5-0 Pattern

Descending Triangle, Volume are down,Big pictureThis is a macro look, we will take a look at Descending triangle a little closer.

We are in a Descending triangle, and things are not looking good as we are entering 5 weak,

Unless breakout happens - a robust one - a lot of buyers will be holding BTC instead.

D and A serving as a strong support Prices entries.

We are still in a up trending channel, and this coin will burst into action soon enough.

We have a lot of support when this will be cheaper to acquire when BTC will costs more.

If we ever get to 2 or 4 below the D and A support.

Accumulating at these levels is advisable.

Leaning Short, not in value, but relative to BTC.

/*This information is not a recommendation to buy or sell. It is to be used for educational purposes only.*/

If you want your coin to be analysed, please PM me.

Thank you,

Ajion

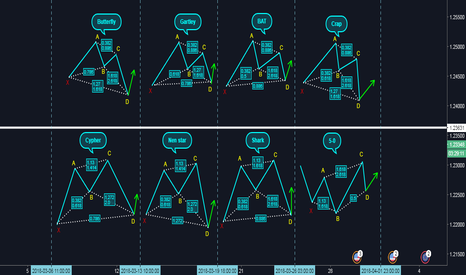

USD/CAD - Bearish 5-0Continuing with the majors before moving onto the crosses, I am monitoring a bearish 5-0 on the USD/CAD. Even without the harmonic ratios, price has made a clear head and shoulders, broken the neckline and is now re-testing the neckline as resistance. As per usual with a bearish 5-0 pattern, I will be on the looking for any reversal candles (hanging men/bearish engulfing) before price reaches the 0.618 retracement level of the previous wave.

Next week, Tuesday 1st of May, we will see the release of Canadian GDP data. This announcement can be very volatile so the trade must be managed effectively- I will give further updates as this move progresses.

5-0 Ratios

B = 1.13-1.618

C = 1.618-2.24

D = 0.5

Alternate Shark @ .9750!!!Shark pattern is a combination of a ‘failed’ wave, an extreme harmonic impulse wave and the famous 0.886 retracement.

RULES:

B point needs to be in range of XA projection – minimum 1.13 but NOT exceed 1.618

C point needs to be in range of AB projection – minimum 1.618 but NOT exceed 2.24

C point at 0.886 0X (not 0B) retracement or 1.13 0X projection

We have the freedom to choose swing 0X to create the most compact zone for C point. 2 elements define PRZ:

0.886 0X retracement (not OB) or 1.13 0X projection, which ever gives the most compact zone. Sometimes you would need to eye for both PRZ to see how the price reacts to each level and decide if you want to trade it.

AB Projection

Bearish 5-0 Pattern ..l.. ()(-_-)() ..l..5-0 PATTERN

"The 5-0 pattern is a distinct 5-point reversal structure, discovered by Scott Carney that typically represents the first pullback of a significant trend reversal. It is a relatively new pattern with 4 legs and specific Fibonacci measurements of each point within its structure, eliminating room for flexible interpretation. The following measurements define the pattern: the AB leg should be a 1.130 to 1.618 extension of the XA leg. The BC leg should be a 1.618 to 2.240 extension of the AB leg. The CD leg should be 0.500 retracement of the BC leg and it includes a reciprocal AB=CD pattern. With this, the Potential Reversal Zone (PRZ) is defined differently from other harmonic patterns.

Conservative traders look for additional confirmation before entering a trade. The 5-0 pattern can be either bullish or bearish. Targets can be set at the discretion of the trader as the reversal point could be the start of a new trend. Common stop levels lie behind a structure level beyond the D point or the next important level for the Fibonacci sequence."

Shark > Possible 5-0 > Weekly Watch List The Shark pattern has the following ratios.

AB leg extends OX leg between 113% – 161.8%

BC leg extends beyond O by 113% of the OX leg

BC leg is also an extension of AX by 161.8% – 224%

Unlike other harmonic patterns, the trades are entered as follows:

Entry is at 88.6% of OX leg with stops coming in at point C

Targets can be 61.8% of BC

Bearish 5-0 Pattern Completes @ 150.80Basic 5-0 Requirements

Although the pattern incorporates 5 points within the structure (X, A, B, C, D), the starting

point of the structure (0) can be the beginning of any extended price move. However, the

initial point X must possess a specific alignment with respect to the A and B point. The X, A ,

B formation of the structure is usually some type of impulse move. The XA projection that

defines the B point can not exceed a 1.618. Any extension greater than a 1.618 will negate the

structure, as smaller impulse moves are preferred. Again, this is the failed wave 3 or wave 5 –

in Elliott Wave terms – that establishes the rest of the structure.

