CYTOKINETICS INC - NASDAQ: $CYTK Grinding HigherAfter recapturing its 200 DMA in early Spring (March), shares of CYTOKINETICS INC - NASDAQ;CYTK have been grinding into higher ground as we can observe in the Daily chart above.

Additionally, CYTK continues to trade above all of its important moving averages 20/50/200 DMA's, suggestive of a favorable technical posture.

Furthermore, when extending out to both the Weekly and Monthly time-frames, CYTK remains in relatively good shape, thus, we have a stock that displays encouraging technical's across multiple time-frames.

Moving forward, both investors/traders may want to continue to monitor the action closely, particularly, should CYTK be capable of going topside of the $11.50 figure and perhaps of more importance the $11.95 level, such development would likely trigger its next advance into a primary objective of $13 with a secondary objective in the $16 handle.

Thus, investors/traders may want to put CYTK front-and-center on their radars and pay close attention to the levels mentioned above for additional clues/evidence that CYTK is ready to embark on its next major leg.

Biotechnology

Biogen - opportunity to get in at the bottomAfter a recent downward gap, BIIB looks to me to have established a new upward channel. With bullish MACD, great analyst ratings, a history of earnings beats, and the next earnings coming up in mid-July, BIIB should be up in the short-to-medium term. Set fairly tight stops to protect against a downward channel breakout.

Here's my Biogen trading plan Monday morning:

Limit buy 238.17

Stop Loss: 231

Take profit: 287

Is CRSP going to "technically" break the bear trend this weekIn my previous post on #CRISPR I talked about the Green upward sloping trendline & how every time CRSPR has traded on or below it since May 2017 we've seen parabolic action.

I don't want to say I told you so, but we've seen some parabolic action.

To my surprise, the parabolic movement came the news of Vertex upfront payment of $175 million upfront payment. Specifically, Vertex gets worldwide rights for CRISPR/Cas9 technology along with other items such as AAV vectors for DMD and DM1. This deal totals just about $1 billion when you factor in all milestone payments for these programs, plus royalties.

Moving on to the chart now..

It appears as though CRSP is about to "technically" breakout of the bear trend which started in May 2018 after reaching ATH's.

The blue downward sloping trendlines are the attached to the swing highs, and one has already been broken to the upside, which could be considered the first real confirmation of a trend reversal. Once the second blue downward sloping trendline is broken to the upside CRSP is "technically" out of the bear trend, IMO.

Time will tell per usual.

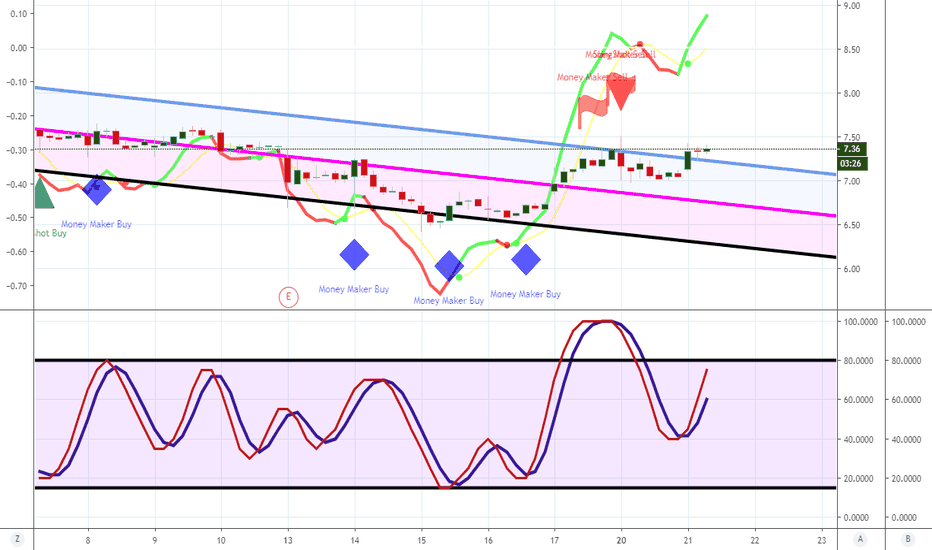

ZIOPHARM ONCOLOGY INC. - NASDAQ: $ZIOP Building BaseAfter recapturing its 200 DMA back in March and subsequently vaulting from a 3 to 4 - handle, ZIOPHARM ONCOLOGY INC - NASDAQ:ZIOP has found itself in a sideways drift and appears to be building a base these past couple of months as we can observe from the Daily chart above.

