AZN (ASTRAZENECA) (Y20.P4.E1).TA on short termHi All,

Astreznenca is one of the hopeful leading pharma to bring about a vaccine for this covid virus.

Rumors or articles suggested that this company would likely be successful in doing so amongst a few attempting it.

Big money is at play.

In the past week, we have news that the vaccine did not pass certain tests which explains the sell off and a 6 month delay in trials.

OBSERVATIONS:

> Upward channel with a top off spurt spike and a sell off, potentially of the news of the delays;

It could also be a deviation from the main channel which is over extended so pulling back to the mean, average range;

> Weekly MACD cross over the Signal, bearish indication;

> Many of the big tech companies are having a sell off on their shares as US dollar looking to go up in the short term.;

> I have previous ATH as potential support on this correction wave;

> Has confluence with the 21 Weekly EMA and fib level retracement as per chart below;

> RSI still above the 50% range on the weekly and hence still bullish and trend intact.

THOUGHTS:

Likely to drop to the bottom of the channel to mid range of the channel in the short term> $50

with a nice bounce as we have additionally the 50 EMA and previous resistance at the 0.5 fib level.

I'm still thinking it will test the bottom of the channel even 2 deviation of the channel represented by the blue dashed lines.

What ever the news it is, its worth considering because if they are successful, their shares will skyrocket.

Please give me a tick or like for this post.

Regards,

S.SAri

Weekly chart;

MONTHLY chart: Upward trend intact and likely another bounce of the monthly macd off the signal trace. or the support line

Astrazeneca

Astrazeneca Stock AnalysisAstrazeneca Stock Analysis

Prices moving inside a channel - trendless condition - Horizontal movement.

Based on Technical Analysis, the idea is to go long as the prices are close to the resistance level of 83 pound (bottom flat line of the channel) and they seem ready to jump up to 88.0 Pound.

MRNA- Leader in the vaccine race. Ladder buy to avoid the riskModerna is the first company to start the phase 3 trial in July and could have the supply ready earliest by Oct and accelerated approval earliest by December, according to Nami Sumida/BioPharma Dive and morningstar.

Other competitors are scheduled to have accelerated approval the earliest around early 2021.

Science Backed by Data[AstraZeneca Series]: Target 3949Good Evening Friends,

AstraZeneca is in very long term uptrend(24 months). It has breaken out today after consolidating for past few 3-4 weeks. Breakout has been on very health volumes almost 4.5 times average volumes(331K vs 78K average volume)

RSI is in uptrend and looks promising.

Buy Closer to 3576 levels

Support Levels

2939 (below this trend may get invalidated on short term)

3302

3451

3520

3565

Target

1st Target 3949 ,

2nd target 4188

Pls support with likes on the idea.

Schrödinger $SDGRRecent IPO Schrödinger extends its existing collaboration with AstraZeneca, $AZN, aimed at enhancing the former's Free Energy Perturbation technology for the optimization of key properties of biologics, particularly binding affinity. As technically, it is rising and needs to break the trendlines and hold above $45.

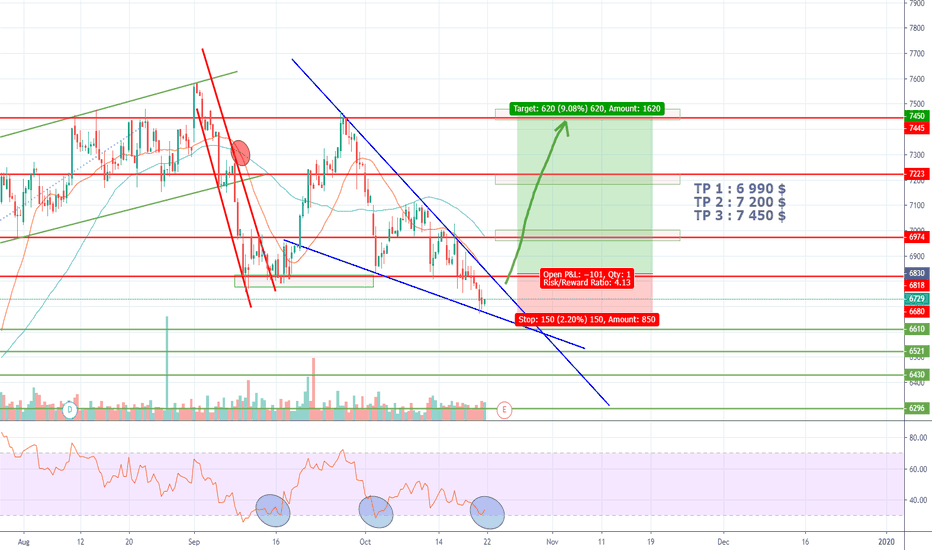

A little jump before big dump ?!Still bullish on AZN.L but ascending broadening wedge :

- Need to break 7 580$ resistance

- RSI divergence

- MM20 > MM50

Statiscally in 80% of cases, the exit of this pattern is bearish.

So, I will open a short position around 7 400 $. (TPs on chart)

Always 2 gap to fill :

- Around 6 930 $

- Around 6 550 $

Happy trading

AstraZeneca - Breaking from a wedgeBuy AstraZeneca (AZN.L)

AstraZeneca PLC (AstraZeneca) is a biopharmaceutical company. The Company focuses on discovery and development of products, which are then manufactured, marketed and sold. The Company focuses on three main therapy areas: Oncology, Cardiovascular & Metabolic Disease (CVMD) and Respiratory, while selectively pursuing therapies in Autoimmunity, Infection and Neuroscience.

Market Cap: £90.48Billion

AstraZeneca is breaking higher from a corrective wedge pattern on the daily chart. The long-term uptrend remains bullish and a move towards new highs is expected.

Stop: 6565p

Target 1: 7465p

Target 2: 7580p

Target 3: 8000p

Interested in UK Stocks?

Join our free Telegram channel for up to date analysis on the best main market opportunities in the UK right now - t.me

Astrazeneca resistanceIdea: Testing a strategy using the relationship of related time frames for measuring retracement high. I am expecting the retrace to have reached its maximum price limit and price to return to the short trend at 35.13.

DISCLAIMER:

This is where I practice ideas and work on my trading techniques. This is not investment advice. Please note I am only providing my own trading information for insight to my trading techniques, you should do your own due diligence and not take this information as a trade signal. Trade at your own risk.