The BC leg is the longest price length of the structure and must be at least a 1.618 extension

of the AB length but it must not exceed 2.24. This tight range of 1.618-2.24 is a defining

element of the structure. If the 1.618 minimum limit is not reached, the structure is not a valid

5-0.

After the BC leg has reversed from that zone, the 50% retracement is measured from the B

point to the C point. In addition, the Reciprocal AB=CD is projected from the C point (an

equivalent length of the AB leg) to compliment the Potential Reversal Zone (PRZ). The

following illustrations and examples will clearly explain these concepts.

The 5-0 Pattern By Scott M. Carney

Copyright HarmonicTrader.com, L.L.C. 2005 All Rights Reserved!

AB=CD, Crab, Bearish 5-0, RSI BAMM"The 5-0 pattern®, was discovered by Scott Carney and released in his book, Harmonic Trading of the Financial Markets: Volume Two.

Is a unique structure that possesses a precise alignment of Fibonacci ratios to validate the pattern. Although the 5-0 pattern® is considered a retracement pattern, as the 50% retracement is the most critical number within the Potential Reversal Zone, the measurements of the various price legs are slightly different than the Bat pattern™ or the Gartley™.

The 5-0 is within the family of 5-point harmonic reversal structures and is primarily defined by the structure’s B point – as is mandatory for all harmonic patterns™. However, the 5-0 pattern® requires a reciprocal AB=CD measurement to define the pattern’s completion.

The basic premise of the pattern is to identify distinct reactions following the completion of a contrary trend. Valid 5-0 patterns® typically represent the first pullback of a significant trend reversal. In many instances, the AB leg of the structure is a failed final wave of an extended trend.

The 5-0 is an incredibly precise pattern that possesses only two numbers – the 50% retracement of the BC leg and the Reciprocal AB=CD Pattern™ " - Scott Carney

Shark, Crab & Potential Bearish 5-0 @ 50% retracementt The Shark pattern is relatively new Harmonic Pattern created by Scott Carney in 2011, where

he used a mixture of Elliot Waves theories and Fibonacci numbers to create this brand new

pattern with relatively high success rate.

1. A qualified Shark pattern consists of an impulse leg (XA), followed by a retracement

leg (B) that has no specific value.

2. That is followed by a continuation leg (C) that must at least reach the 113% Fibonacci

extension of the BA leg without exceeding the 161.8%.

3. Next, a Fibonacci retracement of X to C is drawn. The qualified Shark pattern must

reach 88.6% of the XC Fibonacci retracement and it cannot exceed the XC 113% extension.

4. Next, draw the BC Fibonacci extension. The key to this pattern is the 161.8 extension

of the BC Fibonacci extension. It must reach a minimum of 161.8 and it cannot

exceed 224%

5. The area where the BC Fibonacci extension and the XC Fibonacci retracement

overlaps is known as the PRZ. This is the zone where we look to enter our trades.

Scenario 1

When the BC extension reaches the 161.8% level before the XC 88.6%, we look to execute

the trade off the XC 88.6% level

BC 161.8%

XC 88.6%

Look to enter your trade after the XC 88.6% is reached.

Scenario 2

When the BC extension reaches the 161.8% level after the XC 88.6%, we look to execute the

trade off the XC 100% level (Green Line).

XC 88.6%

BC 161.8%

XC 100%

Scenario 3

When the BC extension reaches the 161.8% level after the XC 100%, we look to execute thetrade off the XC 113% level

XC 100%

BC 161.8%

XC 113%

Here the Shark has reached the 161.8% Extension before the 88.6% so we enter at the 88.6%

Bearish 5-0 Pattern5-0 PATTERN

The 5-0 pattern is a distinct 5-point reversal structure, discovered by Scott Carney that typically represents the first pullback of a significant trend reversal. It is a relatively new pattern with 4 legs and specific Fibonacci measurements of each point within its structure, eliminating room for flexible interpretation. The following measurements define the pattern: the AB leg should be a 1.130 to 1.618 extension of the XA leg. The BC leg should be a 1.618 to 2.240 extension of the AB leg. The CD leg should be 0.500 retracement of the BC leg and it includes a reciprocal AB=CD pattern. With this, the Potential Reversal Zone (PRZ) is defined differently from other harmonic patterns.

Conservative traders look for additional confirmation before entering a trade. The 5-0 pattern can be either bullish or bearish. Targets can be set at the discretion of the trader as the reversal point could be the start of a new trend. Common stop levels lie behind a structure level beyond the D point or the next important level for the Fibonacci sequence.