☕️Coffee futures (KC): third wave bull market.●● Preferred count

● Coffee Cash (KC.C), 🕐TF: 30D

Fig.1

In Fig. 1 , the wave count from 02/07/2022 . At the moment, the market is in the initial stage of the development of the primary wave ③ . The alternative scenario is the same — the continuation of the formation of the wave e of (IV) , as it is marked in black .

______________________________________________

● Coffee C®️ Futures (KC1!), 🕐TF: 6h

Fig.2

The wave ① formed the shape of an expanding diagonal . There is another infrequent pattern on the chart — an expanding triangle at the position of the wave (X) of ② .

Growth is expected to continue.

______________________________________________

📚 Elliott Wave Guide & Ellott Wave Archive ⬇️⬇️

Agricultural Commodities

What commodities will move in the 2nd year Russia-Ukraine War Russia-Ukraine War entered the second year. Most of the commodities skyrocketed after the invasion had returned to or below the pre-war level. Energy is the market focus but the price dropped below the pre-war level and might not have enough geopolitical moment to rebound unless the war fully escalates and spreads to other countries. The weakness of wheat price might reverse if Russia refuse to renew the export deal.

Energy products are the main focus in this war since Russia is the world’s key energy exporter. NYMEX WTI crude oil price started from USD92.10 as of the close of 23 Feb 2022, and reached an intraday high of USD130.5 per barrel in March. NYMEX Natural gas is even more volatile, jumped from USD4.623 per MMBtu to reach over USD10 in August. However, despite the sanction and price cap imposed by western countries, the energy exports from Russia maintained at high level, and European winter weather is relatively mild together with the effort to secure supply from non-Russia energy sources, the supply and demand situation is much less bad than many had feared, and the energy price retreated significantly and dropped below pre-war level. As of 24 Feb 2023, NYMEX Natural gas closed at USD2.548, while NYMEX WTI crude oil closed at USD76.32.

Assuming the war are restricted in Ukraine and haven’t spread to other European countries, the war will no longer have a material impact on energy price. Western countries don’t want to shut down Russia’s energy supply completely, they just don’t want Russia to make a lot of money from energy exports to finance the war. The ideal situation is Russia selling cheap oil and gas to global market. In fact, Russia is still exporting a lot of their energy products to China and India, and the reduced demand from them in the global market pressured the price. I can’t predict the outcome of a war, but a win by Ukraine might further pressure the energy price since Russia might probably need to aggressively sell their energy for war compensation and rebuilding the country. Even the war maintains the status quo for an extended period of time, it will not stimulus the energy price like last year since many countries had already reduced the reliance on Russia’s energy.

What I worry more is grain price. Russia and Ukraine together are supplying one third of global wheat. Many of the Ukrainian grain planted in the Southern and Central part of the country, that had been seriously affected by war. Ukrainian grain exports dropped nearly 30% in the last marketing year. Not only the plantation area will be affected, all the input including labour, fertilizer and chemical supply are also affected, not to mention the harvest and the logistic to export the grain. Grain export deal with Russia is expiring on 19 March, whether Russia will renew it could be a catalyst for market movement, and the lower price of Ukrainian grain because of this uncertainty might also reduce farmer’s willingness to plant wheat.

Russian grain production hasn’t been affected yet; in fact, the harvest of wheat is pretty good. When energy crisis didn’t realize, whether Russia will weaponize grain will need further monitor. At this moment, grain export is not targeted by western countries, so Russia might try to export as many grains as possible to improve their financial situation, but if the war situation turned sour, I can’t rule out the possibility of some form of export ban which might make the inflation situation in western countries more complicated.

CBOT wheat price started from USX 884.75 as of the close of Feb 23, and reached an intraday high of USX 1363.5 per bushel in March. As of 24 Feb 2023, it closed at USX 721.75. Of course, the weakness could also be explained by bumper crop from Australia and an expected high US production in the coming year. Technically USX 712.5 is an important support, and RSI is approaching oversold level. We might consider a long position @ 715, stop loss @ 680, target @ 800.

Disclaimers

Above information are for illustration only and there is no guarantee on the accuracy of the information. They should not be treated as investment recommendations or advices.

CME Real-time Market Data help identify trade set-ups and express my market views. If you have futures in your trading portfolio, check out on CME Group data plans in TradingView that suit your trading needs www.tradingview.com

Cocoa Futures ( CC1! ), H4 Potential for Bullish ContinuationTitle: Cocoa Futures ( CC1! ), H4 Potential for Bullish Continuation

Type: Bullish Continuation

Resistance: 2838

Pivot: 2660

Support: 2565

Preferred case: Looking at the H4 chart, my overall bias for CC1! is bullish due to the current price above the Ichimoku cloud, indicating a bullish market structure. If this bullish momentum continues, expect price to retest the pivot at 2660 where the overlap support and 50% Fibonacci line is before heading back up towards the resistance at 2838, where the previous swing high is.