With the stock trading above all of its important moving averages 20/50/200 DMA's, ZIOP remains in a favorable technical posture as the base building process continues to develop.

In addition, if one were to zoom-out to both the Weekly and Monthly time-frames, we can also see that ZIOP may just be in the process of building-out a potential inverted H&S pattern and should such development materialize and complete, the longer-term measured move implies an initial $8 objective.

Moving forward, if and when at any time in the days/weeks ahead ZIOP is capable of clearing the $4.85 figure and perhaps more importantly the $5 level, such occurrence would likely suggest that higher levels are in the offing.

Thus, both investors/traders may want to continue to monitor the action closely moving forward.

AMARIN CORP - NASDAQ: $AMRN Setting-UpAfter breaking to higher ground in 1Q19 and subsequently drifting back down to its original break-out level in the upper teen's, the shares of AMARIN CORP NASDAQ: AMRN are once again starting to show signs of potentially setting-up for another attempt at loftier levels as evidenced in the Daily chart above.

While AMRN presently finds itself in drift mode working on its right-side, the stock continues to display favorable technical characteristics trading above all of its important moving averages (20/50/200 DMA's).

Although further work is required, it appears that we may just witness a repeat of 1Q whereby buyers once again start to take control of the stock and should such scenario materialize, we suspect that it may have eyes for the $22 - $24 zone once again in the short-term.

Thus, both investors/traders may want to continue to monitor the action closely in the days/weeks ahead for signs/clues that a move for greener pastures is underway.

CHIMERIX INC. - NASDAQ: $CMRX Shaping-UpAfter breaking higher in early April on large volume, Chimerix Inc. (NASDAQ:CMRX) spent the next several weeks digesting/consolidating the move before breaking higher yet again last month (May) and in the process, recapturing its 200 DMA as evidenced in the Daily chart above.

With the stock presently trading above all of its important moving averages (20/50/200 DMA's), CMRX remains in a favorable technical posture.

Moving forward, should CMRX be capable of clearing the $3.80 hurdle, such development would likely trigger its next advance into higher ground.

Nevertheless, CMRX remains in decent shape from a technical lens and both investors/traders may want to continue to monitor the action closely in the days/weeks ahead.

CRMD - Ready for a blast HigherCRMD is lined up for a move much higher, and fast and slow MA's have both turned up now too.

weekly getting tight time to move, news in May June September weekly getting tight time to move, news in May June September

Catalyst investing with T2 Biosystems (TTOO)Shares of T2 Biosystems (TTOO) have fallen by roughly 75% since the company's IPO was priced at $11 in 2014. Over the past 3 years, the share price has lost roughly two-thirds of its value and so far 2019 has seen further decline.

Technical argument

Limited: it’s no easy task trying to evaluate identify trading opportunities in price trends and patterns seen in small market capitalisation biotechnology. TTOO stock price is volatile because it is in possession of a breakthrough technology with its success relying on pivotal data that has not yet been made public. In addition, concerns remain, including cash burn and near-term financing. Even if TTOO is successful in achieving approval for various products the company may have difficulty getting hospitals and labs to adopt the technology.

I have included indictors such as MACD, momentum, Moving Average MA, Relative Strength Index RSI and Point of Control POC. The conclusions from these indicators are limited, I have explained each individually on the graph.

What I do draw from the graph is that TTOO has fallen back into the Point of Control: price point with the highest trade volume. We can see a bullish RSI divergence: TTOO makes a lower low and RSI forms a higher low and volume has started to increase. If investors consider the stock to be oversold the volume with continue to increase as traders buy stock and we will see a price rise.

I would NOT buy stock based on this analysis because the volume spike could be investors offloading stock, even if we are at an all-time low.

So let’s ignore the technical analysis because in this situation making an investment decision based solely on evaluating price trends won’t have any bearing on the outcome of upcoming catalysts and therefore the stocks potential value.

