and outcomes.

Why Would The Market Go Up, if Everything Sucks?

I myself have been incredibly negative about crypto since the beginning of 2022, well before most of the carnage hit the market, so I was able to reduce my risk and get out in time. Here is the post that marked my transition from long term bullish to longer term bearish, in the very beginning of 2022. I received criticism from more experienced investors for being too flighty.

But now is it time for me to become more positive? Am I still being too flighty? To be honest, I still don't see anything of substance emerging from the crypto market, but I do admit that the emotions of traders are likely to continue being manipulated, which could result in some surprisingly large upside moves. I think the most likely way traders will be manipulated is to the upside. Hence, I am looking for some opportunities at current levels to buy a little bit, to be sold towards the end of the year. I am so disconnected from any emotional attachment to crypto at this point that I can have a fairly balanced approach, and not care about wishing new all-time highs into existence.

On the above chart, I've drawn a speculative trajectory to show a somewhat realistic outlook for the coming months, based on the broader market structure and sentiment. This is the best I think we can hope, if the market is to bounce. I think there is a slim possibility for a complete reversal here, but I noted the conditions necessary for that in my last analysis, linked here:

People are now talking about the Pi cycle bottom indicator for Bitcoin, which just flashed. Sure, this can be a bottom. As I keep saying, buyers are welcome to that $20k Bitcoin at any time, although bulls really don't want to see it become heavy resistance. As it now stands, the 200 week MA is already becoming resistance for the very first time in Bitcoin's history.

This is really bad news. But, it still holds on the TOTAL chart.

What's particularly interesting about the above chart is that the TOTAL crypto market cap tested its 2017 all-time high perfectly. If it continues to hold, I think the market can build a bit of a base here and try to exit the downtrend closer to the end of 2022. My speculation is that this breakout fails and TOTAL cannot hold above its next major weekly Moving Average (100 MA, yellow), while traditional markets make a lower high peak after weeks of slowly grinding up. Then, once 2023 begins, markets enter a new phase of implosion. I think it's fairly likely we see some debt-related liquidations across major financial firms in the U.S., as the central bank will remain under stress due to over-reliance on the dollar. The crypto collapse in this case is a strong warning signal to major financial institutions. Without the ability to print much money, I think we enter the worst depression since the 1929. Something like this:

How Can We Avoid The Collapse?

Unless economic conditions sort themselves out miraculously, and unless humanity does some seriously aggressive problem-solving, I think it will be really hard to avoid a depression. Most importantly, the U.S. needs to motivate its workforce and develop projects people actively want to work on - such as improving transportation infrastructure and water management/conservation infrastructure. This could actively solve both inflation and labor issues while helping us move forward in a future that will likely be characterized by severe clean water shortages and changes in how we use fuel. Unfortunately, humans have been trained to be more reactive than proactive over the last century, which makes the aggressive problem-solving more likely to occur once we have reached peak disaster, rather than beforehand. Part of this is due to exploitation and wealth inequality. Since the wealthy elite hold the power and they also do not feel the effects of global economic turmoil until things are at their worst, they are unlikely to do anything preventative. This isn't always because they are bad people, but simply because their privilege makes them blissfully unaware, and less likely to take actions that they see as too "drastic."

The good news is, major contractions are opportunities for growth, in the longer term. Think of it as a necessary growing pain for humanity.

Now if this is the BEST-case scenario, what's the worst? Well, the market can actually just continue to the downside here and offer zero opportunity for people to get out at higher prices. This becomes more likely if traditional markets have not yet reached their short-term bottom, and if more systemic issues surface. Even if Bitcoin heads to a new low shortly, there is still the possibility for a relief rally in the coming months, although it's mostly guesswork.

This is not meant as financial advice. This is meant for personal use, speculation, and entertainment only.