Alternative scenario: Price may head back down towards the support level at 2565, which is the overlap support.

Fundamentals: There are no major news.

Fundamentals favour soybean, sugar and wheatAgricultural commodities, led by grains rose sharply in 2022. The two main catalysts for the upside in price were the Russia-Ukraine war alongside other supply challenges. There has been a number of cascading events around these two catalysts involving government interventions globally as food prices soared.

However, from mid-October the renewal of the Black Sea grain initiative for six months, helped quell concerns of access to Black Sea ports. We have seen prices decline since then, but from a high level.

It’s worth noting that grain exports from Ukraine under the Black Sea Grain Initiative dropped to 3.1mn tons in January compared to 3.6mn tons in December 2022 owing to a slowdown in inspections1. In 2023, the supply demand balance appears to be favouring soybeans, wheat, and sugar.

Extreme drought in Argentina lends a tailwind to soybean prices

In the case of soybean, a gloomier supply outlook has been a key tailwind for prices in 2023. Argentina, the world’s third largest soybean producer, is expected to see a weaker crop at 35.5mn tons owing to persistent drought and high temperatures. The Foreign Agricultural Service of the US Department of Agriculture (USDA) estimates the crop at just 36mn tons after the USDA previously predicted a crop of 45.5mn tons.

However, both estimates are still well above the assessments of local experts. The Rosario Grain Exchange, which asserts the drought is the worst in 60 years, lowered its soybean forecast to 34.5mn tons. Thus, future downward revisions by USDA are quite likely which should help soybeans continue to find support.

Net speculative positioning in soybean futures has increased 124% since the start of October underscoring the positive sentiment owing to the tighter supply outlook.

Tighter supply on the global sugar market

Sugar prices are trading at a six year high. Investors remain concerned over the prospects of the sugar crop in India, the world’s second largest sugar exporter. Sugar cane processing in Maharashtra, the most important growing State, could end 45 to 60 days earlier than last year owing to heavy rainfall that has reduced the availability of sugar cane.

In 2022, sugar production reached a record 13.7mn tons, which allowed India to export a record high 11.2mn tons of sugar.2 The Indian Sugar mills Association (ISMA) revised its estimate for domestic sugar production lower from 36.5mn tons to 34mn tons for the 2022/23 season2. This is raising concerns that the Indian government will not approve any further sugar exports for the current marketing year owing to the recent reports of weak production.

This does suggest a tighter global sugar market particularly as we are in the midst of Brazil’s (the world’s largest sugar producer) sugarcane off-season. Although Brazil produces sugar all year round, during this period (December to March) few mills continue to crush. Supply from Thailand, the world’s third largest sugar producer is unlikely to fill the gap left behind by the smaller Indian harvest particularly during Brazil’s off-crop.

The front end of the sugar futures curve has been in backwardation over the past 3 months and currently provides a roll yield of 7.2% highlighting the tightness in the sugar market.

Wheat most exposed to geopolitical tensions

Wheat prices have under most pressure from the improved supply prospects from the Black Sea Region. However total grain exports have declined by 29% to 27.7mn tons in the ongoing season (from 1 July 2022 to 31 January 2023), with wheat exports down 42% over the prior year.3 The ongoing escalation in the Russia Ukraine war continue to threaten supply from the breadbasket of Europe.

The US Department of Agriculture is forecasting a noticeably smaller Russian wheat crop of 91 million tons for 2022 in sharp contrast to Russia’s State Statistics Agency estimate at a record high of 104.4mn tons. According to the consultant firm SovEcon, the key growing region in the south of Russia has seen only around 40-80% of its normal rainfall over the past three months. The forecasts of this year’s crop in Russia are less optimistic. In the 2022/23 season, a record crop in Russia enabled ample supply of the wheat markets, despite a considerably lower crop in war-torn Ukraine in particular, thereby dampening prices.

Lower supply is likely in the coming season, however, not only from the top wheat producers – Russia and the US – but also from Ukraine on account of the ongoing military conflict. The Ukrainian Grain Association (UGA) anticipates a crop volume of 16 million tons. According to the Ukrainian Agriculture Ministry, 20 million tons of wheat were harvested last year. Before the war, the crop had totalled around 30 million tons.