Upcoming catalysts

The company is in possession of a breakthrough technology for the detection of sepsis.

A possible near-term catalyst for upside is results of the T2Bacteria Panel pivotal FDA clinical trial to be published in a peer-reviewed medical journal in Q2 2019

T2Lyme Panel is currently in a pivotal Phase 3 trial with very encouraging results so far and a $700 million market being targeted.

A Life Changing Science And A Life Changing StockSummary

PKTX is where CSBR was 3 years ago.

PKTX's AAGP molecule is life changing.

Data is coming. With that comes higher stock price.

Those of you who have been following me the last few years, because of my call on Champions Oncology, CSBR, know that I have been predicting that ProtoKinetix PKTX is destined to be my next CSBR. The dynamics of each company and their respective stocks have parallels that can not go unnoticed.

For years CSBR had an incredible technology that the market had just not taken notice of. In 2014, 2015 and much of 2016 CSBR essentially traded by appointment and posted many zero volume days. Even a reverse split and an uplist to NASDAQ didn’t wake the stock up. Then around the 3rd quarter of 2016, the market finally took notice and we saw CSBR go from the high 1-dollar range to as high as $15 and some days trading several millions of dollars in volume. Why the big difference? Sure, they had some wins, they raised some money, landed a contract, increased revenues and brought on an IR firm, but at the end of the day, what really happened is, the market finally realized what they were all about. The market is not always efficient. Many great companies go unnoticed for years while many companies that are garbage enjoy the benefit of liquidity and over inflated market caps…dot com bubble, cryptocurrency, tulip bulb mania etc.

First, a little bit about ProtoKinetix. OTCQB:PKTX. ProtoKinetix is a molecular biotechnology company that has developed and patented a family of hyper stable, potent glycopeptides (AAGP) that enhance both engraftment and protection of transplanted cells used in regenerative medicine. For those of you that are not biochemists or hold a PHD in immunology, let me simplify what this means. Very simply put, their AAGP molecule:

Is an anti-aging molecule

Increases cell survivability

Encourages cell growth

Increases cell viability

Improves cell functionality

Why is this important? Because the use of the AAGP molecule can be used to improve treatments of nearly every disease known to man. I know…that’s a big deal.

They began their first human trials in 2017. The trial is for the treatment of Type 1 diabetes with pancreatic islet transplants. The addition of AAGP to the transplant should increase the life of the islet, thereby increasing the success of the transplant.

AAGP is currently being tested or soon to be tested in the following:

Kidney Ischemia

Ischemia is a condition that occurs when blood flow to cells, tissues or organs is severely restricted. This condition can affect any part of the human body. When this happens, cell death and organ damage follows rapidly. Ischemia is a major cause of kidney damage, heart attacks and strokes. Testing will determine whether AAGP™ can reduce the inflammatory response that causes cell damage and organ failure that occurs during an ischemic attack.

Normothermic Liver Perfusion

Normothermic (body temperature), ex vivo (outside the body) liver perfusion (method of irrigation) is a therapy to livers outside of the body before transplantation. Again, simply put, AAGP, will keep the harvested organ viable longer. This can apply to any organ of the body. A true game changer for organ transplants.

Retinal Cell Replacement

Use of AAGP will improve the survival of stem cells that are currently being used in human trials to treat retinal blindness. Studies have already been completed at the University of British Columbia and showed dramatic improvement on cell survivability and viability, functionality with the addition of AAGP.

Monoclonal Antibody Production

Monoclonal antibodies are antibodies that are made by identical immune cells that are all clones of a unique parent cell, these are used in the rapidly growing field of immunotherapy. Monoclonal antibodies are currently being used to treat Cancer, Rheumatoid Arthritis, Multiple Sclerosis, Cardiovascular Disease, Systemic Lupus Erythematosus, Crohn's Disease, Ulcerative Colitis, Psoriasis, Transplant Rejection, and several more conditions.

By adding AAGP will lead to a dramatic decrease in the cost of production of monoclonal antibody medicines.

Bone Marrow Recovery

Bone marrow can be collected and cryopreserved. Conditions that can be treated by transplantation include bone marrow diseases, histiocytic disorders, hemoglobin opathies, inherited immune system disorders, inherited metabolic disorders, leukemias and lymphomas, myelodysplastic syndromes, multiple myeloma, plasma cell disorders, other cancers and malignant diseases. The inclusion of AAGP will increase functionality and viability of the bone marrow. This could then be expanded to all cryopreserved cells.

