Still Bullish... Daily pattern holding..The daily chart Still playing out a much larger Falling wedge, Still Bullish! If we close above $1.01 ( right at the 20 MA) we are still if a great place! Better discount buy opportunities right now! Remember Sometimes you have to go down a little for a large jump!!! Literally think about jumping off the ground.... you bend your knees get really low and then leap into clouds of money!!!

Biotech

American cancer vaccine patent boost $PCIB.OL over falling wedgePCI Biotech: US patent granted for the vaccine technology (fimaVACC) in combination with cytokines

Oslo (Norway), 21 January 2020 – PCI Biotech OSL:PCIB , a cancer focused biopharmaceutical company, today announces that the U.S. Patent and Trademark Office (USPTO) has granted the company a US patent covering the use of fimaVacc in combination with cytokines.

Cytokines are small proteins that are involved in cell signaling, and that are very important in the immune system, modulating both cell-based and humoral immune responses. The combination of cytokines with PCI Biotech’s vaccine technology, fimaVacc, has been shown to be effective for enhancing cellular immune responses that are important for the effect of therapeutic vaccines. The now granted US patent gives broad coverage for the combination of various cytokines with the fimaVacc technology.

There are many vaccines under development utilising cytokines to elicit immune responses. The US patent granted today is important for PCI Biotech’s development strategy, as it supplements our ability to generate an internal future vaccine pipeline, in addition to bringing value for the fimaVacc technology in partnering efforts, said Per Walday, CEO of PCI Biotech.

As part of PCI Biotech’s strategy for applying the PCI-technology for therapeutic cancer vaccines, several global patent applications were filed in 2013 and 2014. Today’s granted US patent secure protection until 2035 and this patent application is still pending in Europe and key Asian markets.

Press release direct URL:

pcibiotech.no

Nasdaq Healthcare: Closing on January 17thFriday's session presented a retracement on the 20 EMA Line, as predicted. I still believe in the continuation of the bullish trend. However, the bearish divergence needs to be monitored, since further price correction could occur.

Disclosure: My ideas contain statements and projections based on assumptions on capital markets, and therefore inherently subject to numerous risks and uncertainties.

Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

I am not a financial advisor

Possible rough next week for MRNA - possible reverse H&S formingTechnical RSI, MACD and momentum indicator (Lazybear) and chart looks like Moderna will be falling this week (8% +/- 5%) I plan to accumulate on dips into the $19 area while looking at charts.

To confirm the formation of reverse head and shoulders, the nice symmetrical MACD and momentum swings with RSI reaching a bottom would confirm MRNA is poised to break through that 21.50 ish resistant after next week.

1Hr chart setting up nice for a Bounce off 9EMAThe 9 EMA should be a nice bounce point. Watch the Stochastic, needs to cool off a little bit before we Take off!!

Options are Expensive, shorting is riskyThe data is positive, but seems like an overreaction for a small and early stage trial. Watching the chart and will enter a short in the future, at what level is difficult to say. I like the gaps down, however it is more likely to bleed lower versus dramatically dropping. XBI is nearing all time highs, this is a high beta stock, so the correlation will not be great.

Nasdaq Healthcare: Closing on January 16thToday's session generated a bearish divergence on CCI. I am still bullish, but always ready for a trend retracement on the 20 EMA Line.

Disclosure: My ideas contain statements and projections based on assumptions on capital markets, and therefore inherently subject to numerous risks and uncertainties.

Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

I am not a financial advisor

Merck: Ichimoku Clouds on bullish setupIchimoku Clouds still confirm the bullish setup. Today's session will be important, if positive, to manifest further bullish intentions (Break of the $92.10 resistance).

Disclosure: My ideas contain statements and projections based on assumptions on capital markets, and therefore inherently subject to numerous risks and uncertainties.

Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

I am not a financial advisor.

Nasdaq Healthcare: Closing on January 15thIf you like this idea, don't forget to support it clicking the Like Button!

Positive session for Nasdaq Healthcare that gained 0.39%. However, I still see the possibility of a retracement over the basis of the Bollinger Bands indicator (orange crosses). I was waiting with anxiety today's session to check for a signal of retracement, and it comes with the third candles (17:00 - 19:00)

The situation is also confirmed by RSI and CCI indicators.

Disclosure: My ideas contain statements and projections based on assumptions on capital markets, and therefore inherently subject to numerous risks and uncertainties.

Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

I am not a financial advisor

Cup and Handle with ZFGN, SFUN and CHAP. I'm also a penny fan!ZFGN has been showing the cup and handle pattern on its daily chart. With the shape of a flat "U" and a slight down drifted-handle on the right, ZFGN is considered a sign of bullish continuation. The length of its "U" period indicates the bottom has been consolidated and the risk has been shaken out. Volume remained lower than average in the base of the bowl, selling side liquidity sufficiently dried up. And on the right side of the bowl, we could see a bull volume expanded once again as the interests strengthened which is also an additional confirmation of a bullish sign.