Net speculative positioning in wheat futures is currently more than 2-standard deviations below its five-year average, underscoring the extreme bearishness on the wheat market.

Amidst the ongoing conflict and lower wheat supply from Russia and Ukraine, wheat prices appear positioned for a rebound from current levels.

Sources

1 Bloomberg as of 31 January 2023

2 Indian Sugar Mills Association as of 30 December 2022

3 Bloomberg as of 31 December 2022

Coffee C Futures ( KC1! ), H4 Potential for Bullish ContinuationTitle: Coffee C Futures ( KC1! ), H4 Potential for Bullish Continuation

Type: Bullish Continuation

Resistance: 214.05

Pivot: 182.95

Support: 172.60

Preferred case: Looking at the H4 chart, my overall bias for KC1! is bullish due to the current price being above the Ichimoku cloud, indicating a bullish market. To add confluence to this bias, price is also along an ascending trend line. If this bullish momentum continues, expect price to retest the pivot at 182.95, where the overlap support is, before continue heading towards the resistance at 214.05, where the overlap resistance is.

Alternative scenario: Price may head back down to break the pivot at 182.95, where the overlap support is, before heading towards the support at 172.60, where the overlap support and 23.6% Fibonacci line is.

Fundamentals: There are no major news.

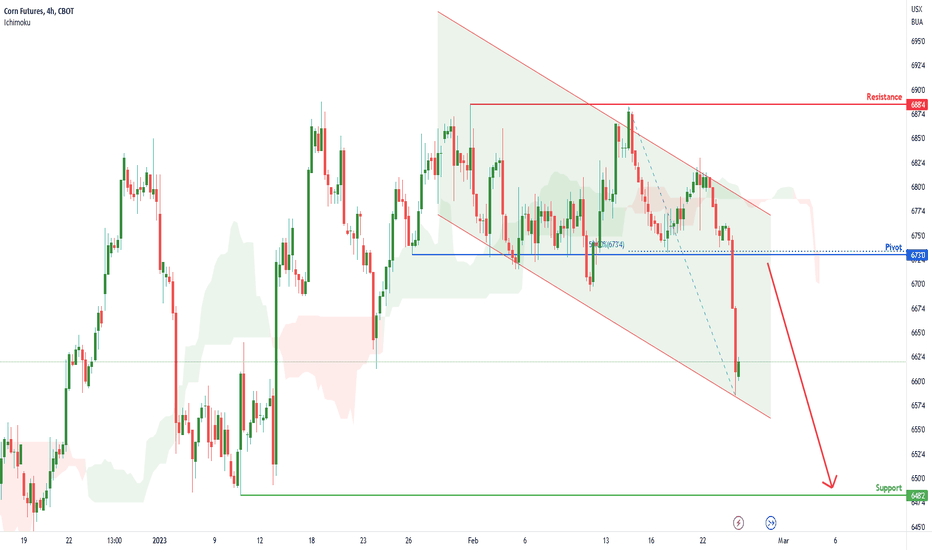

Corn Futures ( ZC1! ), H4 Potential for Bearish DropTitle: Corn Futures ( ZC1! ), H4 Potential for Bearish Drop

Type: Bearish Drop

Resistance: 688.50

Pivot: 673.00

Support: 648.25

Preferred case: Looking at the H4 chart, my overall bias for ZC1! is bearish due to the current price crossing below the Ichimoku cloud, indicating a bearish market. To add confluence to this bias, price is also within a descending channel. If this bearish momentum continues, expect price to possibly retest the pivot at 673.00 where the overlap resistance and 50% Fibonacci line is before heading towards the support at 648.25, where the previous swing low is.

Alternative scenario: Price may head back up to retest the resistance at 688.50 where the recent high is located.

Fundamentals: There are no major news.

Coffee Short - Seasonal weakness starting For my coffee drinkers - Both Arabica and Robusta had a strong start to the year. However, seasonally a bearish phase starts from 22 Feb to 31 Mar. The technical price target was also reached yesterday. In the last 17 years we can observe a negative trend between 22 Feb to 1 Mar. Only in 5 out of 17 years did the coffee price rise during this period. On average, coffee loses around -3.75% in this period with a standard deviation of 6.92%.

Sugar Futures ( SB1! ), H4 Potential for Bullish ContinuationTitle: Sugar No. 11 Futures ( SB1! ), H4 Potential for Bullish Continuation

Type: Bullish Continuation

Resistance: 23.86

Pivot: 21.89

Support: 21.02

Preferred case: Looking at the H4 chart, my overall bias for SB1! is bullish due to the current price crossing above the Ichimoku cloud, indicating a bullish market. If this bullish momentum continues, expect price to rise from the pivot at 21.89 before heading towards the resistance at 23.86, where the previous swing high is.