-Victor Cobra

Bitcoin - Escalation or Reprieve? After some time, Bitcoin has finally tested the $20k level. All the cryptos I held throughout the bull market are now below the levels where I first de-risked in January, 2021. This means that prices are now below every single one of my sell points. A move like this seemed likely to me, considering the breakdown of the 3-day 200 MA back in April. Prior to that, I liquidated most of my crypto earlier in 2022, due to a multitude of other warning signs. Here is the post from April, calling for $20k:

In my last Bitcoin analysis, I wrote about the potential for some sort of relief rally heading into the U.S. Midterm elections. Since then, price has continued to drop, but this scenario remains in play. This is not a time where I feel comfortable putting in a lot of capital, but it's a time where I'm certainly looking or opportunities. This is why I'm toying with some small alt positions to see if I can catch a bounce. Here's the last analysis:

Bitcoin now sits dangerously below the 200 week MA (teal), and must get above soon, otherwise it risks becoming major resistance. As Ethereum is now decidedly below its 2017 all-time high (near $1440 on Binance), it seems a real possibility Bitcoin will drop below the key $19-20k zone. Some liquidity still exists in the large area between $13.6k and $17.2k, so price can even venture briefly down there before any meaningful recovery for the market.

The theme of this post is ESCALATION or REPRIEVE.

What would ESCALATION look like? Well, as you might have noticed, a few major funds, platforms, and exchanges are in danger of insolvency. Many in this space were irresponsibly leveraged, most likely because they did not believe Bitcoin would ever retest its 2017 high and continue its established pattern. Escalation would mean that this creates a domino effect, until almost every exchange and firm shuts down, resulting in an extreme liquidity crisis. This could, in theory, push Bitcoin price continuously lower with no end in sight. This is what most sellers fear at the moment. And it's a very real possibility.

Now, what would a REPRIEVE look like? A reprieve is a delay in punishment. Sure, Bitcoin can bounce here and slowly grind up towards some other Moving Average resistances in the coming months. Historically, it has done this, once it reaches the 200 week MA. The way I see it, a relief rally would simply delay the inevitable. I no longer believe Bitcoin is in a long term uptrend, and instead has reversed to the downside. Almost every bullish narrative for Bitcoin price has now unwinded, in my opinion. I think the last remaining chance is forced adoption . This would mean that although most people would not choose to use it (the evidence for this already exists in El Salvador), the government could enslave everyone by buying a bunch of Bitcoin and doling out limited amounts of it to the populace once the Dollar collapses. This is the doomsday scenario Bitcoiners have been prepping for this whole time. There is an incredibly amount of irony in this. You take a currency that hardly anyone wants to use, so how do you make sure that people use it? You enlist the government and big banks. But wait, I thought big government and banks couldn't control Bitcoin? I thought that was the whole point! You mean to say Bitcoin adoption inevitably evolves into authoritarianism? WHAAAT??

You can see how this argument can end up in absurd circles with logical fallacy upon logical fallacy. But, let's say something like the scenario I wrote about above actually happens . Even in this circumstance, the government may simply end up buying a ton of Bitcoin for $1000 a piece (or lower). Depending on liquidity, this can finally push price above $100k. So, I guess I understand why Bitcoiners want to hold onto their coins no matter what. But will they hold on no matter the value?

Even so, I think the above circumstance is unlikely. Bitcoin has broken its long term trend against traditional markets, as I wrote about here:

As I've also pointed out, a currency with a fixed supply is not a great unit of exchange since it encourages hoarding and not spending. With this logic, it makes sense why Bitcoin price is decreasing rapidly in an inflationary environment - people are finally selling or spending it, and not buying it! This is because its value far exceeded the dollar over the last 10 years, so it's actually a GREAT currency....for those who bought early. Now, even those who bought at the 2017 bubble peak are merely around break-even, and at a loss if they bought Ethereum. This doesn't even take into account inflation.

Here is my post where I outlined a speculative trajectory for the coming months. So far, so good. Now, if it fails to even attempt a bounce near these levels it'll probably look even worse than that.