As the handle been forming on the right side, a selling pressure against its prior high is taking place, but the good side is, it still shows a higher low which viewed as an essential sign as the stock got some big players or managers' attention.

So selling pressure is likely to make price consolidate with a tendency toward a downtrend for a period of days to weeks before advancing higher.

A trade set up could made from here with a stop loss at the previous low or even higher to the recent consolidating base as the two lines underneath price shown above. For the target level, I would rather consider the previous base that stock consolidated before the bowl in the past.

Cup and handle usually managed out the volatility risk as the ATR indicator is reaching to its yearly record low in this case, so only time and momentum(DMI, volume) matter to traders.

Besides, I also find some similar candidates such as SFUN, CHAP. All three of them are from a different industry( Biotech, Energy, Internet services), so this is where you should really concerned about. The dissimilarity among them are CHAP has a shorter "U" length and SFUN got lifted a bit already (volatility picked up), so you may take these factors into your trade set up to see if you are gonna play with the pattern or not.

Nektar is reaching fair valueNektar and Bristol-Myers Squibb announced today the companies have agreed to a new joint development plan to advance bempegaldesleukin (bempeg) plus Opdivo (nivolumab) into multiple new registrational trials (source: Yahoo Finance).

The 19% jump is making Nektar trading around its fair value. Likely, profit-taking will take place in the next sessions. I'm expecting the stock price to consolidate around $23 level.

Disclosure: My ideas contain statements and projections based on assumptions on capital markets, and therefore inherently subject to numerous risks and uncertainties.

Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

I am not a financial advisor.

Don't forget to support this idea, if you liked it, and to follow me here on TradingView.

Investing Fellow

Healthcare: Closing on January 14thGood session for the Nasdaq Healthcare Index, that closed the day with a 1.30% gain. Bullish sentiment is still driving trades. However next session could be characterized by a retracement around the basis of the Bollinger Bands indicator (orange crosses).

This is a daily analysis.

Disclosure: My ideas contain statements and projections based on assumptions on capital markets, and therefore inherently subject to numerous risks and uncertainties.

Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

I am not a financial advisor

LCI may start to climb after today's FDA approvalLannett stock has struggled lately due to opioid litigation and a weakening of its earnings forecast back in November. However, the company announced several product launches in December and early January, and today Lannett got FDA approval for, of all things, a cocaine-based anesthetic nasal spray. The stock has shown little positive reaction to any of this news, but that might change if analysts start to adjust their earnings forecasts to reflect the new product offerings. Despite its underwhelming reaction to the news today, I think Lannett may start to show momentum this week as investors digest the announcement from today.

Lannett has an attractive forward P/E of 6.84 and a history of beating analyst expectations on its earnings reports. Its last round of guidance was neutral, with increased administrative and sales costs offset by decreased tax burden and interest expense. Lannett should have enough cash on hand to cover its product launches thanks to a convertible notes offering last year. It has about $100 million in cash per its last earnings report, although with apparently $66 million in debt due toward the end of this year.

BIOC Still Failing To FillCOMMENTARY

BIOC is one of those penny stocks that have individual, good days. But when it comes to putting together a string of bullish action, it has yet to reach that milestone. Furthermore, though volume is good, the company still needs to execute further in my opinion. Either way. It's a good day today but would like to put this on a 30 day time clock and see where things are, at that time.

QUOTE

"On Tuesday (1-14) the company reported that its Target Selector™ assays are now available to doctors. The goal is for these doctors to use the Target Selector™ to evaluate cerebrospinal fluid of patients and check for the presence of circulating tumor cells for patients with breast or lung cancer suspected of brain or nervous system metastases.According to the company, the presence of tumor cells in the central nervous system might indicate brain metastases that can happen when cancer has spread to these locations. Thanks to this update, shares of Biocept rallied."

QUOTE Source: Top Penny Stocks To Watch Right Now; 1 Up Over 100% Since November

McKesson after-hours guidance raiseAfter-hours today, McKesson raised its FY EPS guidance to 14.60-14.80, about 2% above the consensus analyst estimate of 14.41. Its last round of guidance was disappointing, so this reflects a significant improvement in the company's fundamentals. Even though the guidance bump was only 2%, it could catalyze a much larger move in the stock price, which was already trading at a low forward P/E of about 10. Today's guidance implies a forward P/E of more like 9.7 based on today's closing price. McKesson has been in an uptrend anyway, so fortunately for me, I already owned some shares.

Alexion: Trading around Volume Profile POCIf you like this idea, don't forget to hit the Like Button!