Cord Blood Preservation

Cord blood is the blood left in the umbilical cord and placenta immediately after birth. It can be collected, stored and used at any time during a baby’s lifetime to treat a wide variety of diseases and medical conditions. Cord blood is currently being used to treat multiple forms of cancer, hematopoietic diseases, inborn errors of metabolism and immune system diseases. You guessed it, AAGP will improve viability and function of the stored cord blood cells.

Ischemic Stroke Repair

Ischemic Stroke is associated with severe disabilities and a high recurrence rate. Testing of AAGP™ molecule is to prove it suppresses the inflammatory attack caused by ischemic stroke thereby preventing any long-term damage to the human body.

I could continue but I think that I’ve made my point. AAGP part of the future for the treatment of cancer, blindness, diabetes, transplants, stroke… AAGP conceivably could be used in every cutting edge treatment that we are currently aware of. We’re not just talking about one of two things it can treat, as stated before we are truly talking about nearly every ailment that affects the human body.

To be clear, these things are currently in trials and studies, but the results have been nothing but positive. Last year they announced their first working relationship with a large unnamed international biotech company. I believe we will see more of this. Given the enormity of the possibilities of this molecule, I see only one outcome for ProtoKinetix and that is a sell of the company. They are just too small to capitalize on such a vast technology.

Now that I’ve covered the science and its potential, let’s get into the nuts and bolts of the company. The company was essentially left for dead in 2012. No filings were made for over 18 months and the demise of the company was a given. Then in 2014, through the efforts of the current CEO, the company was revived. This is not the typically outcome for a micro-cap that is in trouble. By mid-2014, the company was current of their filings and back up and running. They also moved from Canada to the US.

Not only did they get going again, they are one of the tightest ran micro caps you will find. The 2018 cash burn for the company was just under $600k. This is remarkable for any public company but even more so for a biotech. In part they are able to keep expenses low due to the fact that most of their trials and studies are Investigator Sponsored by the University of Alberta, so the company isn't the one footing the bill for the research. Another reason for the low expense is the CEO’s salary is $1 a year. More on him later. To top it all off the company not only has no convertible debt it has no debt at all. Unheard of for a small biotech.

One last compelling thing about this company is the amount of insider buying. I can safely say; I have never seen as many Form 4’s from a company as I have seen from PKTX. The buying has been significant. To give you an idea, the current CEO’s initial form 3 that was filed in June of 2014, showed him owning 19,670,500 shares. His most recent form 4 shows him owning 61,353,833 shares. I’ll save you the math exercise, that is an increase of over 41 million shares. Some have been acquired through private placements, but a huge number have been bought in the open market. The past and current CFO were and are regular Form 4 filers as well.

So, the big question? Why is PKTX only trading at .08 with a $22 million market cap. There are a few reasons.

Like CSBR, they have been spending their time on building a business and increasing the value of their technology, rather than spending their time on pumping their stock up.

History. Like I said, the stock was left for dead and forgotten about. It takes a long time to recover from that. And legacy shareholders, I’m sure took advantage of an opportunity to get out, once they had the chance.

It’s a tough environment for OTC stocks. In a market that has been as good as what we’ve seen the last few years, people are content with the easy money being made in the big names.

Why buy now?

The technology…AAGP is a life changing molecule. Nearly unlimited upside.

Last year’s announcement of a Material Transfer Agreement with a global biotech company. Although the market didn’t take much notice, this is significant. It’s official, the big boys are starting to explore the AAGP molecule.

Data/Trials/Studies – Press this week announced they expect results from Phase 3 testing for Retinal Cell Replacement. Data is king and we’re starting to get it. Data is what will bring big biotech knocking…along with their checkbook.

No debt

Insider buying

It’s cheap. $22 million market cap is nothing for a company with a technology of this potential.

I do believe the time is now. ProtoKinetix not only has a life changing molecule, I’m also betting that PTKX will be a life changing stock.

Disclosure: I am/we are long PKTX, CSBR.