Nevertheless, there always exists a possibility counter to my bias. For instance, if Bitcoin can bounce hard here and clear the $37-42k resistance zone, then maintaining above $40k for many weeks, I may consider a longer term ranging market with some eventual upside. I do think there is somewhat of a chance we see some slow relief here with low volume throughout the rest of the Summer, into the fall. During this time, a select few altcoins would probably again pump and dump in a "last hurrah." This is why I have toyed with entering some small altcoin spot positions. Really, I can't help myself. It's the "I might as well" trade. Come on Bitcoin, let's just give the 200 week MA a chance!

In the event of a recovery soon, I can see a media narrative where it is blamed on the FED's perceived inability to tame inflation (meaning that although it may not be true, the market expects no matter WHAT the interest rates are, inflation will still exist, so they YOLO everything back into assets because, well, we're irrational beings). Then, as interest rates continue higher, unemployment jumps, and markets begin their true multi-year decline into the next great depression. Inflation eventually drops, but by then markets are deep into a bear market and unemployment so high that few can buy stocks or other assets. Then, we get The New Deal, Part II. All fun (and scary) speculation of course!

Thanks for sticking with me on this crazy ride!

This is not meant as financial advice - it represents only my opinion and it is highly speculative.

-Victor Cobra

Bitcoin Moving Averages And Fractals This is just a quick update on Bitcoin. I will also include the Bitcoin/SPX chart in this post, simply because it continues to appear much weaker than BTC/USD, which I think is fundamentally significant - particularly with waning liquidity in crypto markets and the loss of broader appeal.

In the above chart, you can see that Bitcoin is treading water above the 100 day Moving Average (yellow). It is also now finding resistance at the 50 day MA (red). The last time Bitcoin began to find resistance at the 50 after a major upswing, it ultimately broke down (circled in red). However, in September 2020 (circled in green), BTC ultimately continued holding the 100 day MA and began a new push to ATH prices.

What happens here? If traditional markets continue to irrationally ignore the glaring credit bubble and other economic pressures, perhaps there will be enough liquidity for Bitcoin to push higher. However, as I mentioned, Bitcoin will need to start showing more strength when compared with traditional markets:

Zoomed in:

So far, it's really struggling at the 200 week MA (teal) against SPX. I won't go into any fundamentals on this post, though I really think that big drop off in volume on Binance since the last bottom is quite suspicious. This is mostly just a technical update. Thank you for reading - as always this is meant for speculation and entertainment only, not financial advice.

-Victor Cobra

Bitcoin below 10K by February 2022, what do you think? 😁I know this might be very annoying for the Crypto enthusiasts but Iooking

at the long-term monthly chart, I get a feeling that BTC/USD will drop below

10K USD in the next 6-9 months.

The big bearish doji candle in the monthly time frame might spell some trouble

for the BTC bulls here.

What are your opinions?

#BTC Daily UpdateIn Daily Chart, Bitcoin is on Last 2 Wave to finish this bullish move.

Expecting that next two months to be bullish for Bitcoin and Crypto as also TVC:DXY expecting to go more down!

Waiting for next week to start this move and see bulls take full control for some months!

Investing is always a good choice.

...DYOR

Update on BTC absolute bottomINDEX:BTCUSD

We saw for the first time that BTC closed below 200 Weekly MA. Also we saw for first time BTC closing below Monthly 50MA. This is not a good sign.

I've updated my analysis and forecast for the bitcoin's absolute bottom.

Currently BTC does not have significant support until the $10,017-$11,680 range except the $16.4k-$17k area.

So stay safe brothers. Let me know if you think the bottom is in or BTC could even go lower.

Bearish Specter Haunts Bitcoin's ChannelHello dear TradingView followers and community!

Today, the Bitcoin price is making a notable attempt to breach the support level of the Head & Shoulders pattern. Based on the height of the head, it is anticipated to potentially land in the range of 24,000 to 25,000, marking a decline of approximately -11.5%.

Nevertheless, it's crucial to bear in mind that the price of Bitcoin has a reputation for delivering unexpected surprises, including bull and bear traps that can catch us off guard. Therefore, exercising caution in our current positions and refraining from engaging in risky trades is undoubtedly advisable.

Best regards

Artem Crypto