Alternative scenario: Price may head back down towards the overlap support at 21.02, slightly below where the 23.6% Fibonacci line is.

Fundamentals: There are no major news.

Coffee (Love Coffee & wanna get rich?)View On Coffee (23 Dec 2022)

I am seeing a possible bottoming in coffee.

It is hard to find a single bottoming point but I reckon the price of coffee will not go lower than $150.

In 1Q2023, you can slowly build coffee postings and possible extract the great profit of it.

It shall easily see $190 or even $210

DYODD, all the best and read the disclaimer too.

Feel Free to "Follow", press "LIKE" "Comment".

Thank You!

Legal Risk Disclosure:

Trading crypto, foreign exchange or CFD on margin carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you.

Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

DISCLAIMER:

Any opinions, news, research, analyses, prices or other information discussed in this presentation or linked to from this presentation are provided as general market commentary and do not constitute investment advice.

Sonicr Mastery Team does not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Cocoa Futures ( CC1! ), H4 Potential for Bullish ContinuationTitle: Cocoa Futures ( CC1! ), H4 Potential for Bullish Continuation

Type: Bullish Continuation

Resistance: 2838

Pivot: 2660

Support: 2565

Preferred case: Looking at the H4 chart, my overall bias for CC1! is bullish due to the current price above the Ichimoku cloud, indicating a bullish market structure. If this bullish momentum continues, expect price to retest the pivot at 2660 where the overlap support and 50% Fibonacci line is before heading back up towards the resistance at 2838, where the previous swing high is.

Alternative scenario: Price may head back down towards the support level at 2565, which is the overlap support.

Fundamentals: There are no major news.

Coffee C Futures ( KC1! ), H4 Potential for Bullish ContinuationTitle: Coffee C Futures ( KC1! ), H4 Potential for Bullish Continuation

Type: Bullish Continuation

Resistance: 214.05

Pivot: 172.60

Support: 142.05

Preferred case: Looking at the H4 chart, my overall bias for KC1! is bullish due to the current price being above the Ichimoku cloud , indicating a bullish market. If this bullish momentum continues, expect price to retest the pivot at 172.60, where the 23.6% Fibonacci line and overlap support are, before continue heading towards the resistance at 214.05, where the overlap resistance is.

Alternative scenario: Price may head back down to break the pivot at 172.60, where the 23.6% Fibonacci line and overlap support are, before heading towards the support at 142.05, where the previous swing low is.

Fundamentals: There are no major news.

May Wheat futures: Daily trend reversalThis setup can lead to a larger failure of a weekly decline signal, which could cause a major move in $ZW_F. I'm long May futures here, paying close attention to how it develops, if the signal isn't stopped the trade could be held for longer until the chart evolves into a higher timeframe trend potentially, that would be the ideal scenario here.

Best of luck!

Cheers,

Ivan Labrie.

easyMarkets Cotton Daily - Quick Technical OverviewDisclaimer:

easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and seamless integration.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. easyMarkets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Coffee C Futures ( KC1! ), H4 Potential for Bullish ContinuationTitle: Coffee C Futures ( KC1! ), H4 Potential for Bullish Continuation

Type: Bullish Continuation

Resistance: 214.05

Pivot: 172.60

Support: 142.05

Preferred case: Looking at the H4 chart, my overall bias for KC1! is bullish due to the current price being above the Ichimoku cloud , indicating a bullish market. If this bullish momentum continues, expect price to retest the pivot at 172.60, where the 23.6% Fibonacci line and overlap support are, before continue heading towards the resistance at 214.05, where the overlap resistance is.

Alternative scenario: Price may head back down to break the pivot at 172.60, where the 23.6% Fibonacci line and overlap support are, before heading towards the support at 142.05, where the previous swing low is.

Fundamentals: There are no major news.

Coffee C Futures ( KC1! ), H4 Potential for Bullish ContinuationTitle: Coffee C Futures ( KC1! ), H4 Potential for Bullish Continuation

Type: Bullish Continuation

Resistance: 214.05

Pivot: 172.60

Support: 142.05

Preferred case: Looking at the H4 chart, my overall bias for KC1! is bullish due to the current price being above the Ichimoku cloud, indicating a bullish market. If this bullish momentum continues, expect price to retest the pivot at 172.60, where the 23.6% Fibonacci line and overlap support are, before continue heading towards the resistance at 214.05, where the overlap resistance is.