Bottom in the making (ONXEO SA)The price is at the lowest area since its listing on OMXC. The price have been down with 90 %.

RSI combined with price shows (look at the red arrows at RSI) that while price is making Lower lows, the RSI is makin Lower highs, which shows that strength of sellers is weakned. This is typical sign of bottom is about to be made.

4H technical shows a bearish 20-50 cross accured which will push the price a bit lower than now. That is why trade is active at price 6.5.

Stoploss is set at 7 % below the lowest price, and also a bit below a triangle, in case of stop hunting.

1st profit taking zone is 0.5 fib zone, if this upper movement is correction.

There is a huge gap, which I think will be closed, sooner or later, which is why the 3rd profit taking zone is where the gap is closed.

A trade with good R:R.

CELLECTIS LONG TERM BUYHi Guys

Following my ideas redarding #cellectis. A promising french biotech company that already celebrates hugh success with "their" ucart19 against leukemia. Check out my thoughts and join the conversatioin.

TA:

- Double bottom which is normally an indicator for a reversal.

- higher high and higher low

- Oversold Stoch RSI (4hr)

- Rising MACD

Fundamentals:

- CASH POSITION OF $ 452M AS OF DECEMBER 31, 2018 COMPARED TO $ 297M AS OF DECEMBER 31, 2017

- CELLECTIS, THROUGH ITS NEW SUBSIDIARY CELLECTIS BIOLOGICS, INC., ENTERED INTO A LEASE AGREEMENT TO BUILD A MANUFACTURING FACILITY IN NORTH CAROLINA, ADVANCING COMMERCIALIZATION CAPABILITIES FOR ITS UCART PORTFOLIO

- UCART123 IN PHASE 1 DOSE ESCALATION CLINICAL TRIAL ONGOING FOR AML

- UCART22 RECEIVED FDA AND IRB APPROVALS FOR PHASE 1 DOSE ESCALATION CLINICAL TRIAL IN B-ALL PATIENTS

- UCART19 ASH ABSTRACT BY PARTNERS SERVIER AND ALLOGENE SHOWED CONTINUED PROGRESS OF FIRST CLINICAL ALLOGENEIC CAR T-CELL PROGRAM FOR ALL ADULT AND PEDIATRIC PATIENTS. MILESTONES PAYMENT CONTRACT WITH PFIZER AND SERVIER UPCOMING

CHECK OUT ALSO THIS AMAZING STORY. WE'RE ABOUT TO CHANCE THE FUTURE BUT ITS A LONG WAY TO GO

google: layla cellectis

Neovacs - strong bullish trend expectedResults of IFN Kinoide on Lupus research are very significant (95% efficacy observed). Volume increase strongly on the biotech and strong breakout of the 0.25 resistance has been observed. Pullback on the 0.25 level is resolved and the stock is now in perfect conditions for a bullish rally. First target is 0.5

IBB Correction IncomingPsychology of a Market Cycle Cheat Sheet: goo.gl

IBB's chart is identical to the chart on the market psychology cheat sheet linked above.

IBB 5-wave cycle is over + Truncated 5th

Algorithms exit the market after extended 3rd waves, leaving the 5th with no volume nor liquidity, just as it's done for IBB .

Current Market Condition: Complacent. Just "cooling off for the next rally".

50%-60% Downside.

I am a permabear... but how can you ignore all this confluence? Target 10,000. I can't believe I said that... but there is just too much confluence to ignore this possibility. However, a breakdown from this wedge will likely eliminate this play. Either we hit it fast in 2019, or this long is off the table. Let me know your thoughts.

Biotech symmetry. Let the market settle down, and then go long.The biotech sector is really interesting when you dive down into the symmetry of the last few cycles. Early 2000s-2008 and 2016-2018 are mini rallies within the bigger wedge. If this pattern is to continues, you can look for entry around the end of 2020 when we bump up against the larger support line (around $3600), and expect to hit the resistance of the larger wedge ($10,000). There is also a lot of confluence around the $7500 mark so we could fall back to that after hitting 10k. This would repeat this pattern for the third time.

Near term, I have some shorts in this sector because I think many of this small biotech companies have been operating at negative cash flow with a ton of free credit. I don't expect massive gains on these shorts, but I will certainly be going long towards the end of 2020.