Alexion business depends on patent-protected therapies in ultrarare and rare diseases of high unmet medical needs. While competitors are entering the market with biosimilars, Alexion still maintains an essential share of the market. My long term view is bullish.

However, from a technical point of view, we are in a critical consolidation phase that started at the end of October 2019. The stock price is consolidating around $107.88 level.

What to do now?

I would wait for Alexion to exit the consolidation phase with a breakout. My signal is the break of the $116.61 important resistance. Look at the purple line in the graph (Developing POC) to monitor interesting volumes movements able to push up the price (in the chart Developing POC is overlapping the POC red line). I suggest to not go in with a trade immediately after the resistance breakout since Alexion presents high uncertainty. Thus wait for a confirmation green candle (daily).

Disclosure: My ideas contain statements and projections based on assumptions on capital markets, and therefore inherently subject to numerous risks and uncertainties.

Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

I am not a financial advisor.

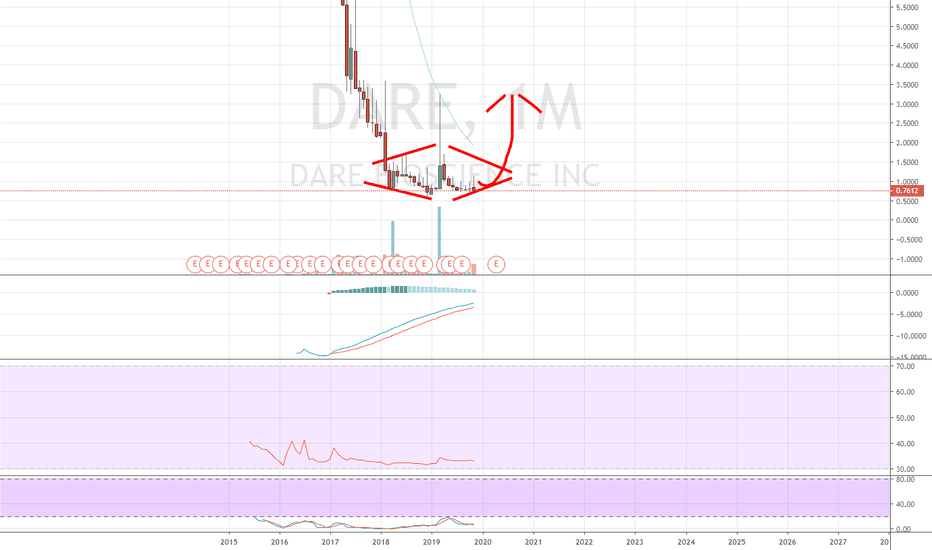

What's The Next Move For DARE?

Big news from Bayer and Dare today . Next thing to watch is for FDA approval and then if/when commercialization begins. Until then I think it's still very speculative. HOWEVER. important to note the chart. Last time it traded this high, it remained the case for a few weeks and then plummeted back down to earth. The last time it consistently traded around this price was way back in 2018. So could this mark a new, higher channel or another head fake?

"However, the fact remains that a commercialized drug in connection with a company like Bayer isn’t something to ignore. Dare could be entitled to as much as $310 million in milestone payments plus a tiered royalty structure. Does this make it one of the penny stocks to buy right now? That will be determined by the market reaction throughout the week, in my opinion. For now, at least, it seems like one of the penny stocks to watch to start the week."

Quote SOURCE: Best Penny Stocks To Watch This Week? 1 Up Over 210% This Year

DARE , OTC:BAYRY

*Speculative* $DARE - Long to $2-$3Women's healthcare company - Lots of upcoming catalysts through 2020. New acquisition this week of Microchips. Could see this fall to .50s if earnings are garbage - which is definitely a possibility, but target is still $2-$3 next year. This is speculative, but I will hold 5k shares from .79 avg.

PledPharma $PLED trading above SMA50 and SMA200, could break outPledPharma OMXSTO:PLED with short term positive momentum on top of recent clinical trial updates.

Should be kept on watch list as it could break out from a year long consolidation phase.

Recent CEO Interview:

www.redeye.se

PledPharma to initiate one pivotal Phase II/III study with Aladote® for marketing authorisation application in both US and EU

newsclient.omxgroup.com

PSTI BoomI've been looking at this company for years, love their proprietary technology. I really think they have huge potential, but as always not financial advise.

Alexion finally making movesI've been adding to my Alexion position since December 9, when I posted my previous idea on this stock. The wait is finally paying off, as the stock has surged higher in the past couple days. Alexion is getting unusually bullish call activity today, and the interest is more than justified at this forward P/E of less than 10 and PEG ratio of less than 1.

Alexion next reports earnings on February 3, and there are reasons to think it may top Wall Street expectations, including a history of earnings beats and a Zack's ESP of 2.07%. The consensus EPS estimate this quarter is $2.53, but the most accurate estimate is $2.58.