Alternative scenario: Price may head back down to break the pivot at 172.60, where the 23.6% Fibonacci line and overlap support are, before heading towards the support at 142.05, where the previous swing low is.

Fundamentals: There are no major news.

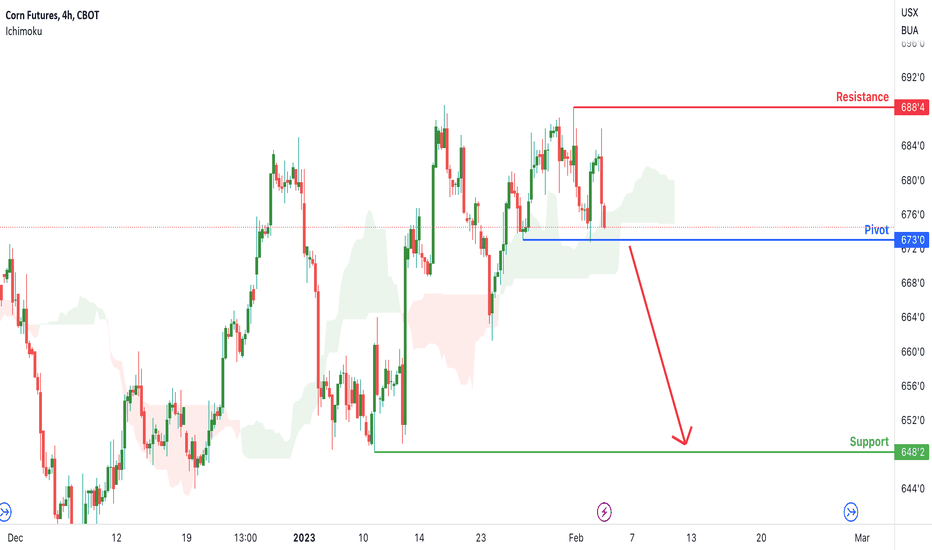

Corn Futures ( ZC1! ), H4 Potential for Bearish DropTitle: Corn Futures ( ZC1! ), H4 Potential for Bearish Drop

Type: Bearish Drop

Resistance: 688.50

Pivot: 673.00

Support: 648.25

Preferred case: Looking at the H4 chart, my overall bias for ZC1! is bearish due to the current price crossing below the Ichimoku cloud, indicating a bearish market. If this bearish momentum continues, expect price to possibly head towards the support at 648.25, where the previous swing low is.

Alternative scenario: Price may head back up to retest the resistance at 688.50 where the recent high is located.

Fundamentals: There are no major news.

Coffee C Futures ( KC1! ), H4 Potential for Bullish ContinuationTitle: Coffee C Futures ( KC1! ), H4 Potential for Bullish Continuation

Type: Bullish Continuation

Resistance: 214.05

Pivot: 172.60

Support: 142.05

Preferred case: Looking at the H4 chart, my overall bias for KC1! is bullish due to the current price being above the Ichimoku cloud, indicating a bullish market. If this bullish momentum continues, expect price to retest the pivot at 172.60, where the 23.6% Fibonacci line and overlap support are, before continue heading towards the resistance at 214.05, where the overlap resistance is.

Alternative scenario: Price may head back down to break the pivot at 172.60, where the 23.6% Fibonacci line and overlap support are, before heading towards the support at 142.05, where the previous swing low is.

Fundamentals: There are no major news.

Corn Futures ( ZC1! ), H4 Potential for Bullish ContinuationTitle: Corn Futures ( ZC1! ), H4 Potential for Bullish Continuation

Type: Bullish Continuation

Resistance: 706.50

Pivot: 6681.00

Support: 673.00

Preferred case: Looking at the H4 chart, my overall bias for ZC1! is bullish due to the current price being above the Ichimoku cloud, indicating a bullish market. If this bullish momentum continues, expect price to possibly head towards the resistance at 706.50, where the previous swing high is.

Alternative scenario: Price may head back down to retest the support at 673.00 where the recent low is located.

Fundamentals: There are no major news.

Soy Bean (The Future is Bright?)View On Soy Bean (26 Jan 2023)

What a lovely Bullish Price action we had.

It also have a strong monthly swing level (1450~1470) to boost.

I am expecting the price of Soybean is to go UP further.

The momentum will pick up stronger once the price has broken up 1510 region.

Le't find out.

Legal Risk Disclosure:

Trading foreign exchange or CFD on margin carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you.

Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

DISCLAIMER:

Any opinions, news, research, analyses, prices or other information discussed in this presentation or linked to from this presentation are provided as general market commentary and do not constitute investment advice.

Sonicr Mastery Team does not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.